The annual corporate report has been a touchstone for investors in companies for more than a century. But financial crises and individual business failures have eroded trust in both companies and in the ability of those reports to tell the whole story. One reason is that financial accounts still largely show information that follows prescriptive reporting standards, and do not always address the needs of all stakeholders.

“In terms of evaluating past performance they do meet their purpose,” says Sha Ali Khan, director of regulatory development at the Association of Chartered Certified Accountants (ACCA). “But investors increasingly look to the future and want some prospective information.”

Another drawback is that despite huge changes in business that have seen the rise of technology, services, and knowledge-based firms, corporate reporting is still based on a limited set of financial aspects. These weaknesses can leave investors in the dark. A

study of intangible asset market value by merchant bank Ocean Tomo finds that net assets of S&P 500 companies represented 16% of their market capitalisation in 2015, compared with 83% in 1975.

Veronica Poole, global international financial reporting standards (IFRS) leader at Deloitte, says there is an invisible premium not captured by traditional accounts. “If we look at the value of companies today, most of the value is in intangibles, so their market capitalisation is way higher than their book value would suggest.”

An example is Alphabet, the listed owner of the Google search engine company. Its share price at the end of March 2017 was $931.14 but its book value per share for the quarter that ended in March was $209.43.

There is a significant amount of information that affects a company’s value and which investors should want to see to help them work out whether the company is managing its risks and opportunities. This includes its impact on society and the environment, its human capital, energy security, natural resources and intellectual property.

“Focus on broader values allows companies to enjoy strong reputations and a strong intangible base, versus companies that suffer really badly as a result of their reputation issues where you see the premium destroyed,” says Veronica.

Wider factors

While traditional financial accounts are well regulated and follow a format familiar to investors, there is a growing consensus that the corporate reporting framework needs to evolve to reflect a wider range of factors that affect corporate performance. One answer is integrated reporting (IR), which has been developed by the International Integrated Reporting Council (IIRC), a global coalition of regulators, investors, companies, standard setters, and the accounting profession.

IR brings together material information about an organisation’s strategy, governance, performance and prospects in a way that reflects the commercial, social and environmental context within which it operates. It seeks to capture the non-financial data – also known as alternative performance measures (APM) – that increasingly drive companies’ values. While financial accounts capture profit and loss for the current quarter, APMs point towards the long-term shareholder value.

But integrated reporting only works when it is based on integrated thinking within the company, so that the two processes of reporting and strategic thinking create a virtuous circle where both aspects are reinforced.

"Focus on broader values allows companies to enjoy strong reputations and a strong intangible base"

For example, it must engage with stakeholders to determine the issues that are material to the business and so formulate a strategy. It has to be able to identify the relevant risks and key performance indicators that will form a more robust basis for identifying long-term risks and opportunities.

Integrated thinking

Advocates of IR say companies that integrate both thinking and reporting will better identify risks and opportunities, and communicate the value created by the non-financial factors to their investors and stakeholders.

Veronica highlights United Utilities, which won the Finance for the Future 2017 award for communicating integrated thinking. The company had set about running the network in a much more integrated way. “The key for us was putting integrated thinking into action, and we wanted to communicate that with our shareholders,” said chief financial officer Ross Houlden.

Traditionally the company, like others in the industry, designed its networks to withstand floods of a 1-in-30-years severity. Integrated thinking enabled it to respond to the 2015 Cumbria flood that was a 1-in-100 year event. The company had established an integrated control centre to view what was going on throughout the network. It spotted a landslide into a reservoir that was causing a plume of dirt, mud, silt and stones coming down towards the outlet of the reservoir. As a result it switched the outlet off, preventing a water treatment works from being destroyed.

This can translate into financial rewards.

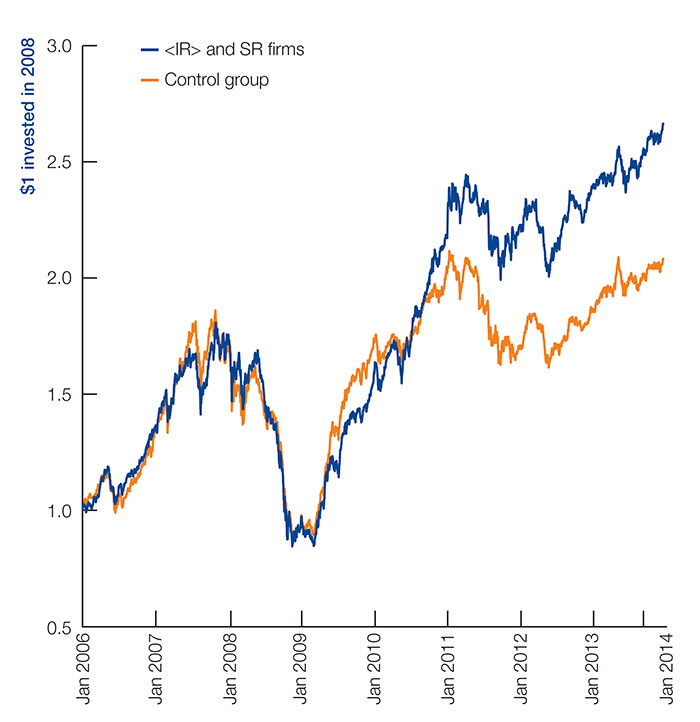

Research by KPMG and the National University of Singapore Business School finds that, since 2010, cumulative shareholder returns have been 30% higher for companies using IR and sustainable reporting (see graph).

Companies using IR reap rewards: cumulative share price performance of portfolios

Companies using IR reap rewards: cumulative share price performance of portfolios

But, of course, there are challenges to producing and using IR reports. First, it is a more complex process as it combines traditional financial accounts, financial and strategy reports and directors remuneration with the extra elements required for an integrated report. This leads to a second downside, that companies will initially struggle to identify the right data and metrics to use to display the findings in a meaningful and convincing way.

The IIRC produced a framework in 2013 based on consultation with 140 businesses and investors from 26 countries and which could form the basis of internationally agreed standards that companies could follow. The Institute of Chartered Accountants of Scotland (ICAS) is running a project with the IIRC and the Green Economy Coalition aligning IR with the United Nations’ 17 Sustainable Development Goals that are increasingly seen as the benchmark for corporate responsibility.

David Wood, an executive director at ICAS, says: “Hopefully it will demonstrate the credentials of integrated reporting to tackle the broader business responsibility agenda. We could use it to start promoting integrated reporting as a communications methodology for complying with the global goals.”

The project will lead to the publication of a report, in the summer of 2017, which will provide the conceptual basis for organisations to be able to link their value creation process to the sustainable development goals (SDGs).

Advantages of integrated reporting

– Encourages an organisation to think in an integrated way.

– Clearer articulation of strategy and business model.

– A single report that is easy to access.

– Creating value for stakeholders by identifying and measuring non-financial factors.

– Tells the investor and manager how value is created.

– Links non-financial performance more directly to the business.

– Better identifies risk and opportunities.

– Improved internal processes, leading to better decision-making.

Finally, and perhaps most importantly, while financial information is subject to an auditing process that is itself regulated, integrated reporting covers matters that refer to issues that are mostly not subject to audit, or that are subjective. While it is not possible to give the same level of assurance for integrated reports that comes with financial statements, David says it should be possible to give a “slightly lower level” of assurance. “The profession needs to show courage and innovation to develop a framework which provides a realistic level of assurance to users.”

Sha at ACCA says there is a concern that less ethical companies may be tempted to include figures that show it in a good light and omit those with a negative tinge. “There is a danger we will have abuses of non-financial information,” he says. That raises a tension between a need for verifiable numbers and room for companies to innovate in what they report. “There is always a conflict between consistency and creativity,” he says.

According to Sha, investors have become more vocal: “People involved in the regulation and development of accounting standards are at last listening to investors, and it’s about time too.”