The European ESG Disclosure Landscape for Banks and Capital Markets report, written in partnership with Latham & Watkins, maps the complex ESG reporting landscape for financial institutions. It calls on policymakers and regulators to build a coherent framework to support sustainable finance by:

prioritising the availability of high-quality data from non-financial corporates

prioritising the availability of high-quality data from non-financial corporates- providing clarity, avoiding inconsistencies and duplication between reporting requirements for financial institutions

- taking into account the global nature of financial institutions.

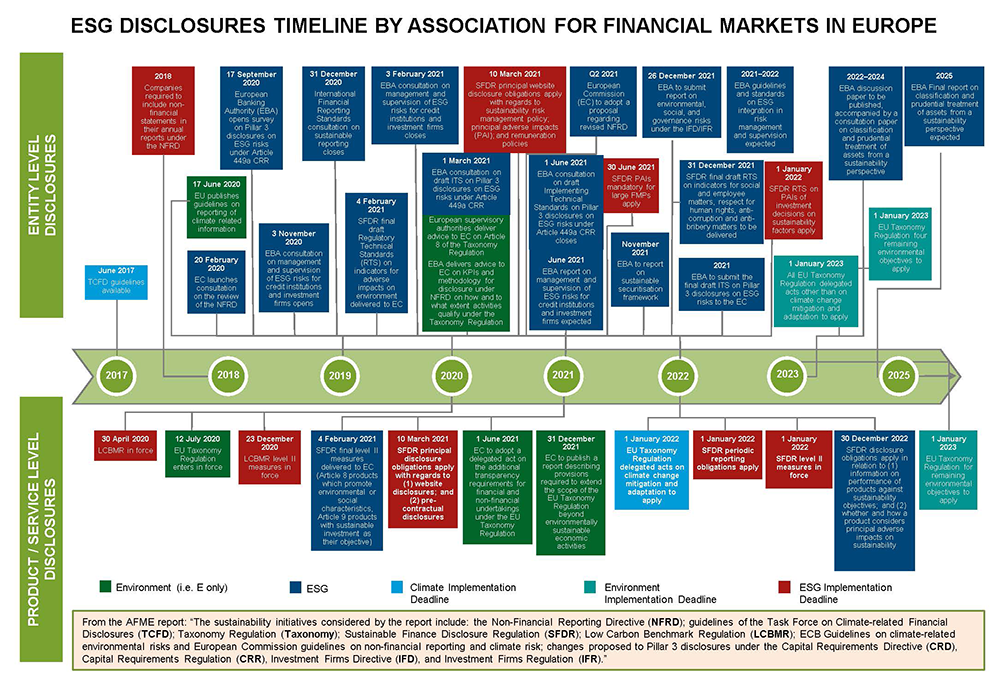

The timeline chart below (with thanks to Latham & Watkins and AFME) published in the latest (June 2021) Review of Financial Markets is a vade mecum – a rich ready-reference source – for anyone involved in this area. We will be organising a series of events for members across all sections of our bailiwick – capital markets and corporate finance, compliance and risk, financial planning, Islamic finance, operations, and wealth management – over the summer months to address key issues. For more information please visit our events page.

Click the below image to see it at full size