The first client meeting can provide planners with a mine of information but only if they ask the right questions and, importantly, listen to the answers

by Gill Wadsworth

All CERTIFIED FINANCIAL PLANNER™️ professionals, and all CISI members, have a fiduciary duty to clients. The CISI Code of Conduct 'client focus' principle requires members "to put the interests of clients first, treating them fairly and being a good steward of their interests, never seeking personal advantage from confidential information received and utilising client data only for a defined purpose".

To achieve this level of client care, it is essential to build effective relationships with clients. An important part of relationship building is asking the right questions, which can help the financial planner understand what motivates a client, what is most valuable to them, and how they can be helped to achieve their goals.

The first two steps of the financial planning six-step process are 1) establishing and defining the relationship with the client and 2) collecting the client's information.

In a speech in 2019, Debbie Gupta, director of life insurance and financial advice supervision at the FCA, echoed these steps, telling delegates at the Money Marketing Interactive Conference that "the foundation of suitable advice is getting to know your client and understanding their circumstances and motivations".

Learning to listen

Getting the most from the discovery process could begin with listening instead of asking questions. George Kinder CFP®, founder of the US-based Kinder Institute of Life Planning, which teaches life planning skills, insists that "the most effective question, the one that wins a client’s trust, is to ask no question at all". One way to do this would be to greet your clients and once they are settled, simply open your hands and say "Well?" pausing in a warm, curious, and inviting way.

This is difficult to do without practice and training, so George suggests for most to simply ask, "Why are you here?" He says: "Let them answer with whatever they want, while you add words of encouragement, empathy, or clarification."

"Use all of your senses to observe and detect what’s not being said to get a holistic picture of what the other person is communicating"

Scott Frank CFP®, founder of Stone Steps Financial in California and a trainer with the Kinder Institute, says that this approach has been successful for him. "I often get to the point where the client thinks this is the best conversation they have ever had. In a normal conversation, people want to connect so they ask questions and then as the other replies you interject with your experience, and your own thoughts come into the conversation, making it about you," he says.

All about them

Richard Mullender, former hostage negotiator with the Metropolitan Police and founder of The Listening Institute, a listening and negotiation training company, says that "Everything must be for [the client]. If you ask too many questions, they will feel the meeting is all about you rather than hearing what they want and need."

Richard says financial planners and advisers have a propensity to get caught up in the moment, becoming too enthusiastic and ultimately interrupting clients rather than listening to their answers. Simply asking "What are you looking for and why is it so important to you?" should be enough for clients to be able to tell financial planners all they need to know.

John Christianson, founder and CEO of US-based Highland Private Wealth Management, has more to say about developing effective listening skills: "Use all of your senses to observe and detect what’s not being said to get a holistic picture of what the other person is communicating." For example, the client may say they are happy, while their body language and facial expressions tell another story. John says professionals need to spot the non-verbal clues and ask the right questions, which "takes practice, courage, and intention to uncover the real issues lurking just below the surface".

John recommends planners ask open-ended questions and paraphrase the issues relayed by the client. "For example, if your client calls to say they are anxious about the markets dropping and the impact on their portfolio. The adviser restates, 'What I hear you saying is that you’re worried that the drop in the market will impact your ability to travel and enjoy yourself because you’re looking at your brokerage statement every day. Is that right?'"

John says it is likely that the client will then provide yet more information, such as fears about job security or ability to keep up with mortgage repayments.

Regarding the non-verbal cues, George says to look out for concerned expressions such as furrowed brows and use those cues to reassure clients with open body language.

"Always stay connected with the client … It’s not unusual for me to empathise by saying something like, 'that must have been really challenging and difficult for you'," he says.

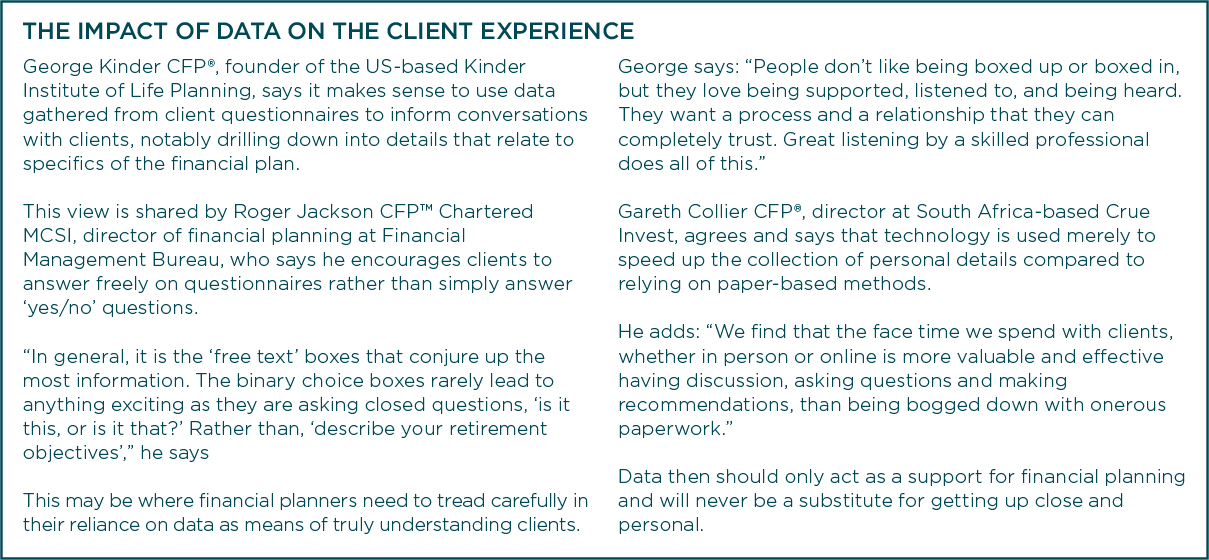

Gareth Collier CFP®, director at South Africa-based Crue Invest, prefers to gather hard facts before meeting the client in person, as "data gathering is a distraction from the conversation they want to have face-to-face”, he says. He advises sending clients questionnaires via email or smartphone in advance of the meeting. "Then we have all the information stored digitally."

Six questions for first client meetings

In a blog for Kitces, a US-based firm that seeks to advance knowledge in the financial planning profession, Dr Meghaan Lurtz, senior research associate at Kitces, suggests six questions for first client meetings:

1. If you could solve any financial concern today simply by snapping your fingers, what would you solve?

2. If you didn’t have financial worries anymore, what would you do and how would that change the way you act?

3. What would happen if all your financial goals come true? How would you know when this happened? Paint a picture of this day for me.

4. If you could fast-forward to your ideal retirement, what would we find you doing to fill your days?

5. What would happen if you made changes to your spending and saving patterns? How would you feel?

6. What would success look like for today’s meeting?

Not only does this save time in meetings, it also means the pre-completed document acts as an ice breaker at the first meeting.

Gathering data at this early stage also offers the chance for financial planners to discover new areas for investigation when they eventually meet the client. It is therefore important that information is collected in a way that lends itself to effective analysis but is clean and free of errors.

Building rapport

George says the Kinder Institute favours keeping questions limited in the first meeting so that it becomes clear to the client that the meeting is their meeting and not about the adviser or financial planner. In the following meetings there is more give and take.

Roger Jackson CFP™ Chartered MCSI, director of financial planning at Financial Management Bureau in Cumbria in the UK, says it is important to ask questions that keep the client talking.

"Asking questions is like peeling back the layers on an onion. The client’s first objective might be to buy a boat but rather than stopping there, we need to ask, 'What is it about a boat that you want?' This might reveal that the boat is where they spend time with their family. You are finding more information with each question."

Simultaneously, planners need to reassure their clients. John Porteous CFP™ Chartered FCSI, managing director, Central Financial Services at Charles Stanley, says that first meetings can be intimidating. "It is important to establish chemistry and let the client know they are giving you good information. We also need to reassure them that it is OK not to know the answers to some of the questions; it is our job to help find the answers," he says.

The importance of this relationship in obtaining a holistic view of a client’s goals is evidenced by an example provided by Gareth Collier. A long-term client had passed away, leaving his wife and son with two properties; one was for use as long-term rental while the other was the family home. The son oversaw running the rental, also living there, but suffered personal difficulties and began struggling to keep on top of the job.

"We all need to remember that in personal finance, it's 90% personal and 10% finance"

Gareth says: "We presented the mother with the hard numbers resulting from the loss of income but then we asked her how it made her feel and what concerns she had. We found out so much from asking the right questions; she desperately wanted to be able to support her son, but she didn’t want to lose the two houses. After speaking with us, she had the confidence to talk to her son and he was able to do more to support her in return. He felt better able to carry on managing the rental property, which meant they were able to keep that income as well as the family home, and the son is also in a better position."

Building a rapport and gaining trust is what leads to lifelong relationships with clients, who then recommend you to others, which ultimately creates a healthy pipeline of business. And it may become increasingly challenging for advisers and financial planners without 'softer' skills to compete in future.

Scott Frank concludes: "It will become more difficult for advisers who don’t adopt this [listening] approach to compete. We all need to remember that in personal finance, it's 90% personal and 10% finance."

Asking better questions and taking the time to listen to the answers is at the heart of successful financial planning. The best financial planners know clients want solutions, but they also want to be heard. The future of financial planning lies in providing not just financial but emotional support for the long-term.