Matt Dickens, Chartered FCSI, senior business development director at Ingenious Group, says that the ‘cost of life’ should always be considered before the ‘cost of death’

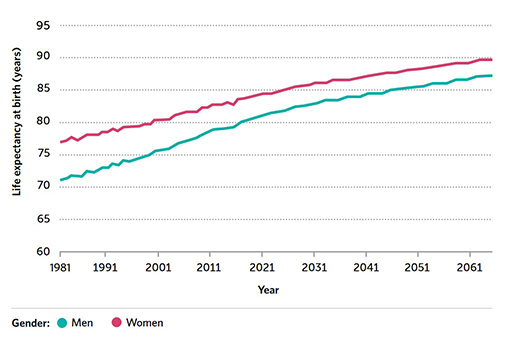

As the table below clearly shows, the population of the UK is getting older, and the most elderly cohort is the segment growing fastest of all. For example, the Office of National Statistics (ONS) suggests that by 2041 there will be double the number of over 85s living in the UK as there were in 2016, from 2% of the population to 4%. Advisers should ensure they understand the full implications of this demographic change and adjust their advice accordingly.

Source: Government Office for Science - Future of an Ageing Population 2016 (p.21)

Source: Government Office for Science - Future of an Ageing Population 2016 (p.21)

What is later life planning?Later life planning starts at the point of retirement, when investors typically transition from being in the ‘accumulation’ phase of their lives and move into ‘decumulation’. This is an essential inversion point as it heralds a collection of new challenges. Many advisers, when prioritising the issues these investors may face and considering what form their financial planning solution may take, can easily be seduced into focusing specifically on their ‘estate planning’ needs, which may only rise in prominence much later on. By doing so, they will have potentially overlooked the opportunity to address some of the more pressing priorities that their investors face in the earlier phases of their retired life.

So, later life planning encompasses so much more in terms of issues and needs than just estate planning. Specifically, it includes issues like:

- How to best achieve an acceptable target level of return from a portfolio to pay for retirement.

- How to best manage the volatility and sequencing of those returns.

- How to deliver these returns in as tax-efficient a way as possible.

- How to plan for the looming problem of the potential need for long-term care (namely how to access the appropriate services and how to pay for them).

- Any vulnerability or mental impairment issues.

Only after all the above points have been addressed should later life planning move on to estate planning issues (or legacy aspirations). It is clear to see that the ‘life needs’ of investors before death can easily come into tension with their ‘legacy aspirations’ (or indeed those of their beneficiaries) and advisers have a mandate to deliver on both, but I believe they should always consider the cost of life before the cost of death.

How could you go about delivering on both?

Asset preservation is key

The overall financial planning objective should be to empower and enable investors to plan for the optimal outcomes in later life by giving them:

- an asset preservation strategy for their estate in decumulation so they have the most to work with, whatever happens

- flexibility for when their needs inevitably change (be it gradually or indeed suddenly).

The asset preservation strategy consists of three key elements:

- Production of reasonable and consistent growth in decumulation, or the portfolio value will be eroded (particularly if in fixed drawdown).

- Robust pre-planning for any significant costs that may arise, such as long-term care fees and/or inheritance tax (IHT).

- Ensuring that any returns are made in as tax-efficient a way as possible, or any of those returns produced will be degraded.

If all the above can be delivered to the investor’s estate, this will mean that they will have more assets available whenever faced with any issue. This will inevitably lead to a better outcome for the investor, their beneficiaries and the adviser. And the outcome is a key objective that the FCA wishes us to all focus on.

So, how could you deliver all three and not pit one element against another? And can this be delivered flexibly?

Volatility is your enemy

If the initial target is reasonable and consistent growth, we first have to assess what level of return would be reasonable for an investor in drawdown and, based on that, see if that return could be produced consistently without excessive fluctuation in the portfolio value, or volatility.

As we sit in the midst of the Covid-19 pandemic, it is easy to highlight volatility as a key risk anyone could face at any time. Being exposed to the market or investor ‘sentiment’ that drives short-term pricing isn’t optimal at any stage but seems particularly relevant right now.

However, at retirement most investors will be introduced to multi-asset portfolios normally utilising a ‘balanced’ mix of equity and fixed income type investments. The blended long-term return they will be expecting therefore may be anywhere between 5–8% per annum over the longer term. Pure cash or specialist IHT investments with a much lower return target than this will either therefore erode the ability of a investor to take the level of draw they would like to target, or more likely make them delay any such decision to invest in this way. This could have negative consequences (or outcomes) for both the investor and adviser. Ideally, any investment selection would be able to maintain this level of return expectation, and advisers may therefore seek different strategies that can deliver this balanced return but without the volatility risk, and ideally including IHT efficacy.

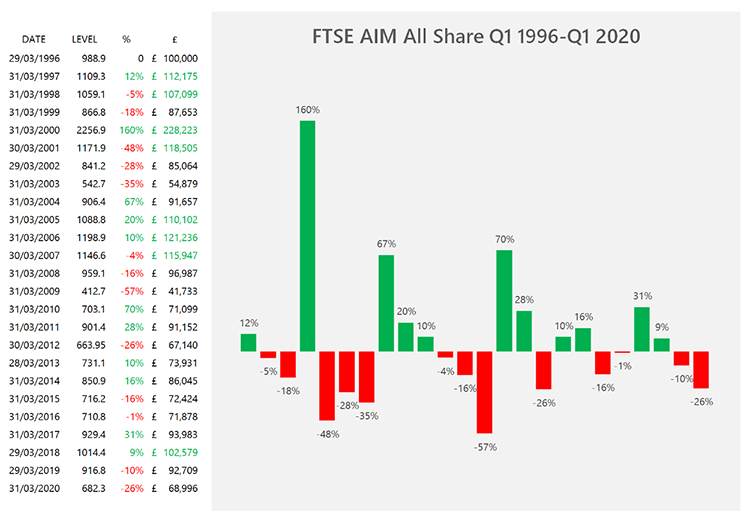

When investing, most advisers will be familiar with the concept of ‘pound cost averaging’. It is a technique used during the accumulation phase of our lives that reduces the exposure of investing in a lump sum by instead investing smaller sums at regular intervals. By doing this more shares are purchased when share prices are low while fewer shares are purchased when prices are high. During this phase, volatility allows one to purchase more shares at below average prices and can be a strong trading benefit, with the more volatile assets showing the best results of all. See below the year on year returns for the FTSE AIM All Share index over the past 24 years for an illustration as to how this volatility could appear.

Data sourced from Yahoo Finance, 1 Apr 2020

However, during the decumulation phase, where shares are being sold during drawdown, the exact opposite effect is at play. As the '£' column shows, despite strong positive years, there has been a lot of volatility which means the value of any initial investment in the index will have been reduced by over 30% if held over the entire period. Clearly, any amount of volatility has a negative effect on portfolio performance which is exacerbated in drawdown. Therefore a low volatility approach, perhaps utilising assets which are less correlated to main markets or even unlisted, during this phase is a major virtue.

Advisers who are able to identify portfolio options which are both able to produce returns in line with investors’ retirement expectations and in a relatively predictable way will find their investors are more likely to both heed their advice and to do so earlier in later life which will improve outcomes.

Pre-planning for significant costs

“Ageing will increase the total amount of ill-health and disability in the population. There will be an accompanying change in the nature of ill-health, with a relative shift away from acute illness towards chronic conditions, multi-morbidities, cognitive impairments and long-term frailty.”

Source: Government Office for Science - Future of an Ageing Population 2016 (p.10)

As the UK population inexorably ages, issues with vulnerability, loss of mental capacity and the physical ability to look after oneself alone will all continue to see the UK care sector grow in importance. I have already written at length about why advisers should talk to all investors about the potential, and growing, issue of long-term care and how it’s going to be funded. Mainly, because in all probability it will be by them!

Not only could this be very expensive but without specialist and independent care advice, investors will likely not end up with the most appropriate care at the best price. This concern could be addressed effectively by accessing the services of a professional care consultant who would be able to reassure the investor and their family that if they did ever need care, all the aspects of their assessment, personal care plan, care provider selection and ongoing oversight would be dealt with, as it is an area where thankfully very few of us build up workable experience and knowledge.

Efficient returns

Beyond the impact of the magnitude of total return plus the sequence and volatility of those returns, how tax-efficiently those returns are made is of vital importance. Later life can expose investors to three key taxes to their portfolios: income tax, capital gains tax (CGT) and IHT. Some tax wrappers, like pensions or ISAs, may have some good tax efficiencies, both giving CGT mitigation benefits for example, but pensions may still incur marginal rates of income tax if utilised for drawdown, and ISAs are not IHT effective. For appropriate investors, advisers could consider the use of business relief qualifying investments as they will normally not incur any income tax charges (most don’t pay an income) and also should be IHT effective when qualifying, but some could also qualify for investors’ relief, reducing the CGT rate on chargeable disposals to just 10%, thus offering a tax effective solution across all three taxes.

Flexibility is vital

If we can invest for people in a way that will meet their expectations in retirement and allow them to meet any anticipated issues in good order, is that the acme of a later life solution?

Well, it is an inimitable fact that life will tend to throw up problems and issues in the future that we can’t even predict now (just look at the latest period we find ourselves in) and when that happens we need to reassess and then reshape our plan to factor in those new issues. This can only be done if you have a strategy in place that is inherently flexible and can react to those fresh demands. Any solution that involves investors making irreversible decisions should be considered at odds with those changes and extra premium put on solutions that are palpably more flexible. Any solution that therefore keeps assets under the investors’ full control and access would be well-suited to this purpose.

Summary

The area of later life planning is of increasing interest as there is a huge planning gap around inter-generational (wealth transfer) planning and this therefore presents a big opportunity to access potential beneficiaries through demonstrating sound financial planning and the value of clear, knowledgeable and genuinely independent advice.

The original version of this article was published in FT Adviser. Republished with permission.