From pensions to regulation, we shine a spotlight on financial planning in South Africa

by Bethan Rees

As with any profession in financial services, there are nuanced and stark differences across the world. In this article we look at the market for financial planning in South Africa, the needs of South African clients, the regulatory climate, and the approach of CFP® professionals.

The Financial Planning Institute of Southern Africa (FPI) is the only licensing authority for CFP® professionals in the country. It is also a founding and affiliate member of the Financial Planning Standards Board (FPSB), which owns the CFP marks outside the US.

There is a four-step process to becoming a CFP professional in South Africa:

- Obtain an undergraduate and postgraduate qualification in financial planning from one of the FPI Recognised Education Providers.

- The candidate must take the Professional Competency Examination, which comprises two case studies and tests the candidate on several financial planning components, "as well as the ability to perform the core competencies of a financial planner" which, according to the FPI, is "to collect, analyse and recommend a financial planning solution in the end".

- Undertake three years of relevant work experience, either supervised or unsupervised, working with clients, or in an educational, supervisory or non-client facing capacity.

- All CFP professionals have to adhere to the rules and guidelines put in place in the FPI's Code of Ethics and Practice Standards. Failure to do so could result in disciplinary action.

Needs of South African clients

According to the FPI, there are currently 4,670 CFP professionals in South Africa working with clients who are, according to a global survey conducted shortly after the onset of the pandemic, mostly concerned about asset values, unemployment, and reduced income.

South Africa’s complex political history influences and shapes the needs of its population today, with the South African economy experiencing a "considerable economic transformation … since the advent of majoritarian democracy in the early 1990s", according to the 2018 Financial literacy in South Africa report, commissioned by the Financial Services Conduct Authority (FSCA) – the financial services regulator in South Africa. This transformation includes, for "most of the democratic period", a "commitment to fiscal responsibility" but, on the other hand, the six years prior to the survey were "characterised by low growth, weak consumer confidence and fiscal irresponsibility by the state".

Most South Africans are solely responsible for their own retirement

Juanita Doolan CFP®, financial planner at Liberty Life, says that because of the country’s history, there is a whole generation of people who are the first in their families to achieve a tertiary degree and have the potential to make good money. "This means that they come from families where there often is no intergenerational financial knowledge, and they are the first generation in their family who has money to invest," she says. They might look to a financial planner not only to guide them, but to educate them. "It's often also the case with these clients that once they start earning good money they are expected to assist with the education of their siblings and/or other young people in their families, as well as support parents financially," Juanita says. These clients need financial planning to help them strike a balance between helping and making provision for themselves and their own families, she adds.

Juanita Doolan CFP®, financial planner at Liberty Life, says that because of the country’s history, there is a whole generation of people who are the first in their families to achieve a tertiary degree and have the potential to make good money. "This means that they come from families where there often is no intergenerational financial knowledge, and they are the first generation in their family who has money to invest," she says. They might look to a financial planner not only to guide them, but to educate them. "It's often also the case with these clients that once they start earning good money they are expected to assist with the education of their siblings and/or other young people in their families, as well as support parents financially," Juanita says. These clients need financial planning to help them strike a balance between helping and making provision for themselves and their own families, she adds.

Kim Potgieter CFP®, director and head of life planning at Chartered Wealth Solutions and founder of the Women in Finance Network (WiFN), agrees with Juanita’s perspective. She says that financial planning clients, especially the younger generation, need assistance with basic saving plans. "There is also a great need for skills development around managing their money, protecting themselves from risk and getting or staying out of debt."

Kim Potgieter CFP®, director and head of life planning at Chartered Wealth Solutions and founder of the Women in Finance Network (WiFN), agrees with Juanita’s perspective. She says that financial planning clients, especially the younger generation, need assistance with basic saving plans. "There is also a great need for skills development around managing their money, protecting themselves from risk and getting or staying out of debt."

Kim set up the WiFN in South Africa in 2013 to enable women to "support, mentor and learn from each other". To illustrate the need for this, she shares some of the messages she’s heard: "My contribution is not worth much"; "my partner is the breadwinner"; "I don’t deserve to earn as much as someone who dedicates their life to work"; "managing money is difficult. I’ll leave that to the experts."

Retirement planning

The retirement system in South Africa is sophisticated. Defined benefit schemes are available, but the majority of private sector employees are covered by defined contribution schemes, according to Pension Funds Online, a source for detailed financial data and contact information on pension funds globally. There is an ‘older person’s grant' which, according to the South African government website, is up to R1,890 per month (roughly £95) for those older than 60, and R1,910 (roughly £96) for those over the age of 75.

Only 16% of the adult population could answer a basic question about inflation The grant is means tested and only available to those on a low income – for singles earning R86,280 (roughly £4,136 per annum) or less and for couples R172,560 (roughly £8,278 per annum) or less. Because of this, most South Africans are solely responsible for their own retirement, says Pierre Taljaard CFP®, founder and director of Simple Wealth. He adds that a large proportion of employees don't have a company pension fund to rely on either. Therefore, he says, retirement planning is the biggest need for the average South African.

The grant is means tested and only available to those on a low income – for singles earning R86,280 (roughly £4,136 per annum) or less and for couples R172,560 (roughly £8,278 per annum) or less. Because of this, most South Africans are solely responsible for their own retirement, says Pierre Taljaard CFP®, founder and director of Simple Wealth. He adds that a large proportion of employees don't have a company pension fund to rely on either. Therefore, he says, retirement planning is the biggest need for the average South African.

Gail Gibson CFP®, senior lecturer at Moonstone Business School of Excellence, describes the pension fund environment in South Africa as a "world leader". "We have a far better online presence than many countries. This online ability is in part due to a dysfunctional postal system," she says. Gail explains that the post office is a state-owned enterprise and technically bankrupt. Throughout lockdown in the country, mail was not being received. "Most people make use of private courier companies who are cheaper and more reliable."

Gail Gibson CFP®, senior lecturer at Moonstone Business School of Excellence, describes the pension fund environment in South Africa as a "world leader". "We have a far better online presence than many countries. This online ability is in part due to a dysfunctional postal system," she says. Gail explains that the post office is a state-owned enterprise and technically bankrupt. Throughout lockdown in the country, mail was not being received. "Most people make use of private courier companies who are cheaper and more reliable."

Financial literacy and education

Juanita sees a wide spectrum of clients from diverse backgrounds. "There are communities where it is considered rude to talk about money, so there is no intergenerational transfer of financial know-how" among some groups, she says. There is a clear need for financial planning in South Africa, given the low levels of financial literacy shown in the 2018 financial literacy report, which surveys 3,067 South Africans. Only 16% of the adult population could answer a basic question about inflation, 46% could calculate 2% interest on R100 deposit after a year, and 35% could calculate compound interest on that amount after five years.

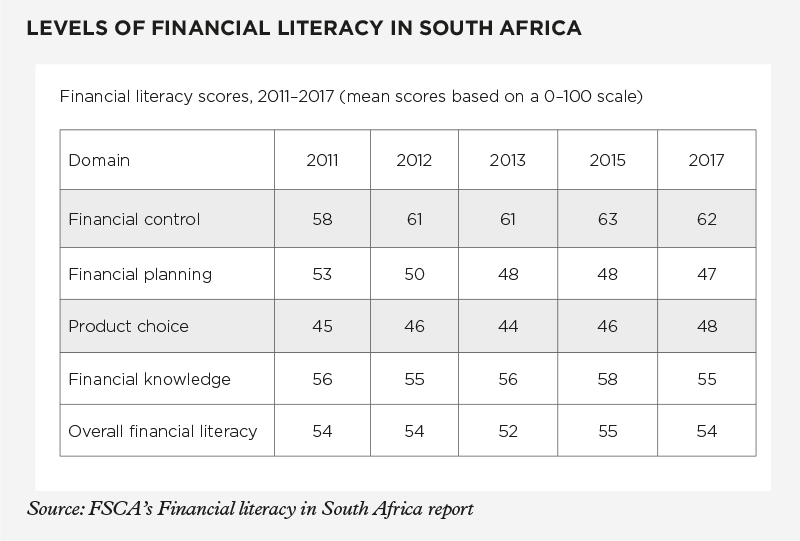

The report focuses on financial literacy under five ‘domains’. The table below shows a decline in individuals’ own financial planning – setting some financial goals and saving for a rainy day, for example – over a five-year period. "The investment and savings product that most South Africans are aware of is a pension fund," says the report. Yet 42% have no retirement plan at all.

According to World Bank figures, just over 16% of South African people are self-employed, roughly the same as in the UK. Gerhardt Meyer CFP®, former chair of the Board of Directors of the Financial Planning Standards Board, says that because of the large numbers of self-employed people, there is a need for business advice and assurance, which financial planners can provide.

Regulation

Financial planning is currently mostly governed by the Financial Advisory and Intermediary Services Act, 2002, Gerhardt says. The Act protects clients by mandating that all financial services providers are registered and have a code of conduct that must be adhered to. It also defines compliance duties and provides a mechanism for enforcement and complaint procedures.

The South African FSCA, previously known as the Financial Services Board, is implementing its own Retail Distribution Review (RDR) – the UK launched its version of the RDR in 2012, with the aim of, according to the FCA, establishing a "resilient, effective and attractive retail investment market that consumers had confidence in and trusted". The FSCA's RDR is to be implemented in three phases, with the first phase having commenced on 1 January 2018 – the full implementation date has not been finalised yet. "Changes are being made in a very considered way, and we are fortunate that our regulator does consult broadly and takes comments into account before making any changes," Gerhardt says.

"Financial planners must have a clear and compelling value proposition – one that clients will be happy to pay a fee for"

The RDR will guide legislation that will define and regulate financial advice, covering how advisers can provide advice, what they need to disclose to clients, how they charge, what clients can do if they receive bad advice, and how regulatory bodies can restrict advisers who act irresponsibly. Pierre says: "This will go a long way to ensuring that advisers are remunerated fairly and transparently, conflicts of interest are properly disclosed, and advisers meet a minimum qualification level." He adds that while the first phase of the rollout has had a larger impact on the distribution of life insurance, the forthcoming phases will also impact the distribution of investment products.

Kim says that the RDR will change the intermediary model under which financial planners in the country can deliver financial services, and predicts that it will have a significant impact on the fees they can charge related to their value proposition. She says: "Under RDR, only two models will be permitted: product supplier agents (PSAs) or tied agents, and registered financial advisers (RFAs) or independent brokers. Intermediaries will not be allowed to operate in both capacities simultaneously."

Financial planners will be required to disclose the model under which they operate and draw up advice and service level agreements (SLAs) with clients. "The delivery of services against the SLAs must be trackable and reported on. This means that financial planners must have a clear and compelling value proposition – one that clients will be happy to pay a fee for," says Kim.

Communicating with clients

Before the Covid-19 pandemic, Juanita had been communicating with clients via a hybrid approach of face-to-face and online interactions. "The pandemic fast-tracked the virtual approach and where clients were hesitant before, now it's just what we do. I still have some clients who only want to meet face-to-face, but I have others who I only see online. I do think going forward it will be a combination depending on the situation and the need," she says.

Gerhardt notes that although some firms did previously operate an arguably more cost-effective model based around online and telephone communication, the holistic side of financial planning was typically conducted face-to-face before the pandemic. "Now, most client engagements are virtual in nature. There has been a huge increase in advisory firms offering webinars and online courses to attract and inform clients, too."

World-class financial planning

According to Pierre Taljaard, some providers are still hiding their product-led and distribution-focus behind the term 'financial planning'. "Our regulator is in the process of wrestling with this challenge, and the term will over time become more defined.

"Given our status as a developing country, the existence of a strong lifestyle financial planning (pure financial planning, as done by a CFP™ professional, which focuses on how a client should manage their money and use it to support their desired lifestyle, rather than focusing on financial products) community, established over 20 years ago, may be surprising to those not familiar with the country," says Pierre. "In this growing community, the concept of being a fiduciary is second-nature, a testament to the role of the FPI and the CFP marks."

Kim echoes this, saying that the reason why clients come to her firm, Chartered Wealth Solutions, is because of its life planning offering, which is slightly different to lifestyle planning in that life planning also looks at a client's relationship with money, as well as planning for their lifestyle. "In fact, we do not look at the finances of clients before doing a series of life planning meetings, guiding our clients to visualise what they are retiring to and putting a plan in place for living their best life after the halfway mark. Only then is the financial plan drawn up," she explains.

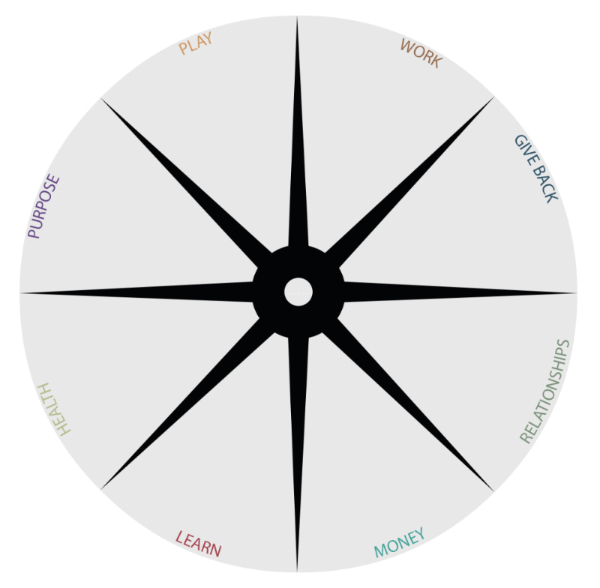

Kim guides clients using a series of exercises looking at what the next chapter for them looks like in an ideal world. "We use the 'wheel of balance' and the 'bucket wheel' to guide clients," she says. The bucket wheel (stylised example below), is used with Kim's clients to communicate what they want to do in specific areas of their lives (as shown in the wheel), such as give back, learn and play. Then, Kim will assign monetary values to the bucket wheel items and this becomes the start of the client's financial plan.

"We also do exercises looking into a client's personality so that we understand their perspective of how they see the world," she adds.

United by the CFP certification

The same level of professionalism unites Kim, Juanita, Pierre, and Gail. They may all be working with clients with differing needs and levels of literacy, but those clients are all guaranteed the same gold standard level of care mandated by the CFP certification.

The CFP certification is globally recognised as a commitment to excellence in financial planning and ethical practice, with CFP professionals undertaking continuing professional development. With the certification available in 27 countries and territories worldwide, the needs of clients will differ in each location, but the commitment to world-class standards remain the same across the board.