The rapid growth of ESG equity funds and green bonds often dominates responsible finance headlines. But under the surface, a plethora of innovations are emerging

by Paul Bryant

Beyond the ever-increasing volume of environmental, social and governance (ESG) equity funds and green bonds, innovative products are starting to gain traction with investors too.

Here we take a look at five of the most promising of these – which are aimed at both institutional and retail investors.

1. 2° Investing Initiative's Paris Agreement Capital Transition Assessment tool

Climate-related data is undoubtedly one of the hotbeds of innovation, with a host of data providers emerging over the past few years. Most are focused on producing scientific 'hard data' – such as measuring the tons of carbon dioxide emissions per unit of revenue in a portfolio – available to investors. While this is a useful and important metric, it is 'backward looking' and gives no indication of what the future climate credentials of a company or a portfolio might be.

Some providers are addressing this problem. For example, the 2° Investing Initiative (2DII) released its Paris Agreement Capital Transition Assessment tool in 2018. It allows investors to upload details of their portfolio and receive (among other analyses) a five-year trend analysis that traces the portfolio's likely evolution of exposure to selected technologies and sectors such as oil and gas, coal mining, automotive, and electric power. Tapping into a global database that houses climate-related data covering 40,000 companies, 230,000 energy-related physical assets, and 30,000 securities, the tool interrogates asset-level data (such as the production plans of a manufacturing plant). It then aggregates this to produce the five-year trend at a parent company level (which is most useful for investors).

This is compared to climate transition scenarios, such as the Beyond 2°C Scenario – a pathway to limiting warming to 1.75°C (considered to be 'Paris aligned'). Investors can then identify misalignments between their portfolio and these scenarios and act accordingly, such as by disinvesting from or engaging with 'non-compliant' companies. As of September 2020, over 1,500 financial institutions worldwide had used the tool, according to 2DII.

2. InfluenceMap's data and scoring system

An investor's ability to assess the climate credentials of their portfolio now goes further than scientific data. Independent think tank InfluenceMap provides data and a scoring system that shows how companies support or obstruct climate policy, such as through carbon taxes or energy efficiency standards.

Co-founder and executive director Dylan Tanner says: "Companies were not being assessed correctly or completely on climate. Most efforts were being put into measuring things like carbon emissions, but nothing was going into measuring their impact on the policy agenda – their behaviour towards current and future regulations – which is also important, because many companies try to block policy changes."

InfluenceMap has developed a tool that provides information on: companies' government lobbying; their links to and use of trade associations that actively oppose climate policy; and their 'wider' anti- or pro-climate policy influence through advertising, public relations and social media. The end product is an organisational score that reflects a company's climate policy stance, and a detailed report outlining its actions that influenced the score. Dylan says this is then used by investors in the company engagement process or to adjust their portfolios.

3. Invesco Quantitative Strategies

The availability of more ESG data is now enabling the design of new equity 'products' that go far beyond a fund with a label, badge, or an ESG score.

The Invesco Quantitative Strategies (IQS) team has been using this data to advance portfolio construction. It uses 'multi-factor investing' to design portfolios – a quantitative process that weights portfolios in favour of pre-selected factors. Historically, these have been financial metrics such as value (favouring stocks that trade at a discount to fundamental value) or momentum (favouring stocks with positive price momentum). But since 2017, ESG metrics have become an integral part of this process for IQS.

A pension fund client recently asked IQS to redesign a portfolio to reduce its overall carbon emissions while keeping the expected financial performance – in this case, closely tracking the FTSE All-Share ex Investment Trusts index – unchanged. The modelling process, outlined in the case study, was adapted to incorporate the carbon emissions data of portfolio companies. But because carbon-heavy companies like oil majors are large and influenced the index performance significantly, they couldn't simply be eliminated. That would create a tracking error and negatively influence the risk-return profile of the strategy.

To overcome this, IQS modelled alternative portfolios – replacing companies with high carbon emissions with others that had lower emissions but similar financial factor characteristics – and simulated the performance of these portfolios under a range of scenarios. It was able to optimise the portfolio mix so that the expected financial performance would be almost identical to the target index, but with approximately 30% lower carbon emissions, according to Maria Lombardo, head of ESG client strategies EMEA at Invesco Asset Management.

4. New bond products

The responsible investing giants of the bond market are green bonds which, according to the International Capital Market Association (ICMA), "enable capital-raising and investment for new and existing projects with environmental benefits".

Issuers can register their bonds on the platform and include pre-issuance green credentials (such as energy efficiency certifications for a new building project) and then keep investors up to date with post-issuance progress and validation (such as using a third-party satellite imaging company to upload project progress images to the blockchain database). Investors can search the platform for suitable green bonds that match their target investment profile, compare and benchmark bonds, and obtain verified data on the impacts their investments are having.

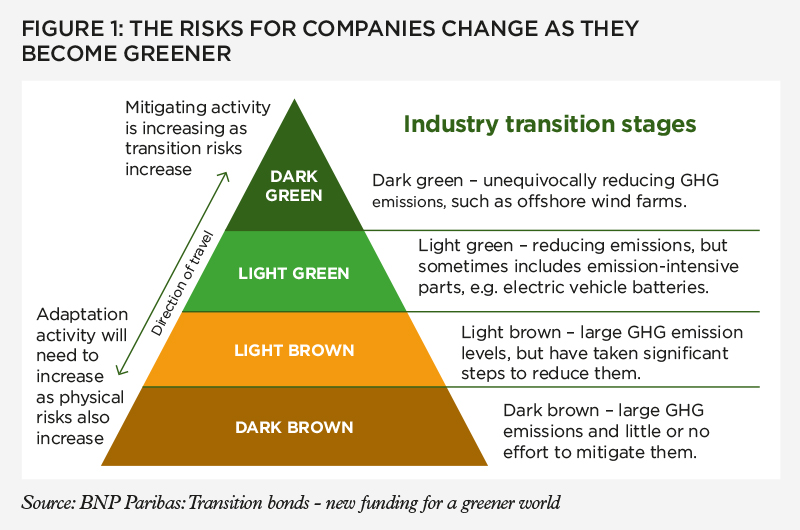

Transition bonds also have strong growth prospects. These are issued by 'brown industries'– industries with high greenhouse gas (GHG) emissions – and are used to raise capital with the specific purpose of improving environmental credentials. It is an asset class in its infancy, and only five transition bonds (three in 2020) have been issued to date, according to BNP Paribas, which published a report in December 2019 called Transition bonds – new funding for a greener world. The report includes a 'risk pyramid' to show the relationship between transition risk – risks associated with lowering GHG emissions, and physical risk – risk from 'catastrophic weather events caused by increasing emission levels'.

Social bonds and sustainability bonds are also rapidly gaining traction and seeing innovations, giving investors the ability to deploy more capital towards the social metric of ESG. According to the ICMA, social bonds raise funds for new and existing projects with positive social outcomes – such as providing access to basic healthcare, education, water and sanitation, or financial services. Sustainability bonds fund a combination of both green and social projects.

The Climate Bonds Initiative (CBI) Green bonds market summary H1 2020 estimates that US$94bn of social and sustainability bonds were issued in H1 2020 (these are provisional figures), around double that issued in H1 2019 and already in excess of the US$82bn issued in the whole of 2019 (according to the 2019 Green bond market summary).

5. Voluntary carbon offsets

'Voluntary carbon offsets' are products that can support the funding of climate-friendly projects. A private individual (say someone about to engage in a carbon-intensive activity such as taking a long-haul flight) or a business (which may be unable to economically reduce the carbon footprint of its operations) 'buys' an offset that funds a project that reduces greenhouse gas emissions, such as a forestation project. Even though the activities of the individual or business are increasing carbon emissions, their 'net' contribution is lowered because of their 'investment'. Voluntary offsets are actively traded on a range of platforms such as the Carbon Trade Exchange.

The full article was originally published in the October 2020 flipbook edition of The Review.

The full flipbook edition is now available online for all members.