The operations function within financial services acts as an engine driving the many processes needed to keep the sector running smoothly. These processes include back office functions such as clearing or settling transactions, managing documentation, and risk management.

India has been dubbed the ‘back office to the world’, with a business process outsourcing (BPO) market of US$35–40bn, about 20–30% of global BPO, according to figures supplied to The Review by global research firm Everest

Group. Financial services BPO in India accounts for US$6–8bn, it says. This includes 300 to 400,000 full-time equivalent back office workers in the financial services sector. Global banks and technology companies, including Goldman Sachs, Google,

American Express, Deutsche Bank, JPMorgan Chase and Citigroup, have thousands of employees each in service centres across the country.

India's evolution

Deutsche Bank employs over 84,000 people across 59 countries, with more than 14,000 of those in India, says Sriram Krishnan, managing director, co-head of global transaction banking and head of securities

services business for India and the sub-continent at Deutsche Bank, and member of the CISI National Advisory Council (NAC) in India.

He says that over the past two decades, India’s BPO market has evolved significantly: “What perhaps began with data entry and conversion and rule-set processing has extended to problem solving, direct customer interaction and even expert knowledge

services, which require specialists.”

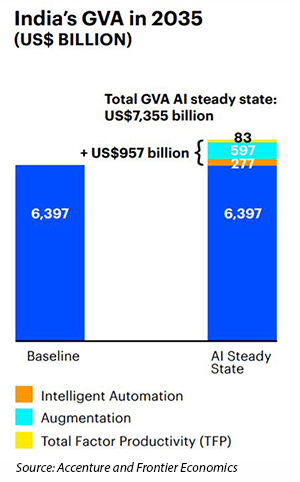

India is also expected to be a global delivery centre for artificial intelligence (AI) in the near future. Accenture's

Rewire for success report, published April 2021, says AI has the potential to add US$957bn to India's economy in 2035, which is roughly 15% of India’s current gross value added. Machine learning, a branch of AI focusing on computer algorithms that improve in accuracy

with experience, can help operationally by combing through data “at speeds that humans couldn’t, and find trends and key data points”, says John Pizzi, senior director of enterprise strategy for capital markets at FIS, in a July

2021 CISI webinar,

Operations Forum: Artificial intelligence implementation.

Low labour cost and the extremely high quality of talent are the biggest pulls for outsourcing to India, says Sriram. But they are not the only ones. India also has the ‘largest online market in the world’ with

over 560 million users, according to Statista, and this technological knowledge is key for financial services outsourcing.

“The back office teams are the backbone and foundation of any business,” says Shankar Gawde ACSI, vice president of operations in India at SS&C Technologies, a global fintech company that provides investment, financial services, and

software for the financial and healthcare sectors. SS&C is headquartered in the US, with more than 24,500 employees in over 100 offices in 40 countries, including more than 6,000 employees based in Mumbai, Pune, Hyderabad and Gurgaon in India.

As of 2020, roughly 1.9 billion people worldwide actively used online banking services globally, with that number forecast to reach 2.5 billion by 2024, according to Statista.

Shankar says that as more customers interact with organisations digitally, numbers of front-line staff are decreasing, and the back office becomes even more pivotal. “The back office represents the largest opportunity for significant improvements

in customer experience and cost reduction. Tomorrow’s market leaders will not be determined by the amount of technology they deploy, but how they evolve their back office processes to become more intelligent and proactive. In other words, the

performance of the back office affects the performance of the customer-facing processes,” he says.

Challenges facing the operations sector

Attrition, the process by which employees leave the workforce, is an issue impacting the IT and financial services sector, Sriram says. A Deloitte report from March 2020 states that attrition rates in India in 2019 in IT were at 21.5%, and financial services was 26.8%, the largest percentage reported out of the eight sectors shown. According to data shared with The Review from India-based

consultant firm Han Digital, the IT-BPM sector will have an attrition rate of 23% by the end of the year. This includes banking, financial services and insurance software captives. Han Digital says a high attrition rate can be due to business growth

and new business deals leading to hiring plans, and employees believing they deserve better promotions.

Another challenge for operations is the frequency of power disruptions, says Sriram. Back in 2012, India suffered from a power outage in 20 of its 28 states, leaving around 700 million people without power – one of the largest 'blackouts' in history. This was a particularly high-profile event, but power outages are still an issue today. For example, on 17 August in Bengaluru, there was no power between 9am and 5pm in some parts of the city. That challenge, though, is something that is within touching distance of being resolved as India has now emerged as a power surplus country, with a strong pivot towards renewables, adds Sriram. Poor internet connectivity can also impact operations, Sriram says, with staff often spending more hours than necessary completing their daily tasks.

Shankar adds that, with remote working, there is an increasing need for operational oversight. To tap into the organisation's “hidden capacity potential” – whereby if the tools aren’t available to measure capacity it’ll remain

hidden and not be utilised – managers and employees need consistent tools, processes, and real-time visibility into performance trends and reports. Some back office organisations lack a single, real-time view of all of their work. “Instead,

managers use spreadsheets and email to try and bridge the gap between the work in and outside core systems. Team members do the job in front of them or wait for work to be given to them. This approach obscures opportunities to maximise capacity and

speed turnaround times,” says Shankar.

The Covid-19 impact

During the initial stage of the lockdown in India, the banking sector was identified as essential and continued to remain operational, says Sriram. His role was smoothly transitioned to working from home and Deutsche Bank staff were provided with “adequate

resources” to work remotely. “We’ve received a lot of positive feedback from our clients owing to our ability to support them and handhold their requirements during this difficult period,” he says, adding that operations teams

have been invaluable in providing support for the front-line staff during this time.

Regulatory landscape

The Reserve Bank of India (RBI) has introduced several regulations intended to strengthen the banking sector, and in recent years, some focus has been put around data localisation and cyber security. The National Payments Corporation of India, an initiative

of the RBI, has “implemented [the] National Automated Clearing House (NACH) for banks, financial institutions, corporates, and government a web-based solution to facilitate interbank, high volume, electronic transactions which are repetitive

and periodic in nature”, according to its website.

Since August 2021, this system has been available all days of the week – previously, it was only available when the banks were open, which is typically Monday to Friday and not on weekends or bank holidays. Changes such as this require the “operations

workforce to work in shifts, until we achieve higher levels of automation”, says Sriram.

Environmental, social and governance (ESG) is also a focus for regulators in India. On 10 May 2021, the Securities and Exchange Board of India (SEBI) 2021 published a ‘circular to all recognised stock exchanges' implementing new sustainability related reporting requirements for the top 1,000 listed companies by market capitalisation. The circular says: “In recent times, adapting to and mitigating climate change impact, inclusive growth and transitioning

to a sustainable economy have emerged as major issues globally. … Thus, reporting of [a] company’s performance on sustainability related factors has become as vital as reporting on financial and operational performance.”

“Operations in India will continue to be the backbone for many financial services firms for the foreseeable future"

The new disclosure will be made in the format of a Business Responsibility and Sustainability Report, which is a step away from the existing Business Responsibility report with a notable move towards sustainability reporting. Shankar says that ESG will

“become a key driver of value, risk and opportunity” and that the regulators “will expect financial services businesses to identify and refine ESG and climate-specific risks”. Increased reporting means more work for back office

teams, including more data collection.

What’s next for India?

IndiaStack, defined on its website as a set of application programming interfaces that allow governments, businesses and developers to use a “unique digital infrastructure to solve India’s hard problems towards a presence-less, paperless and

cashless service delivery”, brings together software such as Bharat QR, an integrated payment system, Aadhar, a unique identification initiative, and Immediate Payment Services, an instant payment interbank system. IndiaStack is just one example

of how digital infrastructure is set to disrupt the financial services sector.

India is on the “cusp of a quantum leap in terms of efficiencies”, says Sriram, and the operations and back office of India “will only get better as we move ahead”. In the next couple of years, Sriram expects a big focus on further

cost savings and efficiency augmentation as it comes out of the Covid-19 pandemic. Operations in India will continue to be the backbone for many financial services firms for the foreseeable future, and with the country's moves into technological advancements,

such as AI, it could become even more valuable to the rest of the world.