It all started in 2009 with the release of bitcoin, the first cryptocurrency, a digital peer-to-peer (P2P) payment network powered by users. It has no central authority or middlemen, and it runs on blockchain, a decentralised public ledger of every transaction made on the network.

Bitcoin is still the most used cryptocurrency, but there are now many more (altcoins), such as ether, dash, and monero.

Blockchain

The core component of bitcoin is the blockchain, which is a kind of ‘triple entry bookkeeping’ system (credit, debit and cryptographic seal), managed by a network of P2P computers. In any one transaction, a seller books a debit for cash received, entering the transaction onto a shared record – a distributed ledger/blockchain – while a buyer books a credit for cash spent, entering the transaction onto the blockchain.

Following the success of bitcoin and its blockchain, many new blockchains have been developed. Ethereum is the main one. It is a project for ‘smart contracts’ – computer protocols allowing two parties to enter into a contract without a middleman. Ethereum has its own coin: ether.

Initial coin offerings

An initial coin offering (ICO) is a new way to fundraise with cryptocurrencies (coins or tokens) for start-ups. Initially, the term ICO referred to the launch of new cryptocurrencies. Today, many if not most ICOs sell crypto ‘tokens’ – which could represent an asset or a utility – as shares in a business and should be called initial token offerings (ITOs). In fact, they raise money via crowdfunding campaigns that use blockchain-based tokens.

An ICO offers the chance to support the next Uber or TransferWise (particularly of the blockchain type) and make some money in the process, possibly. It sounds like an initial public offering (IPO). Although it has similarities with an IPO, it differs quite a bit.

Differences between IPOs and ICOs

|

|

IPOs

|

ICOs

|

|

Stage

|

IPOs take place at a stage when companies have products or services generating revenues, are profitable or close to profitable.

|

ICOs take place at an earlier stage, when companies have unproven products or services, and limited or no revenues.

|

|

Regulation

|

IPOs are regulated events.

|

Most ICOs are not regulated.

|

|

Communication

|

IPOs communicate the problem their companies solve and how with a prospectus – a mandatory, rich document.

|

ICOs communicate the problem their companies will solve and how with a whitepaper – a voluntary, ‘light’ document.

|

|

Equity and rights

|

IPOs provide equity and voting rights in a company.

|

Generally, ICOs do not provide equity or voting rights in the company offering them; they only provide some utility.

|

|

Cost/time

|

IPOs tend to be relatively expensive, due to regulation and lengthy paper-based approach of advisers and lawyers.

|

ICOs are much cheaper and faster than IPOs.

|

ICOs exploded in 2017. In the US, Filecoin, a blockchain-based data storage project, raised over US$205m. In Europe, Sirin Labs, a Swiss company developing a blockchain-based smartphone, raised more than US$150m.

The 2017 explosion was driven by several factors. One is that Bitcoin investors who got wealthy quick found them a way to diversify, without using traditional assets (regulated and taxed). Another is that ICOs can be traded on exchanges.

Exchanges

Two of the most popular cryptocurrency exchanges are Coinbase and Binance. Both are reputable cryptocurrency exchanges that excel in different areas and complement one another. Coinbase is perfect for a beginner wanting a quick way to purchase coins to transfer to other cryptocurrency exchanges. This comes with a higher price tag, though.

Binance is ideal to purchase a wide array of coins for minimal fees. Its more complex interface provides more information to make trades using technical analysis or possibly more advanced quant methods.

In addition, major exchanges are getting involved in crypto projects, as institutional investors signal their interest in the space.

For example, Bakkt, a new company from ICE (the parent of the New York Stock Exchange and other exchanges), estimates that the crypto asset marketplace could be worth around US$270bn. Bakkt’s main offering will be a futures exchange and clearing house for single day, bitcoin contracts for ‘physical’ delivery, involving the exchange of bitcoin. (CME, the world’s largest futures exchange, launched bitcoin futures contracts in December 2017. These contracts are financially settled and therefore do not involve the exchange of bitcoin.)

Bakkt will start operating in late 2019. It is awaiting approval from the US Commodity Futures Trading Commission (CFTC). (Its investors include Pantera Capital, Susquehanna International and Galaxy Digital.)

Meanwhile, the Swiss stock exchange announced the SIX Digital Exchange, “a fully integrated trading, settlement and custody infrastructure for digital assets” that will be launched in mid-2019.

Risks

ICOs carry higher risks than IPOs. The Securities and Exchange Commission (SEC), the US financial regulator, has stated that most ICOs are securities offerings, and therefore fall under the SEC’s securities laws. It has said that calling what they offer ‘utility tokens’ does not prevent them from being a security. As a result, companies that have issued them have broken the law by offering unregistered securities.

There is no guarantee that the product or service that ICO companies plan to develop will ever launch. Some of these companies give cyber security a low priority, are scams or have badly written code. Millions of US dollars disappeared between 2017 and 2018 due to hacks, scams or bugs, according to Coindesk and other sources.

In the UK, the FCA has highlighted the following risks:

- Most ICOs are not regulated by the FCA and many are based overseas

- You are extremely unlikely to have access to UK regulatory protections

- The value of a token may be extremely volatile

- Some issuers might not use the funds raised in the way set out when the project was marketed

- Whitepapers might be unbalanced, incomplete or misleading

- Projects are in a very early stage and their business models are experimental

Meanwhile, countries like South Korea and China have banned ICOs.

The 2018 crash

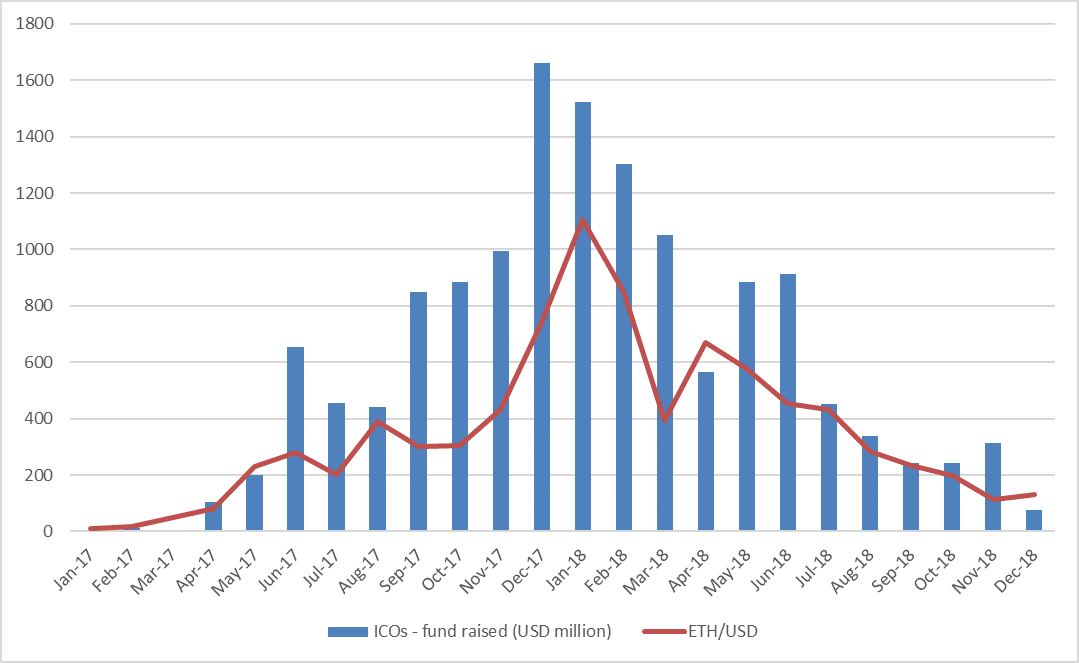

ICOs raised US$6.2bn in 2017 (875 ICOs), and US$7.9bn in 2018 (1,258 ICOs), according to ICOdata. However, the picture is not so rosy if you look at the monthly figures. The following chart shows the fundraising activity over the 2017–2018 period by month. It also compares the ICO funds raised with the price of ether (in USD).

Source: ICOdata, Coinbase

Source: ICOdata, Coinbase

Most ICOs have offered tokens using Ethereum, which makes it particularly easy to create new tokens. The monthly chart above shows that ether (red line) tracked quite well the fund raising of ICOs (blue bars). Both exploded in 2017 and then crashed in 2018. Bitcoin and virtually all the other cryptocurrencies did the same.

(Note that, generally, coins refer to cryptocurrencies that have their own blockchain, while tokens refer to cryptocurrencies built on top of an existing blockchain.)

It is not clear what the root cause of the 2018 crash was, but many in the space point to poor project planning and management, and scams. The latter led the SEC to aggressively investigate many ICOs, killing the confidence in the market. Many investors panic sold, even good projects.

Token classification

There are different tokens, but there is no generally recognised terminology for their classification. But this is changing, as is the way in which these offerings are made. Companies as big as Overstock, a US internet retailer (US$1.8bn revenues in 2017), are leaning toward security tokens, also referred to as asset tokens.

According to the Swiss financial regulator FINMA, asset tokens represent assets such as participation in real physical underlyings, companies, or earnings streams, or an entitlement to dividends or interest payments. In terms of their economic function, the tokens are analogous to equities, bonds or derivatives. (FINMA is one of the first regulators to embrace crypto projects.)

Security token offerings

Security tokens are backed by real assets such as an equity in companies, debt, real estate or commodities. They are also subject to security regulations. Some prefer to call them digital securities to avoid the controversies around ICOs.

Security token offerings (STOs) start with a small private sale, followed by a pre-STO sale to larger group of investors, leading to a public STO. The target investor groups at each stage depend on the jurisdiction(s) where the company issuing the tokens offers them and the restrictions imposed by the national financial regulators.

In 2018, tZero (a subsidiary of Overstock) raised over US$130m with an SEC-compliant STO for a securities trading system, blockchain-based. Its technology and network of strategic partners and affiliates provides issuers with a new solution for accessing capital and enabling secondary liquidity. One of its partners is Polymath, a blockchain platform claiming that what Ethereum did for tokens, it will do for securities.

Meanwhile in the UK, Globacap issued the first equity-security tokens, under oversight from the FCA as part of its sandbox, which “allows firms to test products, services or business models in a live market environment, while ensuring that appropriate protections are in place”). Globacap did this using a process known as ‘tokenisation’, leveraging blockchain. It creates digital securities, allowing “previously illiquid assets to become easily tradeable, and reducing overheads in the process,” according to its website.

The future

Many people do not think much of ICOs, including some executives in fintech. Stefan Thomas, former chief technology officer at Ripple, a global payments network that leverages blockchain technology, predicted their death in 2018. But regulator-compliant security tokens may just be what the market needs to restore confidence and possibly change the world of finance.

IPOs and other public market securities are not about to be replaced by security tokens any time soon. However, tokenisation will grow, possibly exponentially, in the coming years as an additional crowdfunding option. It may also become an option for larger businesses to fund some of their projects.

The efforts of regulators such as FINMA, the SEC and the FCA as well as the entry of some established exchange groups will help to further increase confidence in the cryptocoins/tokens market as a legitimate option for companies and investors, particularly institutional investors who are looking for better ways to diversify their portfolios.

Views expressed in this update are those of the author alone and do not necessarily represent the views of the CISI.