What are mind maps?

Michael Kitces: Mind maps, which were first created by British psychology author

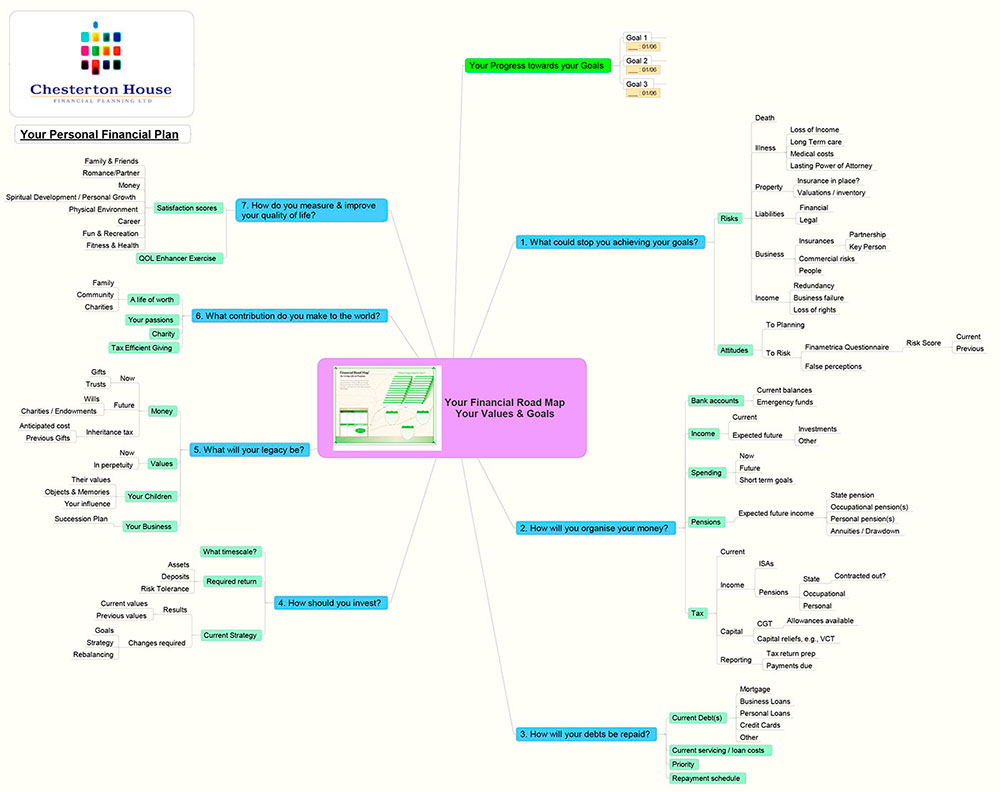

Tony Buzan, are essentially a visual way of taking notes and capturing information. At the centre of the mind map is the core topic or theme, and emanating from this is a series of branches, representing the related ideas or themes of the topic, with sub-branches capturing even more minute information. The result is a visual cloud of information that allows people to holistically view all the relevant details.

Andy Jervis: This visual, non-linear way of representing ideas means you can very easily make sense of large amounts of information, and link to different areas where there might be a relationship.

How are they generally used?

Michael: They can be used to capture and display information in a wide range of contexts. Some use mind maps to simply consolidate a range of information into a single visual display; others to lay out the plans for a project, or organise a presentation. Broadly speaking, anything that is conducive to organising as a list of bullet points in an outline can also be (re-)organised visually as a mind map. For people who prefer to take information in visually, this is far more appealing than simply looking at paragraphs of text or a long series of bullet points.

Andy: There are several ways of laying out mind maps. I use a piece of software called

MindManager (see diagram below), which has a base template with numerous methods for map creation, ranging from trees to organisation charts, and additions such as colours, symbols and logos. But at its simplest, a mind map can just be a piece of paper with notes that are connected using branches, rather than being presented in list format.

Diagram 1: Sample of a financial planning roadmap. Image courtesy of Chesterton House Financial Planning

How are financial planners and advisers typically using mind maps?

Michael

How are financial planners and advisers typically using mind maps?

Michael: In the context of financial advice, the most common use of a mind map is as an

alternative data gathering tool to collect information from clients and display it back to them in a visually organised manner. This would involve a central core, with the client’s name, and then a series of branches to capture major areas of information, such as personal or family information; a listing of accounts; career information; tax details; risk management; insurance policies; and information about family businesses. The result would be a holistic view of the client’s financial information, viewed in a single document. This collaborative creation of the mind map – live with the client – is a far more engaging process for the client, compared to just watching the financial adviser take notes on a pad.

Andy: Mind maps are particularly useful when it comes to financial planning. We break the planning process into five key areas: safety planning (risk management and insurance); cashflow planning (tax and pensions); debt elimination (mortgages, loans and liabilities); investments; and legacy planning. These are interlinked; for example, an investment or tax planning decision may have an effect on legacy planning because it could change one’s inheritance tax position. Drawing this out in map form makes it much easier for the client and adviser to comprehend the situation.

Are there any other scenarios that could be mapped out?

Michael: Another use of mind mapping in the context of financial advisers is to capture and show clients all the ‘

shadow work’ (back office work) that happens behind the scenes, to help justify and enhance the adviser’s value to the client. One branch might show all the investment activities that happened on the client’s behalf; another might show all the operational work; and a third might reflect all the client meetings that occurred. In the aggregate, the visual helps clients see all the work that is being done on their behalf, when it otherwise isn’t visible.

Andy: While mind maps are extremely useful in understanding a client’s overall financial position, you can also home in and illustrate more focused, complex topics. For example, you could clearly show how someone’s investments are structured around different asset classes and types of portfolio holdings, including aspects such as equities and bonds, mixed funds and property. Mind maps can also help to determine the implications of certain decisions, and whether one action may have an impact – big or small – on another. Finally, mind maps can be inherently useful as simple brainstorming tools. Most of what we do as financial planners is have conversations with clients and ask them what they would like to have happen, and this method can be used to help actively talk through plans, goals and scenarios for the future.

What are the key benefits of using a mind map for financial planners and advisers?

Michael: The opportunity to deepen client engagement. The reality is that financial advisers can get all the information they need from clients by simply asking questions and taking notes, but this is not a very appealing experience for the client. A mind map, displayed on a large monitor, allows the clients to more directly engage with the process, which serves to deepen the adviser-client relationship and the client’s trust in the adviser.

Andy: The financial services sector is hugely information rich and understanding poor. There’s so much information out there, ranging from investments and funds to planning and management styles, but everything is presented in such an opaque, linear fashion that it is almost impossible to interpret. Mind maps can be used effectively to tackle this problem, but we’re not using them to their fullest extent.

Table 1: A comparison of leading mind mapping tools

Is special software required to create a mind map?

Michael

Is special software required to create a mind map?

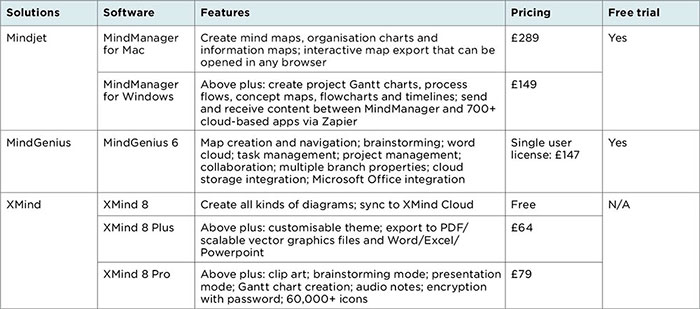

Michael: In practice it is far easier to create a mind map with dedicated software that is built for the task. Using software, the user can easily generate mind map branches, categories and sub-categories, colour coding and visually organising the information with a few clicks of a mouse. Leading solutions include

Mindjet,

MindGenius, and

XMind (see Table 1). Most mind mapping tools are available on desktops, laptops, and via tablets.

About the experts

-(oct-2014)_sized6a2e572d13b668408d49ff0000211f6f.jpg?sfvrsn=86983f02_0) Andy Jervis CFPTM Chartered MCSI is a director and senior financial planner at Chesterton House Financial Planning, and a partner at Chesterton House Accounting Services and Legal Services.

Andy Jervis CFPTM Chartered MCSI is a director and senior financial planner at Chesterton House Financial Planning, and a partner at Chesterton House Accounting Services and Legal Services.

Michael Kitces is a partner and the director of wealth management for Pinnacle Advisory Group, co-founder of the XY Planning Network, and publisher of the financial planning blog Nerd’s Eye View.

Andy: While there are a number of free software tools out there [through sites such as

Coggle,

Wise Mapping and

Sketchboard, which offer no-cost options with simple functionality], if you’re going to start to build more professional mind maps it is worth paying for a more capable program. It’s all very well having something that will build you a mind map, but you need a tool that will then be able to turn it back into a linear report. Through more advanced software such as MindManager you can, for example, turn mind maps into Excel files, and add notes and details to different sections, which can be continually built on or altered.

How are advances in technology affecting mind mapping software?

Michael: As technology continues to improve, more advanced mind mapping tools make it even easier to use the software across platforms – for example, capturing a mind map on a tablet, and then transferring it to a desktop computer with a large-screen monitor – manipulate the visuals on the fly, and link to external documents, or automate the integration of updated information into the mind map. In the US, one financial adviser created a dedicated mind mapping tool, called

Asset Map, specifically to fit the traditional data gathering process, and integrate it into related software to automate the updating of relevant information.

Andy: We’ve moved to IRESS’s Xplan platform as our back office system, and it has mind maps built into it from the start, illustrating a client’s position in a more visually appealing way. We haven’t used it with our clients much yet, but our planners seem to love it, which is always a great sign.