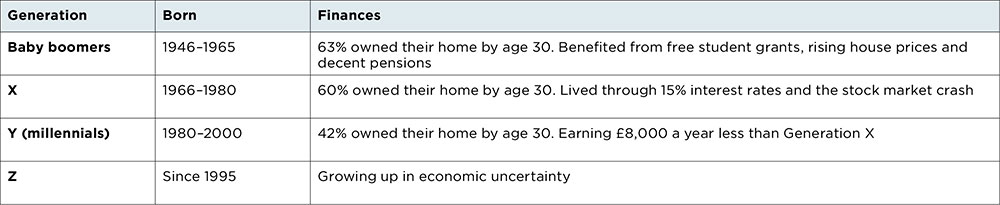

Today’s young people could be the first generation to be worse off than their parents. A combination of debt, unemployment, demographics and rising house prices have depressed the financial prospects of millennials, also known as ‘Generation Y’ (see Table 1).

Table 1: Definitions of generations X, Y and Z (as defined by The Resolution Foundation)

Research from the Resolution Foundation finds that, taking inflation into account, today’s under-35s earn £8,000 less in their 20s than Generation X workers, born between 1966 and 1980.

So, against this backdrop of generational inequality, how can millennials, and their parents, save for their future?

Tax-free savings

A popular way is to save money in an individual savings account (ISA). The big attraction of ISAs is that returns are paid tax-free. According to HMRC, about £518bn is currently held in adult ISAs, with 52% of holdings in cash and 48% in equities.

Former Chancellor Nigel Lawson first introduced the concept of tax-free savings in 1987. He launched personal equity plans (PEPs) to encourage greater equities ownership. Initially, savers could save a maximum of £2,400 in a PEP each year.

When Gordon Brown was chancellor, he replaced PEPs and tax exempt special savings accounts (TESSAs) with ISAs in 1999, while Junior ISAs were introduced in 2011. Both allow cash savings, as well as shares, to benefit from tax-free returns.

Help to Buy ISAs launched in December 2015 while Lifetime ISAs (LISAs) became available in April 2017.

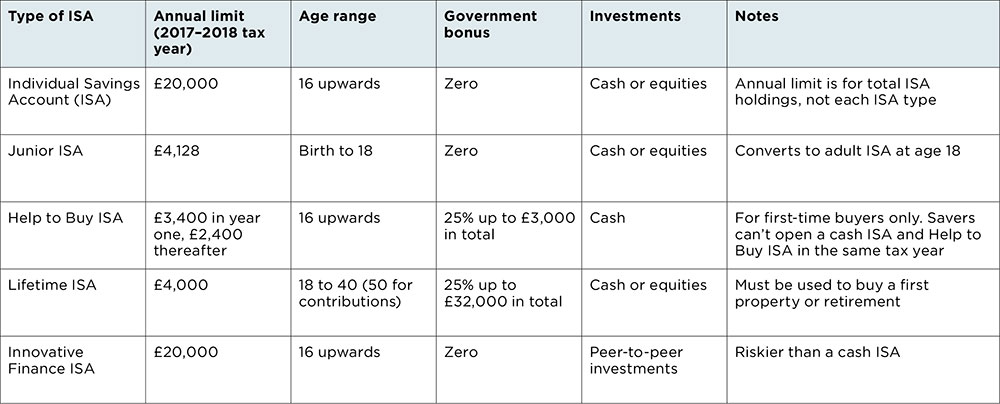

The ISA limit has risen considerably over the years. The current adult annual allowance is £20,000. This allowance can be spread between the different types of ISA (see Table 2) and can be taken out and reinvested in the same tax year.

Table 2: Types of ISA

But although ISAs are much more flexible these days, they won’t necessarily be the best option for everyone. The new personal savings allowance (PSA) and dividend allowance came into effect on 6 April 2016. The PSA means that basic rate taxpayers can earn up to £1,000 interest a year before they start to pay tax on it, and higher rate taxpayers £500. The dividend allowance is £5,000 per tax year.

“ISAs have become more complex in recent times as a result of the Junior ISA, new Lifetime ISA, and personal savings and dividend tax allowances,” says Martin Bamford CFP

TM Chartered MCSI, a wealth manager at Informed Choice. “Financial planners are well placed to help Generation Y and their parents navigate these complexities by understanding their wider financial plans.”

Junior ISAs

One way that parents can help their children secure a more stable financial future is to invest in a Junior ISA. Parents can open one Junior ISA per child and save up to £4,128 each year for each child. The account is converted into an adult ISA when the child reaches 18 and the child then has full control over the money.

According to Alliance Trust Savings, parents investing in a Junior ISA for a newborn baby could help him or her become a millionaire by their early 40s. Its calculations found that by contributing the current maximum allowance into a Junior ISA from birth, continuing to pay the maximum into adult ISAs, and benefiting from 5% annual growth, the investment pot could be worth more than £1m by the time the child is 43.

You could still reach the £1m mark even if you started saving later in life.

The Telegraph newspaper calculates that an individual saving the full ISA allowance at the start of each tax year, and enjoying 7% annual growth, would become an ISA millionaire in 19 years, while someone able to save £10,000 a year would make the grade in just under 31 years.

Becoming an ISA millionaire is not beyond the bounds of possibility. In April, Hargreaves Lansdown reported 91 such clients on its books, up from just 26 a year ago, and Barclays Stockbrokers said it had 154 ISA millionaires, up 83 on the year. Both money managers put the rise down to the FTSE 100 rally following the UK’s vote to leave the EU.

But the trend for ISA millionaires started long before the EU referendum. Liberal Democrat peer Lord Lee of Trafford is thought to be Britain’s first ISA millionaire. He became a DIY investor when PEPs were first introduced in 1987, and his ISA was valued at £1m just 16 years later. Lord Lee’s investing habits are common among ISA millionaires: patient investing in conservative stocks and dividend reinvestment. In 2015,

The Telegraph reported that Britain had 200 ISA millionaires and estimates that that number will reach 2,000 by 2020.

But for young people without wealthy parents who can gift them their full ISA allowance every year, generational inequality means becoming an ISA millionaire is highly unlikely. However, there is help on its way for those buying their first home or saving for retirement.

Lifetime ISAs

Lifetime ISAs (LISAs), launched in April 2017, are available to savers between the ages of 18 and 40. Contributions can be made up to the age of 50.

The LISA has a £4,000 annual limit and the government will add a 25% bonus, up to a maximum of £1,000, each year – the same amount for basic and higher rate taxpayers. The money can be invested in either a cash LISA or a stocks and shares LISA. It is possible to hold more than one LISA at a time but savers cannot open and pay into more than one LISA in the same tax year.

Those who make full contributions from 18 to 50 will accumulate a pot of £160,000, inclusive of the bonus, plus interest or growth in the savings. To qualify for the government bonus, savers must either use the money to buy their first property or wait until they’re 60 to access the money. In the 2017–2018 tax year, the bonus will be added at the end of the year and in subsequent years it will be added monthly.

However, pensions experts have criticised the LISA concept. Steve Webb, former pensions minister and currently director of policy at Royal London, has described it as a “horrible hybrid” of an ISA and pension and says that the new account complicates the savings market.

“Young people who invest in a pension can take a long-term perspective and benefit from investing in higher risk assets,” he says, “But there is a real danger that those who take out a LISA will invest in cash, perhaps for a decade or more. A combination of low interest rates and rising inflation could make this a very poor savings strategy.”

Four out of five of the 12.65 million ISAs subscribed to in 2015–2016 were into cash.

Innovative Finance ISAs

Those looking for higher returns than cash can offer might want to consider an Innovative Finance ISA (IFISA). Introduced in April 2016, IFISAs allow savers to use some or all of their annual ISA allowance to invest in the growing peer-to-peer (P2P) lending market, which saw lending volumes grow by two-thirds in 2016 to reach more than £7bn for the first time. Interest and capital gains received via IFISAs are tax free.

Savers tend to get higher interest rates and borrowers more reasonable rates than they might at a high street bank because you are effectively cutting out that intermediary. Crowd2Fund, one of the few FCA-authorised IFISA providers, advertises an 8.7% rate on its

home page.

FCA authorisation allows savers to complain to the Financial Ombudsman Service should something go wrong but IFISAs still carry more risk than other ISA products. P2P investments are not protected by the Financial Services Compensation Scheme (FSCS), which guarantees savers their first £75,000, or £150,000 for joint account holders, should a financial institution go bust.

£518bn

The amount currently held in adult ISAs, according to HMRC

Instead, P2P lenders limit the risk of a saver losing all of their investment by spreading those funds across multiple borrowers to limit the impact of potential defaults. P2P lenders also often have compensation arrangements of their own. That said, without FSCS protection, savers could lose some or all of their investment should the worst happen.

Despite the risks, IFISAs might appeal to millennial investors because they can see their money making a difference to a real company or individual, rather than going to what they might see as a faceless bank.

Cutting through the confusion

Given the range of savings products on offer, it’s possible that many millennials are confused about whether an ISA or pension is the best product for them. Generally speaking, any young person saving to buy a home would be well advised to make use of the government bonuses offered by Help to Buy and Lifetime ISAs. Those saving for retirement, meanwhile, should take advantage of tax breaks offered by pensions.

Danny Cox CFP

TM Chartered MCSI of Hargreaves Lansdown says that financial planners can help people understand their savings objectives and the amount of risk they need to take.

“Once these are decided, the selection of the right wrapper will be fairly straightforward. For example, if the primary objective is a house purchase, a Lifetime ISA will work better than a standard adult ISA. Importantly, the adviser can ensure the investor has other bases covered, such as the need for protection and the joining of a workplace pension,” he says.