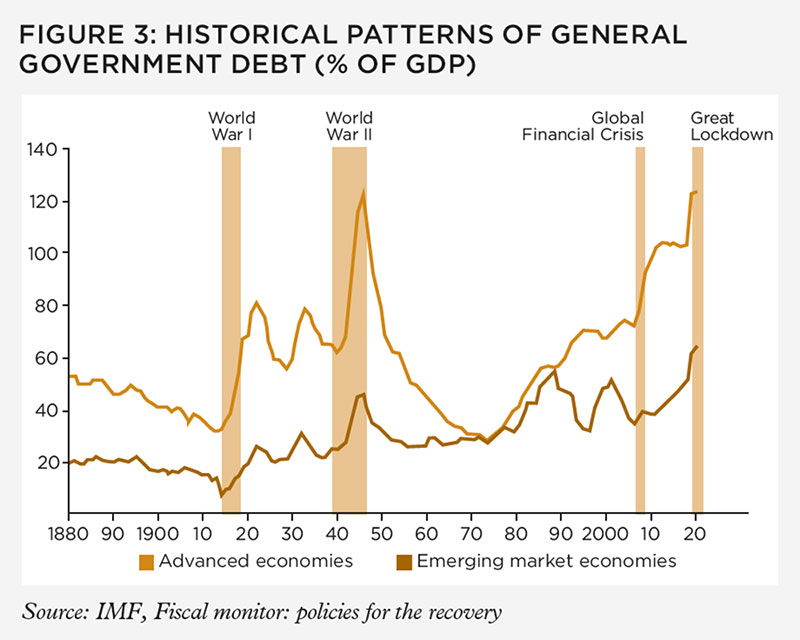

Many businesses around the globe took on higher levels of debt in 2020 than they would have planned for because of Covid-19. The pandemic has prompted an unprecedented government response worldwide to support health systems and provide lifelines to vulnerable households and firms. Total monetary measures to date are estimated at US$14tn, with global public debt approaching 98% of GDP, according to the International Monetary Fund’s (IMF’s) Fiscal monitor update, January 2021.

Click to take our short survey on recapitalisation

At a country level, the Canadian Federation of Independent Business estimates that small and medium-sized enterprises (SMEs) had taken on debt totals of US$117bn by July 2020 due to pandemic-induced market conditions. In India, around 122 million people lost their jobs in April alone, according to the Centre for Monitoring Indian Economy. Figures from the IMF’s Fiscal monitor update, January 2021 show that India’s government debt ratio is expected to remain elevated in 2021, at 83% of GDP, as a result of the increase in public spending due to Covid-19.

In most countries around the world, businesses both big and small have struggled to survive. In the UK, nearly 1 in 20 firms are likely to be pushed into technical insolvency due to the levels of debt built up since March 2020. This is according to a September 2020 report by UK think tank Onward, which incorporates data from the Office for National Statistics’ Business impact of coronavirus (Covid-19) survey, alongside a large sample of firm-level data. The 1 in 20 estimate may prove to be conservative, given the subsequent second and third waves of Covid-19.

Global relief efforts

In March 2020, the UK Treasury stepped in to support businesses through loans and the furlough scheme. The total cost of measures announced to combat Covid-19 amounted to £210bn in the six months to 7 August, according to figures from the National Audit Office, the UK’s independent public spending watchdog.

In October 2020, the UAE formed a national Covid-19 crisis management committee. The Crisis Recovery Management and Governance Committee has been set up to identify the financial and economic resources required for supporting the recovery phase. As well as ensuring the sustainability of vital sectors – such as food, water, energy, and pharmaceuticals – the committee’s remit also includes ongoing financial backing for SMEs.

In Hong Kong, the government has provided support for SMEs via a Financing Guarantee Scheme and Employment Support Scheme, as well as more lenient tax rules relating to income, profit and property, and a succession of stimulus packages that have been rolled out in recent months.

Nigeria’s government responded to rising debts within its SME community with a US$195.5m Small Business Support Fund, which has been set up to help cushion the blow for small business owners.

In Germany, state development bank KfW offered companies unlimited loans to keep them afloat, and German businesses have been able to defer billions of euros in taxes since March 2020.

The outlook for the global economy has been boosted by the start of vaccine roll-outs in the new year

Denmark’s government covered 75% of monthly salaries up to 23,000 Danish crowns (US$3,418) for a six-month period to the end of August 2020, on the proviso that companies would retain employees.

On 27 March 2020, the US government’s CARES Act, costing an estimated US$2.3tn, was launched, coming hard on the heels of the country’s Phase 1 and Phase 2 stimulus packages.

In May 2020, the Irish government announced initiatives including a €2bn Pandemic Stabilisation and Recovery Fund, focused on investment in medium and large-scale enterprises. For smaller businesses, it announced several loans and schemes, including Covid-19 Business Loans up to €25,000; a Sustaining Enterprise Fund for Small Enterprise that provides a short-term working capital injection of up to €50,000; and a Restart Grant Plus that helps businesses reopen and re-employ staff.

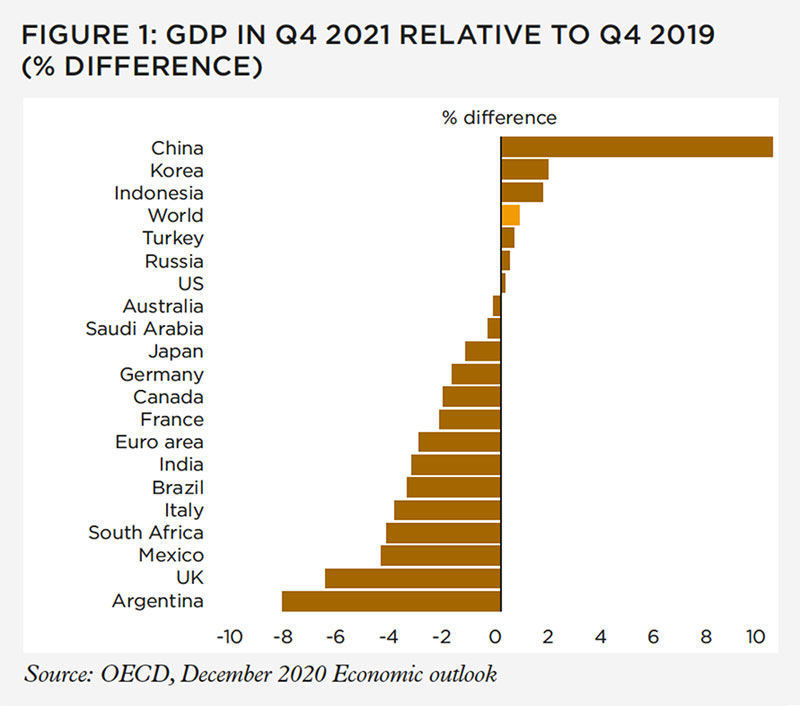

In the short term, the outlook for the global economy has been boosted by the start of vaccine roll-outs in the new year. But caution remains in some quarters regarding the long-term damage wrought on economies and the logistical challenges of vaccinating billions around the globe. The Organisation for Economic Co-operation and Development (OECD) echoes this sentiment in its December 2020 Economic outlook. The report notes that although progress with vaccines and treatment has “lifted expectations”, the road ahead remains “challenging”. The OECD report predicts that global GDP will rise by around 4.25% in 2021, and by a further 3.75% in 2022, but forecasts that the recovery will be gradual in nature, and uneven across countries.

A capital markets union in Europe?

The European Central Bank (ECB) believes that the crisis makes the call for a capital markets union (CMU) across the EU highly desirable. In a blog post published in September 2020, Luis de Guindos, vice president of the ECB, and Fabio Panetta and Isabel Schnabel, members of the bank’s executive board, stress that a CMU would lessen firms’ reliance on bank financing by allowing easier access to market-based financing instruments.

Pablo Portugal, managing director of advocacy at the Association for Financial Markets in Europe (AFME), agrees that the EU’s proposal is fundamentally a positive one. He argues that Covid-19 has amplified the need for deep and well-integrated capital markets in Europe in virtually every area. He stresses that post-pandemic recovery and sustainable long-term growth cannot be funded solely through government support programmes and the provision of bank loans.

Even before the pandemic, the ECB was an ardent supporter of the CMU. It believes a CMU would allow European firms to benefit from more diverse funding sources, which would, in turn, enable them to adapt more effectively to changing funding conditions.

"The focus must turn from immediate firefighting to addressing these longer-term challenges"

An October 2019 report by AFME, Capital markets union – key performance indicators (second edition), shows that the EU’s reliance on bank lending has increased in recent years, with 88% of companies’ new funding coming from banks, and only 12% from capital markets in 2018, compared to 14% between 2013 and 2017.

But the landscape has changed significantly due to Covid-19. The pressure on banks is now immense, as companies across Europe look to recapitalise. Consequently, alternatives to bank financing may need to figure more prominently. Given this backdrop, the EU’s consistent and repeated calls for a CMU may finally pay off.

A UK solution

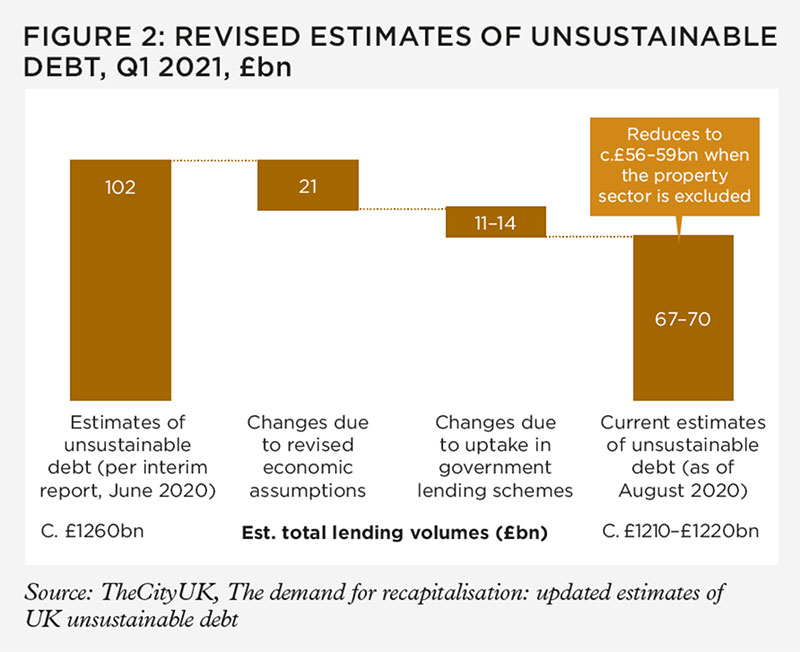

Alternative funding options are being scrutinised in the UK too. In September 2020, TheCityUK’s Recapitalisation Group (RCG) – which is supported by EY and has input from senior practitioners from across the financial and professional services sectors – published updated projections for levels of unsustainable debt faced by UK SMEs.

The RCG now estimates that the total unsustainable business debt expected by March 2021 will be £67–70bn, down from the £102bn predicted in May 2020 (see Figure 2). As much as £20–23bn of this unsustainable debt is expected to stem from government-guaranteed lending schemes, although this is also less than the £35bn projected previously.

An improved outlook for the economy, due in part to government stimulus, led to this fall in the projected level of unsustainable debt, but the recapitalisation of UK SMEs remains a huge challenge, which will be a drag on the long-term return to economic growth.

Omar Ali, UK financial services managing partner at EY and chair of TheCityUK Recapitalisation Technical Working Group, warns that movement towards economic recovery should be welcomed, but the journey is far from over. “The UK has made progress, but the projected unsustainable debt is still large, and this will slow SME recovery up and down the country. The focus must turn from immediate firefighting to addressing these longer-term challenges. Supporting the recapitalisation of millions of SMEs remains a critical issue.

“Our sector is determined to play its part in helping SMEs meet their obligations, and in doing so, save taxpayers billions in loan guarantees. There are no easy answers to this problem, but a great deal of creativity and innovation is going into finding a viable way to convert, restructure and repay this debt.”

Volume of recapitalisation

The reality is that many businesses will need to recapitalise. The question is how, and over what time period? The RCG’s argument is that while there is plentiful private capital, it will be insufficient for this task. Marcus Scott, chief operating officer at the TheCityUK, explains that while private capital can help in some instances, for many SMEs it is not an answer. “Lack of equity finance to SMEs is an age-old problem and it is not an easy nut to crack,” he says. “The vast majority of SMEs get funding from high street banks, but each of these businesses can only borrow a certain amount.”

Omar agrees that for many SMEs, private equity is just not a realistic option. This is because large numbers of these firms are family businesses where control rests with a small number of individuals who are uncomfortable with the term ‘private equity’.

But that is just one part of the problem; the volume of SME equity finance in the UK is low, under £10bn per annum, according to TheCityUK’s July 2020 report, Supporting UK economic recovery: recapitalising businesses post Covid-19. And only a fraction of this equity investment is allocated to rescue/turnaround (approximately 2% in 2019), with the majority focused on growth capital – for instance, investing in biotech. Therein lies the problem for those firms adversely affected by Covid-19 and with distressed debt.

There are also regional variations that need to be factored in. As Marcus stresses, the vast majority of businesses that receive private equity support are in London or the South East, but some 70–75% of businesses that need support are outside of London, according to the Supporting UK economic recovery report. These regions have typically long suffered from comparative underinvestment.

To help SMEs in this hugely difficult time and to overcome some of the issues outlined, the RCG has proposed the creation of a UK Recovery Corporation. The UK Recovery Corporation would focus primarily on unsustainable debt, but could supply growth funding in the future. Initially state-owned, the hope is that the Corporation would steadily attract increased private sector funding. The options within the UK Recovery Corporation proposal include:

- Business Repayment Plan (BRP) – This would convert Bounce Back Loan Schemes and small Coronavirus Business Interruption Loan Schemes into a tax obligation, which would be administered by HMRC with the operational support of the UK Recovery Corporation and repaid through the tax system. This would be means-tested, ensuring businesses only pay what they can afford, which could be calculated based on taxable profits or another measure of business recovery.

- Business Recovery Capital (BRC) – This would convert government-guaranteed loans into subordinated debt (an unsecured loan that ranks below others) or preferred share capital (that provides fixed dividends ahead of ordinary shareholders). These are non-voting instruments and, while there may be restrictions on businesses, they would not lead to a business owner or founder losing control of their business.

- Growth Shares for Business (GSB) –This would use a mix of instruments, including preference shares, to provide growth capital to rebuild cash reserves, invest in working capital, and help a business relaunch after the crisis.

The scheme would see government and business working together to help businesses recapitalise, without having to load the burden on to UK taxpayers.

But when TheCityUK talks about the corporation being initially state-led, with public sector involvement building over time, how would that work in practice?

Omar believes the public sector needs something to dock into in order to play a more substantive role in recapitalisation, and the UK Recovery Corporation – which is essentially a toolkit of options – provides just that. He also stresses the different benefits these options bring to the table. “The BRP has been called the ‘student loan for businesses’. It is means-tested so businesses can pay what they can, when they can.” He adds: “With the BRC, it is an equity-like option but without SMEs losing control of their business, while the GSB option ensures this part of the market is given support too.”

Essentially a UK Recovery Corporation would allow companies to repair the balance sheet and repay government loans in a sustainable way. It would provide more time for businesses to get back on their feet.

Plan B

It is reasonable to look at the Recovery Corporation as the alternative option, or plan B. Plan A was the Coronavirus Business Interruption Loan Scheme, which worked on the basis that when the economy started to open up, companies began to repay. But the impact of second and third waves with further lockdown restrictions in the UK (whether localised or national) introduced a different dimension.

As Omar explains, the UK Recovery Corporation, which already has the support of many constituency MPs and devolved local government, will not be in a position to save every business in debt, but it will be able to provide a lifeline to many businesses that offer growth potential in the post-pandemic world.

The private investor

Anand Sambasivan, co-founder and CEO of investment platform PrimaryBid, accepts the merits of the RCG, but he stresses that this is just one body, and that there are other innovative ways to refinance the private sector.

He thinks the listed markets can play an important role here. “Businesses don’t need to IPO to benefit from the public markets. For instance, investment trusts are a great structure for getting public money into underappreciated private assets. At PrimaryBid, we’ve recently helped Tellworth British Recovery & Growth Trust and Buffettology Smaller Companies Investment Trust raise funds specifically for this purpose.”

Can individual private investors play an important role in refinancing business? There has been much talk about them being excluded from placings, but why is this happening? As Anand explains, the traditional rights issue process gives all shareholders (private and institutional) an opportunity to participate. But it does so with a major drawback: the process takes several months to complete and involves the preparation of a prospectus at some cost and management distraction.

Retail investors have historically been excluded from these accelerated offerings because there has been no process or technology in place to aggregate the demand. Recent changes in trading technology are starting to put retail investors on a more equal footing. Changes in the rules post-Brexit may also serve as a boost, as Anand spells out: “If the €8m limit on retail participation without a prospectus is lifted, retail investors will be able to play an even bigger and proportionate role in recapitalising UK PLC. It’s worth remembering that retail investors directly own around 13.5% of the UK market (as at end of 2018), according to the ONS. For a PLC at the bottom end of the FTSE, raising 10% through a placing amounts to a £58m entitlement for retail. The arbitrary €8m cap prevents retail from playing its rightful role.”Recapitalisation requires consumers to ‘put their hands in their pockets’

In the Philippines, the government has been clear that it is relying on private sector investment, with special reference to SMEs, to power the country’s recovery from the crisis. In an October 2020 speech to the Philippine Chamber of Commerce and Industry, finance secretary Carlos Dominguez commends SMEs for their “inventiveness and willingness to adapt quickly” to the rapid changes being forced by the pandemic. He notes they have swiftly conformed to new health standards, which “helped preserve jobs and keep the domestic economy afloat”.

But Dominguez highlights that the private sector will need to step up investment in two key areas as the country emerges from the pandemic landscape. One of these is tourism, which Dominguez says should seize the opportunity to upgrade its weak infrastructure and facilities. The other is manufacturing, where competitiveness needs to be improved “to create more jobs and regain economic momentum”.

Covid-19 has wrought incredible economic damage on companies. Many have been forced to reduce their workforce, and all businesses are facing a shock to both demand and supply sides of their businesses. But, as Anand explains, in the listed markets this has been reflected in share prices, and on that basis the UK market could be viewed as extremely attractive.

Having access to a market is one thing, but an appetite to invest is another thing altogether. Recapitalisation requires consumers to ‘put their hands in their pockets’. But can you really ‘build back better and stronger’ if a significant proportion of the population are out of work or fearful of losing their jobs?

Amyr Rocha Lima CFP™ Chartered MCSI, partner at Holland Hahn & Wills Financial Planning, and chair of the CISI Financial Planning Forum Committee, says that some of his clients feel they have been forced into taking an earlier-than-planned retirement due to redundancies amid the pandemic. Holland Hahn & Wills has, according to Amyr, seen a “surge in prospective clients contacting us about their retirement planning, seeking to understand whether they have ‘enough’ to transition into this new phase of their lives sooner rather than later”.

Despite this trend, Amyr is optimistic that consumers will play their part in the months to come. He notes that there is “significant pent-up demand” that “will no doubt be released” once lockdowns have been negotiated. “Many will simply turn to online giants, but it’s important for people to consider their local small business community, as they will need their support more than ever,” he says. “Consumers are facing their own uncertainties, but they still have an important role to play in the economic recovery by deciding where to employ their purchasing power.”

Shared learning

The pandemic has unquestionably forced governments, economists and businesses to think outside the box. If or when another pandemic strikes, they are battle-hardened and in a better position to act from experience. Companies have been able to reassess their cost base and working practices in a new light. Do they need to pay out huge rents on city offices? Have the benefits of remote and flexible working been understated until now? Cost-cutting measures have inevitably been introduced. PwC’s Covid-19 CFO pulse survey from June 2020 features responses from just under 1,000 global finance leaders. Some 80% say that ‘cost containment’ is the top financial action they are considering as a result of Covid-19-induced economic conditions. More than half of CFOs (52%) intend to introduce remote working as a permanent option, while 50% plan to accelerate automation and new ways of working. Some 75% of CFOs believe that the increased flexibility developed during the crisis will make their company stronger in the long term, with 65% highlighting the resilience and agility they have built as key factors.

There is a degree of shared learning between countries too. For instance, the thinking behind TheCityUK’s Recovery Corporation proposal can be seen in the proposed launch of a European Pandemic Equity Fund. The fund has not been set up as yet, but the proposal is being studied by the European Commission. The aim is to provide equity-like investments in SMEs, in exchange for a proportionate stake in the companies’ earnings. Cash would be injected by the fund into SMEs in return for a share in future profits, with the possibility of a buy-out by the company. This fund could be financed out of the European budget, to which countries would contribute. This is just another example of an innovative approach to business funding that might have an impact long after the pandemic has passed.

The full article was originally published in the February 2021 flipbook edition of The Review.

The full flipbook edition is now available online for all members.