Although the UK isn’t signed up to the EU’s

Sustainable Finance Disclosure Regulation (SFDR), about two-thirds of UK-domiciled fund assets (calculated as registered for sale in the UK, reporting currency GBP) have so far been registered, either as Article 6, 8, or 9: non-ESG, ‘light green’, or ‘dark green’, respectively.

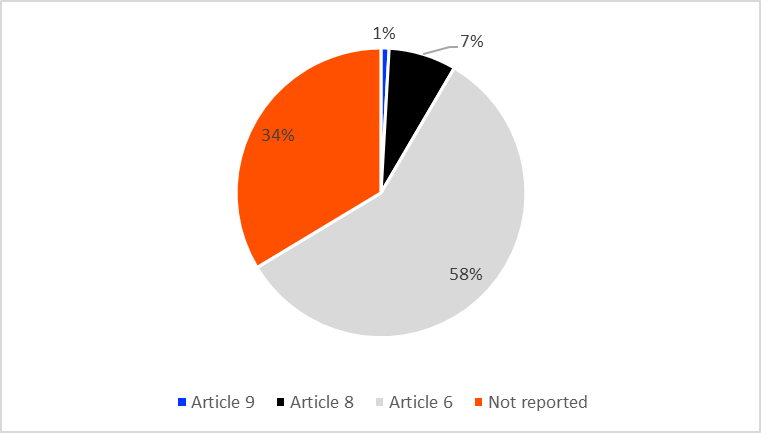

Chart 1: UK Funds by SFDR classification (AUM,%)

Source: Refinitiv Lipper

That amounts to 62.5% of assets flagged by Refinitiv Lipper as ethical, and 8.4% of total UK assets. Some £19.2bn of total assets are registered as Article 9, with £162.7bn for Article 8. The majority (£1,247.5bn) of funds have been registered as Article 6. The remaining 34% (£724.3bn) have not reported (Chart 1).

European comparisons

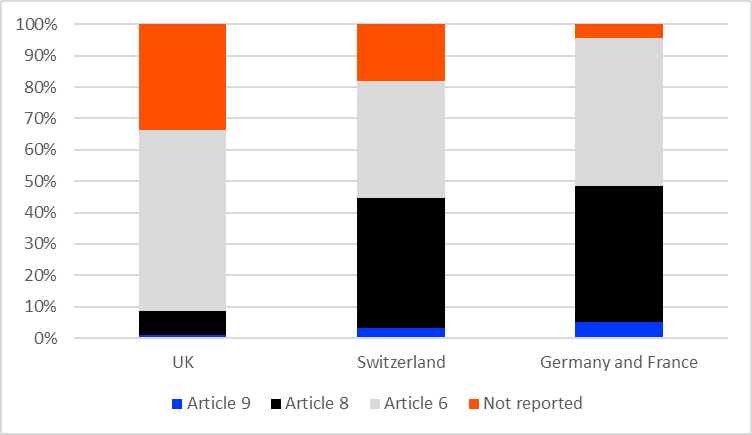

We get a sense of the relative degree to which the UK has engaged with SFDR by comparing it with France and Germany combined, as well as Switzerland (Chart 2). The latter is a useful comparator, as, like the UK, it’s an important European financial centre outside the EU.

Chart 2: UK, Swiss, and German/French SFDR designation, AUM (%)

Source: Refinitiv Lipper

By AUM, 8.4% of UK funds are either Article 8 or 9, compared to 44.7% for Switzerland and 49.9% for Germany and France. What’s surprising is not just the lower level of participation not only with respect to EU members, but also relative to Switzerland; it’s that even when those funds that have not reported are excluded, the proportion of Article 8 and 9 funds to total reporting funds (Articles 6, 8 and 9) is still much lower than for Switzerland, and France and Germany: 12.7% for the UK compared to 54.6% and 51.4%, respectively. That suggests that, while ethical fund uptake is becoming increasingly important in the UK, the country lags its European peers.

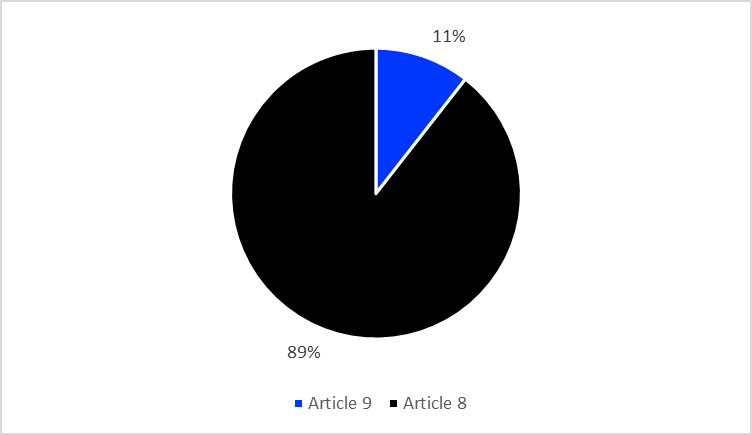

Chart 3: UK Assets Under Management, Articles 8 & 9 only (%)

Source: Refinitiv Lipper

In the UK, 11% of so-called green funds are Article 9 (Chart 3). That compares to 6% for France and Germany. In terms of total assets, 0.89% of UK assets are Article 9, with that percentage being 3% for France and Germany. So, while there’s a relative weighting to ‘dark green’ in the UK relative to other sustainable funds, ESG uptake – whether through SFDR or more broadly – is lower in the UK than with continental peers.

UK ‘green’ assets by classification

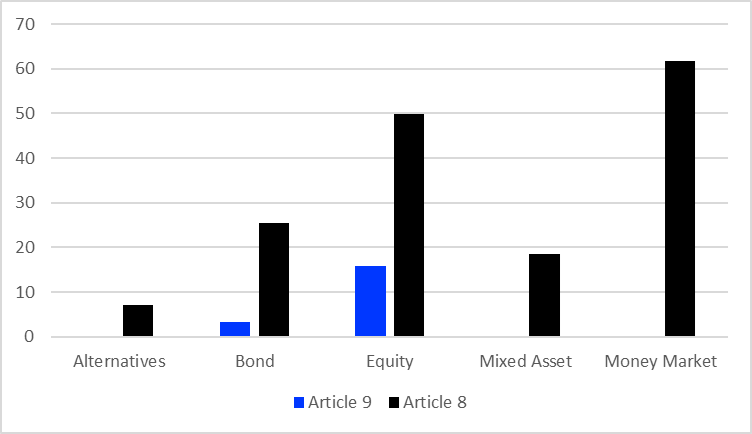

Chart 4: Article 8 & 9 AUM by asset class (£bn)

Source: Refinitiv Lipper

Equities comprise the greatest number of assets (£65.7bn), followed by money market (£61.8bn), bond (£28.7bn), mixed asset (£18.5), and alternatives (£7bn). Equity vehicles have attracted the bulk of Article 9 assets (£15.8bn), followed by bonds (£3.3bn). While UK real estate ethical AUM is £22.6bn, only £128m is SFDR registered, all of which is Article 9. It’s something of an anomaly, because UK real estate tends to have broader appeal, because of the way property law is tilted more strongly in favour of the owner in the UK when compared to other European countries.

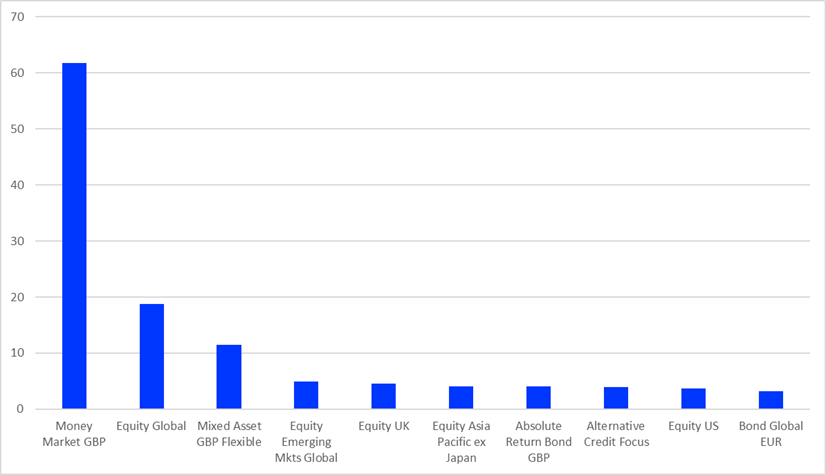

Chart 5: Top Article 8 Lipper global classifications (£bn)

Source: Refinitiv Lipper

Taking a more granular look at where the green money has gone, using our Lipper global classifications you can see the huge effect that the designation of more than £60bn of money market funds as Article 9 has had. The next largest classification is Equity Global, at £18.8bn, then Mixed Asset GBP Flexible at £11.4bn.

When it comes to flows, rather than stock, a rather interesting picture emerges, as investors are using the shift to green assets to move out of non-ESG equity assets across various geographies and into ESG global equity funds – a significant trend over the past couple of years. So, it’s not just that investors are swapping brown assets for green, like-for-like, but that this shift to sustainability is going hand-in-hand with a shifting asset class allocation.

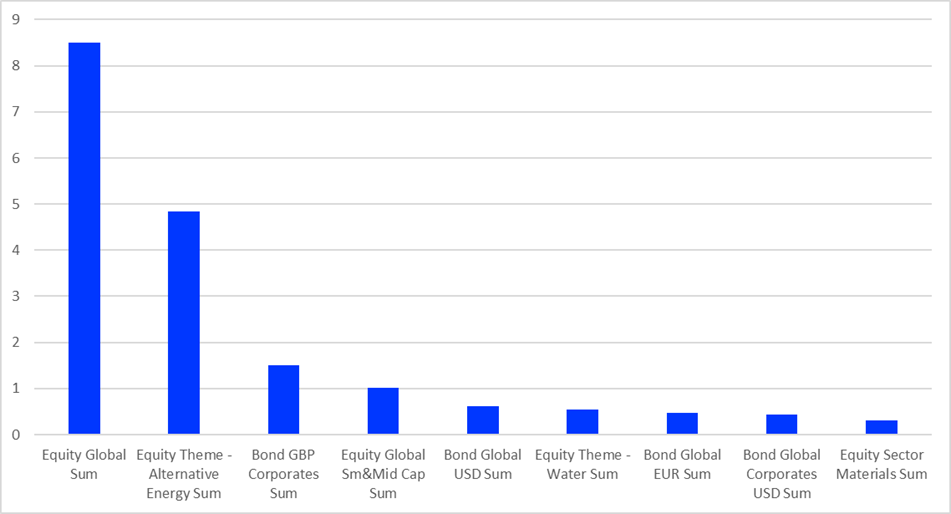

Chart 6: Top Article 9 Lipper global classifications (£bn)

Source: Refinitiv Lipper

In line with other countries, UK Article 9 assets are much lower than Article 8 – unsurprising, given their more stringent requirements. There are no Article 9 money market funds, so here Equity Global muscles its way into first place (£8.5bn), followed by Alternative Energy (£4.8bn), despite the large market correction in the early part of last year that provoked gnawing fears that an ESG bubble may have developed.

One noteworthy aspect of this chart in comparison to the previous (Article 8) is the greater prevalence of bond classifications in the line-up, as ESG activist investors increasingly look to debt as a way of linking capital to quantifiable sustainability outcomes.

Dominant fund managers

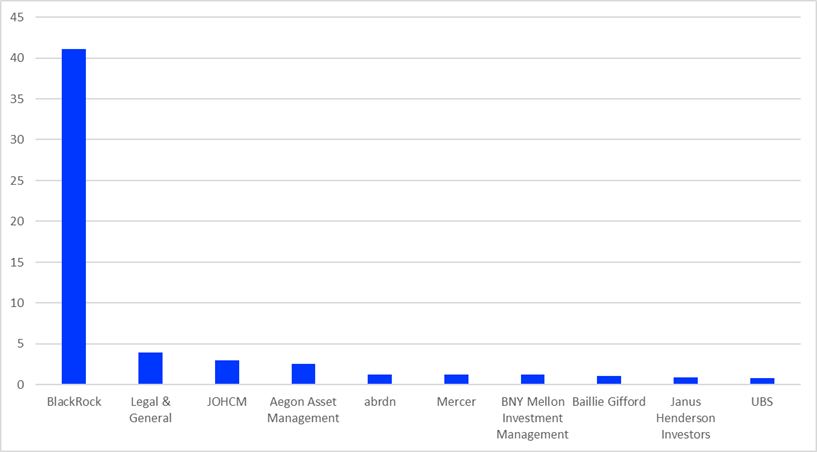

Chart 7: Largest UK Article 8 promoters (£bn)

Source: Refinitiv Lipper

BlackRock dominates Article 8 assets, with £41.1bn, followed by Legal & General (£3.9bn) and HO Hambro Capital Management (£2.9bn) (Chart 3).

Article 8 fund manager rankings are subject to a fair amount of volatility, as money market assets, which make up a large proportion of these funds, are the most short term, and when we looked at this in October, both net assets and rankings looked rather different at the top end of the table – with the exception of BlackRock, which has a commanding lead, especially in the equity space.

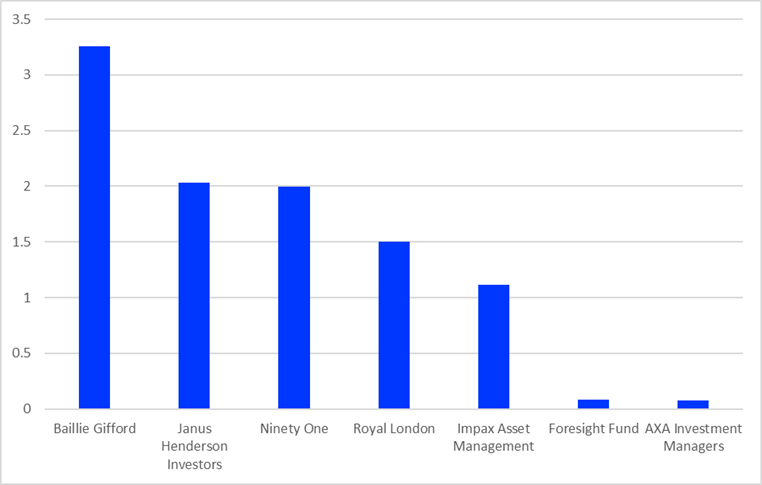

Chart 8: Largest UK Article 9 promoters (£bn)

Source: Refinitiv Lipper

The line-up of top Article 9 providers looks very different, with Baillie Gifford leading with £3.3bn, followed by Janus Henderson (£2bn) and Ninety One (£2bn). Equities dwarf all other Article 9 allocations, and it’s no surprise that this is reflected in the dominant equity funds that are making the running with these managers.

Users of Lipper for investment management can now identify whether funds are categorised as Article 6, 8, 9, or not reported, filtering by domicile, asset class, promoter, fund category, and many other criteria.

Views expressed in this article are those of the author alone and do not necessarily represent the views of the CISI.