In the UK, £17bn has been drawn from defined contribution (DC) pensions since the government changed the rules back in 2015.

The FCA’s

Retirement Outcomes Review, published in June 2018, reports that over 1.5 million DC pension pots have been accessed, taking advantage of pensions freedom and choice legislation. This allows people to draw their DC pension as they wish, subject to the marginal rate of income tax. The report also states that 72% of consumers who accessed their pots did so before the age of 65.

But there are still concerns about how savers are accessing their pots and whether they have sought suitable guidance to ensure the pot will last for as long as needed.

The March 2018 FCA

Data Bulletin reports that since 2015, more than half (55%) of DC savers aged over 55 took their entire pot in one lump sum while 30% entered income drawdown where the fund remains invested and used to provide an income each year. However, 32% of all drawdown sales over this period took place with no advice. And the September 2018 FCA

Data Bulletin reports there is still almost a third of drawdown sales being non-advised. These statistics are a cause for concern. People who fail to access income drawdown effectively may be in real danger of running out of money in retirement.

People who fail to access income drawdown effectively may be in real danger of running out of money in retirement

Getting personal The most important factor, which can usually be defined with a reasonable degree of reliability as most people do not vary their lifestyle greatly after stopping paid work, is an individual’s goals and what they are likely to cost. Early exploration of both the financial and personal elements of a client’s life will be critical to start formulating the right strategy for meeting those costs. Once these are clear, a financial planner can begin to work on combining the provided information with agreed assumptions to create a forecast into the future and to determine a workable approach for drawing benefits.

Once the expected costs of the desired lifestyle are known, the next challenge lies in tackling the number of unknowns. No one can predict with any real certainty when they will die, the rate at which their expenditure will change, the direction of interest rates or the fate of global stockmarkets. In order to model the future it is therefore necessary to make a number of assumptions to address these, as well as to have a robust process for determining what they should be and for reviewing them regularly.

Assumptions Using assumptions is a crucial stage in the financial planning framework to enable financial planners to help clients achieve their goals in the required timeframe. The international CERTIFIED FINANCIAL PLANNER

TM certification requires assumptions to be reasoned, reasonable and adequate for the client’s plan.

Predicting the future accurately is impossible but financial planners can make some educated guesses as to how things will work out. This is why it’s important to have a repeatable process in place on which to base estimates.

Robert Lockie CFP

TM Chartered FCSI, investment manager and branch principal at Bloomsbury Wealth, explains in

IFP Fellows’ briefing paper: Assumptions that CFP professionals will ensure that their assumptions “cover investment growth, price inflation and earnings inflation, as well as any other relevant working assumptions, and that they are adequate for the advice required”.

In a subsequent interview, he says that the assumptions for looking at income drawdown should be the same as those used for comparing other options. “Whether someone is doing drawdown or annuity for example, you have to keep the assumptions the same because otherwise you end up with things you can’t compare to each other.”

Based on the IFP paper mentioned above, here are just some of the assumptions a planner should look at when discussing drawdown rates with a client.

Expenditure inflation While published measures of inflation (in the UK, the Retail Prices Index (RPI) and the Consumer Price Index (CPI), for example) are relevant for some aspects of an individual’s finances, they are not necessarily the most important ones. The former affects index-linked gilts, state pensions and some National Service certificates, while the latter is applicable for some state benefits and aspects of other pensions.

However, one of the most important variables for a client is the rate at which their own expenditure increases. This may match CPI, RPI or neither of them and it may vary over time as well. Particularly for a relatively young individual in good health, the rate at which their expenses change over the remainder of their life will have a significant impact on the ability of their capital to meet their goals, and consequently the implied degree of investment risk that they might need to take. Even a small variation in this rate will affect the present-day value of their future outflows.

Education costsFor clients with children, or with a responsibility for the education of someone else, education costs may come into assumptions. If the client is looking to put themselves, their children or grandchildren and so on through private education, there are different aspects to look at here. For private education, will school fees jump up at various stages? Will there be expensive ski trips and netball tours to fund? Will you be paying for additional childcare in the form of after school clubs, or might your children need an au pair or nanny?

For private education, will school fees jump up at various stages? Will there be expensive ski trips and netball tours to fund?

And then comes further education such as sixth form, college and university, which will need to be taken into consideration to reflect an accurate assumption. Looking at historic data on fee increases across institutions might give a financial planner an idea of what a client can expect to pay in the years to come but, of course, the costs they actually pay in the future won’t necessarily match these historic averages. It is therefore useful to look at both historic fees and price inflation to determine whether any trends can be recognised, such as a relatively consistent relationship to price inflation.

Costs for care in later lifeWith older age comes the possibility of care costs. If the financial planner and client establish that future care costs might be necessary, then a starting age and duration for such costs should be assumed. While this is difficult to predict, an assumption can be made using averages and data. For example, according to the

Alzheimer’s Society, 850,000 people in the UK have dementia and this is set to increase to over one million by 2025 and two million by 2051. One in six people over the age of 80 currently has dementia.

Costs depend on what type of care is expected to be needed, the location and the level of ‘luxury’. Full time care at home, for example, is likely to be the most expensive option. By asking a client questions surrounding these, looking into average costs could be made easier.

How long will you live?Financial planners tend to run life expectancy to 100 and some even go longer. This may seem cautious now, with ONS cohort

figures for England and Wales up to 2016 showing that a male is expected to reach an average age of 79.46 and a female is expect to reach 83.08. However, by

2066, cohort life expectancy at birth in the UK is projected to reach 98.1 years for females and 96.1 years for males. Life expectancy for the most affluent, a demographic typically over-represented among the clients of financial planners, is unsurprisingly greater than the population average and who knows whether any particular individual is average?

Tools for financial plannersA lifetime cashflow can be used to help

create a picture of a client’s financial future. Providing a visual tool to help clients understand outcomes from taking differing levels of risk helps to demonstrate the trade-off between protecting capital from market reverses and from being unnecessarily cautious and generating a lower return than is necessary to meet their goals.

However, since almost no predictions can be guaranteed to be accurate, cashflow modelling tools help financial planners to look at the most likely outcome using assumptions agreed with the client for such variables as price and expenditure inflation as well as investment returns and life expectancy. Such tools can also help to look at the impact of extremes – another credit crunch, for example, or a loss of earned income. They will also show the material impact that increased or reduced withdrawals might have on the value of the portfolio, and thus help to inform the discussion about how much investment risk it is appropriate to take. The risk/return balance is critical when deciding how to invest, particularly just before and during retirement when there may be no further opportunity to replenish the capital.

“Almost all assumptions will be wrong, but as financial planners we can show a client different outcomes based on those which we have agreed with them"

Robert says: “We find that people often have complicated cashflows. If a client asks if they have enough resources to last the rest of their life, doing a cashflow planning exercise can help as it may not otherwise be apparent where the potential problems may arise. If we do that, and there’s money left in the pot at the end, that tells us that based on those assumptions and the data given to us, they should be OK.

“Almost all assumptions will be wrong, but as financial planners we can show a client different outcomes based on those which we have agreed with them, including the impact on their future if the market goes down 20% tomorrow and does not bounce back.”

The combination of assumptions, clients’ attitudes to risk, their ability to withstand financial shocks, the nature of their overall resources, their tax situation and their personal objectives all help to determine how financial planners suggest they invest and the rate at which they draw on their investments. For example, it may be worthwhile to secure a basic level of guaranteed income to continue regardless of market conditions rather than relying entirely on withdrawals from invested assets to meet regular expenditure.

Tackling taxEffective drawdown solutions also hinge on tax efficiency. Retirement planning needs to make the most of the different ways in which HMRC treats certain vehicles and there are myriad situations where drawdown could be employed.

Robert explains how drawdown works in terms of tax efficiencies. “Assuming a client hasn’t already taken their 25% pension commencement lump sum (PCLS), they can elect to take part of each drawdown payment as PCLS so that up to a quarter of it is tax-free and the rest taxable income. Alternatively, they can just take the non-PCLS element, which is taxed as income. As ever, tax efficiency depends on individual circumstance though. For example, drawing taxable benefits while continuing to work could result in a higher tax liability.”

How pensions are drawn also impacts estate planning since they do not form part of the taxable estate on death, making them more attractive than their ISA counterparts. If an individual dies before age 75, benefits can also be paid to beneficiaries free of tax. These factors will influence the rate at which individuals should draw on their savings and from where. There is no right answer; what matters is meeting their personal objectives in the most efficient manner.

According to the Markets in Financial Instruments Directive II, firms are required to provide an annual review wherever there is an ongoing fee, although, regardless of regulatory requirements, this is an important step for financial planners to take. Robert says: “Without regular review, planning for a client's long-term future is dangerous and probably borders on negligent. Whether you use drawdown or not, life changes and no one knows the future. The value of a financial plan that is left untouched declines over time and therefore it has to be kept up to date to remain relevant. It’s similar to the reason why people shouldn’t write a will and forget it, because over the years they might have married, divorced, had children, acquired or disposed of a business ... any number of things could happen. It is essential to keep things under review.”

Given the differences between how much individuals have saved and the lives they want to live in retirement, no two plans will be the same but the ‘right’ drawdown rate follows the same rule for everyone: it needs to ensure a person can live comfortably for their entire life and enable them to achieve any other financial goals they have. Financial planners will need to use all the tools in their kit – including technology and the human touch – if their clients are to draw the right amounts for an active retirement and a secure financial future.

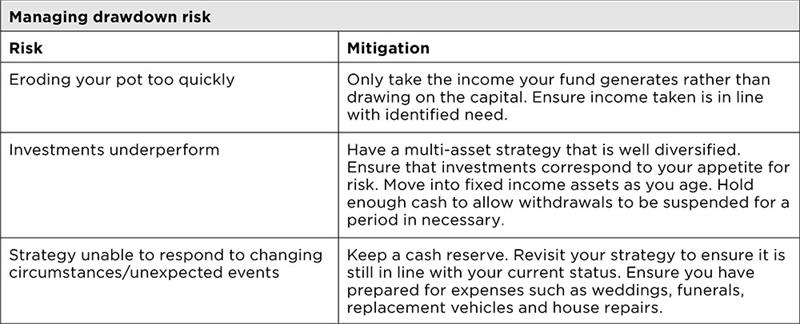

How to manage drawdown risk effectively

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.