Technology has played a huge role in bringing previously excluded people into the financial system and will without doubt continue to do so. But technology alone is not the silver bullet

by Paul Bryant

Globally, about 1.7 billion people remain unbanked, with nearly all of these people residing in developing countries, according to the Global Findex Database 2017 (Findex), produced every three years by the World Bank. The situation has, however, been improving rapidly, with Findex reporting that 515 million adults worldwide opened an account at a financial institution or through a mobile money provider between 2014 and 2017, raising the percentage of adults with an account from 51% in 2011 to 69% in 2017 (63% in developing countries).

The Covid-19 pandemic has thrown into sharp relief the advantages of digital financial services over a cash economy, not only in terms of reduced human contact but also the robust nature of automated payments systems over those reliant on bank staff.

Which technologies have had the most impact on financial inclusion, why is this, and what can we expect in the future?

Findex highlights research that illustrates the impact of digital financial services on financial inclusion in developing countries, such as helping people to save or enabling the transfer of money from distant friends and relatives; encouraging entrepreneurial activity and gender equality; and reducing 'leakage' from cash pension or benefit payouts.

However, Till Bruett, global practice lead, financial services and investment at development consultancy DAI (and previously secretariat director of the United Nations task force on the digital financing of the Sustainable Development Goals), cautions about getting too obsessed with numbers. "People must actively use the product, not just 'sign up', and that product has to have a positive impact on their lives," he says.

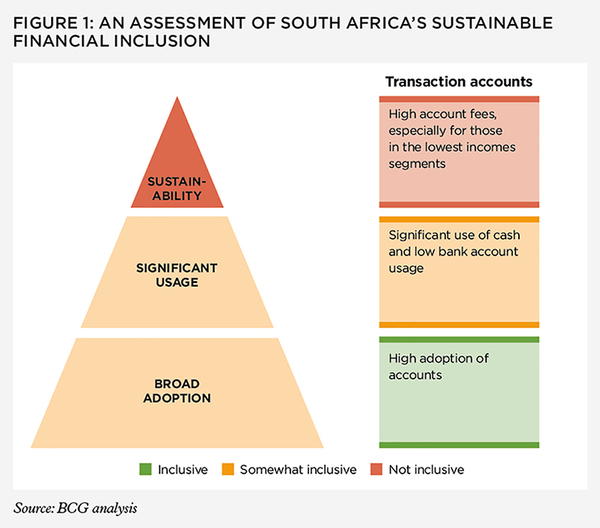

His point is illustrated by an example presented in the 2017 Boston Consulting Group (BCG) report, How to create and sustain financial inclusion: "In South Africa, 70% of adults have transaction accounts [a high share of the market considering South Africa's overall economic profile], but more than one-quarter of account holders withdraw their wages as soon as they are deposited. These adults are not actively using the accounts to achieve financial goals, and they are not taking advantage of other financial services. Many view accounts as constraints, not enablers." BCG came to these conclusions after interviewing 1,500 low-income South Africans, 40% of whom said the reason they did not have an account was that fees are too high.

His point is illustrated by an example presented in the 2017 Boston Consulting Group (BCG) report, How to create and sustain financial inclusion: "In South Africa, 70% of adults have transaction accounts [a high share of the market considering South Africa's overall economic profile], but more than one-quarter of account holders withdraw their wages as soon as they are deposited. These adults are not actively using the accounts to achieve financial goals, and they are not taking advantage of other financial services. Many view accounts as constraints, not enablers." BCG came to these conclusions after interviewing 1,500 low-income South Africans, 40% of whom said the reason they did not have an account was that fees are too high.

Foundations in mobile and digital ID

Jan Bellens, global banking and capital markets sector leader at EY, says that two technologies in particular are foundational to financial inclusion – access to mobile phones (preferably, but not necessarily, an internet-enabled phone) and some form of digital identification.

Access to mobile phones has raced ahead of financial inclusion. Findex reports that globally, around two-thirds of all unbanked adults – 1.1 billion people – have a mobile phone, with a quarter of these having access to the internet as well. Even a simple mobile phone can open up access to mobile money accounts.

Probably the most successful example of mobiles being an enabler of financial inclusion is M-Pesa in Kenya (see cisi.org/mobilemoney). M-Pesa launched in 2007 as a basic payments system using existing SMS technology to allow people without bank accounts to deposit or withdraw cash at agent shops, transfer money person-to-person, and buy prepaid airtime. According to parent company Safaricom's 2019 annual report, active M-Pesa users (those who used the service at least once within a 30-day period) grew 10% over the previous year to 22.6 million and, on average, executed 12 transactions per month (11% up on the previous year).

Access to identification that satisfies financial services' onboarding requirements remains a big problem

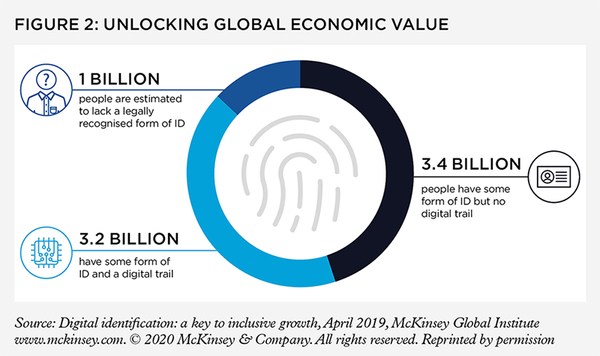

But while mobile phone adoption presents an opportunity in many countries, access to identification that satisfies financial services' onboarding requirements remains a big problem. According to the World Bank's Identification for Development (ID4D) initiative, nearly one billion people lack any legal identification (digital or otherwise), which mostly prevents them from opening a bank account.

Digital ID is a solution to this problem. It can include a range of technologies and methods to verify and authenticate identity, including verification of personal traits (fingerprint, iris, face or voice); knowledge (PIN or password); and possessions (smart card, mobile phone, security token). It can also be deployed over a range of channels such as mobile phones, computers, or internet-enabled central authentication points (such as a bank ATM).

A 2019 report by McKinsey, Digital identification – a key to inclusive growth, says that dozens of countries are implementing digital IDs, often with mixed results. However, the Indian government's Aadhaar programme, started in 2009, has achieved the highest participation rate at 95% of all adults (1.2 billion people). According to State of Aadhaar: a people's perspective, 49% of participants have used Aadhaar to access one or more services, such as bank accounts or pensions, for the first time.

Building on the foundationsJan Bellens says these foundations, which are often used to get people into the financial system for the first time with a transactional banking or payments account, can then pave the way for rolling out more sophisticated financial products such as credit, insurance and savings. McKinsey has said a transactional account is commonly the start of a 'digital trail'(which would include an electronic record of transactions or even social media activity) that provides useful credit scoring data.

In this vein, the Aadhaar programme has provided a platform for the private sector to participate in and accelerate financial inclusion. Bharat Financial Inclusion (BFIL), the largest microfinance company in India according to the 2018–19 annual report of parent company IndusInd Bank, is one such company. A BFIL press release from June 2017, describing the programme, says the company is in the process of rolling out 20,000 Kirana Points – a customer service point, typically equipped with a tablet, connected to a mobile network, with a fingerprint and card reader attached, housed in a BFIL branch or an affiliated merchant store – across 16 states in India. Loan officers, trained by BFIL, help consumers to apply for a loan using a mobile device and "supporting tools like a biometric device or a card reader". The system provides multiple benefits, including easier and cheaper access to credit, as well as access to new financial services such as savings and bill payment facilities.

The Aadhaar programme has provided a platform for the private sector to participate in and accelerate financial inclusion

Till Bruett says the growth of digital credit is one of the more prominent trends in the world of inclusion, noting in particular the 'savvy' companies using basic data sets (such as a limited history of payments or even airtime purchases), or more advanced but 'alternative' data sets, such as the size of consumers' social networks and the frequency of contact, to determine creditworthiness.

For example, in Indonesia, micro-financing company Amartha provides a peer-to-peer loans service and has developed a credit scoring algorithm based on a review of its credit-seeking businesses (typically a single-person business such as a food vendor or weaver, with the applicant known as a 'micropreneur'), as well as demographic and personality data – gathered through psychometric testing. According to a 2018 conference paper Psychometric credit scoring in Indonesia microfinance industry: a case study in PT Amartha Mikro Fintek, Amartha applicants are required to respond to a set of 23 statements from field officers (necessary because some borrowers have limited literacy skills) which produces a personality profile correlated to creditworthiness.

Lending is restricted to women, often in rural areas, who would struggle to raise credit through conventional means because of issues such as a lack of credit history. According to Amartha's Inspiring change: social accountability report 2018: "Early marriage for girls has contributed to less decision-making ability for women in the family and reduction of future earnings by 9% (World Bank, 2017). With the spirit of empowering women, Amartha's financial literacy and entrepreneurship curriculum have been designed to improve the decision-making of women in the family, especially with regard to budget allocation for children's education, and health and sanitation needs of the family."

Keep an eye on the tech giantsA potentially key development to look out for, according to Till, are further moves into financial services in developing markets by the global tech giants, with Chinese companies leading the way.

Ant Financial, a financial services company spun out of ecommerce giant Alibaba, has used Alibaba's existing customer base to become a provider of payments to 1.2 billion people globally (900 million in China alone), and a provider of wealth management services, small and medium-sized enterprise loans, insurance and credit reference services to a further 740 million consumers and 28 million small businesses, according to the Alibaba Group 2019 Investor Day presentation. Evidence of these companies expanding into international financial services is not hard to find. Ant Financial's international operations include a partnership with Safaricom in Kenya, which allows Kenyans to purchase goods on AliExpress (an Alibaba-owned ecommerce platform selling mostly Chinese goods), using M-Pesa.

Despite its big contribution to financial inclusion, Jan stresses that technology itself should not be seen as a silver bullet, and that continuing the growth trajectory of financial inclusion will depend on finding the correct blend of technology, regulation, and human ingenuity.

He says: "The bottlenecks today are often not because of technology constraints, but in other areas, such as the ability of regulation to keep up (accepting digital IDs in a KYC process), financial literacy (not just education in terms of financial management and financial products, but literacy in terms of having trust in the financial system itself), and also the design of customer experiences, which, if done poorly, constrain the adoption and use of new technologies."

There are encouraging examples of leaders to follow or learn from in these areas, such as India's 'Small Finance Bank' regulatory regime, designed specifically to promote financial inclusion by lowering the capital requirements of lenders; and Amartha's financial literacy classes, which were attended by all 110,392 new borrowers onboarded during 2018 before they received their first loan disbursement.

Finding that blend will be the key challenge, not only to financial and tech companies but to the public and developmental sectors as well.

The full article was originally published in the June 2020 flipbook edition of The Review.

The full flipbook edition is now available online.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting 'Yes'.

Once you have read the flipbook edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.