Russell Catley, CEO of Catley Lakeman Securities, explains how structured products work and where they come from, and Andrej Ogorevc, head of structured products at Old Mutual Wealth, explains how structured products could be used to meet a client’s investment objectives.

What is a structured product?Russell: A kind of fixed-term investment where the payout depends on the performance of something else, like a stock market index, and it will have a defined return that will be either a coupon or a percentage return or a percentage in relation to the equity index itself. When we talk about structured products, we generally mean equity derivative structured products, that’s 95% of the market – the other part is fixed income derivatives. Structured products are appropriate for both institutional and retail investors.

In the UK, retail structured products mainly use the FTSE 100 as an underlying index, but institutions and wealth managers also use other indexes, such as the S&P 500, Eurostoxx 50 and Nikkei 225 indices. Additionally, some may use exchange-traded funds or other esoteric underlying assets.

There are two main types of structured product:

- Structured deposits – savings accounts offered by banks, building societies and National Savings & Investments. In this instance, the rate of interest depends on how the stock market index – or whichever measure is used – performs. The money invested has the same protection as with any other savings account.

- Structured investments – offered by investment banks, that have conditional capital protection, based on a specified level of the underlying index. Such protection will not help in the worst market scenarios.

What are the different types of structured products?

What are the pros and cons of types of structured products?

Andrej: The first three types of products described below are yield enhancement products and provide a relatively high return, which is capped. The products are appropriate for clients who don’t believe the market will increase significantly over the product’s term and can offer attractive terms in market conditions with relatively higher volatility.

1. Reverse convertibles

These pay a relatively high income and provide some capital protection in case the underlying asset falls in value. They can be used to profit from high volatility, but their upside potential is capped and clients’ capital is at risk if the underlying asset drops below the capital protection barrier.

2. Synthetic zero

These have a similar risk profile to reverse convertibles but instead of a regular income they only pay a return at maturity if the underlying asset closes above the barrier. The potential return is higher than in the reverse convertible as the return is not guaranteed.

3. Autocallable products

These are a variation of the reverse convertible or a synthetic zero, but may mature early, before the final maturity date, if the underlying asset is observed at or above a certain level on the relevant observation date. Autocallables can pay a regular income if the underlying asset is at or above the coupon barrier or they can pay a return at maturity. Due to the product coming to an end when market conditions are in clients’ favour, the autocall provides higher returns than the reverse convertible with the same underlying asset and capital protection barrier.

The following two products are suitable to use in clients’ portfolios when the expectation is that the underlying asset will increase in value over the term, but clients have different attitudes to risk.

4. Call spread

Typically used in a capital protected product. It offers an exposure in the increase of the underlying asset, which is capped. The cap is used to increase the participation in the rise of the underlying asset which would otherwise, due to current low interest rates, be too low.

5. Accelerator (geared participation note)

Used by investors who can put capital at risk and want to trade dividends in return for a higher participation in the rise of the underlying asset. This kind of product can also offer some degree of capital protection.

The two products above allow clients to generate returns in sideways or rising markets, while some types of structured products are used to profit in periods when markets drop and volatility increases.

6. Dispersion note

Offers the investor the ability to profit when the underlying assets don’t move in tandem, for example, when the volatility of single stocks rise relative to the benchmark index. As this typically happens when equity markets are decreasing, this type of product is a perfect diversifier in clients’ portfolios.

Dispersion notes may be more appropriate for professional investors, while all other products mentioned above are appropriate also for retail investors if products features, risks and benefits are appropriately disclosed for the intended target market.

'Structured product' is a generic term for investments that can be tailored to meet the specific market view and risk profile of the retail and institutional investor. Therefore, the pros and cons of a certain product can be assessed only when taking into account the investor’s risk profile and investment needs.Russell: Having begun in the 1990s and early 2000s with reverse convertibles and synthetic zeros – the equity structured product market has broadened out into a range of payoffs, based around similar principles, the most important being probability of return.

The full (not exhaustive, but most broadly used) list of equity payoffs for institutional and retail investors would be as follows. See boxout for pros and cons:

- Reverse convertible

- Synthetic zero

- Autocallable

- Call spread

- Accelerator (geared participation note)

- Dispersion note

Each of these increase the probability of the return the investor is looking for, while defining the specific risks.

Autocallables give the highest probability of a reasonable risk-adjusted return from the major equity markets. They can mature prior to their scheduled maturity date, if certain predetermined market conditions are met. If the reference asset is at or above its initial level (or any other predetermined level) on a specified observation date, the investor receives a coupon equal to the number of years multiplied by the initial coupon level.

How can structured products work for financial planning clients? Andrej: They can bring much needed flexibility to financial planning as different products can be used to meet different financial goals, and they can be tailored to a client’s unique circumstance. For example, if a client is saving for a specific financial goal with a time horizon of three years, such as buying a house, there is a common misunderstanding that investing in cash is the only way to mitigate risk of loss of capital. If this approach is followed the client will with certainty forego growth of their funds.

A structured deposit can offer the client the opportunity to secure the total capital value, while increasing the growth opportunity. For example, instead of earning 0.2% per annum with a cash deposit in British pounds, a client could get a structured deposit that pays 1% per annum plus the additional performance of an index, for example the FTSE 100, at maturity, capped at 5%, if the index is at or above its initial level.

However, to meet a longer-term financial goal over a period of more than five years, clients may want to select a riskier product that could outperform the market over a longer time horizon. For example, a structured product could provide an increased index growth, say of 250%, while offering capital protection if the market drops by less than a predefined amount, say 50%. If, in this example, FTSE 100 increases by 50% in six years’ time, this product would yield 125% return, a 75% outperformance over FTSE 100.

Structured products are investments with defined outcomes which, when included as part of a client’s diversified portfolio, enhance the return potential. In the current low interest rate environment, fixed income instruments are no longer able to effectively diversify a portfolio and financial planners should look to alternatives to traditional 60:40 debt and equity asset allocations.

Why would you recommend structured products? Russell: All structured products are about probability. If clients want 12–15% returns annually, they’re better off investing in private equity type investments, because they’re unlikely to get it from traditional assets on a sustained basis, given the contemporary economic environment.

Interest rates have been on their knees for ten years, with little inflation and there’s been very little economic growth, so in that environment if you said to a client ‘would you be happy with 7% or 8% per annum?’ they pretty much ought to say yes. Now you’re taking equity risk for that so it could fall and not recover but what you’re doing is increasing the probability of returns.

What are the counterparty credit risks?Russell: For structured products, counterparty risk is the risk of a client losing money not because of the performance of the product, but because of the failure of the bank that has issued the product. However, after the financial crisis, banks were made to restructure their balance sheets to make them more resilient to market events.

The other element that should protect clients from counterparty credit risk with structured products is the Financial Stability Board’s (FSB)

global systemically important banks (G-SIBs) list. It’s a list of 29 banks that are deemed ‘too big to fail’, as they are systematically important to global financial markets. Post-financial crisis, regulators have made these banks’ balance sheets much stronger, but ultimately the rhetoric is that they will protect them in another crisis. People investing in structured products issued by G-SIB banks should feel relatively comfortable.

Credit risk is still important if you’re running a portfolio, however, if a bank’s credit weakens in times of financial stress, the daily secondary market value of the product should fall, thus impacting the value of the client’s portfolio.

What do structured products cost?

Andrej: Manufacturing costs of a structured product are typically low. For example, a typical British pound six-year autocall that yields a potential return of 12% per annum costs less than 0.3% per annum.

Clients may pay additional fees for advice or distribution; however, these sit outside of the structured product true costs and should be carefully considered. The legislative framework instituted by the EU requires that all costs and charges, including the issuer’s fees, are disclosed to a client via a Key Information Document prior to the product being purchased. This ensures that clients are appropriately informed and provided with all fee related information, in order to make an informed decision. This measure provides a level of transparency which exceeds that of the fund sector.

What affects the pricing?Andrej: Market parameters determine the price of a particular product for the issuer while the distribution channel will have an effect on the fees built in the product. Total costs of a product have an impact on the reduction in yield. Institutional investors, such as discretionary fund managers, will pay up to 30 basis points per annum, whereas retail investors buying a structured deposit or a structured plan will pay around 60 basis points per annum, depending on the product. Since the introduction of Packaged Retail and Insurance-based Investment Products rules, all costs are disclosed, and these total costs take into account one-off, ongoing and incidental costs.

Russell: There is full intra-day pricing and liquidity of institutional and retail structured products, so an investor can sell at any point of any day. What affects the price in the secondary market is potentially a range of factors, these can be any number of the following:

- Movement in the Spot Price of the underlying index

- Volatility of that index

- Interest rates

- Dividend futures curve

- Credit risk of the issuer

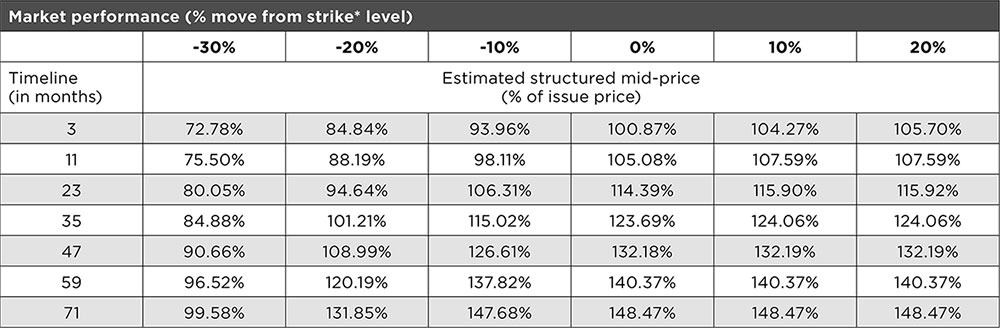

Generally though, for retail and institutional investors, these are fairly easy to model. So when a professional client buys one, they should be aware of these potential movements (which can be both positive and negative) and how they would affect the price in most markets, so investors fully understand what they are buying. An example of such modelling for a FTSE 100 Defensive Autocall can be seen in the table below:

An example of a forward looking scenario analysis

Source: Catley Lakeman Securities. Please note: Assumes credit, interest rate and implied volatility curves remain unchanged. Path dependence – assumes structure has not previously autocalled and that no coupons have previously been paid. This table therefore gives a conservative approximation of the sum of paid coupons and the price of the investment assuming it has not called at each point. *Scenario analysis performed as of 14/12/2018 strike.

Here, the table shows the market performance at different points, and a timeline of an investment, and what the security would be valued at those points.

How could structured products be used practically in a client’s portfolio?

Andrej: The strength of a structured product lies in its flexibility and tailored investment approach. In their simplest form, structured products offer investors full or partial capital protection while tracking an equity or index linked performance with a variable degree of leverage. They are commonly used as a portfolio enhancement tool to increase returns while limiting the risk of loss of capital.

About the experts

Russell Catley, CEO, Catley Lakeman

Russell Catley, CEO, Catley Lakeman

Russell was previously head of UK & Ireland retail equity derivatives at Citigroup, joining in early 2004.

Prior to joining Citigroup, Russell was director of retail sales at AXA Investment Managers, with responsibility for the sales of proprietary retail investment funds, multimanager and alternative investment products from AXA Group companies and Alliance Capital Management. Russell's appointment with AXA in 1999 was preceded by one year in institutional asset management and 11 years in pensions and investment consultancy.

Andrej Ogorevc, head of structured products, Old Mutual Wealth

Andrej Ogorevc, head of structured products, Old Mutual Wealth

Andrej has worked at Old Mutual Wealth since June 2014, when he joined as part of the structured solutions team, and subsequently took on the role as head of structured products in December 2016.

Before joining Old Mutual Wealth, he held various roles at Lloyds Banking Group, including as a consultant for the interest rate derivatives sales review and worked at Chenavari Financial Advisors where helped deliver cross-asset structured solutions for private banks and asset managers across Europe and the UK.

Prior to this, he joined TFS Derivatives in 2007 and worked across a number of areas including structuring, pricing, equity, commodity, FX and fixed income linked derivatives.

While they could be thought of as risky investments, their flexibility allows them to be used as investments from the whole risk spectrum, ranging from 100% capital protected products to high-risk high-return products, which have full market exposure and limited to no capital protection.

Another great feature of structured products is the ability to tailor them to meet specific client objectives. A client can achieve capital protection, diversification, yield enhancement, regular income generation, tax efficiency, and access to non-traditional asset classes such as volatility, all through a single product.

What is an income paying product? Andrej: Income paying structured products are market-linked investments that are designed to pay an enhanced predefined level of income well above the risk-free rate and ahead of inflation.

Many investors who are looking for a regular income may see dividend yields as attractive but are not comfortable with the equity risk. Fixed income securities such as gilts, on the other hand, may offer less risk on the capital but the income is too low.

The alternative solution is a structured product that can provide an income stream, which exceeds fixed income securities (eg gilts), while protecting the capital provided so that the underlying asset does not drop below the predefined barrier. A reverse convertible or autocallable product appropriately structured can outperform an equity investment or a balanced portfolio in many market scenarios, for both retail and institutional investors.

What are the pros and cons of structured products versus annuities, zeros and gilts to stabilise a portfolio alone?Andrej: I believe that the traditional portfolio construction of varying the mix of equity and fixed income exposure to stabilise a portfolio has for the most part been ineffective since 2012 due to market conditions, and it won’t work at current levels of interest rates.

Bonds and other fixed income instruments such as annuities do not provide the diversification benefits when interest rates cannot offset falling equity prices or to dampen down the volatility of the portfolio. If yields increase in the future, bonds will create a drag on the portfolio performance while being unable to reduce the risk of a portfolio. For example, BBB+ rated bond maturing in 2031 pays 5.75% per annum and costs 131%. While this translates to a yield to maturity of 2.7% the bond will be pulled to par while the client would need to pay income tax on the coupons.

Structured products allow investors to access the market with a risk/return profile tailored to their market view and their attitude to risk. These products also allow investors to profit from other investment attributes such as volatility and correlation that are not easily accessible via traditional investments and can be useful diversifiers in a portfolio.

As an alternative to a balanced portfolio a financial planner could, for example, select a product with 100% capital protection at maturity in six years that offers 135% participation in the FTSE 100 index. With this kind of payoff profile, the client could outperform an index in most scenarios (unless the index finishes at the same level as it started). The product could offer leveraged equity exposure if the market goes up while limiting risk on the downside with 100% capital protection at maturity.

Are structured products regulated?Russell: Products are never regulated in themselves. Everyone involved in the process of issuing structured products (the bank and any broker for example) is regulated. The conduct of each party is regulated by the FCA (in respect of UK issuance), the marketing of such products is regulated under the

Financial Services and Markets Act of 2000.