A narrowing opportunity

The State Street Global Advisors’ Client Experience report, published in September 2019, finds that financial advisers spend:

• 14.7% of their time on client facing activities

• 23.1% of their time on portfolio management

According to a May 2019 report by Nucleus:

• In 2018, 21% of financial advisers spent 40%+ of their time with clients

• In 2019, 15% of financial advisers spent 40%+ of their time with clients

• In 2018, 11% of advisers spent 40%+ of their time on admin tasks

• In 2019, 31% of advisers spent 40%+ of their time on admin tasks Storytelling is a powerful and appropriate communication form for many clients, says Stuart Podmore, investment propositions sales director at Schroders, who spoke at the CISI Financial Planning Conference 2019 about developments in psychological theory.

“If the financial plan story is engaging, clients remember and act upon what you say first, what you say most often, what surprises them and what you say to conclude,” he says. “Personal anecdotes, vulnerability, self-deprecation and the avoidance of patronising, complicated jargon are all helpful.”

Of course, what works with one client will not work with another, so it is important to be flexible. Marlene Outrim CFP™ Chartered FCSI, managing director of Uniq Family Wealth, describes a scenario where she had to change her method of communicating with a client. “I spent a couple of meetings going through the minutiae of a client’s cashflow and whether they should transfer one of their defined benefit pensions, which was quite sizeable. There were equal pros and cons, but they were detail people and they were going around in circles considering a myriad of permutations. In the end, I told them that their decision had to be based upon how they felt about it. I asked: ‘Would you sleep at night if you transferred the pension given the volatility of the markets or would you feel more content and satisfied if you did not transfer it?’ Then his decision was made,” she explains.

Whichever method a financial planner may choose to present information to a client, it should be engaging enough for the client to understand what is being said and be able to remember it later. This is vital because statistics tell us that financial planners have little time to spend with clients, and that levels of financial literacy vary significantly – see boxout, top right.

The FCA requires all firms to be clear, fair and not misleading to their customers or clients. Communication is key. Here we take a look at some techniques for helping clients absorb and retain information.

Explaining the basics to clients

David Swanwick, head of client services EMEA at Dimensional Fund Advisors, spoke at the 2019 conference about how using a structured communication framework, together with purposeful diagrams and visual aids, can make all the difference in helping clients truly understand money. David was a financial adviser for more than a decade and found that most of his clients had received limited financial education. “I would try to ensure that they had an understanding of the basic characteristics of key asset classes and how to be a good investor, but I did not try to make them investment experts,” he explains. “Most people don’t need to know how an aeroplane works, just to be assured that it will get them safely to their destination. So, alongside the basics of asset classes, I would help them understand the simple principles of setting goals and managing their finances appropriately. I would start by explaining something verbally before grabbing a notepad and sketching the idea on paper or I might retell a story from past experience that brings the idea to life,” he says. “Over time I built a mental archive of sketches and stories that covered the tricky questions.”

View the process from the client's perspective and use open-ended questionsThe value that clients obtain from these conversations depends on several factors, starting with the financial planner’s questioning and listening skills and the ability to gain an insight into the client’s true level of understanding. That is the view of Jon Pittham, managing director of ClientsFirst, which works with financial services companies to improve their customer service.

He says it is vital that the adviser views the process from the client’s perspective and suggests that open-ended questions, rather than closed-ended, will yield a much better quality of response. He provides the following examples:

- What is your experience of investing to date?

- What is/was your parents’ approach to money – was it talked about much?

- What does financial planning mean to you?

- What does financial security mean to you?

Marlene explains how she ascertains if her clients have understood what she has said. “I ask if they have any questions or queries and I use techniques known as reframing and mirroring. Reframing is rewording or putting the issue in another way. Emotions can skew how we put matters to them or frame them. Taking out the emotion can show things in a different perspective. Mirroring is reflecting back to the client exactly what they have said, and this can help the client feel more relaxed and likely to engage more.”

Financial literacy does not guarantee that clients will make optimal choices. The provision of knowledge alone won’t make them do the right thing in the future. Stuart suggests that establishing financial literacy is but one (albeit important) step in the process.

The different ways of communicating

The best communicators are adept at simplifying complex ideas and recognise that people respond to different learning styles. Because clients may be unaware of their preferences, advisers using a range of styles need to experiment until they find the approach that works best.

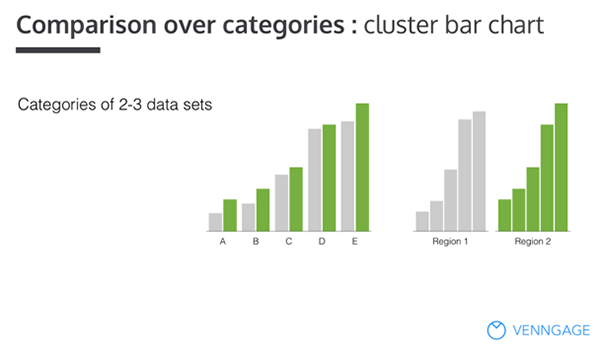

Visual content can be highly effective. The graphic below, for example, shows a comparison of two data sets. The two different colours set the categories apart and make it easy to decipher the comparable data.

However, Jacqueline Lockie CFP™ Chartered FCSI, CISI's head of financial planning, highlights the challenge of producing plans that can be easily viewed within the confines of a mobile phone screen. She says that in Japan, most individuals only have a mobile phone, rather than laptops or tablets. “The logistics for financial planners there is how to engage clients and show them the benefits of financial planning on such a small screen. As technology advances across the world, there are potential obstacles to overcome, if what is seen in Japan happens here,” she says.

Due to Covid-19, many employees and clients are working and staying at home. Marlene explains how this transition has changed the way she interacts with clients. “Using video call technology, clients have readily accommodated, even though we have an older client base. The meetings have gone well, a bit more focused, although I miss the actual face-to-face. We have still been able to present our cashflows by screen sharing, too”

She says that although this may not become a regular way to talk to all clients, it might help those clients who are further away and for whom meeting face-to-face isn’t convenient. “We are going to survey clients later to see how they feel about this. Those with issues, such as clients who are hard of hearing or not comfortable using technology, are happy to put off their meeting until after lockdown. We have sent out regular mailings by email and on social media, and we are encouraging clients to visit our Facebook page as we post on there regularly.”

Keith Butten CFP™ Chartered MCSI, director of financial planning firm boosst, has also been talking to clients via video calls. “Our only challenge has been training a few clients as to how to select speakers and microphone. To assist this, we drafted a guide with embedded video that we share via our portal ahead of meetings.”

Visual, aural, kinaesthetic learning

Understanding which method to use to deliver information to clients can be helped by understanding how they absorb information. A 2017 paper in the International Journal for Innovative Research in Multidisciplinary Field explores the styles of learning and looks at researcher Neil Fleming’s VAK model, which stands for visual, aural and kinaesthetic. The authors write: “People commonly have a preferred learning style which may be a blend of all three of the senses. Some people have a very strong preference, while others have a more even mixture of the two or three styles. When an individual knows his or her preferred learning style(s), he or she is able to understand the type of learning that best suits him/her.”

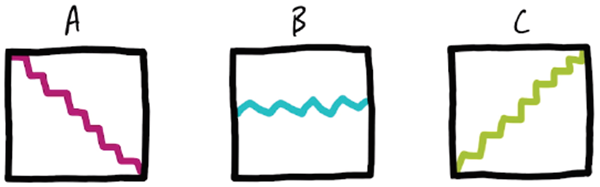

Individuals may be visual learners, preferring to see information and instructions, and might forget information that has only been heard. These types of learners will find mind maps and graphs useful to remember things. For example, David Swanwick explains how exploring data with a client through charts can help lead them to informed decisions. “If we think about how to explain a long-term perspective of short-term volatility to a client, we might dig out a long-term growth of wealth chart that illustrates how insignificant the 1987 crash looks now and how the market recovered over time. Or we could hand a client a table of annual returns for a market and ask them to pick out the best and worst years.” In this scenario, the process of exploring the data helps the client see that there is little to fear in the randomness of short-term returns. Another option, he says, is to sketch out three ‘portfolio returns’ – one down, one flat and one up – and ask the client which they would prefer to own, explains David. “Inevitably they will pick the one that goes up, at which point you could explain that they could all be the same portfolio, just illustrated over a day, a year and a decade.”

Those who prefer to learn through aural, or auditory learning, depend on hearing and speaking to learn and keep information in their memories. These learners might benefit from reading information out loud, repeating things that the financial planner has said and asking questions. They might also benefit from more of a presentation-style engagement and talking through that with their adviser or financial planner.

Kinaesthetic learning refers to people who prefer to learn through physical activity, absorbing information best by doing or experiencing something. For example, a client who engages with information in this way might benefit from writing down pros and cons of pension drawdown, rather than by reading or listening.

Marlene says while it’s important to ascertain what type of learning technique works best for a client, there are other factors that contribute to their understanding of subjects. “It is about understanding and recognising the client’s personality. We ensure that a client who is into detail will get more detail than usual; for those who want the bigger picture and bullet points, we don’t waste their time with an overload of information and present in a way, written or verbal, that they can quickly take on board,” she says.

Marlene also stresses the importance of empathy, recognising and acknowledging feelings, and talking about them: “That is the most important aspect of a meeting, to be empathetic and not just nice or avoid difficult moments. You need to get to the crux of anything that may be worrying them and show them a way to deal with it.”

With a narrowing window to make an impact on their clients, financial planners’ need to deliver information in a manner that is both compliant and easy to understand has never been greater.

Mana Habibian, project designer at Venngage, spoke at the CISI Paraplanner Conference 2019 on making graphs for reports. She said that some people are better at grasping information presented in the form of visuals.

She recommends at least a 50/50 balance between text and images on each page of a presentation, with the latter communicating the bulk of the information and the former listing the major takeaways. Other suggestions include using a single strong colour to draw readers’ attention to key facts and figures and create visual groupings; making charts as simple as possible through the use of a single number in large, bold text for simple aggregations such as monthly sales; employing a two-column grid to give the document visual structure; and leaving space around every piece of content on a page to prevent it looking too ‘busy’.

By visualising their own data or original research, Habibian believes advisers can provide value to their audience while positioning themselves as an authority in their sector.