When the FCA published proposals in July 2019 to ban contingent charging (where clients pay fees only if they decide to accept their adviser’s recommendations) in the defined benefit (DB) pension transfer advice market, its assessment of current practice was damning: “We are concerned that too many advisers are delivering poor advice, much of it driven by conflicts of interest in the way they are remunerated.”

Are the remedies that have been put in place by the FCA, and those still to come, protecting DB pension scheme members from unscrupulous advisers enticing them away from their DB schemes with ‘free’ initial advice in the hope of securing hefty fees after the transfer? Or has the regulator gone too far and made the DB transfer advice market so prohibitively expensive, thanks to rocketing personal indemnity insurance, that advisers are struggling to participate?

FCA changesThe July 2019 consultation – CP19/25 – is the latest in a long line of missives from the regulator designed to halt the rising number of transfer recommendations that may not be in members’ interests. The proposals to ban contingent charging mean advisers could no longer offer ‘free advice’ and then deduct charges from funds if the transfer goes ahead.

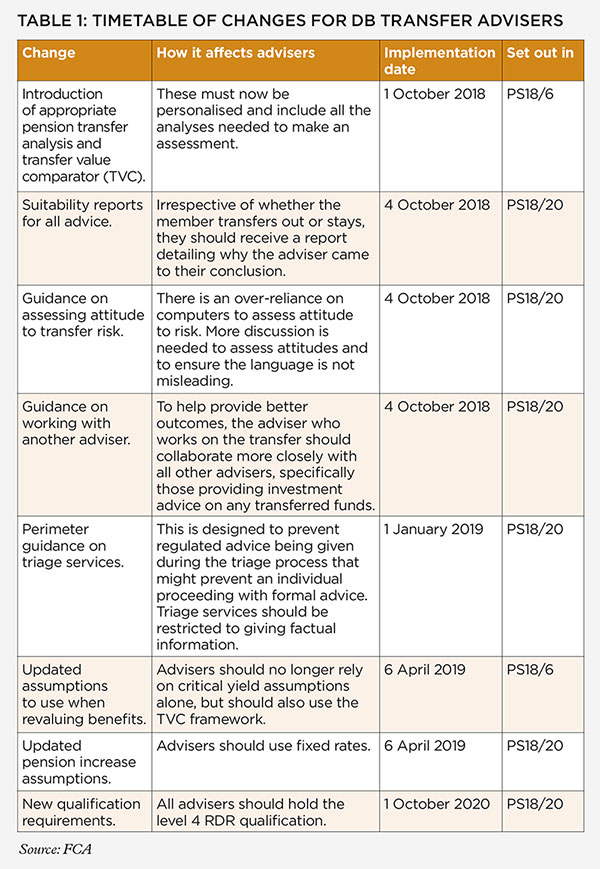

This follows more than two years of exploration and legislation that ended with CP18/20, published in October 2018, that sets out a timetable of changes for advisers operating in the DB transfer advice market (see table below). These rules build on those that have been in place since 2017 but that have so far failed to prevent, in the FCA’s words, “too much advice [of] an unacceptable standard”. The CP19/25 consultation reveals that a 69% rate of recommendation to transfer is too high given that the starting point for advisers is that it is not in the members’ best interests.

The CISI’s response to the FCA consultation represents the views of CERTIFIED FINANCIAL PLANNER™ professional members of its Financial Planning Forum. While the rules may need review, the CFP professionals are clear that “a pensions transfer is a valuable, viable and sustainable action that represents to many savers the embodiment of pensions freedoms”.

Kevin Wood CFPTM MCSI, founding director of Watson Wood Financial Planning, says, “Advisers I have spoken to in north Scotland all agree that anything that takes away some of the unconscious bias that may come into the advice process is a good thing.

“However, while the banning of contingent charging looks like a good way to mitigate some of the conflicts of interest that exist in the DB advice process, the proposals need more consideration to ensure they do not result in the withdrawal of advice in this area.”

A ban on contingent charging means that any member exploring a transfer will have to pay an upfront fee, in the region of £3,000, according to CP19/25.

Peter A Sudlow CFPTM Chartered MCSI, founder of Sapienter Wealth Management, agrees that consumers could be disadvantaged by a contingent charging ban: “It is not uncommon for health, or other reasons, to drive clients to seek to alter pension arrangements that will help finances. With a [contingent charging] ban, consumers will be disadvantaged twice. They will likely be unable or unwilling to commit to fees, not knowing the outcome.” Peter also believes that since advising firms will have to tell consumers there will be a fee for non-transfer, and they will be pursued for non-payment, client relationships may be strained from the start.

In addition, there are discrepancies between the FCA’s more stringent and prescriptive interpretation of the rules on transfer advice, and that of the broader view taken by the Financial Ombudsman Service (FOS). FOS chief ombudsman Caroline Wayman argues in the November 2018 issue of the Ombudsman News newsletter that “the challenge for advisers isn’t just to know the rules, but to apply them to real lives – understanding where people have come from, their hopes for the future, and what really matters to them”.

CISI members have expressed concern that while they may have given watertight advice on a pension transfer in accordance with FCA rules, the FOS might find against them if a complaint is brought at a later date, on the basis that the average person could not have understood all of the technicalities involved in the process. This creates a challenging environment for advisers who wish to assist in pension transfers to the best of their ability, but who also recognise the very real danger that they may fall foul of the FOS.

Obligatory advicePart of the challenge in improving the DB transfer advice market lies in the fact that advice is obligatory for pots over £30,000. Members wanting to transfer must seek a certification from a registered adviser, which has resulted in less reputable firms approaching members and offering to release them from their DB schemes with the promise of huge lump sums and tax-free cash.

Part of the challenge in improving the DB transfer advice market lies in the fact that advice is obligatory for pots over £30,000

The advisers have offered the ‘advice’ for free and then charged ongoing percentage fees. Research from pensions, investment and insurance consultancy Lane Clark and Peacock (LCP) finds that with the average transfer value paid now over £400,000, and with advice charges of 2–3%, these fees can typically be £10,000.

David McKendrick CFP™ Chartered MCSI, a partner at wealth manager Equilibrium, says: “I spoke with a client to whom I was recommended. He said all his friends were going to another adviser who was transferring their DB pensions one after another, like a conveyor belt. He didn’t want that; he wanted to be challenged and to get the right outcome.”

Backlash on PI paymentsAlongside tightening the rules, the FCA has increased the compensation payments to be awarded by the FOS in cases where poor advice has been given. Since 1 April 2019, the compensation award limit has increased from £150,000 to £350,000.

There has been some backlash from advisers who argue that professional indemnity (PI) insurance premiums have risen in direct relation to the increase in FOS compensation limits. FCA figures show that 1,000 advisers might be forced out of the market and only 500 claimants will benefit from the compensation hike.

Sir Steve Webb, former pensions minister and, at the time he spoke to The Review, a director of policy at pensions provider Royal London (he has since left and is now a partner at LCP) says: “The insurance that advisers are obliged to buy will more than double in price. There is already clear evidence that PI insurers have been hiking premiums in anticipation of this policy change, yet the FCA is pressing on regardless. This is a shocking decision. If far more members of the public are unable to access advice, consumers will lose out as a result.”

There are concerns that this increase in PI premiums will create a two-tier system in which corporates conducting large cash equivalent transfer exercises and moving large numbers of members out of the DB scheme will be able to absorb such costs without too much trouble. Meanwhile, an individual who has a pot just over the £30,000 threshold may struggle to justify paying £3,000 to receive advice.

Kevin chose to renew Watson Wood’s cover in the summer of 2019. He says: “There were no great changes to the terms of our cover, [although] we did see an increase in the premium and excess for DB work. It would appear that insurers are nervous about being in this market and are looking to carefully cost any policies for advisers who provide DB advice.”

A reduction in the number of insurers actively offering cover could result in a lack of competition and “a continuation of the upward trend in pricing”, he adds.

Members lose outIt stands to reason that if an adviser’s insurance bill rises, they may pass some of those costs to clients.

Clive Harrison, a partner at LCP, says that only those members who are particularly keen to transfer and who believe they are suitable and have enough disposable cash to pay the fees up front will generally take up advice. He adds, “As a result, some members for whom a transfer might be suitable will lose out.”

It stands to reason that if an adviser’s insurance bill rises, they may pass some of those costs to clients

However, the FCA is considering an exemption to the contingent charging ban for “groups of consumers with certain identifiable circumstances that mean a transfer is likely to be in their best interests”. These members are typically in very ill health or impoverished.

Clive is uncomfortable with these exemptions and suggests both groups should receive greater protection from making transfers, rather than be given exemptions. “It is very difficult to get evidence that someone has a particular life expectancy and sometimes people get [diagnoses] wrong,” he says. “It is also dangerous in my opinion to give exemptions to those in financial difficulty; their DB pension could be the most stable income they have, and they might be better off getting debt advice.”

Clive’s recognition of the types of individual that may need special protection from substandard advice on pension transfers links to the FCA’s renewed focus on vulnerable clients. In July 2019, the regulator launched a consultation on improving the guidance for vulnerable clients, reiterating its commitment to protecting those clients who may suffer financial detriment due to their personal circumstances or background.

Tougher rules needed

Despite concerns that members may not be able to access advice, there are those who believe transferring out of a DB scheme is such a fundamental decision that the rules do not go far enough.

Geraint Davies, founder and managing director of independent financial adviser Montfort, says the FCA regulations should be a minimum standard and that advisers should go beyond this base level to ensure members get the best advice. He is an advocate of ‘the triple check process’, where three transfer specialists always check the advice. “One person can make a mistake, so we get three people to look at everything. We ask what is odd here, what are the quirks,” he adds.

Giving clients valueEquilibrium’s David McKendrick agrees and says he follows a four-step process. The first step is to talk about the member’s circumstances and not about the transfer in isolation. Stage two is ‘number crunching’. The FCA expects advisers to use the transfer value comparator framework, which presents the client with a comparison between two lump sum figures: the actual cash equivalent transfer value they have been offered, and the lump sum that would likely be required, if it were invested at a ‘risk-free’ rate up to scheme pension age, to generate a pot of money large enough to buy benefits equivalent to those being given up. All this leads to stage three, cashflow modelling, which is stress tested. Finally, the recommendation is given and options are discussed.

Completing a process to this level takes time and money, but David believes it provides value for clients. “[The client] might have spent £3,000, but they should feel they have reached a conclusion as to the best outcome for them based on rigorous testing. Once you transfer, you can’t go back; you must get this right,” he says.

David accepts a contingent charging ban – if it goes ahead – and rising PI costs could push advisers out of the DB transfer market, but believes it is the right thing. “It increases the likelihood that recommendations to transfer are made for the benefit of the client, not to cover the cost of advice,” he says.

Operating in the DB transfer advice market is challenging. The rules are tight and will likely get tighter, and the risks are great if advisers get a decision wrong. Yet leaving a DB scheme is one of the biggest financial decisions an individual can make. The challenge for the regulator and the sector lies in ensuring that there is something of a ‘sweet spot’ in the cost of advice and the service received. A step too far in either direction can leave consumers terribly exposed.

This article was originally published in the February 2020 print edition of The Review.

The full print edition PDF is now available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.