Homeowners tend to buy residential property with a mortgage, which makes it a relatively volatile investment due to the leverage effect from borrowing.

However, investing in residential property without the borrowing has surprisingly low volatility, and downturns in previous market corrections were far less severe than with other investment asset classes.

FOR INVESTMENT PROFESSIONALS

Homeowners tend to buy residential property with a mortgage, which makes it a relatively volatile investment due to the leverage effect from borrowing.

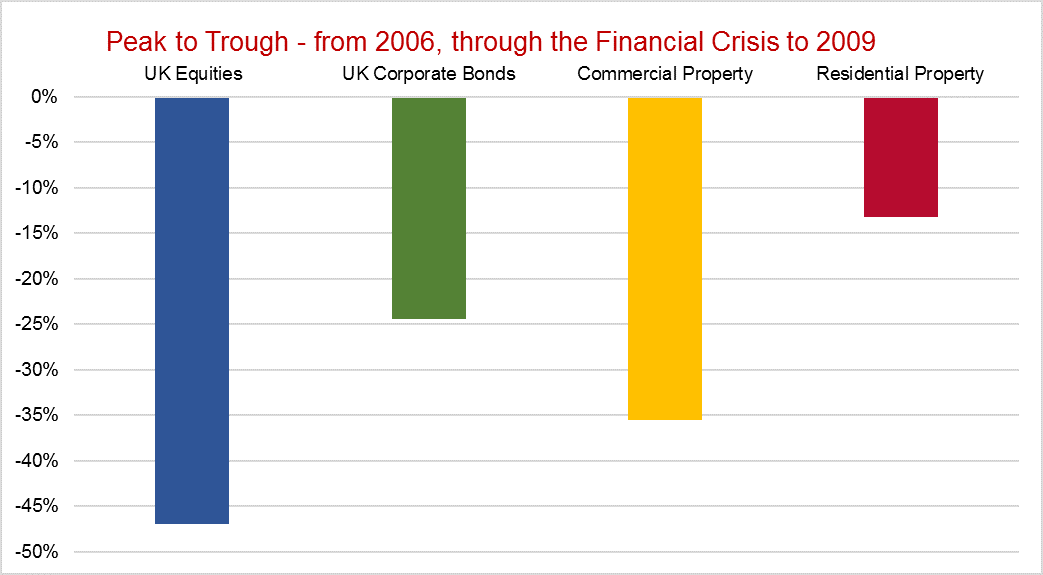

However, investing in residential property without the borrowing has surprisingly low volatility, and downturns in previous market corrections were far less severe than with other investment asset classes:

Figures from the Financial Crisis in 2008/09 show that the peak to through falls for residential property were 13%, compared with 24% for Corporate Bonds, 36% for Commercial Property and 46% for UK Equities.

One way to access residential property returns is through investing in an open-ended fund. Hearthstone Investments is a pioneer in this area, having launched the first FCA authorised direct residential property fund for retail and private clients in the UK over 5 years ago: the TM home investor fund.

Its key features are:

- A proven 5-year performance track record (over 35% cumulative returns, net of fees, as per Sept 2018; C-Class, Retail Gross Unbundled), with volatility below 3%.

- Holds over 200 mainstream residential properties directly across mainland UK, with no exposure to prime London

- No borrowing

- Daily liquidity

- Permitted via ISA, SIPPs and other tax wrappers; available on intermediary platforms

At Hearthstone, we believe that adding residential property to a diversified, multi-asset portfolio can enhance diversification, in particular for defensive portfolios. Returns from residential property, a combination of capital growth and rental income, show low or negative historic correlations to Equities, Bonds and importantly Commercial Property.

The fund recently obtained an Elite rating from FundCalibre (https://www.fundcalibre.com/elite-rated-funds/tm-home-investor-fund), and Hearthstone commissioned Defaqto to provide an independent Due Diligence report.

Please visit our website www.homeinvestor.fund to find out more or call us on 020 3301 1300.

Important: This article should not be considered investment advice or an invitation to invest. Investors may get back less than the amount invested. Past performance is not necessarily a guide to future performance and future returns are not guaranteed.

The Authorised Corporate Director is Thesis Unit Trust Management Limited, Exchange Building, St John’s Street, Chichester, West Sussex, PO19 1UP. Authorised and regulated by the Financial Conduct Authority.

Hearthstone Investments launched the UK’s first open-ended residential property fund approved by the FCA for retail distribution in 2012.

The TM home investor fund now has a 5-year track record, holds some 200 properties across mainland UK, and is available on most major UK platforms as well as via SIPPs, ISAs, Offshore Bonds and Trusts.

Residential property can help diversify a portfolio both in terms of capital risk and income. On a stand-alone basis, a residential property fund could be of interest for those looking for an alternative to Buy-To-Let investing, or others saving for a deposit.

You can find more information on our website: www.homeinvestor.fund