Live webcast: The economic backdrop and the longer term implications

Thursday 23 July

3.30pm–4.30pm (UK BST)

1 hour CPD

As the UK government begins to taper off support, who are emerging as the winners and the losers? Where are we currently in the economic cycle? What can we expect as we enter Q3/Q4 and move into 2021?

Analysis conducted by BlackRock of more than 750 portfolios of European private banks, wealth managers and asset managers finds that bonds made up 30% of all portfolio allocations in 2019. Equities accounted for 53% with cash and alternatives accounting for the remainder. The firm expects bonds to continue to be a core and strategic exposure in multi-asset portfolio construction around the world this year.

One of the most interesting consequences of the market dislocation caused by Covid-19 has been a reassessment of the merits of government bonds and US treasuries in particular. In March 2020, the bond yield on one-month and three-month US Treasury bills went into negative territory for the first time shortly after the Federal Reserve cuts its benchmark rate.

The low level of yields on government bonds means they provide fewer diversification benefits within a multi-asset portfolio. During February/March 2020, the yield on US treasuries declined by more than any other defensive government bond, says Colin Dryburgh, co-manager of the UK-based Kames Capital Global Diverse Growth Fund, although this could be due in part to currency moves, because the dollar is considered a safe haven currency. It is also important to note that government bond yields can go negative, as we have seen in some European countries, and yet you can still make a positive return on your investment in the short term.

“For a few days in March, equity and government bond prices appeared to have had a positive correlation, which could be explained by a scramble for cash during chaotic market conditions as some investors were forced to liquidate investments for risk management purposes,” he explains. In this case, this was an anomaly in market behaviour, which can happen in times of severe stress.

The exposure limits of some market participants (including banks, hedge funds and asset managers) are based on a measure of risk that includes recent market volatility. When volatility increases and these risk limits are breached, this triggers a forced liquidation of positions.

Since then, various central bank commitments to large scale, or even unlimited, asset purchases have restored at least some market order, and the relationship between government bonds and equities appears to have normalised.

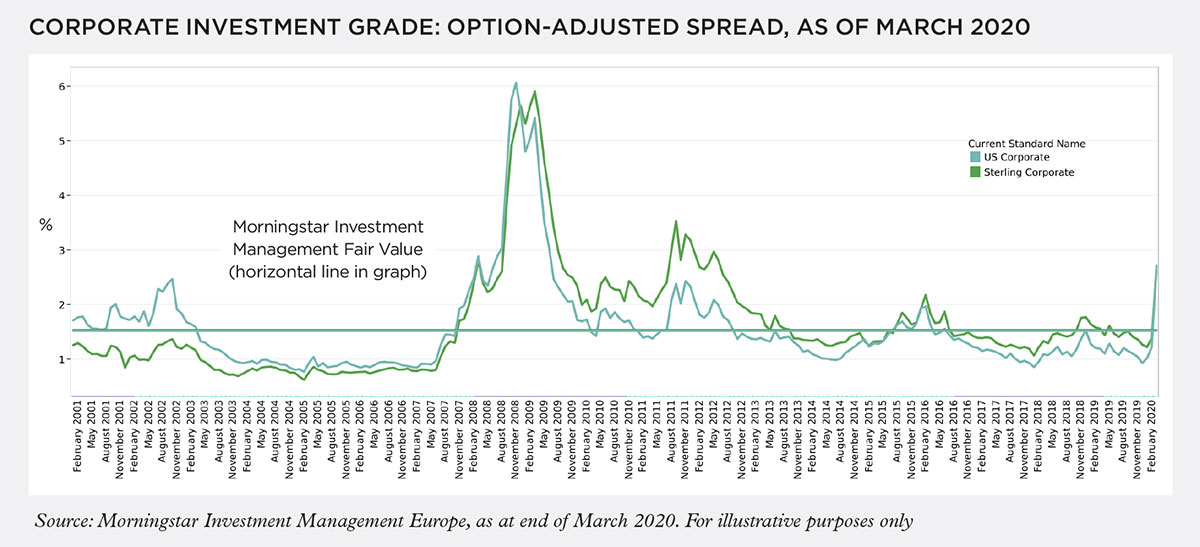

The monetary and fiscal stimulus introduced since January 2020 has been extraordinary, most notably the Federal Reserve’s decision to purchase investment-grade corporate bonds for the first time as part of an unlimited quantitative easing programme. The European Central Bank and the Bank of England have taken similar steps in an effort to ensure that good quality corporates (but not restricted to only good quality corporates) continue to have access to credit, while in Asia, Japan’s central bank has removed the limit for buying government bonds, and the Reserve Bank of Australia has launched a quantitative easing programme.

According to Yoram Lustig, head of multi-asset solutions EMEA in the multi-asset division of T. Rowe Price, this move has increased the appeal of investment-grade corporate bonds for investors with a long-term investment horizon.

Teaching portfolio construction

When asked about how to evolve allocations against the backdrop of current market conditions, Ursula Marchioni, BlackRock’s head of portfolio analysis and solutions for EMEA suggests that responding to the Covid-19 shock is first and foremost a strategic portfolio construction problem.

“Against a new macro environment, the need to account for and embrace higher levels of uncertainty when thinking about future asset behaviours, and the need for portfolio resilience, should act as ‘North Stars’ for investors looking to achieve their long-term portfolio objectives” she says.

Yoram, who studied law at university in Israel and for whom an MBA in London Business School was his first taste of studying finance, says the 2008 global financial crisis and the recent market turmoil have underlined the importance of central banks in keeping markets alive. But he believes students are not taught enough about how policymakers can drive markets by cutting interest rates. However, Amy Lazenby, Chartered FCSI, managing director at Close Brothers Asset Management, says that while central banks have expanded their historical tool kit, including recent additions such as quantitative easing and corporate bond purchases, “the teaching we receive cannot be so prescriptive. Some of it is common sense, some of it is behavioural psychology, some of it will mirror the past but be entirely new. That is what makes our jobs so varied and interesting.”

Professor Dehuan Jin from the Shanghai University of Finance & Economics (SUFE) teaches students and practitioners the CISI’s International Certificate in Wealth & Investment Management. He has been teaching for more than 20 years and says that he has the same set of construction methods and skills for portfolio management as the traditional Western teaching content.

“The main content of the syllabus is portfolio theory, the specific method of risk asset allocation, the allocation of risk asset portfolio after adding risk-free assets, the optimal allocation ratio of risk assets and risk-free assets, the selection of optimal risk asset portfolio and the construction of index model, the construction of capital asset pricing model, arbitrage pricing theory and multi-factor model of risk return, positive and negative portfolio management theory, and more,” he says.

Dehuan explains the role of bonds and risk in portfolio construction. “Stocks and corporate bonds are both risky securities, and only treasury bonds are risk-free bonds. In order to reduce the total risk of a portfolio, it is necessary to invest a part of the total investment in treasury bonds, which can avoid maintaining a part of the stable yield of treasury bonds in the case of huge risk loss of stock securities. Therefore, the allocation of certain treasury bond assets in any fund or asset management risk portfolio can make the portfolio bear a lower risk under the same income, or obtain a greater income under the same risk.”

What about the traditional role of alternative investments in a portfolio? Dehuan says that in general, students are taught that the “smaller the correlation between asset classes in a portfolio, the better the effect of risk offset. For example, in addition to the assets such as stocks and bonds, you can also invest in real estate, antiques, calligraphy and painting, gold and other asset categories, which is the role of alternative investment in the portfolio.

“Especially in the current situation of the global economic downturn, asset price decline and investment income decline, it will have a positive significance to combine more alternative investment into the traditional portfolio,” says Dehuan.

Martin Mitchell FCSI, director, training services at CCL Academy, one of the CISI’s accredited training partners, designs and teaches programmes for students in the Middle East. Regarding the role of bonds in portfolio construction, he says: “They should (and often do) play the normal part in an efficient and relevant portfolio, but they are far less familiar to investors and professionals in the Middle East, typically because they are not acceptable under Islamic religious law. My own view is that advisers often recommend them without proper appreciation of the complexities (around different measures of yield for example) and the investor has even less awareness.”

The role, and understanding, of alternative investments in portfolios is less than bonds, he says. “What I have talked about in terms of bonds (relatively unfamiliar and not well understood) is even greater when it comes to derivatives, which are the route into investment in many alternatives. The only two alternatives that are really contemplated are gold and real estate, if they can be considered ‘alternative’.”

Mitigating risk

The traditional role of alternative investments in a portfolio is diversification. Ursula Marchioni refers to an average allocation of around 10% to alternatives within the multi-asset portfolios of European private banks, wealth managers and asset managers.

"However, ‘alternatives’ is a catch all definition which groups disparate assets – which inevitably see significant dispersion in performance. This makes it important for investors to understand the different types of risk/return profiles accessed through these positions, and how these interact with other (public) asset classes in their portfolio,” she says.

Some alternative assets simply don’t have defensive characteristics

Investor attitudes to alternatives will have been challenged in the March 2020 sell-off, as many of these assets had money taken out of them in huge volumes. This was in part a result of sales by investors who feared the value of these assets would fall even further, although Tihana Ibrahimpasic, multi-asset research analyst at Janus Henderson Investors, says there also has to be a realisation that some alternative assets simply don’t have defensive characteristics. “Some of these assets are also challenged by structural factors, such as the closed-ended vehicles that invest in real assets and sit in equity-like wrappers, which saw their correlations spike during the broad-based de-risking,” she says. “In that sense, periods of heightened volatility represent a test for the alternative assets universe and can in fact help investors understand the true features of the assets they own.”

Amy adds that in times of market stress, correlation among assets increases but this is usually short term in nature. “In this low interest rate environment cash is defensive and broadly there haven’t been any surprises in what has happened year to date among the different asset classes,” she explains.

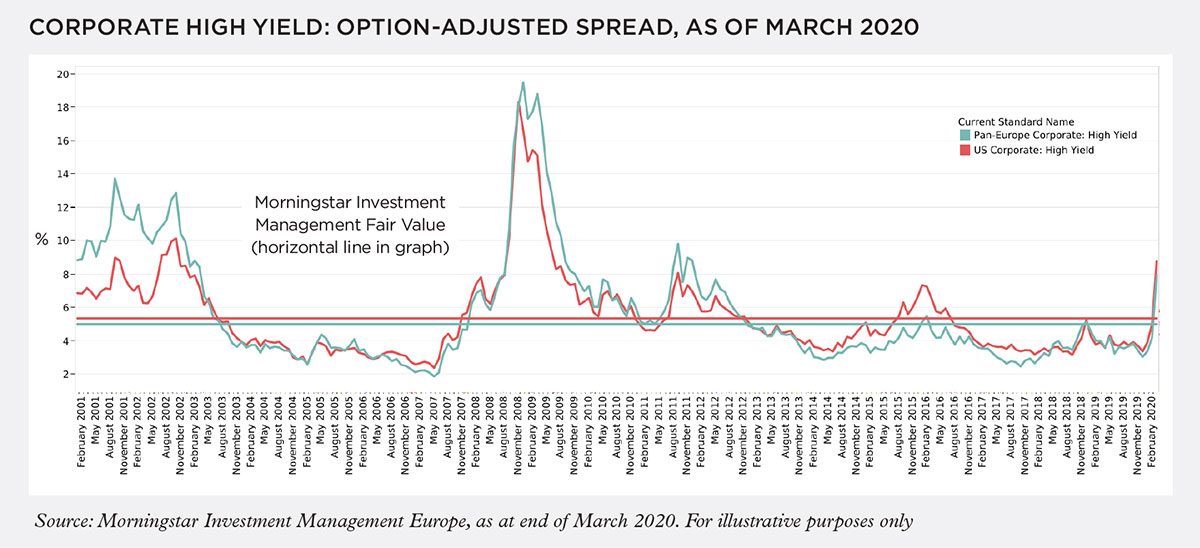

Morningstar Investment Management Europe has long argued that credit provides very little drawdown protection in times of stress and can be highly correlated to equity markets, says Mark Preskett, a portfolio manager at the firm.

“This proved to be the case in the current Covid-19 crisis and credit losses were severe,” he adds. “Spread levels were as tight as they had been since the global financial crisis of 2008 and the asset class was very over-owned, which exacerbated the losses."

In times of market stress, it can be worrying for investors to see large-scale sell-offs of traditional safe haven assets, such as gold. But it is important to note that a lot of these sales simply reflect insufficient access to liquidity, with traders needing to meet margin calls and exit positions. In addition to US government bonds, other defensive assets include currencies such as the US dollar, Japanese yen and Swiss franc – all of which appreciated when the markets started to fall.

Nick Watson, portfolio manager on the multi-asset team at Janus Henderson Investors, describes currency as an important but generally overlooked tool for managing risk and taking a defensive exposure. The Japanese yen has defensive characteristics when markets enter periods of stress, generally rallying as investors exit risky carry trades funded by borrowing in yen. “Quality defensive equities are another option for bringing more protection to the portfolio on a relative basis to other parts of the equity markets,” he adds. “These are businesses with characteristics such as strong balance sheets, good profitability and high-quality earnings, low and sustainable debt and low leverage. Liquidity and solvency perspectives have rarely been so important.”

Some derivative strategies could also be defensive, according to Yoram. For example, by buying low volatility stocks and shorting the market, in a sell-off the low volatility stocks are likely to outperform.

Within equities, BlackRock favours assets with a quality factor bias which, while not immune to the sell-off, will likely provide more resilience and potentially deliver interesting risk-adjusted returns as we enter a market recovery.

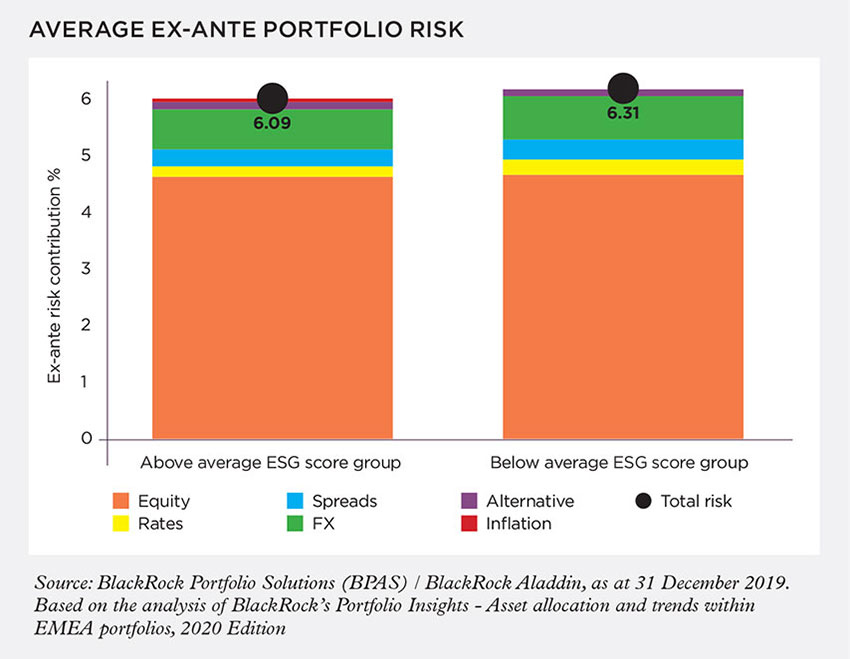

Quality factors can best be described as characteristics likely to increase the value of a company’s stock, such as a commitment to environmental, social and governance (ESG). According to Ursula, portfolios analysed with “above average” ESG scores have exhibited a tilt towards style factors, such as quality and low volatility, which can deliver a better investor experience through volatile times and add portfolio resilience. Other quality factors could include recurring revenues, high barriers to entry, and a business that can grow organically regardless of the macro environment.

Recent events have shown that most allocations, even assets that are apparently predictable, can behave erratically in times of severe market stress. In the foreword to the BlackRock report, the authors point to feedback from investors questioning their asset allocation processes and correlation assumptions, and conclude that the current crisis will result in an evolution of strategic asset allocation choices, with strategies that have worked before not necessarily expected to work in the future.