Employers must do more to educate staff on pensions as UK 18–24-year-olds’ retirement dreams struggle to match reality, with social conscience taking priority over profit, says CISI survey

The CISI omnibus survey on attitudes, knowledge and behaviour of the UK population towards pensions was conducted by YouGov 6–7 December 2017. All figures, unless otherwise stated, are from YouGov. Total sample size is 2,078 UK adults, of which 1,141 UK adults are aged 18+ and in full or part-time work. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

The CISI’s latest YouGov survey on pensions finds that 10% of UK 18–24-year-olds who work do not know what a pension is and how it works, with women understanding less than men.

The UK-wide omnibus study looked at attitudes, knowledge and behaviour of the population towards pensions. The findings reveal some surprising results, with indicators on the themes of financial capability, green and social impact investing and people’s overall hopes vs reality on their retirement horizon.

Financial capability and understanding

A quarter of respondents aged 55+ (26%) know what a pension is, but don’t know how they work (10% of those aged 18–24).

Of those workers who are contributing to a pension, over half (56%) don’t know how much money they are paying in each month. Those in Scotland and London are least likely to know (62%), compared to those in the east of the UK (47%) and 49% in the Midlands.

Three-quarters (76%) do not know the value of their pension pot, with significantly more women (80%) than men (72%) not knowing and those in Scotland being least likely to know (86%).

Over a third of respondents (34%) say they never check the status of their pension account (43% women; 28% men) with less than a third (31%) only checking less often than six-monthly.

A quarter of respondents aged 55+ state they never check their pension. This compares to 81% of people saying they check their bank account at least once a week.

One in eleven (9%) report that they are making additional contributions to their pension fund, with 39% saying that they have considered doing so. However, of those that have considered or are currently making additional payments, a third (36%) of people are unaware that these pension contributions can be tax free (ie, benefit from additional tax relief funded by the government).

Hopes vs reality

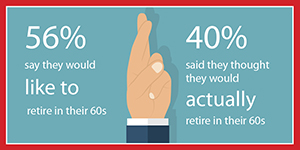

Most workers declare that they would like to retire younger than they believe they will, with 56% saying they would like to retire in their 60s versus 40% who say they think they will actually retire in their 60s. But some people (4%) say they don’t want to retire at all.

Most workers declare that they would like to retire younger than they believe they will, with 56% saying they would like to retire in their 60s versus 40% who say they think they will actually retire in their 60s. But some people (4%) say they don’t want to retire at all.

Only one in eight (13%) say they will be able to retire when they want to as they believe they have saved and planned appropriately for retirement. This rises to one in six for men (16%) but is only one in ten (10%) for women.

A phased approach to withdrawing from work appeals to respondents as a quarter (25%) say they would like to transition into retirement, while one in nine (11%) of workers say they want to keep working for as long as possible.

Money is cited as a key factor in determining ability to retire, with almost a quarter (23%) of people saying they’re not sure they will be able to retire when they want to, due to various financial commitments. Almost half of workers who hope to retire (45%) believe their standard of living will decrease in retirement, with 38% feeling their standard of living will stay the same (39% of 18–24-year-olds) while 8% feel it will increase during retirement (18% of 18–24-year-olds ).

When it comes to funding retirement, most workers who hope to retire expect to fund this through their workplace pension (58%) or state pensions (57%). More than a quarter (27%) will rely on their private pension or on their bank savings, with the bank savings option being highest for under-35s. And 10% of respondents do not know how they will fund their retirement.

Workers pay a median amount of £120 monthly into their pension pot, with 35–44-year-olds paying £164 monthly; 18–24-year-olds £50; 25–34-year-olds £90 , 45–54-year-olds £150; and 55+ paying £122).

Ethics and social impact investment

The majority of respondents (72%) are aware that part of their private or workplace pension fund is invested, with 28% saying they are unaware (21% male vs 37% female). Respondents are most concerned about investments in armaments or countries with alleged dubious human rights (69%), slightly less so with the tobacco industry (56%), gambling industry (54%) and the alcohol industry (35%). There is noticeably more concern amongst young people about investing in the alcohol industry (43% of 25–34-year-olds) compared to 30% of 35–44-year-olds.

The majority of respondents (72%) are aware that part of their private or workplace pension fund is invested, with 28% saying they are unaware (21% male vs 37% female). Respondents are most concerned about investments in armaments or countries with alleged dubious human rights (69%), slightly less so with the tobacco industry (56%), gambling industry (54%) and the alcohol industry (35%). There is noticeably more concern amongst young people about investing in the alcohol industry (43% of 25–34-year-olds) compared to 30% of 35–44-year-olds.

Over half (56%) of all workers with a pension are interested in investments in community projects, and 61% are interested in environmental projects. Nearly half (45%) of all workers with a pension are interested to discover that the return on community project investments could be lower (44% environmental projects). This social conscience indicator is higher amongst women (69%–66%) than men (56%–48%) and higher amongst young people (67% of 18–24-year-olds) than in those aged 55+ (51%).

The government-commissioned report, Growing a culture of social impact investing in the UK, published in November 2017, indicates that government, the financial services sector and others should publish educational guidance on social impact investment that is easily accessible for all stakeholders, including individual investors.

Trust and financial advice

The most trusted person a worker in the UK would go to for advice is a qualified financial adviser (46%) – an increase from 41% when this question was asked in a CISI survey in 2016 – with a good friend/relative coming close at 28%; bank 25%;online guidance 20% and the government 8%. Just 5% say they would trust digital/print media and 10% say they would not trust anyone when seeking financial advice.

The most trusted person a worker in the UK would go to for advice is a qualified financial adviser (46%) – an increase from 41% when this question was asked in a CISI survey in 2016 – with a good friend/relative coming close at 28%; bank 25%;online guidance 20% and the government 8%. Just 5% say they would trust digital/print media and 10% say they would not trust anyone when seeking financial advice.

Clive Shelton, Chartered FCSI, chairman of the Tax Incentivised Savings Association, said: “This survey offers important insights around the issue of financial capability and adds to the evidence that a high percentage of individuals do not understand pensions or tax relief benefits. It highlights the need for industry and government to work collaboratively to develop a framework that builds public trust and enables individuals to make informed retirement decisions. We must continue to increase good financial habits from an early age with education initiatives in schools, like KickStart Money, through to the delivery of effective engagement solutions for employees.”

CISI CEO Simon Culhane, Chartered FCSI said: “The lack of knowledge on the part of the general UK public relating to pensions has emerged as a worrying theme in our survey. A pension is likely to be the biggest single asset owned by an individual – more than a shared house – yet receives little attention.

“With 39% of 18–24-year-olds believing their standard of living will stay the same during this period of their lives, while paying £50 per month on average into their pensions (with 35% of 18–24-year-old workers saying they will rely on their bank savings to fund their retirement) the funding gap is too huge to make their retirement dreams a reality. Their dreams, sadly, are likely to become their nightmare.

“It is a surprise that over a third (36%) of those who are making or considering making additional payments are unaware of the tax advantages of pension contributions. The general lack of knowledge about pensions is an educational deficiency that responsible employers should remedy.

“The survey shows that trust in qualified financial advice has grown and people should seek advice. I wonder how many are aware of the Pensions Advice Allowance introduced by the government in 2017, which allows up to £500 tax-free to be taken from an individual’s pension pot to redeem against the cost of retirement advice?”

For more infomation on the survey, visit

cisi.org/yougovpensions