In his March 2014 Budget speech, then Chancellor of the Exchequer George Osborne announced the government’s intention to allow peer-to-peer loans (P2P) to qualify as individual savings account (ISA) investments. P2P lending was a small but fast-growing market at the time, with only £600m of loans being made in 2013, while almost £60bn was invested into cash and stocks and shares ISAs that year.

The announcement was recognition of the potential for P2P and of its important post-financial crisis role. There was clearly demand for an efficient matchmaking service between credit-starved individual and small business borrowers, and return-starved savers and investors.

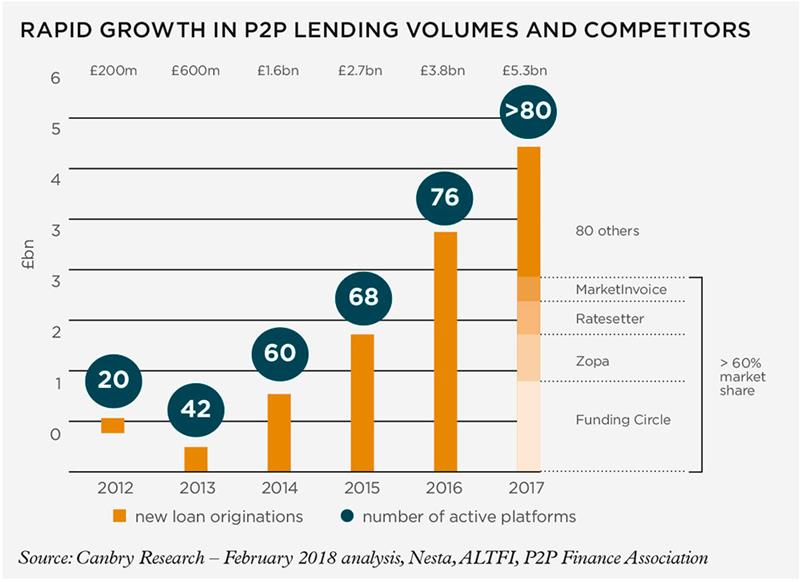

Fast-forward four years and P2P lending is certainly delivering on its growth potential. In 2017, according to AltFi Data, new loan originations reached £5.3bn, almost nine times more than in 2013, and are forecast to reach £7.5bn in 2018.

But it took until April 2016 for the Innovative Finance ISA (IFISA) to come into operation. This provides a mechanism for qualifying platforms to offer P2P investors the added benefit of a tax efficient wrapper. But platforms did not automatically qualify to offer it. They first had to obtain full authorisation from the FCA, having previously operated under interim permissions granted by the Office of Fair Trading.

Authorisation proved to be a slow process and put a handbrake on IFISA investments. Only £17m was invested in the tax year ending April 2017. None of the ‘big four’ platforms (Funding Circle, Zopa, RateSetter and MarketInvoice) – between them commanding more than 60% market share – were fully authorised by that time and fewer than ten of the smaller platforms (all issuing less than £50m of loans per annum at the time) had live IFISA products.

With a spate of regulatory approvals in the second half of 2017 and early 2018, this regulatory handbrake has now largely been released. Of the 80 to 90 platforms in operation, 63 were fully authorised by 22 February 2018, with more than 40 of those registered with HMRC as IFISA managers.

P2P might now be poised to capture a much larger slice of the ISA pie.

The P2P lending landscapeThe sector has attracted over 100 new entrants since the financial crisis and is still growing rapidly. In 2017, new loan originations were nearly 40% above 2016.

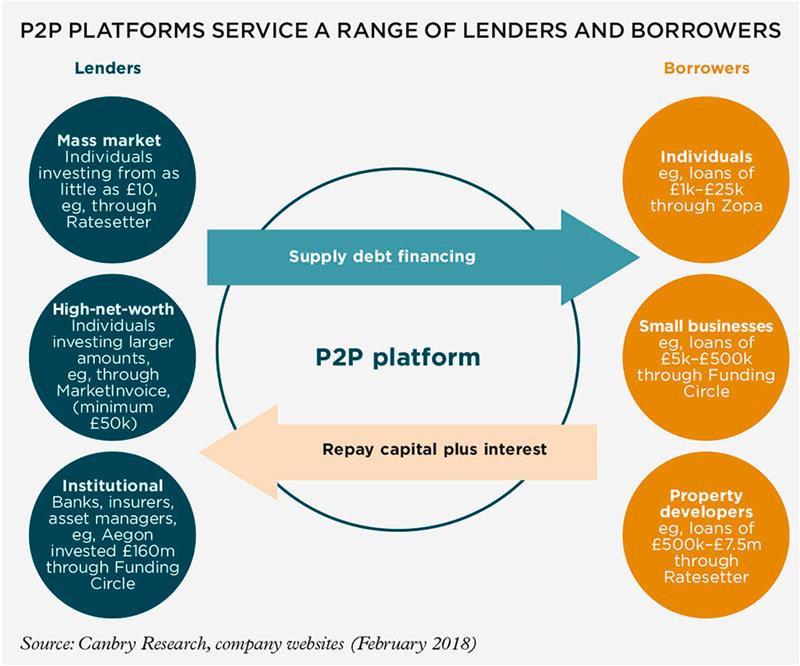

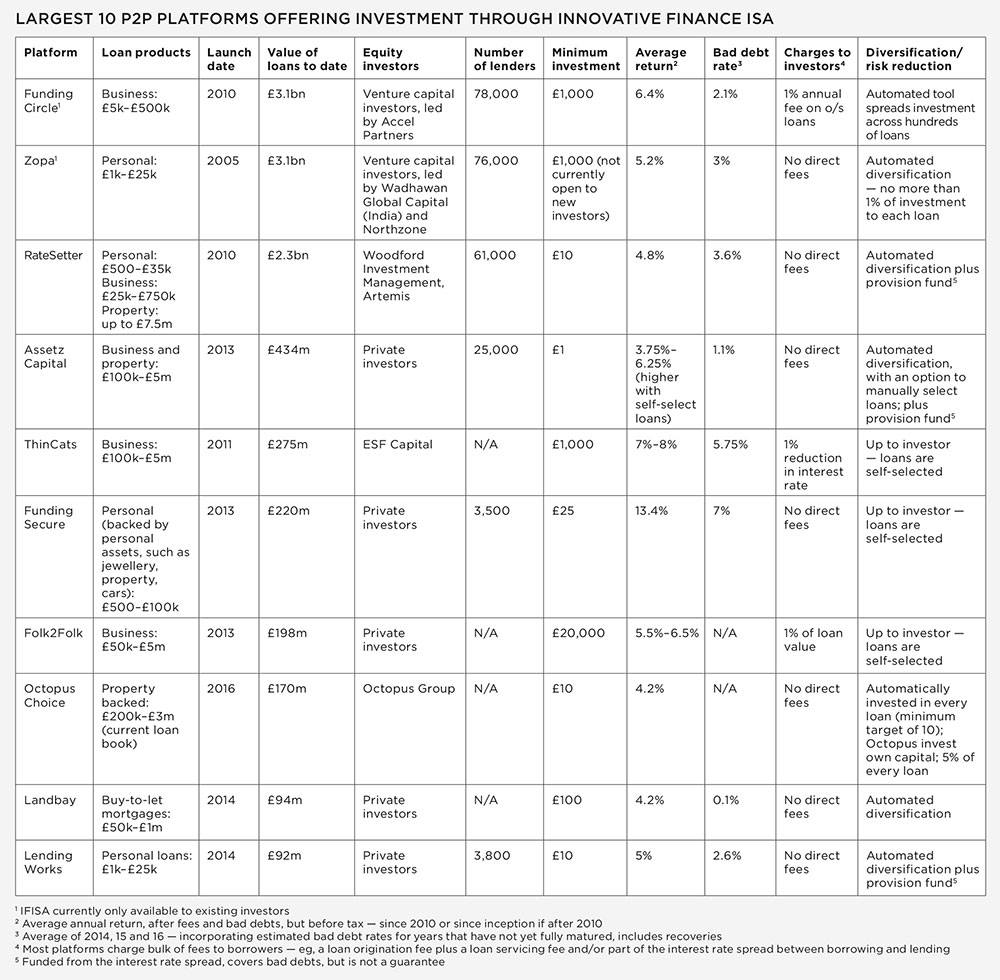

Platforms tend to specialise in certain types of loans. Funding Circle, the largest platform of new loans, (£1.26bn in 2017) provides loans to smaller businesses. Zopa, the second largest (£985m in new loans in 2017) but oldest platform, operating since 2005, provides consumer loans. Others offer invoice financing, property development loans and buy-to-let residential or commercial mortgages.

A more recent development is the emergence of ‘aggregators’, such as Goji, which offers investments across a number of platforms – the P2P equivalent of a fund-of-funds.

The larger platforms in particular rely heavily on technology to source borrowers, lenders and to automate parts of their operations. But algorithms have not taken over.

Borrowers are also sourced through introducers such as loan brokers. Funding Circle still has human account managers and credit assessment teams. Credit committees are common, particularly for higher value business or property loans.

Retail investors are sourced mostly through platform websites but increasingly through financial advisers as well. And contrary to the name of the sector, many platforms also source lending capital from institutional investors.

Attracting investors appears to be easier than attracting quality borrowers, especially in the consumer loan segment. Zopa being closed to new investors for much of 2017 and into 2018 is evidence of this. In 2017, CEO Jaidev Janardana said that this was due to the high volume of investor demand, particularly after the introduction of the IFISA, and Zopa not being prepared to relax credit standards on the borrowing side to boost loan availability.

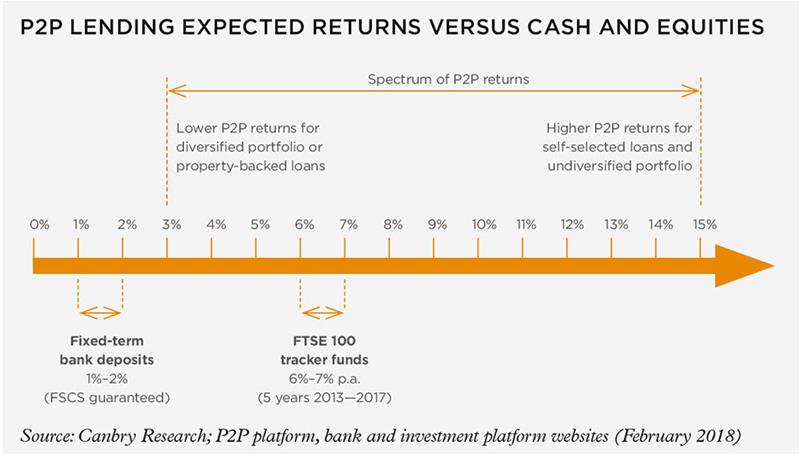

Weighing up the investment propositionThe main attractions of investing in P2P lending have been the higher rates of return when compared to cash (albeit with additional risks such as foregoing Financial Services Compensation Scheme protection); and that returns are in the main uncorrelated to equities or bonds, making it a valuable tool to increase portfolio diversification. Now, with the recent introduction of the IFISA, the additional benefit of tax-free returns becomes available.

But the diversity of P2P products makes it impossible to compare the sector as a whole to other asset classes. Comparisons need to be made at individual platform and product level.

Investment options can range from a diversified portfolio of property-backed loans offering a 4% return (for example, through Octopus Choice) to self-selecting individual consumer loans that return 15% (such as through FundingSecure).

Many platforms do not charge explicit fees to investors (see table). They typically charge borrowers an up-front loan origination fee plus an ongoing loan servicing fee and also benefit from the interest rate spread between borrowing and lending.

Liquidity also varies greatly between platforms. It is dependent upon how the underlying P2P loans are structured and not the fact that investment is made through an ISA wrapper.

Typically, a P2P investment is not an investment into a formal fund. It is money deposited with a platform that is then used to lend directly to borrowers. On some platforms, investors can choose loans themselves while on others, the platform automatically spreads the investment across a portfolio of loans.

Once a loan is made, investors will not have access to any outstanding loan balance, but they will have access to their interest and capital repayments as borrowers repay. These repayments can be withdrawn or reinvested immediately into new loans to compound returns. So withdrawing the full value of a P2P investment will take as long as the duration of the longest loan.

An exception to this is that some platforms offer a secondary market for loans, where investors can sell their outstanding loans to other investors and withdraw their full investment. This can attract a fee – Zopa charges 1%; Funding Circle does not charge – and is also dependent on a willing buyer being available. A sale is not guaranteed.

A disadvantage for investors is that P2P investments are not covered by the FSCS

Some platforms also offer higher returns for not withdrawing funds for a fixed term. RateSetter currently pays 2.7% for its ‘rolling portfolio’ where investors can withdraw interest and capital repayments as they are received. But if an investor commits to not withdraw funds for a year, RateSetter pays 3.9%.

A disadvantage for investors is that P2P investments – whether held in an ISA wrapper or not – are not covered by the Financial Services Compensation Scheme (FSCS). So, unlike a cash ISA with a bank that enjoys an £85,000 ‘government guarantee’, the capital invested into an IFISA is at risk.

The primary risk is borrowers defaulting on loan repayments. Diversifying investments across many loans and choosing platforms with rigorous underwriting processes can reduce this. Funding Circle and Zopa are examples of platforms with products that automatically spread investments across a minimum of 100 loans.

The other risk is losses due to the platform itself failing. But regulation has been structured to minimise losses in the event of this happening. Deposits not yet lent out have to be held in a segregated bank account, complying with FCA’s

Client Asset Sourcebook rules. And platforms also need ‘resolution plans’ that spell out how loan repayments will be collected and passed on to investors after a failure.

Credibility is building, but questions remainSome platforms have now built multi-year track records of stable returns. Most have also navigated a rigorous regulatory approval process.

But the resilience of returns has not been tested through a severe economic downturn or recession. And even though some have high-profile backers – for example, Woodford Investment Management is an equity investor in RateSetter – doubts remain about platforms’ ability to run profitably. The latest financial statements of the vast majority of platforms, including the largest showed losses, some heavy.

The sector has taken major strides to become a mainstream asset class, but the job is not done.

This article was first published in the Q2 2018 print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.