The global financial services sector faces a series of new challenges, from the rapid adoption of automation, increasing regulation and Brexit to protectionist rhetoric in the US. This changing landscape means that traditional outsourcing models are under scrutiny, some roles may disappear and others are shifting to new parts of the world.

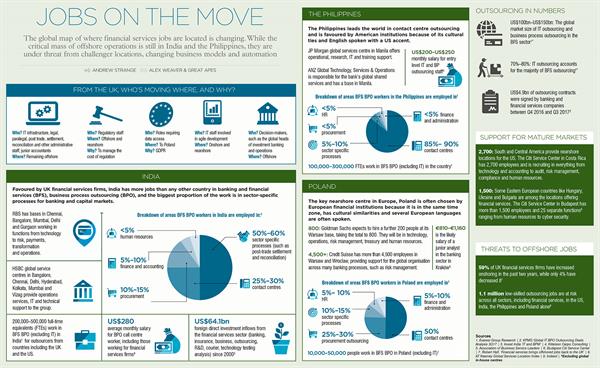

Globally, banking and financial services sector (BFS) companies signed US$4.9bn worth of IT and business process outsourcing (IT-BPO) contracts between Q4 2016 and Q3 2017, according to KPMG’s

Global IT BPO outsourcing deals analysis. Figures from Everest Group Research reveal that global revenue from the IT-BPO market in BFS is between US$100bn and US$150bn. And the three key low-cost countries of India, the Philippines and Poland employ a total of between 310,000 and 850,000 people in BFS BPO alone.

However, outsourcing may no longer mean employing lower-cost staff to complete administrative tasks. Instead, robots are rapidly taking on many repetitive, high-volume roles and this poses a risk to the low-cost nations.

The AT Kearney Global Services Location Index warns that, across all sectors, more than a million BPO posts are at risk from automation in the next five years in the US, India, the Philippines and Poland. And Fabrizio Napolitano, partner and head of outsourcing advisory at Deloitte, points out that with fewer humans carrying out administrative roles, fewer middle managers will be needed to oversee them.

Moving offshoreOne area where the use of robotics is currently limited is audit and compliance, which is increasingly moving to low-cost jurisdictions. Institutions have faced rising costs to deal with

a raft of new regulations in recent years, such as Europe’s Markets in Financial Instruments Directive II and the Dodd Frank Act in the US, and remain unsure how much more is still to come. Therefore, many audit and compliance roles are being

outsourced to countries such as India and Poland to control costs.

Some senior roles have also been moving to low-cost countries. Fabrizio says: “In investment banking we have seen quite a few banks moving very senior people to India because now the balance of people that they manage is in India. This is not necessarily a new thing. The first time I saw it happening was when Deutsche Bank moved their global head of operations to India from London about five years ago. But in the past two years we’ve seen more of it.”

Companies are also seeing the value of low-cost locations closer to home. Poland’s BPO workforce grew by 15% across all sectors in 2016 and it now has between 10,000 and 15,000 people working in BFS outsourcing. Institutions are attracted by the country’s excellent language and IT skills and the fact that it is in a similar time zone to their European operations. Agile development of such things as trading platforms, websites and apps, for example, require close collaboration with onshore teams, which is difficult when there is a significant time difference.

Poland has also been the recipient of functions that need data access because of new privacy laws, such as the EU’s General Data Protection Regulation (GDPR), says Fabrizio. Because Poland is an EU member state, most outsourcing providers based there will already be GDPR compliant.

Goldman Sachs is among those with an operations hub in Warsaw and has announced plans to employ a further 250 people in 2018, increasing its headcount in the city to around 800. Most of the new roles will be in operations and technology, but there will be other positions in risk management, treasury and human resources.

Functions coming homeBut while some roles are moving to low-cost regions, others are returning onshore. India is the favoured offshore location for UK firms and employs between 200,000 and 500,000 people with up to 60% working on industry-specific processes such as post trade, settlement and reconciliation, and another 30% in call centres.

A 2017

survey of 100 chief financial officers and finance directors with financial services in the UK by HR consulting firm Robert Half finds that 59% of UK firms had increased onshoring – bringing roles back to outsource centres in the UK – in the previous two years. Firms cited service complaints and rising costs as the key reasons, and only 4% had increased offshoring.

Another report,

Enabling growth across the UK, published in February 2017 by TheCityUK, which lobbies on behalf of the UK’s financial services sector, finds that contact centre roles and some support functions have returned to the UK. It says that in Glasgow, Morgan Stanley has grown its operations from just six people in 2000 to 1,200 across a range of business areas, including technology, finance, operations, fund services, human resources and internal audit to support its operations across Europe and the US.

Anthony Potter is a partner at ‘challenger’ consultancy Elixirr, which was named as one of the Top 20 World’s Best Outsourcing Advisors by the International Association of Outsourcing Professionals in 2017. He says that rapid salary increases, combined with the inevitable rise in property prices in cities like Mumbai and Bangalore, have made onshoring more attractive.

Global advisory company Willis Towers Watson predicts salaries in India will increase by 10% in 2018, the same as 2017, although they could dip into single digits for the first time since 2011.

And there is added political pressure to bring jobs back to the US as the Trump administration takes a more protectionist stance. This could benefit states like Florida, Texas and Utah that have relatively low cost work forces and, in some cases, offer significant tax breaks.

Impact of changesBut a decline in the outsourcing sector could have a serious impact on the low-cost economies. In India the IT-BPO industry is worth US$154bn and contributed 7.7% of GDP in 2015, according to Investindia. Anthony says: “Outsourcing is one of the biggest industries in India. It has had a huge effect on their economy and on the economies of Poland and The Philippines. In the Philippines, for example, until the outsourcing boom their biggest industry, their biggest GDP contributor, was remittances – that’s people working abroad in places like the US and sending money home.”

The impact of Brexit on the UK’s financial services sector also remains to be seen. A KPMG report –

Impact of Brexit on relocation of financial services institutions from the UK (October 2017) – says that more than a quarter of the 222 largest UK financial services firms are expected to shift resources out of the country or change their domicile. JP Morgan, for example, says that between 500 and 1,000 jobs could be lost in the UK, with many going to Dublin, Frankfurt or Luxembourg. Goldman Sachs is considering moving up to 1,000 jobs to Frankfurt and HSBC Holdings could move 1,000 investment banking positions to Paris.

Other banks, though, are simply expanding operations in response to new opportunities. Silicon Valley Bank recently opened an office in Frankfurt to be close to Europe’s emerging tech hubs. Oscar Jazdowski, co-head of the German branch, says: “We are recruiting here in Frankfurt and have taken office space to support our growth over the coming years. Growing technology companies are our core clients and with tech hubs emerging all over Europe, our bankers need to be close by.”

Remaining onshoreAnthony says that advanced technology is now essential for banks and roles such as quantitative analysts and data scientists are unlikely to be moved away from home countries. And the research, analytics and modelling teams of hedge funds and asset managers are likely to remain at the heart of onshore teams. And despite some movement of senior people in investment banks, Fabrizio believes that most senior decision-makers will remain in the home countries, as will regulator-facing and customer-facing roles.

But overall the global financial services sector faces a challenging future as roles either disappear because of automation or move to new locations because of issues such as Brexit or political pressure to bring jobs back to the US. The traditional low-cost centres such as India and the Philippines will face particular pressure as their costs rise and the challenge grows from countries such as Poland, which offer cultural and time zone benefits.

Mapping the moves

Find an infographic about jobs movement worldwide below. It was originally published in the Q2 2018 print edition of

The Review. Click to view the full-sized version.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.