The financial services sector’s ability to hire the best global talent will be curtailed by the UK Government’s measures to cap visas for skilled non-EU workers, says a Chartered Institute for Securities & Investment (CISI) survey.

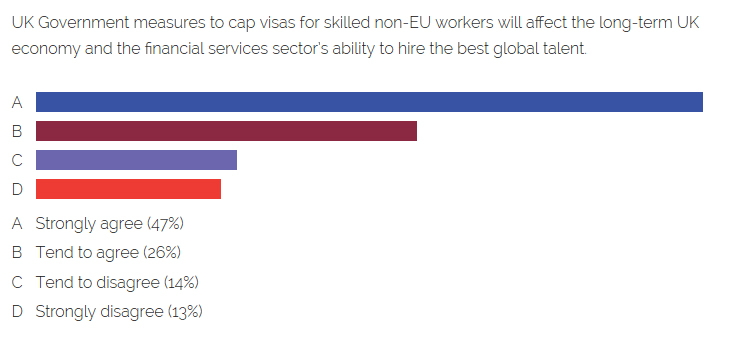

The CISI has 40,000 members working across the financial sector areas of operations, wealth management, capital markets, corporate finance, compliance, risk and financial planning. The survey attracted over 828 respondents, of which 73% agreed that the Government initiative to cap visas for non-EU workers would affect the long-term UK economy and the financial industry’s efforts to employ the best global talent.

The survey, which ran from 24 September – 10 November generated over 40 comments. Those against the visa cap included:

“This will result in smart people moving to places like Singapore, Hong Kong, the US and other places. At the end of the day, when it comes to financial markets, it is survival of the fittest: whoever is hard working and intelligent will win. So, in the long term, 30-40 years down the line, Singapore and Hong Kong will perform better than the UK and big investment firms will try to focus their talent pool and head offices in those areas.”

“London has been developed as an international financial centre. Without access to global talent it is impossible to access the global market. Londoners’ knowledge is usually limited to the English-speaking areas only.”

“I agree 100% that any cap will negatively affect the financial services industry. I do not want to go down the same path as the US in capping visas.”

“I do feel they should look no further than the current Bank of England Governor, who so happens to come from outside the UK.”

Those who supported the visa cap included:

“The UK Government should start more investment in home-grown talent and young people in this country.

“The UK currently has a big enough pool in the financial services sector for companies to hire and develop existing candidates. Companies can become lazy in developing others if they have others to choose from.”

“It may affect the GLOBAL talent that can be hired, but at the same time can mean that UK and EU talent can grow and develop.”

“Non-EU workers aren’t affiliated with the UK’s or the EU’s financial market, hence turning them away will not affect hiring the best, because often the best comes from those who are familiar with the environment.”

Simon Culhane, Chartered FCSI and CISI CEO said: “The result of this survey has demonstrated the depth of feeling which exists in the industry on this important issue.

“Availability of human capital is one of the Key Areas of Competitiveness cited in the September 2015 Global Finance Centres Index 18, published by the Long Finance Group, with London ranked no 1 globally in this specific area of human capital. The attraction of skilled personnel is therefore pivotal to London’s continued success.

“London’s foundation as an attractive, international financial services centre has been built over the years by the same global talent pool the Government is now trying to drain.”

In 2014 financial and insurance services contributed £126.9 billion in gross value added (GVA) to the UK economy, 8% of the UK’s total GVA.

In addition, founders of internet groups including Zopa, Shazam, Unruly and lastminute.com recently issued a letter to David Cameron stating that the visa rules for skilled workers would also hurt the UK’s digital economy.