David Burrows reports on how the financial services sector is taking steps to support customers in vulnerable circumstances

According to the FCA’s Guidance for firms on the fair treatment of vulnerable customers (the Guidance), published in February 2021, a customer with characteristics of vulnerability is:

Someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care. The Guidance uses the terms ‘consumer’, ‘customer’ and ‘client’ interchangeably.

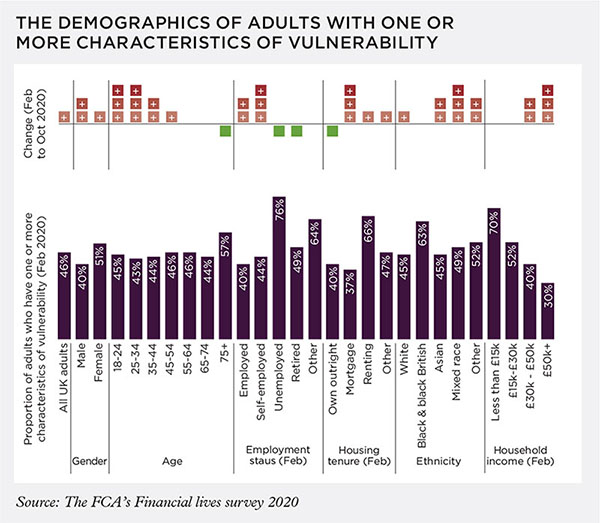

This definition specifies personal circumstances that can make an individual vulnerable, often temporarily. Understanding how broadly and fluidly ‘vulnerability’ extends is an essential starting position. The FCA’s Financial lives 2020 survey (published in February 2021), for example, indicates that in February 2020, before Covid-19 hit the UK, almost half (46%) of the 16,000 respondents showed one or more characteristics of vulnerability. When the figures were updated in October that year the percentage had increased to 53% of 22,000 respondents.

It is clear that vulnerability is not confined to a small number of elderly people who struggle with their hearing or fail to get to grips with technology, and that it can happen to everyone at some point.

Elaine McCormack, senior manager, risk consulting at KPMG, points out in a CISI webinar in December 2020 that consumers in vulnerable circumstances “may be at risk or suffer harm disproportionately if harm occurs” and that the FCA found it was more likely to have an impact “on those who were unemployed or had no formal qualifications”.

Covid-19 has made consumers more vulnerable than ever. Simone Easton, technical manager at life assurance company Abrdn, and author of the CISI Vulnerable Customers Professional Assessment, elaborates: “There are people suffering ‘long Covid’ now, which is debilitating, and the pandemic has isolated people. They have not been able to leave their home, and many have suffered mental health issues as a consequence. People of a certain age are going online for the first time, which leaves themselves open to scammers.”

Identifying vulnerability

The FCA has identified four key drivers of vulnerability: health, life events, resilience, and capability [click the image on the left for the full size PDF showing the drivers and examples]. The drivers and their associated characteristics indicate many potential complex interactions between different combinations of vulnerable circumstances, illustrating the need for the FCA’s broad definition of vulnerability.

The FCA has identified four key drivers of vulnerability: health, life events, resilience, and capability [click the image on the left for the full size PDF showing the drivers and examples]. The drivers and their associated characteristics indicate many potential complex interactions between different combinations of vulnerable circumstances, illustrating the need for the FCA’s broad definition of vulnerability.

The FCA’s Financial lives 2020 survey reveals that before the pandemic, 20% of adults who had a relationship breakdown in the previous 12 months had fallen into debt because they did not want to deal with difficult financial situations at a traumatic time. Some 20% of those surveyed avoided debt but struggled to manage their money.

In October 2020, “the proportion of adults experiencing a negative life event, such as an income shock, relationship breakdown, bereavement, or ill health” had increased in the seven months since March 2020 by 45%: from 20% in February to 29%, according to the survey. Some 27% of UK adults had low financial resilience, up from 20% in February, and 5% of adults had poor health, 30% of whom had “issues dealing with customer services over the phone”, with a similar proportion having “difficulties getting to a bank branch”.

Understandably, people in vulnerable circumstances may not want to be labelled ‘vulnerable’, so it is important that staff are trained to recognise the drivers to help customers deal with their individual circumstances. Simone Easton provides a scenario to illustrate the point. “A widow contacts her bank or insurer and tells them her husband has passed away. She is immediately passed to a trained member of staff who asks the right questions. ‘How are you coping?’ ‘What are your main concerns and how can we help?’ In some instances, the spouse that died took all the financial decisions so there is suddenly a lot of pressure on the other person at an already difficult time.”

People in vulnerable circumstances may not want to be labelled ‘vulnerable’ The customer feels vulnerable, especially as they will be asked to provide details of any will that is in place and what pensions and insurance policies exist. “These types of questions can put people on the back foot, which is why it is so important for the bereavement team to recognise the customer is vulnerable, be understanding and give customers more time to consider their options and make better decisions,” says Simone.

What it shouldn’t be is a rigid process where bereaved customers feel they need to make important financial decisions on the spot at a time when they are in shock and having to deal with many non-financial pressures. In an instance such as this, Simone adds, good practice would be to ensure a note is put on the customer’s file, to inform future contact with the customer.

The CISI’s recent ‘quick survey’ on its homepage, asking how well financial services professionals understand their duty of care responsibilities, produces largely encouraging numbers. Just over 84% of 766 respondents say they have a full understanding of their duty of care responsibility and 14% have either limited or partial understanding of their duty of care responsibilities – which shows there is further to go for some.

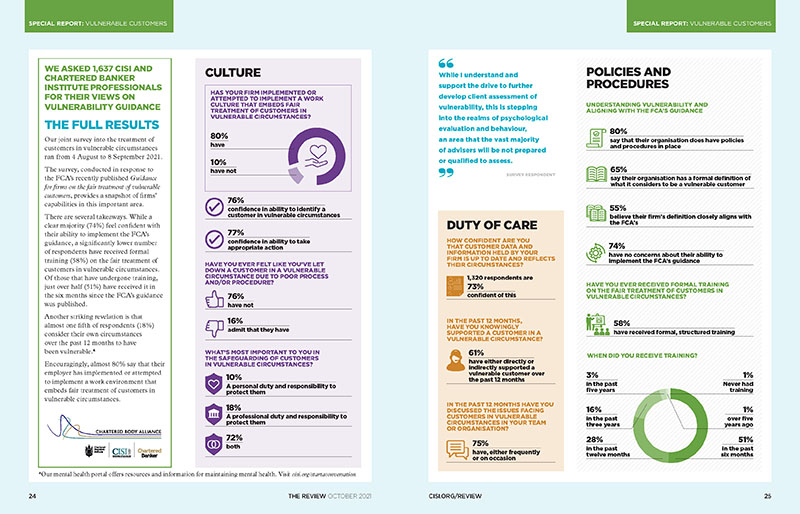

From August to September, the CISI also conducted a joint survey with the Chartered Banker Institute, asking 1,637 professionals for their views on vulnerability guidance.

View the results below – click on the image for the full-sized PDF

International approaches

The Hong Kong Monetary Authority (HKMA) has issued guidelines on how to treat customers in circumstances that make them vulnerable. It requires financial advisers to adopt holistic assessments, taking into account customers’ circumstances and investment experience. This assessment is conducted on an ongoing basis.

In the US, the Financial Industry Regulatory Authority has issued rules requiring brokers to add a trusted-contact person to clients’ accounts and allowing firms to suspend accounts where they believe ‘financial exploitation’ has occurred.

In April 2021, the French regulator Autorité des Marchés Financiers and the Autorité de Contrôle Prudentiel et de Résolution published a summary report on cognitive decline in elderly customers, calling for increased vigilance based on three pillars: training, vulnerability ‘points of contact’, and procedures.

Across Europe, there are several directives aimed at protecting vulnerable customers (see the full special report in the October 2021 edition for more detail).

Consistency is key

The Guidance from February 2021 outlines some practical action firms can take, such as considering the positive or negative impacts of a product or service on vulnerable customers and taking such customers into account “at all stages of the product and service design process”. It expects firms to consistently treat all customers fairly in accordance with its Principles for Businesses and other rules and guidance. In July 2021, the FCA published FAQs on its finalised Guidance. They are grouped by theme, including sections on practical action for firms.

As Simone points out, all firms will be different with regards to what they already have in place and the resources they can draw on. “It is different for companies like Abrdn and a financial advisory firm with 30 staff in total. Some companies will have a team of trained staff and, for instance, 30 categories for vulnerable customers. Others will have ten categories and some will have no vulnerable customer policy at all.”

For those companies that are behind the curve in developing clear policy, the incentive is there to act. Simone stresses that while theoretically firms could choose not to adhere to FCA guidelines, the reality is somewhat different. “There is a minimum regulatory element to this in that companies will need to evidence fair treatment of vulnerable customers and that staff training programmes are in place. The FCA is also linking this to its Senior Management and Certification Regime. They are going to go back and ask questions, such as, ‘do you have a vulnerable customer policy in place and how can you evidence this is working’?”

Levels of understanding

The investment sector has too often been hit by mis-selling scandals – from with-profits funds and payment protection insurance to sub-prime mortgages. Given the scale of these scandals, it is fair to say that we all need protection to some degree. But for the more vulnerable, there is even more need to be vigilant and understanding. Simplicity in communication is crucial here.

The FCA’s Financial lives 2020 survey finds that 57% of adults with low capability about money and finances “felt nervous, overwhelmed, or stressed speaking to financial services providers”, 37% “struggled to assess financial products or found it difficult to shop around”, and “16% had fallen into debt, which might have been avoidable if they had understood their options better”.

Financial literacy scores decline by about 2% each year after age 60, according to a paper titled ‘Old age and the decline in financial literacy’, published in Management Science journal in 2011. However, confidence in financial decision-making abilities does not decline with age.

“I have had cases where the children of clients have exerted undue influence on a parent”Philip Wise CFP™ Chartered MCSI, managing director at Sussex Retirement Planning, explains how he deals sensitively with clients when their confidence doesn’t match their decision-making ability: “On our website, we ask all clients over 80 if they would like a family member to attend financial planning meetings with them. We are not singling anyone out or asking them bluntly ‘are you sure you are taking in what I am saying’?”

Philip will also directly ask clients who have recently been bereaved, divorced and those under 25 with little or no financial experience, whether they too would like another person at their meeting. Dave Robinson CFP™ Chartered MCSI, director of Bristol-based Centurion Financial Planners and member of the Society of Later Life Advisers, agrees that family support can be helpful but explains it can also be detrimental to vulnerable customers. “I have had cases where the children of clients have exerted undue influence on a parent – one example being pressure to agree to an equity release loan. The financial benefit was to the children – not to the client.”

Dave explains that even when a client has approved a family member to attend meetings with them, he will request the other party to go out of the room briefly for a short one-to-one consultation. “If a family member is talking over their parent or you sense that the client is on edge, it is really important to talk privately to them.”

An adviser with doubts over the mental capacity of a client cannot flag this with other advisers unless the client consentsOne of the challenges is that financial advisers and wealth managers are required to ‘assume mental capacity’ under the Mental Capacity Act until they know otherwise. However, says Dave, if an adviser has doubts over a client’s mental capacity, they should investigate further. “If I have concerns that a client may not have mental capacity, I will give them my financial advice and ask them to put in their own words what I have just outlined. If there are any doubts – you can’t take instruction.”

Under the EU’s General Data Protection Regulation requirements, client information cannot be shared without the client’s approval, so an adviser with doubts over the mental capacity of a client cannot flag this with other advisers unless the client consents. Simone says: “What if someone doesn’t want ‘vulnerable’ on their record? This is an area the FCA hasn’t dealt with yet.”

Regulators globally have evidently moved the conversation forward on how to protect customers in vulnerable circumstances, but, as Simone concludes, it is still a work in progress. Now that those vulnerable circumstances have been identified, processes need to be implemented to ensure the financial services sector is acting in clients’ best interests at all times.

The full article was originally published in the October 2021 edition of The Review.

The flipbook edition is available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.