Marc Elliott, energy transition specialist, advisory services at Union Bancaire Privée, and Deirdre Cooper, co-head, thematic equity at Ninety One, explain why hydrogen could be a key part of the energy transition

by Bethan Rees

“Energy carriers allow the transport of energy in a usable form from one place to another. Hydrogen, like electricity, is an energy carrier that must be produced from another substance. Hydrogen can be produced – separated – from a variety of sources including water, fossil fuels, or biomass and used as a source of energy or fuel.”

Source: US Energy Information Administration

Hydrogen is an energy carrier (see box). It can deliver or store lots of energy, and it can be used in fuel cells to generate electricity, power and heat. The International Energy Agency (IEA), an organisation that works with countries around the world to shape energy policies for a secure and sustainable future, says hydrogen is versatile and "can help tackle various critical energy challenges". It adds: "Hydrogen can be produced from almost all energy resources, though today’s use of hydrogen in oil refining and chemical production is mostly covered by hydrogen from fossil fuels, with significant associated carbon dioxide emissions."

Many governments and organisations have made hydrogen part of their strategy to achieve a net zero carbon economy. One of the most notable strategies is the European Commission’s proposal, which is pledging to double existing hydrogen infrastructure funding in Europe, to €1.3bn.

Hydrogen is listed as number two on the UK government’s Ten Point Plan for a Green Industrial Revolution. The government is aiming to generate 5GW of low-carbon hydrogen production capacity by 2030, and develop the first town heated entirely by hydrogen by the end of the decade. To put 5GW into context, that's enough energy to power 1.5 million homes (according to a Hydrogen View article), and a typical nuclear reactor produces 1GW of energy. However, Edison Group, an investment research and advisory company, published a report in December 2020 that says that governments need to go further in encouraging hydrogen adoption, and an IEA report, published June 2019, echoes this, saying that "the development of hydrogen infrastructure is slow and holding back widespread adoption".

Deirdre Cooper, co-head, thematic equity at Ninety One, an active investment manager that aims to make a positive difference, and Marc Elliott, energy transition specialist, advisory services at Union Bancaire Privée, a private bank and wealth management firm, talk through the pros and cons of using hydrogen and how it can help us on the road to net zero.

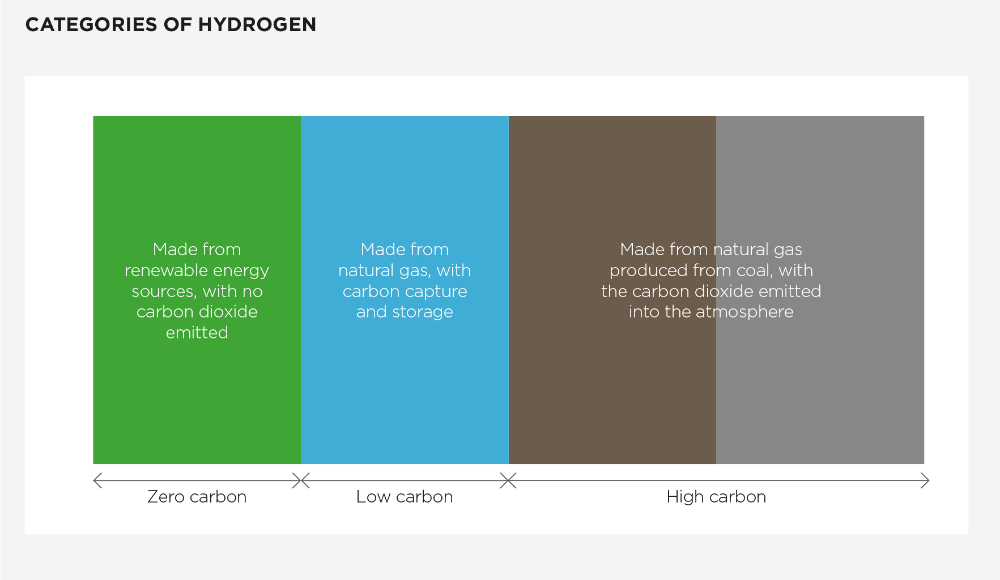

How is hydrogen categorised? And what are the differences between the categories?

Deirdre Cooper (DC): Grey hydrogen, or brown as it's sometimes called, is hydrogen made from natural gas produced through coal. Blue hydrogen uses the same process as grey hydrogen but with carbon capture, so the carbon is sequestered in some way. Green hydrogen is created when renewable energy is put into an electrolyser, which uses electrolysis to split water into hydrogen and oxygen.

What are the benefits of using hydrogen as an energy carrier?

Marc Elliott (ME): One of the great things about hydrogen is you can store it in an underground salt cavern almost indefinitely, unlike batteries. Also, batteries lack energy density and hydrogen is the most energy-dense fuel by mass in the galaxy. Albeit, volumetrically it lacks the volumetric energy density of fossil fuels.

Another great thing about hydrogen, and one of the reasons why academics have long cited moving to the hydrogen economy as the ultimate energy structure for society, is the flexibility and options it gives you. You can do so much more once you've got those electrons in a molecule – you can use it in boilers to heat homes, run gas turbines and engines and, if your hydrogen is green, use it to decarbonise hard-to-abate industries, for example, steel and cement.

How are companies monetising the hydrogen opportunity?

ME: You have to look at it in the context of decarbonisation. On a conventional economic approach, fossil fuels are way more competitive. We've been building engines for the last 100+ years and we've got loads of refineries with natural gas infrastructure. We know how to extract it, process it and deliver it. And so arguably, on a near-term basis, monetising hydrogen doesn't make sense. But, if we want to decarbonise, which is the stated agenda of many governments around the world, then green hydrogen as an energy carrier with all its flexibility is a very important tool. And monetising that will be, in my opinion, similar to how renewables have been monetised, and how more recently, batteries have been monetised.

None of the monetising opportunities for renewables were possible until governments put in the necessary incentives to de-risk the activities of big companies that can support projects of scale. We need governments to step in with hydrogen subsidies in a similar manner to the way it was achieved in renewable development, for example, de-risking the near term to facilitate scale up.

DC: Companies are monetising this hydrogen opportunity, and there are a number of different business models. For example, there are companies that manufacture electrolysers or fuel cells. And there are also companies involved in the distribution of hydrogen. There are natural gas pipeline owners who want to put hydrogen through their pipelines, although it's unclear how much hydrogen you can put in an existing natural gas pipeline.

How can someone invest in hydrogen, and what are the main risks?

DC: Retail investors today can invest in hydrogen by investing in renewable energy if they want to invest in green hydrogen. However, I would advise retail investors to be incredibly cautious on investing in early stage hydrogen companies. It is very unclear how this business model is going to work. There are lots of companies out there that are telling a story to retail investors that is not necessarily backed up by the data. For example, there's a Nasdaq-listed company, Nikola Corporation, which makes predominantly hydrogen-based zero-emission vehicles. Nikola Corporation infamously had a promotional video showing one of their trucks moving along a highway, supposedly powered by hydrogen. However, it turned out that the truck was just rolling down a hill and wasn’t using its own power, and it didn’t have a hydrogen fuel cell.

Retail investors need to be incredibly careful when they invest in companies that are pre-revenue or pre-profit. That is a very high-risk way to think about it. And there's quite a lot of them in the hydrogen space, which is why we wouldn't advise retail investors to invest in the listed hydrogen companies today. Put your money to work on the ancillary benefits of the hydrogen economy, which are the renewable energy companies.

"If you were a policymaker, what would you do first? You would need to do everything at once"

ME: There are the inherent ramp-up risks of deploying these technologies at scale. For example, some of the earlier wind turbines suffered from reliability issues. But if the political will and the finance capital remains available, it's been demonstrated that projects do get done and it is achievable, but it can take time. For example, ITM Power, a British manufacturer of electrolysers for hydrogen production, is building the first proton exchange membrane electrolysers, to convert renewable to hydrogen fuel, but this was brought to a halt by Covid-19. So, there can be roadblocks and there are always teething issues with scale up of such technologies.

Another challenge for the players in the hydrogen field is ramping up enough capacity to allow government targets to be reached. It’s a two-way street, in that governments have got to de-risk the pathway for these companies to put in their investment, and that’s where incentives and stimulus packages need to be put in place.

Grey hydrogen accounts for the majority of hydrogen production, according to the IEA. How can grey hydrogen be replaced by green hydrogen?

DC: This is a very hard question to answer, because to do that we need to have much more renewable energy to produce green hydrogen. We need to do that anyway because we have to decarbonise the electricity grid.

If you were a policymaker, what would you do first? You would need to do everything at once. The faster the electricity grid is decarbonised, the faster green hydrogen is truly green. If you were to make the hydrogen today from a standard electricity grid, you won't get that big carbon benefit because that's a grid that has a lot of fossil fuel in it. You need to move that electricity grid, and then you need to use that green electricity to make green hydrogen.

ME: Blue hydrogen could be important to narrow the gap. However, I think it's more of an interim solution for certain cases in a retrofit context. So, where there are refineries already producing grey hydrogen at scale, and where they have access to geological structures where you could store the carbon dioxide, then the blue hydrogen route has a role to play. But fundamentally, if you want to go carbon neutral, blue hydrogen is not carbon neutral; it’s very hard to capture 100% of carbon dioxide emitted. Realistically, you want that to be green hydrogen, or alternatively doing another carbon offset, for example, in a forest or atmospheric carbon capture.

What is the cost of producing hydrogen, and is it too expensive?

ME: I think we have to consider this in terms of its economic use case – it boils down to what is your cost of electricity? In certain instances, this will be expensive.

Today if your electricity is US$1.82 per kW hour, hydrogen is likely to be competitive in the next few years. If we compare this to batteries, around 10 to 15 years ago, batteries were roughly US$1,200 per kW hour. BloombergNEF's annual battery price survey, published in December 2020, finds that batteries are US$100 per kW hour, depending on the technology.

About the experts

Deirdre Cooper is co-head of thematic equity within the multi-asset team at Ninety One. Deirdre is a leading voice in understanding and committing to sustainable investing, including engagement and integration of environmental, social and governance into the investment process, in order to address and combat climate change.

Marc Elliot is a chemical engineer by background and started his career in that sector before moving into finance. He has 14 years’ experience as an equity analyst and in recent years has been focused on the energy transition.

He recently joined Union Banque Privée as an energy transition specialist, having previously been a senior energy transition analyst at Investec.

This is an example of the scale effect, and we have to enable industry to scale up to drive down cost. This cost argument is dependent on putting in policies that allow industrial players with the technologies to scale up and to get the cost down to where they need to be to enable adoption. Twenty years ago, we’d never have dreamed that solar and wind could be the cheapest source of generation today. The International Renewable Energy Agency's Renewable capacity statistics 2021 report finds that 80% of all new electricity capacity added in 2020 was renewable.

People are right to say it isn't economic on a level playing field. And that's a valid point. But if you put in the stimulus and the incentives to build it up, the outcome is likely to be more economical than what we've got, particularly if carbon taxes are applied to fossil fuel solutions.

DC: The cost of hydrogen mostly depends on two things: the electrolyser cost and the electricity cost. Today, green hydrogen is more than double the cost of grey hydrogen, and this depends a lot on the price of electricity. Over time, as electrolysers get cheaper with US$20 a MW hour, we could see hydrogen costing US$1.50 per kg.

Do you agree that leveraging hydrogen is essential for us to meet our carbon emission goals?

DC: There are things we need to think about around the edges. To get to an 80% zero carbon electricity grid, we know how to do that through using renewables. Then think about ground transportation and passenger cars – these are likely to be decarbonised with electric vehicles. Many automakers have pretty much signed up to that. And then you have other areas that are more challenging to figure out, the last 20% on the zero carbon electricity grid. For this, we might need to build six times the amount of solar power.

The reason why we need to leverage hydrogen for the last 20% is because of the intermittency of renewables. Lithium-ion batteries are very good for hourly storage, so they're good for managing the clouds that pass in front of the sun. However, they're bad for seasonal storage, and it makes no sense to put electricity into a big battery and keep it in the UK, for example, when we have a winter peak. Countries that use a lot of air conditioning have a summer peak, so solar works very well in these countries. It’s less well suited in countries that have a winter peak, and you need to find a way to move that power from the summer to the winter, and hydrogen storage is one way to do that.

What are some of the industries that are getting excited about using hydrogen?

ME: The chemical industry space is probably going to move at scale. There is legislation, such as the EU’s Renewable Energy Directive II, which is going to push it that way. I think a very important point here is that it's actually a lower barrier for entry to adopt and scale for large chemical plants that have extensive experience and infrastructure to handle the gas.

And the transport sector is starting to develop, because heavy-duty commercial transport companies, for example trucks and trains, have realised that for long distances, batteries struggle and yet emissions targets need to be met. Then lastly there is the issue of decarbonising heat, which is going to be a big challenge. We have boilers in our homes, and those boilers could be arranged to burn hydrogen rather than natural gas. So much of our energy demand is met through natural gas, and natural gas is a lower carbon fuel. But often, that ignores part of the issue with natural gas, which is its greenhouse gas potency, 84 times the potency of carbon dioxide on a 20-year time horizon. If, for example, as much as 3% methane is leaked from extraction to combustion, in a greenhouse gas emissions context, you might as well have burned coal for all the good you've done.

DC: Steel's another good example of an industry that I think would be a near-term user of hydrogen.

Is hydrogen a 'new dawn' or a bubble in terms of investing?

DC: As a long-term solution for decarbonisation, hydrogen has the potential to be a new dawn. However, if you look at the listed market cap today and you invested in the entire listed market cap, it's a bubble.

For example, the 'tech bubble'. In early-stage trends, if you bought every single tech company in 1997, you would find that roughly three of them generated any value, and by the time you got to 2001, many of them would have gone bankrupt.

ME: I think hydrogen is recognised as a very important long term decarbonisation tool, and it comes back to policy and government plans. Basically, if decarbonisation remains on the political agenda, then this will be an important space. Although I concede valuations appear to have gotten ahead of themselves in many instances. We need to get to net zero carbon emissions by 2050, and then governments want to go carbon negative. On that basis, we have something that's going to run and run for decades, and it's our energy systems that essentially underpin all our economies.