Josh Butten FPFS CFP™ Chartered MCSI, director at boosst, helps put a retired couple's minds at rest after they come to him with concerns about the longevity of their wealth and the threat of inheritance tax

The brief

Contact jane.playdon@cisi.org if you work in a planning firm and have a financial planning case study that will be of interest to our members. You will receive a £25 voucher as a ‘thank you’ if we publish your story

Sue (68) and Adrian (64), a retired couple, were introduced to us by their accountant, who had supported them through the sale of their family business in 2008, generating £1.5m. They were keen to ensure that the proceeds of their hard work were invested prudently.

Despite their combined assets of £3m including their estate and pensions, they were worried about their spending and were trying to find ways to reduce their outflows. Their concern was founded upon their excellent health and the long lives enjoyed by their parents. Would their funds last long enough, and would they be swallowed up by inheritance tax?

The financial plan

Josh Butten FPFS CFP™ Chartered MCSI

Josh is a director at boosst, a CISI-Accredited Financial Planning Firm™. He has accrued ten years of financial planning experience and became a CFP professional at the age of 23.

Josh is a director at boosst, a CISI-Accredited Financial Planning Firm™. He has accrued ten years of financial planning experience and became a CFP professional at the age of 23.

Josh aims to be a future leader of our profession and enjoys guiding other youngsters towards a long and happy career in financial planning. He splits his time between working directly with clients and mentoring boosst’s trainees, and forms the boosst leadership team alongside his father Keith and colleagues Vicki and Jennie.

He represents boosst by hosting events, speaking at conferences, contributing to sector press and lecturing financial planning students.

At our initial meeting it became clear that Adrian and Sue’s key objectives were not typical of the average retiring couple. While there were some similarities, such as their desire to enjoy outstanding holidays, to spend time with family (especially their new grandchildren!) and their eagerness to support a local charitable hospice – there were also some less common objectives. Adrian wanted to spend £20,000 per year on his fishing trips, which led to an amusing matrimonial conversation and the decision to not make any further financial gifts to their three children, who they both agreed had already been generously supported throughout their lives.

They have been receiving the net proceeds of the business sale in amounts of £100,000 per year for the past ten years, and will continue to receive this amount for the next five years. This currently funds the majority of Adrian and Sue’s annual expenditure, but with the upcoming change, their attention had turned to their lofty personal pensions, worth just under £1m between them, to fund life thereafter.

We spent time learning about their lives and the financial decisions they had made along the way. It is always a powerful exercise to understand the roles that clients have taken in key decisions before moving on to discussing their future. We heard that Adrian is a creative engineer and designer by profession, but by his own admission, struggles with numbers. Sue had taken responsibility for the company finances and felt that she had a strong grip on numbers and data. This created an interesting dynamic for explaining ideas and presenting advice, needing to use methods that worked for both Adrian and Sue. Sue grasped the numbers in conversation and data in tables quickly, but Adrian was first to spot visual trends in our ‘live’ onscreen cashflow planning sessions. Adrian quickly absorbed the visual graphs and imagery and was soon explaining the impact of an annual inflow surplus or deficit to Sue.

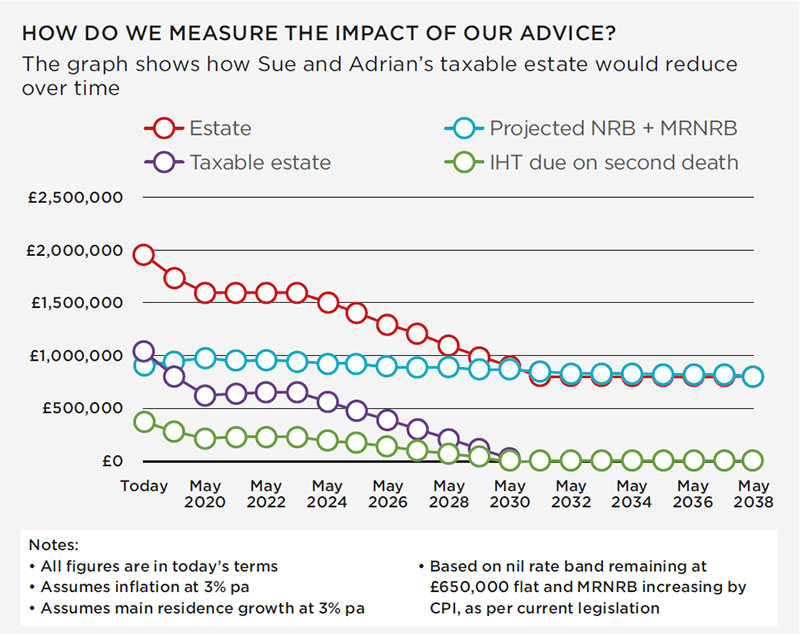

A key moment in our first meeting was the revelation of inheritance tax (IHT) and the large liability that blocks the inheritance pathway to their children. Having always had a reasonably high net worth, Adrian and Sue had explored IHT many years previously and had been reassured that their assets were all within their allowances and reliefs. This was true at the time, but only until the day that their shares were sold, and their estate lost its business relief. Thinking everything was okay, they hadn’t sought new advice for many years and were now confronted by a £400,000 IHT liability.

Before our intervention, they had an estate of almost £2m plus their pensions, and were on the brink of accessing a pension commencement lump sum (PCLS), drawing pension income and losing their main residence nil rate band (MRNRB).

With IHT planning back in their sightline, we built a new financial plan, which focuses on Adrian and Sue:

- Spending the capital and income they receive each year and deferring access to their personal pensions.

- Doing more of the things they love, creating an income deficit, to begin sustainably depleting their estate.

- Downsizing to a smaller home in 2024, when the £100,000 annual capital inflows cease, better suited to later life living. The downsize from a £1.5m home to a £750,000 home will release a further £750,000 of capital, which will be used to fund their lifestyle between ages 75 and 81.

- Acknowledging that it is likely they will spend less in later life as health hinders them from continuing their expensive hobbies and travel, so a key assumption is that expenditure from age 80 will reduce.

- Commencing pension withdrawals to fund their lifestyle once their taxable estate has reduced to just their main residence and £50,000 cash. This will leave them with a comfortable cash buffer for any spontaneous decisions. Their pensions will fund their lifestyle beyond age 110, without incurring higher rate income tax – which Adrian says “is probably long enough!”

- By Adrian’s 80th birthday, their estate will be valued at less than the projected nil rate band plus the MRNRB.

Although gifting funds to their children wasn’t an immediate objective, they were keen to ensure their assets weren’t diluted upon death by IHT. We explained their option of arranging joint life, second death, decreasing term assurance to insure the projected IHT liability as it reduces from around £400,000 to nil over the next 12-year period. They didn’t know this was possible and they took up the option immediately. The cost of cover wasn’t too severe.

We also discussed their objective to support the hospice that had supported their loved ones in times of need. Adrian and Sue decided to amend their wills to donate 10% of any taxable estate upon death, reducing the tax rate applied to the taxable estate by 10% from 40% to 36%. This also reduced the amount of decreasing term assurance required and therefore the cost of funding it.

We also advised a change to their personal pensions and moved their existing provisions to a platform solution, giving access to a far better range of funds, significantly reducing their ongoing costs and enabling flexible access in due course.

What happened next

Adrian and Sue have continued to enjoy their retirement lifestyle, albeit now with a renewed focus on sustainably reducing their estate. With their financial plan in place, they have the confidence to do so with conviction. Most recently, Adrian surprised Sue with a memorable trip to see the northern lights from the Scandinavian wilderness for New Year’s Eve.

The below graph projects the reduction of their taxable estate reducing over time.

This article was originally published in the Q1 2018 print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.