Investors have a key part to play in the transition to a net zero carbon economy. But, while there is evidence that responsible investment produces superior returns, there is still a lack of standardised metrics

by Tim Turner

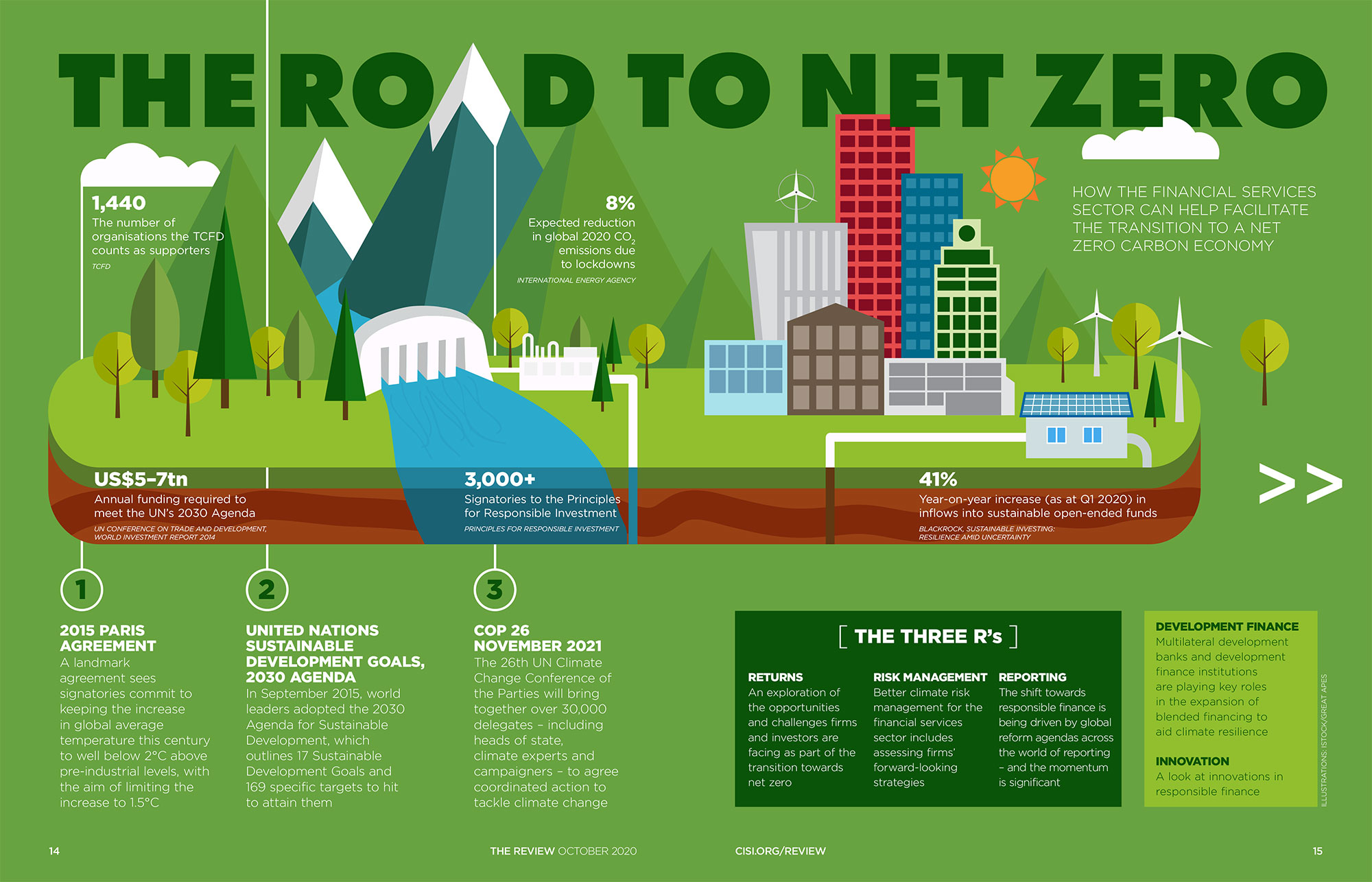

The Paris Agreement of December 2015 was hailed as a turning point in the battle against climate change, with 195 countries committing to the goal of keeping the increase in the global average temperature to well below 2°C above pre-industrial levels. That same year, the United Nations set out its 17 Sustainable Development Goals (SDGs), covering not just climate change and energy use, but a wide range of factors necessary to create a sustainable future for the world.

Over the past five years, the Paris Agreement and the SDGs have provided the framework for discussions on the transition to a more sustainable, low-carbon and circular economy. And the economy is at the centre of this because systemic change is expensive. In its World investment report 2014, the UN Conference on Trade and Development estimates that implementing the SDGs globally will require an investment of US$5–7tn per year.

While some companies have proactively embraced more sustainable practices, others have needed persuading. "Investors can heavily reinforce good practice if the company isn’t moving in that direction, by being more activist," explains Hector McNeil, co-CEO of exchange-traded fund specialist HANetf. "Once companies see that it’s a positive thing for them, whether that’s as simple as generating good PR, or attracting a greater share of investors’ money versus their peer group, then that forces change."

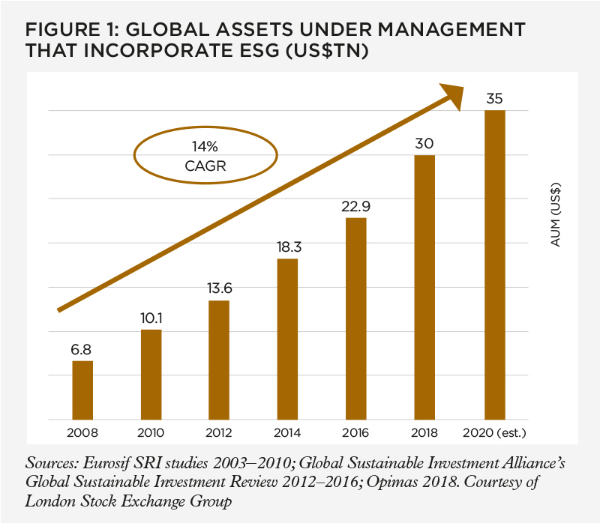

The share of investors’ money that is being allocated responsibly is certainly significant. Adrian Rimmer, senior adviser, green finance, at London Stock Exchange Group, says that the volume of assets under management (AUM) linked to a variety of environmental, social and governance (ESG) strategies has increased by 14% compound annual growth rate (CAGR) over the past ten years (see Figure 1) and is currently around US$35tn worldwide. In parallel, the number of signatories to the UN Principles for Responsible Investment (UN PRI) has increased to over 3,000, representing around US$100tn of AUM.

Another milestone was the launch in January 2019 of the S&P 500 ESG Index. Companies can be excluded from this index for reasons including:

- failure to meet the required ESG scores

- disqualifying UN Global Compact scores

- business activities in the exclusion list – the production or sale of tobacco or controversial weapons – or an ownership stake of 25% or more in a company involved in these activities.

Proof of returnsA powerful argument for responsible investment would be that it demonstrably provides better returns for investors, but is that the case? Anjalika Bardalai, chief economist and head of research at TheCityUK, says there is some evidence, pointing to MSCI research that shows that over the period 2009–2019, the top 20 ESG funds identified in the analysis marginally outperformed the MSCI USA Index by 0.78% on an annualised basis.

"Why would an environmentally poor, socially irresponsible, badly governed company be a good investment?"

"I don’t think the evidence is incontrovertible, though," she cautions. "We should look beyond the simple metric of return on investment when trying to judge the benefits of responsible investing. For example, a body of research suggests that companies that perform poorly on ESG metrics are more likely to suffer credit-rating downgrades. Of course, correlation does not imply causation. But there are also examples of corporates suffering ratings downgrades based partly on ESG factors, as documented by the UN PRI. This suggests that there may be a benefit for investors – especially more risk-averse ones – to choose ESG-focused firms over firms where ESG issues are not being prioritised."

For Mike Fox, head of sustainable investment at Royal London, it’s a question of common sense. "Why would an environmentally poor, socially irresponsible, badly governed company be a good investment?" he asks. "Increasingly, you can look at sustainable funds and ask yourself if it’s any coincidence that they’re at the top of the performance tables against their non-sustainable peers over one, three, five, ten years and longer."

Even so, responsible investment is not yet the norm. Anjalika points out that examples of responsible investment – or disinvestment from non-ESG sectors – generate headlines, suggesting that "such moves are still unusual enough to be newsworthy".

Metric conversionIf there is broad agreement that responsible investment produces superior returns, why haven’t we reached the tipping point? One key problem is measurement. TheCityUK’s 2019 report Financing low-carbon infrastructure states: "The lack of a clear benchmark for measuring investment performance is seen by many as one of the main disincentives to investors increasing their exposure to low-carbon infrastructure."

This presents a challenge for the asset management sector, which increasingly wants to quantify investment decision-making, Mike says, whereas there are huge elements of it that are qualitative. "You have to start with the idea that ‘if you can’t count it, it doesn’t mean it doesn’t count’ and then work with the available information in different ways. There’s a lot of due diligence and detailed work that has to be done to make a judgement on how responsible or sustainable a business is," he says.

The TCFD framework has been adopted by a number of investor initiatives that are promoting responsible investment

Adrian Rimmer is more optimistic. "The increasing recognition by investors of the value of ESG data and metrics as a way of evaluating company management’s understanding and management of corporate risk and opportunity is creating a positive feedback loop," he says.

Significant disclosuresWhen it comes to corporate reporting, there is no shortage of initiatives that encourage reporting of non-financial metrics, particularly those related to sustainability. The most influential has been the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD). Its Recommendations, published in December 2016, sets out 11 recommended disclosures grouped under four headings – governance, strategy, risk management, and metrics and targets – that deliberately follow the approach companies use already for other types of disclosure.

The TCFD framework has been adopted by a number of investor initiatives that are promoting responsible investment. The UN PRI introduced TCFD-based climate risk indicators to its reporting framework in January 2018.

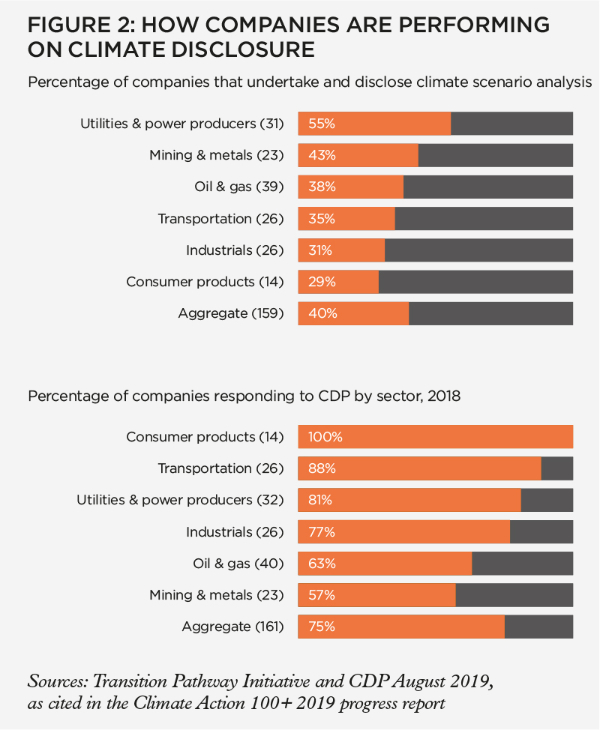

Similarly, Climate Action 100+, an initiative to ensure the world’s largest corporate greenhouse gas emitters take action on climate change, sees corporate reporting as central to its efforts. Its 2019 progress report shows that while the percentage of companies reporting to CDP (an organisation, formerly known as the Carbon Disclosure Project, that supports companies and cities to disclose the environmental impact of major corporations) is healthy, only 40% are undertaking climate scenario analysis (see Figure 2).

Accelerating the pace of changeIn February 2020, the UN Special Envoy for Climate Action and Finance (and former governor of the Bank of England) Mark Carney launched the Private Finance Agenda for the 26th UN Climate Change Conference of the Parties (COP26) with a speech at the Guildhall in London. He said: "For COP26, we intend to leverage the success of existing groups and coalitions, like the Net Zero Asset Owner Alliance, Climate Action 100+ and the UN PRI, to build a large collection of asset owners and asset managers who expect their portfolio companies to become net zero aligned."

Thomas Fekete, Europe, Middle East and Africa head of strategy and products for sustainable investing at BlackRock, explains that the volatile markets precipitated by Covid-19 have had significant results. "As investors have sought to rebalance their portfolios during market turmoil, they are increasingly preferring sustainable funds over more traditional ones," he says. He cites BlackRock data showing that, in Q1 2020, global sustainable open-ended funds (mutual funds and ETFs) brought in US$40.5bn in new assets, a 41% increase year-on-year.

"We believe these inflows during a period of extraordinary market drawdown suggest a persistence in investor preferences towards sustainability," he continues.

"I think the Covid-19 crisis will have done more for the ESG agenda than has been done in the past ten years"It seems that the pandemic has forced companies to rethink what they do and how they do it – in the process, making themselves more attractive to investors who prioritise responsible investment. Two clear themes have emerged, says Adrian. "First, the resilience of stocks that have strong ESG performance, which has further demonstrated the value of company management understanding and acting to manage risks and opportunities that are often thought of as externalities.

"Second, the attention being paid by business leaders and policymakers to ‘building back better’ or green recovery packages. This may mean that companies with demonstrable transition strategies are at an advantage when raising capital, as well as those that have the necessary products and services to build a more resilient, low-carbon economy."

Mike Fox sees the pandemic as a form of reckoning for companies that have ignored the sustainability agenda. "Sustainable funds have been saying for 15 years that if your only stakeholder is your shareholder, and your only metric is return on capital, then you’re going to come up short at some point in the future. And that’s exactly what’s happened," he says. "I think the Covid-19 crisis will have done more for the ESG agenda than has been done in the past ten years."

Click to enlarge

Click to enlarge

The full article was originally published in the October 2020 flipbook edition of The Review.

The full flipbook edition is now available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting 'Yes'.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.