Mauro Tortone, Chartered MCSI

Mauro has been a member of the CISI Corporate Finance Forum committee for ten years. He is a director and adviser at P27, a business advisory firm focused on financial services and technology.

Mauro has over 25 years of experience, working for investment banks such as UBS and Deutsche Bank and smaller firms in the EU, the US, and Asia.

He is an alumnus of London Business School (IMP) and Henley (MBA).

The term ‘fintech’ emerged in the years after the financial crisis that started in 2007. Arguably, it is a series of responses to the traditional financial system failings. It emerged for two reasons: the financial crisis and technology such as open APIs (application programming interfaces), big data, AI and blockchain, which reached a mature stage at that time.

Fintech areas include crowdfunding, digital payments, robo-advice, cryptocurrencies, social trading and more. An increasing number of fintech start-ups (fintechs) are aiming to provide not only more inclusive financial services, but also more sustainable societies. Some of the most interesting projects are now in ‘clean energy money’.

The post-crisis fintechs need funding to support their ambitious growth plans. Therefore, they need to value their businesses using methods that investors with the risk appetite for fintech ventures use. Using the right valuation method and funding option is especially important in this challenging Covid-19 world.

In this article, we primarily focus on valuation and funding for those fintechs in earlier stages, supported by venture capital.

Valuation methodsIn this section, we cover some methods to value earlier stage fintechs.

Venture Capital Method

Venture capital firms are a primary source of funding for fintechs in the early stages looking to raise £100,000 or more. Many if not most VCs use the Venture Capital Method (VCM) – or a variation of it – to value the businesses they invest in. It was originally described in a 1987 case study by Professor Bill Sahlman of Harvard Business School (revised in 2009).

This is a method for valuing high-risk, long-term investments, which uses the following equations:

Return on investment (ROI) = terminal value/post-money valuation

Post-money valuation = terminal value/anticipated ROI

Where:

Terminal value is the start-up’s anticipated selling price in the future.

Anticipated ROI is the 10X return the investor expects.

A fintech start-up example

A VC firm, based on similar start-up exits, expects the terminal value of the fintech business to be £10 million and looks for a 10X return. The post-money valuation of the start-up is calculated by:

10,000,000 / 10 = £1,000,000

(An ‘exit’ is a transaction where an investor sells shares in a business. It requires a business valuation.)

NB To calculate the exit value, the VC firm could use a market approach, for example by finding similar start-up exits. However, it is not always possible to find similar companies. Alternatively, it could use an income approach by estimating revenues and then earnings in the year the VC firm plans to exit the investment. Ideally, it should use both approaches.

The fintech founders need £200,000 to obtain a positive cashflow. That means that they need to offer 20% of the company to external investors.

The pre-money valuation of the start-up (the business value not including the external investors) is:

1,000,000 – 200,000 = £800,000

The VCM is simple and straightforward. However, assessing the riskiness of a start-up requires assumptions which can produce wildly varying results. It should be used in conjunction with one or two other methods (below) to arrive at a more comprehensive valuation.

The valuation could include sensitivity analysis, dilution, multiple rounds, and scenarios (base, best and worse).

Berkus

Dave Berkus, an angel investor and venture capitalist from California, created a basic but popular method to value a start-up. It is based on the idea that the best way to value a start-up is to use risk-reduction elements (rather than projected financials). It is for start-ups that have the potential to achieve gross revenues of at least US$20m at the end of the fifth year in business. The start-up is evaluated based on five risk-reduction elements: sound idea, prototype, management team, strategic relations, and product rollout/sales. Each element can add up to US$500,000. Therefore, this method caps the total pre-money valuation at US$2m.

Scorecard

Also known as the Bill Payne valuation method. It compares the target start-up to recently funded businesses to establish the valuation of the target. It uses the following factors to assess the target: management team, opportunity size, product/technology, competition, marketing/sales/partnerships, additional investment need, and other. Each factor is rated from -3 to 3, multiplied against the factor range (from 0-5% of the ‘other’ factor to 0-30% of the ‘management team’ one), summed up to give the total factor, which is then multiplied against the average industry valuation.

| Strength of the management team | 0–30% |

| Size of the opportunity | 0–25% |

| Product/technology | 0–15% |

| Competitive environment | 0–10% |

| Marketing/sales channels/partnerships | 0–10% |

| Need for additional investment | 0–5% |

| Other | 0–5% |

Later stage methods

There are many more valuation methods, especially for later stage companies, such as First Chicago and Discounted Cash Flow. But they may be too complex and inappropriate for earlier stage fintech businesses. For more on valuation, see the International Private Equity and Venture Capital Valuation (IPEV) Guidelines, which represent current best practice, on the valuation of private capital investments.

Funding options

In this section, we cover some of the funding options available to earlier stage fintechs.

Venture capital

Venture capital firms (VCs) make equity investment in the growing stage of businesses with high growth potential. VCs invest £100,000 or more (some much more) in each business. They also provide strategic, financial, and operational advice. They make decisions after a thorough, and often quite lengthy (six months or more) investment process. Many of them look to invest in start-ups that could return 10 to 40 times the capital invested in 2 to 8 years.

In the biggest VC market in Europe – the UK – venture capital investment increased to £1.65 billion with 821 companies backed in 2019. VCs are now focusing on existing portfolios as a result of the Covid-19 pandemic, but they expect to put more capital to work on new investments in 18 months or so. Meanwhile, they are helping their portfolio companies to review their strategies.

Globally, VC investments in fintechs worldwide increased from US$1.89bn in 2010 to US$53.3bn in 2019, according to Statista.

Corporate venture capital

Corporate venture capital (CVC) includes many forms of equity investment made by (larger) corporations or their investment units (CVCs) into high growth private companies.

Financial services CVCs invested in a record 329 deals worth US$8bn in the first three quarters of 2019. Banks have rapidly accelerated their CVC activity, with annual deal activity up over eight times between 2014 and 2018. The North American share of financial services CVC deals fell from 57% in 2014 to 40% in 2019 (Q3), while the European share grew from 7% to 25% over the same period.

CVCs v VCs: the latter have one objective, that is to generate above average financial returns. The former have strategic objectives too, such as learning new technologies or improving reputation. Therefore, CVCs could value start-ups higher than VCs. However, they may restrict the scope of the start-ups they invest in more than an independent VC, if that is best for the corporate strategy.

Equity crowdfunding

One of the most interesting areas of fintech is equity crowdfunding, a new alternative source of finance for start-ups. It allows retail investors to buy a small stake in a business project or venture online, often alongside angel investors and sometimes alongside smaller VCs. In the UK, fintech crowdfunding declined by 15% in Q2 2020 as Covid-19 started to impact markets. Over £53 million was crowdfunded in Q2 2020, just below Q1 2020 (£57 million), but down about 50% compared to Q2 2019 (£112 million).

Interestingly, while top-line numbers declined, more people invested in start-ups via crowdfunding platforms in Q2 2020 than in the two previous quarters. Perhaps because more retail investors are spending more time at home and browsing start-ups on platforms. However, they may not be able to invest large sums due to limited net worth and job uncertainty.

Security token offering

A security token offering (STO) is the latest way to fundraise with crypto tokens for start-ups. These tokens represent an asset or a utility – as shares in a business. An STO is a crowdfunding campaign that uses blockchain-based tokens. For more on this, see my article Tokenisation: crypto is preparing for prime-time finance.

Revenue-based financing

In a revenue-based financing (RBF) deal, investors inject capital into a business in return for a fixed percentage of ongoing gross revenues. RBF sits between a bank loan, which requires collateral, and an angel (or VC) investment, which requires an equity portion of the business. Usually, the business keeps sharing revenues with the investor until a multiple of the initial capital amount is repaid.

In the past, RBF has been used to invest in companies with predictable financials, such as business services. Now, some VCs purchase a portion of a tech start-up’s revenues for a time. For example, Novel GP provides software-as-a-service (SaaS) companies up to US$1m in growth capital. SaaS businesses have relatively predictable financials. Fintechs with a similar business model may consider this funding option.

Valuation v funding options

As the valuation and funding range increases, funding options change. The recap table below includes the ones covered in this article and a few more (including some for later stage fintechs).

| Business stage/ funding round | Funding size range (US dollars) | Valuation range (US dollars) | Funding options include |

| Idea (prototype)/ Pre-seed, Seed | 10,000 | 100,000 | 100,000 | 1,000,000 | Bootstrapping, grants, accelerators, angels |

| Minimum viable product (gained proof of concept)/ Seed, Series A | 100,000 | 5,000,000 | 1,000,000 | 20,000,000 | Angels, crowdfunding, smaller VCs |

| Rapid growth/ Series A, B | 5,000,000 | 20,000,000 | 20,000,000 | 100,000,000 | VCs, IPO (select exchanges) |

| Stable to Challenged Growth/ Series C+ | 20,000,000 | Any | 100,000,000 | Any | Any equity (larger VCs, PEs, IPO, etc), debt option; anything in between |

| Note that funding size and valuation ranges are indicative. Debt options are also available at earlier stages if the business is profitable. |

Source: P27

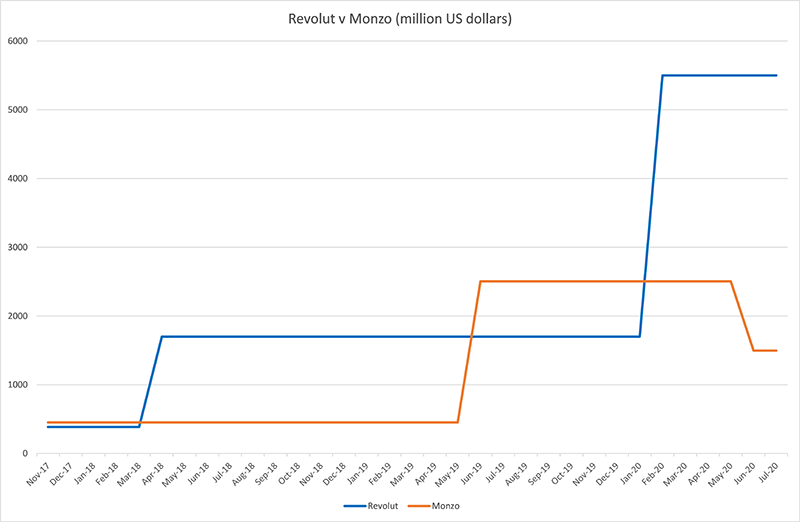

Covid-19 impact: Revolut v Monzo

Fintech has been a major investment for many VCs globally in recent years. However, in the second quarter of 2020, fintechs raised US$6.3bn (£4.8bn), down 41% on the year. For the first time, VCs invested more in mature fintechs than younger ones (52% of total funding).

Covid-19 boosted fintechs in areas such as digital payments and online trading, but it hurt others, such as online lending.

In the UK, digital bank Monzo raised £60 million in a June funding round with a 40% cut in its valuation (£1.25bn, down from £2bn last year). However, Revolut, a direct competitor of Monzo, completed an US$80m top-up raise in July, maintaining its US$5.5bn valuation.

Source: Craft.co, P27

Final thoughts

If you are considering launching the next Revolut (maybe one with a ‘green twist’): back your valuation with the strongest possible business plan. However, remember that earlier stage investors are all about people. The quality of the start-up team is the ultimate key to success for most of them. A great team will fix a flawed business plan, product, or service. But the opposite is usually not the case.

Because of Covid-19, Monzo had to accept a 40% cut in its valuation in a June round. Revolut managed a raise at no discount. Some investors think that the team may be the main reason why.

However, even a great team needs good governance. Venture capital firms consider corporate governance a core component of smaller business value creation. Some investors think that up to a third of that value creation may come from better governance.

Glossary

Accelerator

Short programme (three months, usually) for seed/early stage start-ups, which includes class time, mentorship, and often financial help.Angel investor

A high-net-worth individual who provides funds to early stage start-ups for equity.Bootstrapping

Funding the initial stage of a start-up using the founder’s money only.Initial public offering (IPO)

A process in which shares of a company are sold to public investors. It is underwritten by investment banks, which also arrange the listing on stock exchanges.

Minimum viable product

A version of a product or service with enough features to satisfy some early customers and provide feedback for future development.

Private equity (PE)

Firms (PEs) that invest on their own hundreds of millions of dollars, even billions, to acquire a controlling interest a company, using debt.

Seed capital

The initial funds to start a new business.

Unicorn

A start-up that does not have an established financial record, with a market valuation of US$1bn or more.