Take the Bond Essentials Professional Refresher to earn 30 mins CPD

Central banks around the world are raising interest rates and more people are looking for where they can make their money grow. Our introductory module explains key points about bonds.

What is a bond?

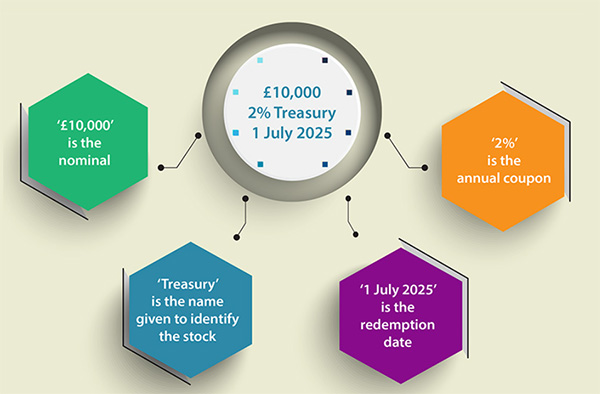

It is a loan that is effectively an ‘IOU’ from the bond issuer with key information for the bondholder/investor. This includes:

- nominal value, also known as the issuing price – the amount the bond is sold for

- redemption date (also known as the maturity date or repayment date) – when the bond issuer will pay the bondholder back

- coupon – the interest rate applied to the nominal value

- name – the pot that the loan is going towards.

Who issues bonds?

There are two main groups that will typically do this to raise money through IOUs: governments (or government agencies) and companies. Issuing bonds is an easy and cost-effective option for a government that may want to invest in local services and infrastructure but doesn’t have the funds to do so. Some popular bonds include UK government gilt-edged securities, US Treasury Bonds, and Japanese Government Bonds.

A private company that wants to expand and needs money to buy more resources may issue corporate bonds.

There are bonds that are traded for different reasons with distinct features between each of them. For example, three types of corporate bonds are domestic bonds, foreign bonds, and eurobonds. There are also call provisions that come with some corporate bonds which give the issuer rights to ‘call’ or buy the IOU back before the maturity date, usually at a slightly higher price (par value plus one coupon payment). This is known as a callable bond and can benefit the bond issuer if market rates fall as it can then reissue the bonds at lower interest rates. You can also get bond exchange-traded funds – which are growing rapidly – where you can invest in a basket of fixed-income securities, long-term or short-term, government or corporate.

How do they work?

Bonds can be sold in units. For instance, a company may want to raise £20,000, so it decides to sell four units at £5,000. As a bondholder, you also have the option to trade the bond, meaning you can sell it independently.

The trading value of a bond is susceptible to movements in interest rates in the financial market. For example, it can increase or decrease depending on changes that will have occurred since the issue date. This affects the return investors can expect and is known as the yield, which is calculated by dividing the annual coupon by the nominal price paid. There are different kinds of yield you can calculate on your bond like the flat yield, the current yield, and the gross redemption yield.

To illustrate how bonds are affected by interest rates, the module takes you through an example animated scenario, in which an investor purchases a bond worth £10,000 with a set repayment date of six years’ time and a coupon of 7% per year (£700 per annum). The investor decides they want to sell the bond at the same nominal value two years later. During this time interest rates have risen, meaning that the coupon value of the bond will be lower, which deters other investors. As a result, the bondholder drops the nominal value to £9,950 which attracts a purchaser who eventually will make a profit of £50 on the bond as they are guaranteed to receive the full £10,000 when the bond is repaid on the redemption date.

What should you consider?

There are several risks that could affect the return on your investment as a bondholder. These can come from the bond issuer or the financial market. For example, there is a possibility that the bond issuer may redeem their bond early because of a drop in interest rates. This means that the issuer could then sell the bond for less and pay a lower coupon price. Issuers could also fail to pay what they owe, which is known as ‘default risk’ or ‘credit risk’.

Credit risk on bonds is measured by credit rating agencies, of which the module lists the top three: Fitch Ratings, Moody’s, and S&P. These are companies that can “measure and report on the degree of solvency and the likelihood of default”.

Bonds are a long-term investment option that provide a predictable income with a set repayment date. While there are pros and cons, like with many investment options, they continue to form a part of investment portfolios globally.