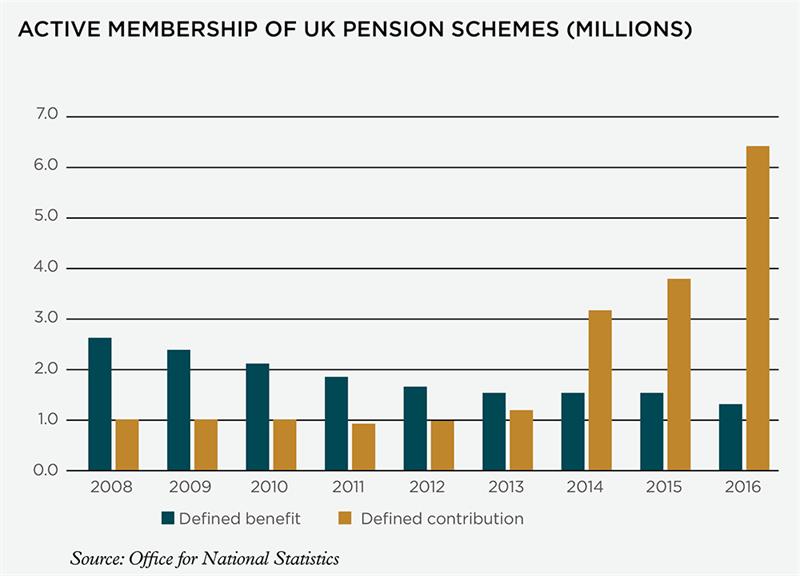

There have been enormous changes in the pensions landscape in the past decade. The old-fashioned final salary, also known as defined benefit (DB) pension, has become virtually extinct for new employees as companies have progressively closed schemes in the face of a huge

increase in the cost of pension provision. There has been an even bigger increase in membership of defined contribution (DC) schemes, whereby members save into an individual pot that is ultimately available to fund their retirement. Total UK pension assets were

estimated at £2.9tn at the end of 2016, equivalent to more than 100% of GDP.

Before the government announced pension freedoms in 2014, almost all DC pots had to be converted into annuities – providing a guaranteed income stream – by the time the member was 75. Since the 2015/16 tax year, however, anyone over the age of 55 can draw down the money when they want or take the whole of their pension pot as a cash lump sum, with the first 25% free of tax and the rest taxed as if it were their salary. The freedoms have been popular as people regain control of their own money. But they have pushed potentially life-changing financial decisions on to a public ill-equipped to take them.

A CISI survey of 1,141 adults over 18 in full- or part-time work, carried out by YouGov in December 2017, shows a ‘black hole’ in pensions knowledge. Its findings show:

- 57% know what a pension is, but 40% don’t know how it works

- 76% don’t know the value of their pension pot, with significantly more women (80%) than men (72%) not knowing

- 56% don’t know how much they are paying in each month, with those in London least likely to know (62%)

- 45% haven’t considered making additional pension contributions, mainly because of other financial commitments

- 34% never check the status of their pension account

- 26% of respondents aged 55 and over know what a pension is but don’t know how they work

Schemes must provide regular information to members, at least those that are still employed or paying in, and many have websites with extensive document libraries.

Key requirements for DB pensions include an annual funding statement, setting out information on the financial strength of the scheme, and an individual statement on request. Anyone paying in to a DC scheme (including personal pensions) should automatically receive an annual statement showing current and projected future fund values. However, according to the Confederation of British Industry, a typical employee moves jobs once every six years on average and will therefore have between ten and 11 jobs in a lifetime. With state pensions also in flux, people often find it hard to keep track of their pension entitlements as they change jobs and it becomes increasingly rare to spend a whole career with one employer.

Research commissioned by The People’s Pension and State Street Global Advisers, titled

New choices, big decisions: Exploring consumer decision making and behaviours under pension freedom and choice, reports that some feel upset and confused about pensions. One 64-year-old man told researchers: “It’s a very serious matter. If I muck up at 60, I muck up for the rest of my life, I’ve got to get this absolutely correct and that’s the problem, it’s a minefield.”

Ignorance is not blissIn the CISI survey, 57% say they know what a pension is and how it works, and 40% don’t know how it works. Despite this lack of knowledge, less than half say they would trust a qualified financial adviser to help them and nearly a fifth of over-55s would not trust anyone.

Researchers and public policy organisations have tried to understand why the level of pensions knowledge is so poor. Workplace pensions provider, NOW: pensions, conducted

research on pension knowledge. The survey of 1,000 adults in the UK aged 18–30 reveals: 71% say the terminology and jargon is a barrier to engaging with the subject; 42% say they don’t need to understand them as retirement is far away; and 27% say they are just too complex.

Part of the answer lies in the low level of numeracy and financial literacy generally. For instance, according to a 2015

report by the Money Advice Service (MAS), only 60% of UK adults surveyed understood inflation and buying power – and perhaps even more shocking, that was down from 79% a decade earlier.

Trust in financial services in general, and pensions, has been undermined by the 2008 financial crisis, successive pension scandals and the steady stream of tax and regulatory changes.

Annex 3 of the FCA’s 2017

Retirement outcomes review: interim report says: “Amongst all respondents, we observed a strong undercurrent of mistrust in pensions, with many reporting that their faith in pensions has been eroded over the years by one bad news story after another. Such perceptions are very deep-seated and will not be quickly or easily reversed by education or interventions. Rather, they are likely to be reinforced by continuing coverage about the future of DC tax relief and DB scheme difficulties. The language of pensions, particularly now we have added drawdown, flexi-access drawdown, uncrystallised fund pension lump sum, and so on, into the assortment of jargon they are faced with when trying to navigate their new choice set, is confusing and only serves to further reinforce their sense that pensions are a black box, operating for the benefit of the provider rather than the consumer, and are not to be trusted.”

But there are also wide variations in financial confidence and capability between age and social groups. The CISI survey shows knowledge of and engagement with pensions is low among younger adults (who potentially have most to gain by starting the ‘pensions habit’ early) but increases as people approach retirement and face up to their future financial position.

The MAS report goes further, identifying groups that score lower or higher in ‘financial capability factors’ – behaviours towards managing money. It identifies two sets of characteristics that determine financial capability and can act as barriers or enablers to financially capable behaviour:

-

Internal capability: skills and knowledge, which can collectively be thought of as ability; and attitudes and motivations, which can collectively be thought of as mindset

- External capability: ease and accessibility, or the ease with which consumers feel confident about engaging with the financial system.

Such barriers can make it difficult for people to assimilate the information available from organisations like Pension Wise and MAS, or to weigh the new choices available to them. Yet the uncomfortable truth is set out in

research from the Pensions and Long Term Savings Association, which projects that, of the 25.5 million people in employment: 1.6 million are at high risk of falling short of a minimum retirement income (calculated as £9,500, including state pension in 2016); and 13.6 million are at risk of not meeting a relatively modest target income replacement rate (including state pension) worked out according to a formula that would give an income of £18,395 to an individual earning a median income of £27,456.

There is some consolation in the fact that many of those approaching retirement over the next few years still have some DB pension entitlement with their current or previous employers, while those in younger age groups have longer to accumulate the money they need.

DB deficits and discount ratesManagers and trustees of DB pensions face a slightly different task from individual savers, as their role is to ensure the scheme has enough assets to pay all the members’ pensions when they fall due. Depending on market movements, changes in the prospective cost of providing those incomes may be more significant to the fund’s position than the value of the investments held.

It’s usually relatively easy to value the assets, as they tend to be invested in equities, fixed interest, property and other relatively conventional instruments. Working out the size of the future liabilities is much more complicated.

The starting point is to take detailed data on the scheme’s membership, including each member’s date of birth, length of service, salary and contractual pension entitlement. This is then fed into a model using reasonable assumptions about future rates of inflation, wage increases (for active members), member and employer contributions, life expectancy, pension increases, investment returns and so on. All those future pension liabilities are then discounted back to a present value. The higher the discount rate, the lower the liabilities and vice-versa.

If the final figure is bigger than the assets, there is a pension deficit. If it’s smaller, the scheme is in surplus. A full valuation is undertaken every three years and if there is a deficit at that stage, the employer must agree a plan for eliminating it. If the employer becomes insolvent with a big deficit, as in the recent Carillion and BHS cases, the scheme may be transferred to the Pension Protection Fund, an industry-funded insurance scheme that covers most of members’ pension entitlements. If only it were that simple.

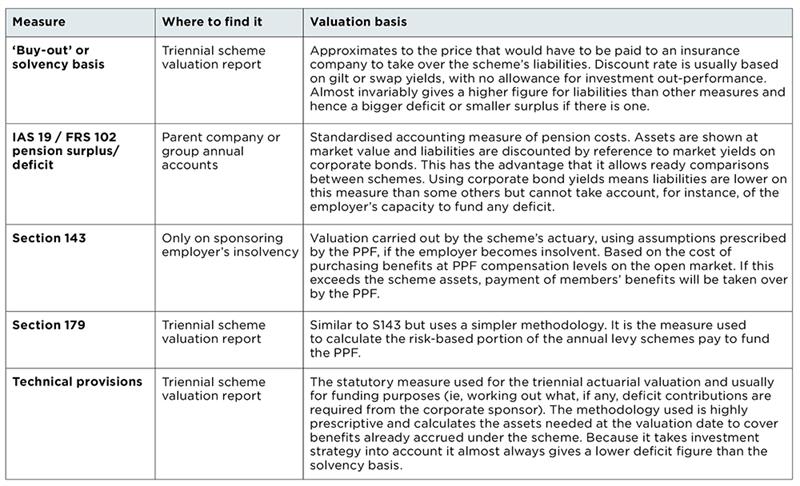

In practice, there are at least five recognised methods for calculating liabilities, each of which measures a slightly different thing:

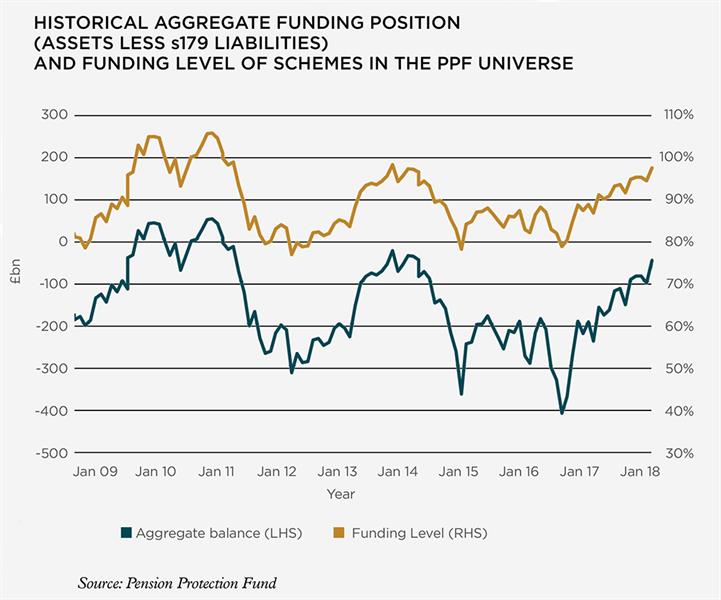

Regardless of the method, a decade of ultra-low interest rates, combined with increases in longevity that mean pensions have to be paid for longer than ever before, has led many schemes into huge deficits. The latest

funding figures show that the aggregate deficit of 5,588 schemes in the PPF 7800 Index is estimated to have increased to £72.1bn at the end of February 2018, from £51bn at the end of January.

Reasons to be cheerful?There is a glimmer of hope that the black holes of consumer ignorance, pension shortfalls and deficits are beginning to be addressed. Deficits are extremely sensitive to changes in interest rates, so the recent increases in rates and a decade of deficit reduction programmes mean the aggregate PPF deficit is hugely reduced from its peak (as seen in the graph below). If interest rates continue to rise, as expected, the overall deficit could disappear, although some individual schemes will undoubtedly remain in trouble.

For current employees, automatic enrolment means that almost everyone in full-time work automatically joins a pension scheme unless they actively opt out. The contribution rates for both employers and employees are due to be increased over the next few years, so that people can begin building up meaningful pots. Public policy is also beginning to address the knowledge gap via initiatives such as the creation of Pension Wise (shortly to be replaced by a new financial guidance service), adding financial education to the national curriculum in schools, and development of a national ‘pensions dashboard’ to help members see all their entitlements in one place.

Effort is also being put into combating the fraudsters who continue to ensnare a steady trickle of scheme members, and tightening the standards required of pensions financial advice.

Ultimately, though, a great deal rests on individuals to ensure they make adequate provision for their future. Not everyone can be an investment professional, but ignorance will unfortunately be no consolation the day you reach for the pension pot and find it is empty.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk