In 1984, Paul Etheridge, a founding member of the Institute of Financial Planning (now part of the CISI), was concerned that a considerable amount of financial planning relied on guesswork, or long hours labouring on spreadsheets. He enlisted the services of a computer programmer to write him a piece of software that would allow him to show clients their financial futures. Together, they created one of the world’s first lifelong cashflow modelling software, now known as

Truth®.

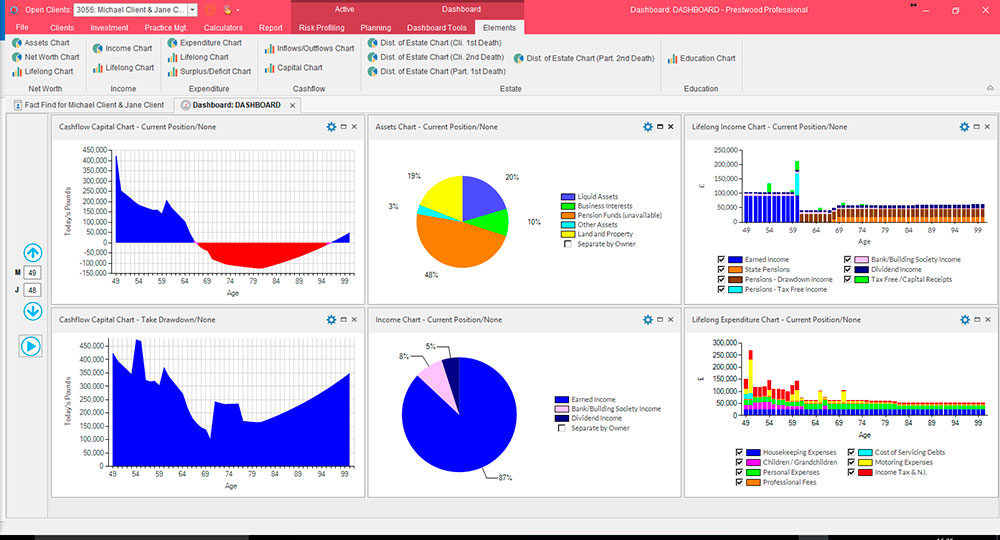

Essentially, cashflow modelling is a software tool used for financial planning. Entering a client’s income, assets and outgoings will generate data in a graphical or chart format. This shows whether the client will run out of money, or has enough to live comfortably until the time they expect to die.

A visual that illustrates the impact of a client no longer having a wage but their expenses not dropping in tandem, is a fantastic reality check. It is at this point that a planner can explore options, such as retiring later, spending less or saving more. However, income, outgoings and expenses change constantly, so it is important that clients have their plans updated at least annually.

Is cashflow modelling essential?Spreadsheets and charts are useful, but being able to visually illustrate to clients a scenario that you can amend – and straight away reveal the impact – is far more powerful. “It is the ‘light-bulb moment’ when clients buy into the whole concept of financial planning, and how it can make a difference to their lives,” says Ritchie Walton, managing director of Prestwood Software. Using cashflow modelling, wealth managers and planners can point out to clients that they have scope to spend more than they thought, or retire earlier than expected. Decumulation without using cashflow modelling is far less reassuring.

Figure 1: Dashboard. Image courtesy of Prestwood Software

However, many financial planners believe cashflow modelling tools are not essential to do the job properly. “Cashflow modelling is hugely beneficial to the advisory process, but there are many independent financial advisers doing a very good job without the need for a cashflow plan,” says Ray Adams, who developed his own software,

CashCalc, in 2014. Labelling cashflow modelling as essential “gives the impression that if you do not conduct it you are letting the client down, which is not necessarily the case”. Currently, cashflow modelling is not part of the CERTIFIED FINANCIAL PLANNER

TM certification.

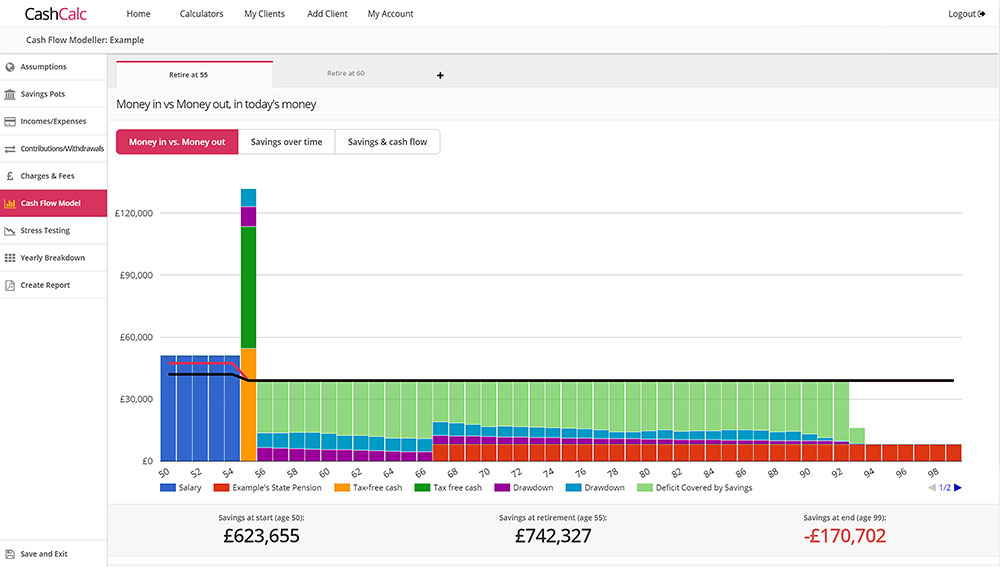

Figure 2a: Advanced cashflow modelling tool, money in versus money out graph (retiring at age 55). Image courtesy of CashCalc

Note: Once the client retires, they are going to have to dip into their savings in order to meet expenditure. The client’s state pension kicks in at age 67, however savings run out after age 93.

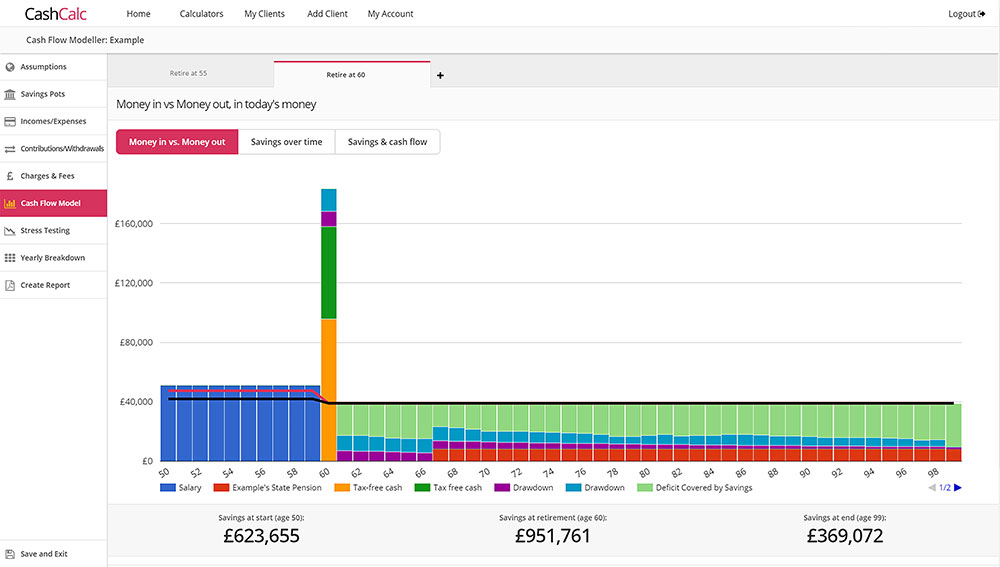

Figure 2b: Advanced cashflow modelling tool, money in versus money out graph (retiring at age 60). Image courtesy of CashCalc

Note: Once the client retires, they are going to have to dip into their savings in order to meet expenditure. The client’s state pension kicks in at age 67, however savings run out after age 93.

Figure 2b: Advanced cashflow modelling tool, money in versus money out graph (retiring at age 60). Image courtesy of CashCalc

Note: By retiring at age 60 and having five years' extra salary, and an extra five years' of making pension contributions, the client's savings last beyond age 99, even with the anticipated spending in retirement.

Note: By retiring at age 60 and having five years' extra salary, and an extra five years' of making pension contributions, the client's savings last beyond age 99, even with the anticipated spending in retirement.

Ross Mackereth, director of cashflow modelling software provider

PlanLab, says: “If not essential, cashflow modelling certainly has an important role to play in financial planning and wealth management, especially when taking a holistic view of an individual’s future planning arrangements.” This is particularly important when considering protection issues. How will a planner know, for instance, how much a client needs if they become disabled and unable to work unless they build a cashflow model? A skilful planner will be able to demonstrate to their client using cashflow modelling how best to finance various potential life events under one umbrella.

Furthermore, the ability to model disruptive events or ‘Monte Carlo’ simulations, such as a stock market crash, as well as personal events, is also inherently useful. Many clients, especially those who are at or nearing retirement age, are nervous of a market crash. Cashflow modelling enables the planner to simulate a crash, including periods of both recovery and no recovery. It can be quite shocking to clients, when they see this modelled in front of them, that the effect on their finances can be quite minimal over a lifetime. With their minds put at ease, planners will also find that clients are less inclined to contact them following a market fluctuation.

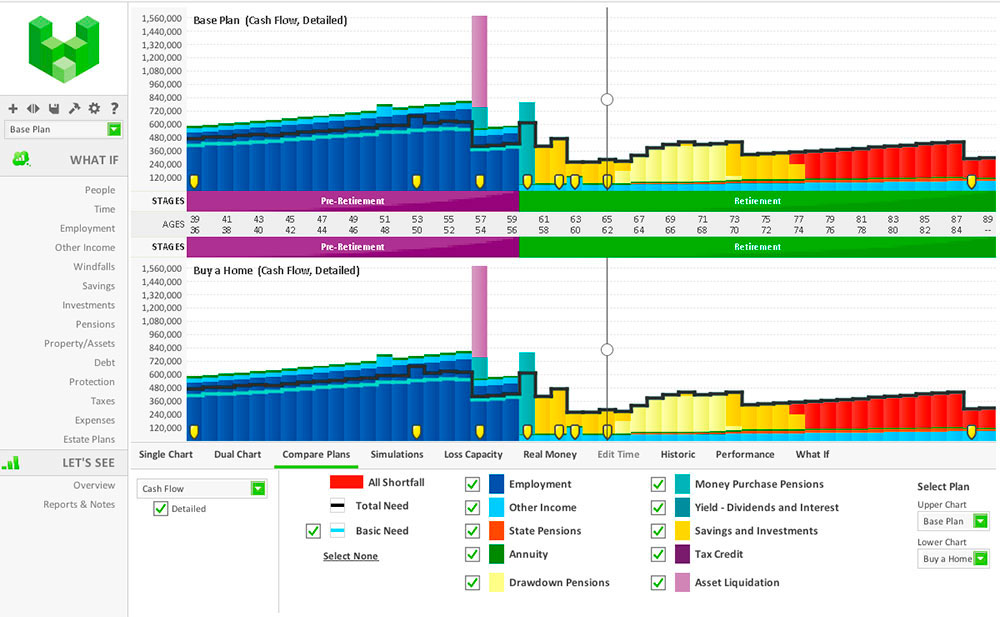

Figure 3: Detailed cashflow plan. Image courtesy of Voyant

Robert Lockie CFP

TM Chartered FCSI, investment manager and branch principal at Bloomsbury Wealth, emphasises the importance of keeping the visual information as simple as possible in documents that are handed to the client. He said: “Although we do demonstrate the detailed version of the cashflow in a meeting by starting with just the outflows (so it is all red initially) and then adding the inflows one at a time to show where they arise, as soon as we have added the last inflow we switch to the simple chart (on which any red is now indicative of running out of liquid resources and thus indicates that some action will be required based on the data and assumptions used) and never show the detailed one in that meeting again. In our experience, the degree of confusion which results from showing someone a chart with potentially a dozen or more colours (some of which can be fairly similar) far outweighs any benefit from doing so.”

Figure 4: Simple cashflow chart used in client communications. Image courtesy of Bloomsbury Wealth

.jpg?sfvrsn=9cd53202_0)

How have cashflow modelling tools changed?In 1985, the landscape was vastly different. The insurance sector was focused on training advisers to ‘sell’ to consumers, whether that was an investment, protection or insurance product. “It wasn’t until 1986 that I got my first computer,” says Michael Hague CFP

TM Chartered FCSI, owner and director of Investment for Life. “I remember one client asked me to look at private school education for five children and this took hours with a pen, paper and rate book. It worked very well, but it sometimes took days to do what now can take seconds.”

Years ago, planners followed the usual path of aligning their clients’ risk to a range of high, medium and low, and implemented their financial plan according to what was deemed ‘suitable’ for their tolerance to risk. With the benefit of technology, we can now model different scenarios in the future. And, with technology being so integrated into our daily lives, it seems old-fashioned if clients meet a professional that chooses not to use it.

A critical factor in cashflow planning is a deep understanding of the effects of assumptions on outcomes. Planners need to understand what

assumptions are being made and ensure the client agrees with these assumptions. There is no one-size-fits-all when it comes to clients.

Furthermore, tools today “need to be fully fit-for-purpose to reflect the tax and financial rules that you work within”, says Andy Hart, a financial adviser at The Voyantist. “For the UK this is hyper-complex, mainly due to tax and pension rules.”

Should consumers just do cashflow modelling for themselves? There will always be analytical people who want to conduct their own cashflow modelling, with rudimentary inflows and outflows, “but they will not be able to keep in touch with legislation that changes”, says Ritchie. “Will they be able to implement these changes to their plan as the changes take place? It could cause serious harm if they rely on a plan they made earlier and don’t review it at least on an annual basis.”

Should the FCA regulate cashflow modelling tools? Online financial planning tools, and specifically cashflow planning tools, are readily available for advisers to develop a client’s cashflow plan. However, this could also be carried out using a piece of paper and a calculator, says Ray, “so where does the regulation end?”

Selecting a cashflow provider

For those thinking about choosing a cashflow tool, there are a range of options that differ in price and complexity. Key considerations include:

– What do you want the tool to do for you or your business? Will the tool be stand-alone, or are you looking to integrate it into a customer relationship management (CRM) or straight through processing (STP) system?

– Research the tools and stress test them to be sure – put yourself through it. Leading software providers include Prestwood Software (see Figure 1), CashCalc (see Figure 2), Voyant (see Figure 3) and PlanLab.

– Are the tax assumptions explained? For example, does the tool include age allowance? Are other variables and assumptions valid for the client, and changeable, if necessary?

– Challenge the figures, test more then one system and make sure it fits your business. A number of planners use cashflow systems as a crutch, not as a tool – it is important that they are fully understood.

– Identify the need of the client before selecting the cashflow modelling tool. If the client’s financial arrangements are quite straightforward, it makes sense to use a tool that can quickly process the cashflow analysis. If the client’s arrangements are complex, or involve numerous financial transactions, a more comprehensive modelling tool could be used.

The regulation of any software product would prove difficult due to the constant changes, adds Ross. “I suspect the FCA would see regulation as a very time-consuming and expensive undertaking.” There remains a risk that these tools could be misused but, providing specific products are not recommended, there is no need for regulation, he says.

The FCA appears to be more focused on how the software is used as part of the whole financial planning process, and if the assumptions used are reasonable and sensible. “The regulator is interested in products. Financial planning is an art,” says Andy.

There is no doubt that cashflow modelling, of either the deterministic or stochastic type, is becoming more visible to the FCA. The regulator recently launched a CP17/16 consultation paper,

Advising on pension transfers, which cautions that stochastic modelling, when used alone, may not be useful to consumers. This looks particularly at defined benefit (DB) pensions and replacing transfer value analysis with an appropriate pension transfer analysis. Julie Lord CFP

TM Chartered FCSI, partner at Magenta Financial Planning, says: “Cashflow modelling can present complex financial information to consumers in simple terms and provide the evidence required by the FCA to satisfy its concerns about DB pension transfer suitability.”

Do you think there is reluctance for wealth managers to use these tools?According to Ritchie, many wealth managers believe they are playing the market and tend to deal with only part of the client’s portfolio – perhaps their pension or investments. However, what they would find if they were to compose a comprehensive plan for clients is that they would end up managing more money. When clients can see the whole of their financial lives played out on one page – their business interests, multiple investment types, complex pension arrangements – they are far more likely to become engaged. “It isn’t just a question of ‘my clients have enough money’. They should be asking: ‘Could they or their descendants be having a better life?’”

Things are evolving, however. “It is always difficult changing working practices, and incorporating cashflow modelling into the service proposition can be a big change. But I think wealth managers are starting to see the real benefits of these programs,” says Ross.

Cashflow modelling supports the adviser’s recommendations and advice, but it also involves the client more fully in their own financial planning arrangements. When clients see the results of their current arrangements, it often leads to requests to see the effect of implementing one or more different approaches in their plans. It is this ‘what if’ feature of cashflow planning that really draws clients into the financial planning process.

Wealth management firms such as Brewin Dolphin and Close Brothers are embracing cashflow modelling to provide a better service to their clients and their families, and the rest of the sector is following their progress with interest.