Graham Withers, Chartered FCSI, joined the financial services sector after what he describes as a “chequered post-university history”, which included jobs in a morgue, a nightclub and as a pub landlord. When his wife fell pregnant, not wanting to bring their child up in a pub, the couple moved to Tunbridge Wells where, after three months of jobhunting, Graham landed a role as an assistant with stockbroker Neilson Cobbold.

“After a couple of interviews I was told to cut my hair, which was down to my back in those days, and I started as a highly qualified tea boy in 1993,” says Graham. He immediately joined the Securities Institute (SI), the CISI’s precursor, to study for the Securities Industry Diploma. “It was, and still is, widely seen in our industry as the investment managers’ and stockbrokers’ exam, so I got on and did it and it gave me legitimacy in the eyes of my peers,” he explains.

In search of an extra string to his bow, Graham put his hat in the ring to become an exam panel member for the CISI. He had already been mentoring junior colleagues at Rathbones, which acquired Neilson Cobbold in 1996, and was interested in finding other ways to help people progress in their careers. He joined the

Private Client Investment Advice & Management (PCIAM) Examination Panel in the early 2000s and was appointed chairman within five to six years; a role he still holds today.

And almost 25 years after joining Neilson Cobbold as a “highly qualified tea boy”, Graham is an investment director with Rathbones. He is just one of the hundreds of thousands of people whose successful and rewarding career has started with a CISI exam.

Student membership

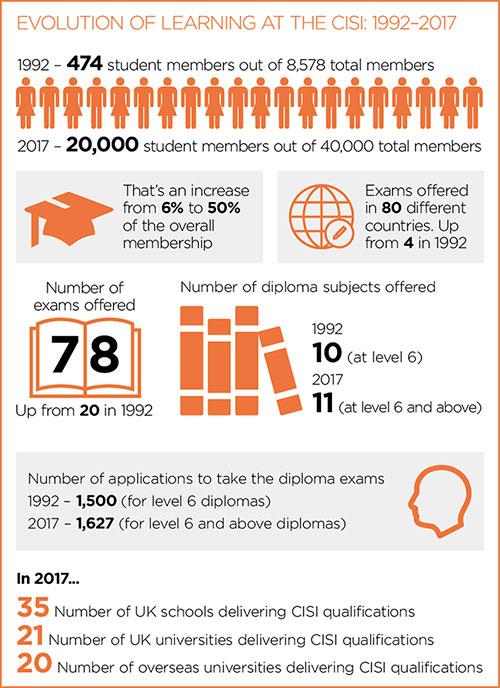

The Institute’s 20,000 student members comprise half its membership. It could, though, be said that all 40,000 members across more than 80 countries are students engaged in lifelong learning. They enjoy access to a constantly-evolving programme of

continuing professional development (CPD), mandatory for non-student members from 2017, which includes refresher courses, seminars, workbooks, e-learning modules and 78 examinations. For those just starting out in their career and based in the UK, the CISI offers a number of workplace apprenticeships.

In a generation, the CISI membership has become a vibrant, global campus. But what has driven this over the 25 years the Institute has existed, and how will its role in educating financial services professionals evolve?

The governance era

In the 1990s, the electronic trading of financial products went from niche to norm. Banks all over the world structured countless forms of ‘exotic’ financial products and traded them at unprecedented volume and speed.

With this came new risks, which created demand for better governance and regulation and a drive to formalise it through compliance rules, governance codes and reporting requirements. The need for training and education about these new ways of working was the defining market opportunity for the SI, set up in 1992.

8,578

The number of applications to join the Securities Institute when it was founded

It signalled its belief in the value of learning early on. In 1993, it adopted the requirement that professional applicants must have passed its own diploma (SIE Dip) and possessed three years’ relevant experience, while student applicants had to be studying towards it.

The focus on education seemed to resonate with the sector. Students accounted for 6% of the total membership in 1992 but that had grown to almost 23% just five years later as new entrants to the profession sought to build their career on a solid foundation of recognised and respected qualifications.

The CISI’s early offering

The Institute’s professional education department first offered 20 well-established examinations brought over from the stock exchange. It administered the Securities and Futures Authority’s (SFA) Registered Persons examinations and offered ten diplomas, including Corporate Finance and Operations Management.

The Institute’s first workbooks reflected the fashions of the day, including

An introduction to futures and options and

Regulatory environment. It hosted monthly seminars for members to update their knowledge, eventually customising these for delivery in-house at firms. A decision at the Securities and Investments Board (later renamed the Financial Services Authority), requiring self-regulatory organisations to formalise staff training, increased the number of individuals taking the Institute’s exams and training courses by 20% in its second year. By 1997, the year it formed its CPD scheme, it delivered 18,707 exams and that grew to 54,620 by March 2001. By its tenth anniversary, in 2002, it offered 37 exams.

Enduring standards

All told, the Institute has run over 190 individual exams in its 25-year history, feeding into 51 qualifications. Many have come and gone with the regulatory tides and economic boom-and-bust cycles. Yet there are some on the CISI’s books today that endure from its early years.

PCIAM – which Graham describes as “my paper”, such is his commitment to the exam – is a case in point. Originally part of the old Securities Institute Diploma, it became part of the

Chartered Wealth Manager exam when the diploma was phased out. PCIAM offered an excellent grounding in the knowledge needed for a career in the investment sector. Its first chief examiner called it a general practitioner’s paper rather than a consultant’s paper, which, says Graham, meant it was a “good knowledge giver”.

For this reason, many practitioners continued to take it as a stand-alone exam but it really came into its own in the late-2000s when the Retail Distribution Review (RDR) required experienced investment managers to re-qualify in order to continue to practise. For those affected, PCIAM was the paper of choice. The exam panel went from administering two papers a year to 100 candidates, to offering six papers a year to around 2,000 candidates.

“It was a completely bonkers time,” says Graham. “We were having to set papers before the last one had been marked to get ready for the next one and people were having to apply for resits in case they failed. They were trying to get qualified before the RDR window closed.”

Today, PCIAM remains a stand-alone exam, regularly taken by those wanting an introduction to the sector and by qualified advisers seeking to refresh their background knowledge. It can also count towards one of three modules required to gain a Masters in Wealth Management.

Doing well by doing right

Over the years, teaching students how to behave has become just as important as teaching them what to know. In April 2013, the Institute became the first professional body requiring exam candidates in the wholesale and capital markets sectors to pass an integrity test.

IntegrityMatters puts users through a series of ethical dilemmas they may face at work, and asks them to decide what they would do in that situation. Passing the test is a requirement of membership. Kevin Moore, Chartered MCSI, CISI’s director of global business development – who joined in 2007 after a long career in retail banking with Lloyds – says the number of seminars the CISI offers on integrity-related topics has grown from around ten annually to around 100 or more in some years, including delivery in-house for financial institutions.

Ethics have evolved from a gentleman’s handshake to a comply-or-explain regulatory requirement. “When I was in banking, people took behaviour for granted, so there wasn’t an understanding of what constitutes good behaviour,” says Kevin. “Today a number of large international banks we work with openly discuss the need for good behaviour, putting it front and centre.”

Global reputation

The Institute built an overseas reputation for its education programme from inception, sustained by the increasing globalisation of financial markets. Five years on from its birth, its International Capital Markets Qualification exams were taken across 13 countries, as the qualification became an industry standard overseas.

By 2002, it had delivered exams and training in 20 countries, including training for the Chinese government and its securities market; global custody education for India’s national stock holding corporation; and exam management on securities and investments for the Russian Securities and Exchange Commission, sending a team to Moscow to install examination systems and prepare the Commission to use it. Delegations from Eastern Europe and the Far East came to London to understand the Institute’s offering, seeking its help to set up their own local offerings.

Educational partnerships

The CISI’s Educational Trust, formed in 2011, works to further financial services education in schools, colleges and universities, delivering the Institute’s charitable objective of dissemination of financial knowledge and information about the field of securities and investment. Thirty-five UK schools currently deliver CISI qualifications, while 21 UK universities and a further 20 universities outside the UK partner with the Institute to offer CISI qualifications on accredited degree programmes. Demand is also growing for accredited school programmes to develop students’ hard and soft skills for better employability – understanding the finance and investment worlds as well as being able to undertake presentations, networking and teamwork.

Today, with members across 116 countries, a growing contingent of CISI students are in territories where the Institute does not yet have formal operations, and where students may face logistical challenges to accessing education. In response, CISI qualifications are now readily available to students in the Middle East, China, Africa and Latin America through e-learning.

Offering online teaching and learning resources, including interactive e-books and video tutorials, is important to the CISI’s aim of reaching new members overseas, as well as appealing to young people. CPD is also offered through its own television channel, CISI TV, including filmed events, as well as pre-recorded tutorials and

Professional Refresher learning modules across a range of topics.

Giving something back

Alongside increasing digitilisation, the Institute continues to expand its range of qualifications and geographical reach. It plans to respond to strong interest in events and courses on the Senior Managers and Certification Regime, Conduct Rules and MiFID II. There is also demand for training around the misuse of technology, and in leadership and communications.

Two new exams for the Kuwaiti financial market regulatory environment are being prepared for release in 2017 – in English and in Arabic – while the new International Certificate in Wealth & Investment Management will be released for the Chinese market. These developments will be part of a constantly evolving offering that helps members to achieve globally recognised standards of professionalism and integrity.

“Professional training and assessment of competence was a key objective of the CISI when it was formed 25 years ago,” says Scott Dobbie FCSI(Hon), former chairman of the CISI. “It is very rewarding to see how well the Institute has successfully adapted and widened its range of services in this respect to meet the changing structure of the financial services industry and, hence, the changing needs of the market and of its members.”

For members like Graham, the Institute’s professional standards have given him the legitimacy to succeed, and he hopes he can pass that on to younger members. “There are an awful lot of people like me who want to give something back to an organisation that has helped us in our careers in the past by giving us the qualification we needed to get on in our working lives,” he says. “It’s quite nice to be able to help to progress the next generation.”

This article was originally published in the Q2 2017 print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.