Webcasts in conjunction with Adempi Associates

Wind-down planning – when is the right time?

2 June 3pm BST

Communicating at a distance – what have we learnt?

10 June 3pm BST

Could conduct risk be amplified during lockdown?

23 June 3pm BST

Entrepreneurial thinking in the workplace

2 July 3pm BSTUnprecedented in terms of the speed, scale and spread of its impact across all sectors and all geographies, the Covid-19 crisis has shed a harsh light on businesses’ operational resilience and the robustness of the continuity planning that companies had in place. It has seen entire workforces furloughed or shifted to remote working and sweeping changes in the ways we communicate with our colleagues, suppliers and clients. It also raises the question of whether it is practical or even possible to have planning in place that is equal to a black swan event such as this.

“I don’t think in our wildest dreams we could have envisaged a business continuity planning scenario like this one,” says Hennie de Villiers, deputy CEO of Sanlam Personal Finance, headquartered in Cape Town, South Africa. “We’d planned for a scenario where we might lose a building to a natural disaster, crime or terrorism. But now, with the lockdown, we’re at around 95% of our staff working from home.”

It’s a sentiment, and an experience, that is echoed all around the world, as firms in the financial services sector have scrambled to upgrade their technology, support their people and sustain their business, all against a backdrop of significant market volatility. What is immediately apparent is that businesses that had a head start in terms of technology to enable remote working have found it easier to weather at least the initial stages of a storm.

Michael Kitces CFP®, head of planning strategy at Buckingham Wealth Partners in St Louis, Missouri and producer of Nerd’s Eye View, a blog and podcast series for financial advisers, says: “For technology-adopting firms that were already largely cloud-based, nothing has changed. It’s business as usual, just sitting in a different place.”

One such tech-forward business is Dolfin, a London-based wealth management firm. Chief operating officer Amir Nabi says: “We are fortunate in that we deal with international clients quite a lot, so we realised at the start of the year that Covid-19 could be quite a big risk. We shifted our focus in terms of portfolios and holdings to be much more conservative and reduced our exposure to the equities market. We made operational resilience a priority. In January, we introduced a cyber security upgrade and carried out an assessment of our IT security, simulating a hack into our network. When it was clear lockdown was coming, we swiftly ramped up our preparations for firm-wide working from home.”

However, says Michael, “For the non-technology-adopting firms, this is a significant disruption. They’re trying to pivot and adjust as quickly as they can, and some are pushing their employees to come into work because they don’t have the systems.”

People and practicalities

While the initial shock of lockdown was felt across sectors and around the world, the specific risks that businesses face and the adaptations they have needed to make have varied.

“Sanlam is a diverse financial services entity,” says Hennie. “It’s the largest in Africa, with a presence in 34 countries, but our base and the majority of our people are in South Africa, where Sanlam Personal Finance has just over 6,000 office staff. Those in the middle- and upper-income brackets have connectivity at home. But for people on lower incomes that’s more difficult.

“We issued laptops to almost 1,000 people, and enabled many others to take their desktop computers home. But there is a portion of our people who can’t work from home, some because they live in communities where it would be dangerous for them to have such valuable equipment in their homes. Luckily, they are in the minority, and for those whose roles aren’t covered by the essential service exemption for insurance, we arranged for them to take Covid-19 special leave,” he says.

Amir says: “Our trading team in particular need much more powerful set-ups with five or six monitors, so a laptop set-up at home would not be adequate. We prioritised those teams to have a set-up that is effectively the equivalent of being in the office in terms of the equipment. Before the formal lockdown, we had people work from home on a provisional basis to test if things were working and report any issues to IT.”

Regulatory changes

Around the world, regulators responded swiftly to the sector’s business continuity challenges. On 27 March, the UK’s Financial Conduct Authority issued guidance stipulating that firms should take “every possible step to facilitate their employees working from home”. A few days later, on 31 March, the FCA published a Dear CEO letter detailing supervisory flexibility over 10% depreciation notifications (a requirement under the EU’s second Markets in Financial Instruments Directive) until 1 October 2020.

Sean Lam, Chartered FCSI, group chief executive officer at London-based investment management firm Walker Crips, explains how his firm has tackled keeping clients informed, while adhering to the relaxed FCA rules. “When sending out a 10% letter, we include a short paragraph explaining the FCA’s new guidance and that there will not be another ‘drop’ letter for the quarter until the guidance is revised. And that clients should always feel free to contact their investment manager. We also include a clear and obvious message in all our 10% notification letters pointing clients to our market commentary page on our website,” he says. Walker Crips fortunately haven’t had to battle with postal issues either. “Our post room staff were designated key workers in financial services. Therefore, we had staff to deal with all things paper, from receiving and scanning to generating and posting.”

"We have implemented a fully functioning temporary post room offsite, where two staff members can print and post documents as needed"Cynthia Poole, Chartered MCSI, director of relationship management and business support at wealth management firm Raymond James in London, says that the firm delivers the majority of 10% depreciation notifications via email, even before lockdown. “Where a client does not have an email address, previously our client services team would print and post the letters to clients. During Covid-19, we have implemented a fully functioning temporary post room offsite, where two staff members are able to print and post documents as needed (the staff are in the same household, so observing government guidelines),” she says.

“We have also leveraged our relationship with a third-party print and distribution firm to print and post other items, and if needed, this third party could post the 10% letters, too.”

In South Africa, the government published guidance on competition legislation, which was eased to allow banks to work together to address some of the issues they face. The banks are allowed to agree a coordinated approach to help customers in financial distress, which would usually be prohibited under competition legislation. In New Zealand, the central bank swiftly altered its guidance on anti-money laundering and customer due diligence to allow compliance with the government’s strict lockdown. It has relaxed its identity verification rules so that customers can be onboarded without face-to-face contact and without providing original documents.

Challenges inspiring creative solutions

Supporting clients during lockdown has also led to innovative ways of working for many businesses.

“Financial planning is a much more detailed process than simply managing investors’ accounts, but it can still be done remotely,” says Brett Millard CFP®, chair of financial planning professional body FP Canada, and regional manager at IG Wealth Management in Canada. “The biggest challenge is building a relationship of trust with a new client when you aren’t able to meet face-to-face for initial meetings. As people become more comfortable with video conference meetings, this should subside to some degree.”

Joanna Redmond CFPTM Chartered MCSI, financial planner at Investment for Life, based in Doncaster, UK, has found the transition to home-working mostly smooth. “I already worked from home one day a week and had a dedicated office space to do this, so I have good facilities to work in,” she says. “Not being able to visit clients has been the biggest change, but many have enjoyed video calls. We have had some technical problems as we help clients to log in to meeting rooms, download the apps they need and make sure they can hear or see us, but these are relatively straightforward problems to fix. My main difficulty comes from a pesky cat who insists on sleeping on my keyboard.”

Where possible, Joanna says, her firm has made sure that a client will have a tablet or computer available before offering an online meeting. “We have tried to use [the software that] clients already have wherever that is possible, within reason due to security issues,” she says. “Sometimes, clients need a phone call to talk them through how to log on and see their adviser. One of our paraplanners will do that at the start of the meeting if it looks as though our client has not logged on at the agreed meeting time. We have also made a point of starting with a quick ‘housekeeping’ session at the start of online meetings, explaining to clients what will happen if for some reason technology lets us down during our call.”

Much of this client interaction within the financial services sector involves reassuring people who are understandably alarmed about the impact of the crisis on their investments, or, on a more fundamental level, the safety of their jobs and their ability to survive the crisis financially.

“We’ve got to work with clients and explain this is not dramatically out of the ordinary for bear market cycles,” says Michael. “In the US we had the tech crash and 9/11, the global financial crisis, and now this pandemic. It’s not the same cause, but they all rhyme in what happens: the market goes down and it’s very scary and it feels like we’re on the cusp of the world ending, and then the world doesn’t end and we get growing again, the markets go back up and we move forward.”

Guy Kashtan, CEO of fintech company Rewire, a digital platform that offers international online banking services to migrant workers, says: “This has been a challenging time for our customers, with some of them temporarily losing their jobs. We moved rapidly to assist them, increasing our support team by 50%, preparing manuals and websites to educate them in how to use financial services without leaving the home. We have also upgraded our applications to support diverse languages and allow money to be sent to different countries, opening remote accounts for quarantined migrants, and offering remote support and account opening for workers in lockdown.”

From an HR point of view, providing emotional support for a newly remote workforce has been a priority, says Hennie. “Sadly, the first Covid-19 death recorded in South Africa was a Sanlam employee, and it was a huge shock to all our staff. That happened on the night lockdown started. We immediately arranged for our employee assistance programme providers to provide counselling remotely, and we encouraged staff to make use of that. We also committed to sharing as much information as possible to counteract all the fake news that’s around.”

Risk and resilience

With most countries around the world still in various stages of lockdown, and only a handful of regions beginning to emerge and resume economic activity at the time of writing, it’s impossible to predict what the long-term impact of the pandemic on the global economy will be, or what ‘normal’ might look like in a post-Covid-19 world. What lessons have businesses taken from the current crisis, and how might their business continuity planning be adjusted in future?

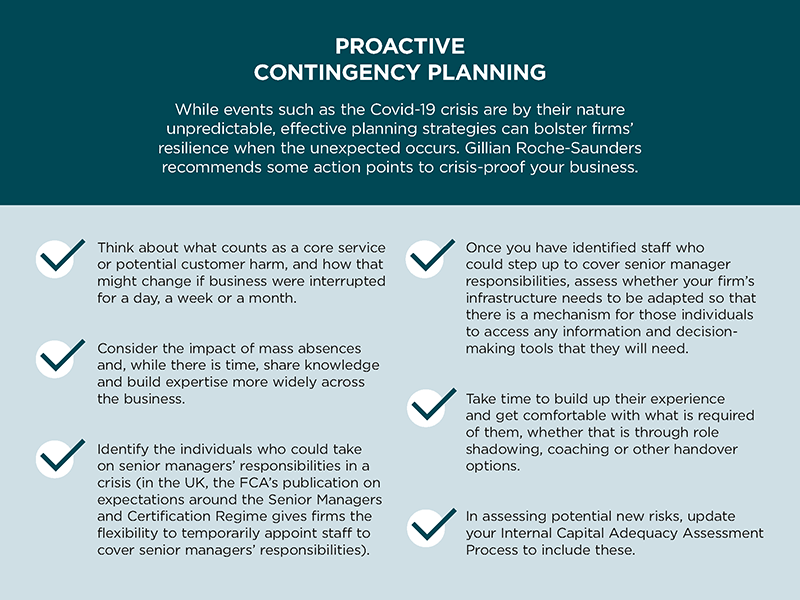

“Most firms had considered operational resilience from both a premises and an infrastructure perspective and many previously felt confident in their business continuity planning because of that,” says Gillian Roche-Saunders MCSI, a partner at Adempi Associates, a London-based compliance consultancy.

“We have seen the most revision in the people aspect of continuity planning. Even those plans that covered key-person risk were mainly focused on the absence of certain senior managers or deal makers in the firm. What if all the senior managers are ill at the same time? What if key knowledge is temporarily missing in an entire department?”

However, as Gillian points out, contingency planning that protects the loss of knowledge when a key individual leaves the firm or is indisposed is less applicable to the Covid-19 challenge, which has raised the possibility of a high volume of people being away at the same time.

Cary List CFP®, president and CEO of FP Canada, explains: “We maintain a detailed, dynamic risk register, which helps us monitor the organisation’s ability to cope with a disaster or crisis. Some parts of that risk register have proved to be applicable to the current crisis, and the organisation is coping well. For example, a registered risk would be something like the risk of our operating revenue being cut dramatically, and we have a detailed response plan on how to operate if that happens. Having the responses to these risks thought out ahead of time and regularly reviewed by our senior leadership allows us to revise our planned responses as needed.”

“What this has confirmed is that as a business we need to be agile,” says Amir. “We already focus our efforts on tech and development, but this has demonstrated just how important that is. We were able not only to switch people to working from home but also to continue progressing four new hires, getting their equipment up and running, having their inductions via video calls and screen sharing. The attention and priority we’ve given to some of these tools as a way of working and functioning has been validated, and we have learnt that it is possible for the entire business to very effectively function from home.”

Brett believes that the financial services sector in Canada, which is currently governed by various different regulators at state and national levels, could benefit from a more joined-up approach in future. “Disaster stress-testing is important for all industries and organisations,” he says. “If you don’t have a plan and review it regularly to make changes, this kind of crisis can overwhelm you quickly. In order to implement something like this for our sector here in Canada, I believe we would first need to adopt a system where we have a single national regulatory body. Currently we have too many different bodies all responsible for a piece of the sector and a unified approach would be too difficult to put together.”

While there have been positive learnings from the Covid-19 crisis and many firms will find themselves evolving the way they work and communicate with their colleagues and clients, there is little doubt that the world in which they will be doing so will be radically changed, and the economy severely disrupted.

Hennie says: “Our focus as an organisation will shift from driving new business to how do we protect the business we have until the economy picks up again. And that might be a very long time.”

Another clear outcome of the crisis is that it has exposed shortcomings in some firms’ risk management approaches and highlighted the dangers of being slow to adapt to technological change, says Michael.

“There is a famous Warren Buffet saying people like to quote when we go through cycles like this: it’s only when the tide goes out that you find who was swimming without their trunks on. For advisory firms that ran a robust business with healthy margins, had reasonable cash reserves, delivered good value to clients and were appropriately leveraging technology, this is basically a non-issue. Firms that were not running well are struggling and may not survive. Recession cycles help to identify who was doing a good job of running a business and who was not,” he concludes.