Clockwise from top left: Tyler Cameron-St Luce, Giulia Laghezza; Sumaya Regal; Billy Zi Rong Huang; Jakaria Uddin

While diversity is firmly on the boardroom agenda for many in the financial services sector, this has not translated to representation at C-suite level, according to an October 2020 Racial equity in financial services report by McKinsey. It says that, in the US, at the entry level of financial services firms, the proportion of people of colour is roughly around 40%, but this share figure "falls steadily along the corporate pipeline until, by the C-suite, it has dropped by 75%". At C-suite level, the report finds the share is just 3% for black people, 2% for Hispanic and Latinx, 6% for Asian and 0% for Native Hawaiian, Pacific Islanders and mixed-race people.

What barriers are there to a diverse and inclusive financial sector, and what can be done about it?

We spoke with two separate groups of young people over two roundtable sessions – students in their first year of university and sixth-formers – about what they want to see in terms of diversity in financial services and how to achieve greater diversity and inclusion. The student group is made up of people aged 17 to 20 from The Brokerage, a social mobility charity that works with young people and employers to help drive positive change in the workforce.

The second group comprises sixth-form students, aged 16 to 18, from City of London Corporation sponsored schools, who are in the process of completing a two-year programme covering the CISI level 2 qualification in Fundamentals of Financial Services.

The benefits of a diverse workforce

Two clear themes emerged over the two discussions: Widening scope through different perspectives, and the business case for diversity

One of The Brokerage ‘ambassadors’ (who act as the student voice and represent The Brokerage when required), Billy Zi Rong Huang, who works on a podcast with six others, all from different backgrounds, says that his diverse podcast group helps to generate different ideas. Jakaria Uddin, a candidate (someone who has selected to access the programmes such as work experience, internships, mentoring and skills sharing through the charity) from The Brokerage, agrees, saying that fintech, for example, can include a collaboration of perspectives whereby finance and technology "come together for a common goal". He says that more people should be encouraged to enter the financial services sector through a variety of routes. "You don't have to have a finance-related degree, you could enter from any sector and share a different perspective," he says.

From the CISI roundtable, held as part of a class taught by Matt Bolton, CISI teaching and lesson specialist, student Madeleine Pedder says that diversity in the workplace is important so that people don't get "caught in an echo chamber or an information bubble", where only one point of view is considered and perpetuated.

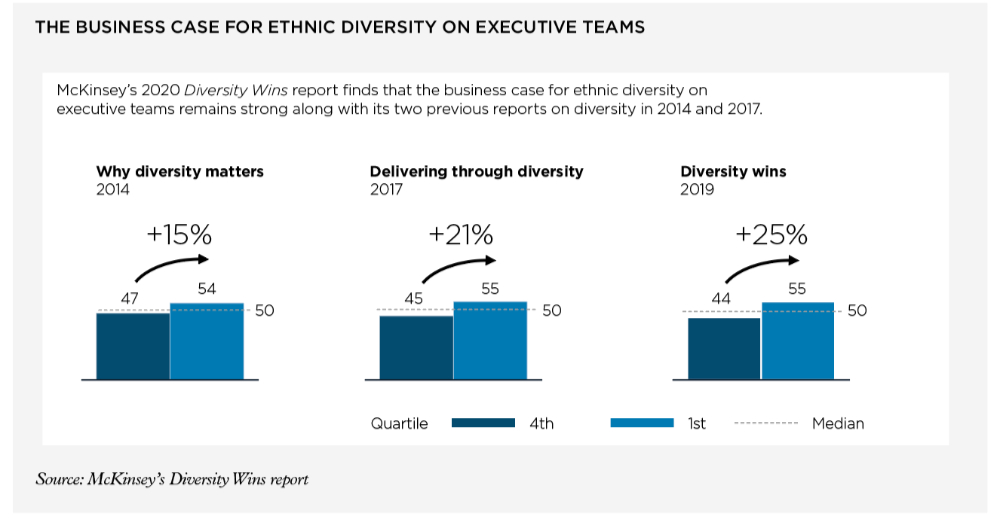

There is a business case to be made for diversity, too, according to Sumaya Regal, a candidate from The Brokerage who says that companies that are more diverse are likely to be more profitable. The preface to McKinsey's May 2020 report Diversity wins: how inclusion matters, explains how diversity and inclusion are a "powerful enabler of business performance", and that "companies whose leaders welcome diverse talents and include multiple perspectives are likely to emerge from the [Covid-19] crisis stronger". The report draws on company surveys, case studies, and interviews, from 1,000 large companies covering a range of sectors, including finance and insurance, in 15 countries. Its 2019 analysis finds that companies in the top quartile for ethnic and cultural diversity outperformed those in the fourth quartile by 36%.

Future actions for the sector

When the two groups were asked "what would you like to see happen in terms of diversity in financial services workplaces?" there were several ideas suggested.

Sumaya from The Brokerage would like to see more discussion around topics that matter to racially diverse groups. She said that "a lot of companies shy away" from discussing racial issues that are deemed 'too political'. Giulia Laghezza from the CISI class agrees and says that they have open discussions about these types of topics at school, and this should be extended into the workplace. Fathiat Raheem from the CISI class adds that "we need people that are not afraid to show that they are allies".

However, authenticity is important. "I think sometimes companies piggyback on these [diversity initiatives] to boost their own reputation or sales, for example having special Pride month products to increase revenue," says Matilda Aldridge from the CISI class. The class agrees that support should be ongoing.

Recruitment and merit

Improving recruitment processes is a big theme for both of the groups, who want to see firms focus more on recruiting talent on merit. Jakaria suggests that in terms of testing competencies at the recruitment stage, often in financial services this could be a numerical, verbal or psychometric test. However, if you want to "widen the recruitment pool", these tests might not be appropriate for everyone. "For example, if you take someone from the humanities stream, they may not necessarily fit into the existing numerical testing. Maybe there should be another option in the process, testing for traits that might be synergistic to the values and the core missions of the business," he says. This could include a test for emotional intelligence.

Jakaria says that "there shouldn't be any pre-existing beliefs regarding certain institutions and universities", and that confirmation bias – defined in our Diversity and Inclusion Professional Refresher module as "favouring certain, selective information to support pre-existing beliefs, theories or biases, combined with a tendency to interpret new evidence as confirmation of these" – should not exist. "Hiring someone or recruiting people as graduates should be irrespective of that," he says.

The introduction of ‘blind’ applications, where information such as name, gender, age and education institution are removed is an area that some financial institutions are looking at, according to a Q4 2018 report by human resources consulting firm Randstad, Diversity and inclusion in financial services. This is something UK Finance, trade association for the UK banking and financial services sector, has implemented. Its website states that this process "helps our hiring teams to evaluate applicants purely on the basis of their skills, competencies and experience".

"For people who don't want to go to university, there's not much opportunity"

Robert Walters, a specialist professional recruitment consultancy, working with businesses in areas such as accountancy, banking, wider financial services and IT, published a whitepaper in 2017, Diversity and inclusion in recruitment. It finds that 45% of employers believe their current recruitment tools are ineffective at helping diverse candidates find their company and 81% of employers recognise that unconscious bias can impact their hiring decisions.

Addressing unconscious bias can be done in a number of ways, the whitepaper suggests. Anti-bias training for managers is used by 36% of firms, while 86% believe this would be effective. Having a wide range of stakeholders assessing CVs is a tool used by 22%, while 68% believe this would be effective. "By having CVs assessed by a wide range of stakeholders across the business, including staff at the same level of seniority as the applicant, employers can ensure that the broadest range of perspectives are gained on the applicant’s suitability," it says.

The paper finds that 17% of firms remove personal information from CVs and 76% believe this would be effective. "Removing certain information from CVs, such as the name and gender of the applicant or the name of the school they attended, can help employers minimise the impact of unconscious bias by forcing hiring managers to focus solely on the applicant’s qualifications and experience," it says.

Tyler Cameron-St Luce from the CISI class would like to see more emphasis on ability. His classmate, Dan Manolache, adds to this and says there should be "more emphasis on how you think, rather than where you come from or how you look".

However, Edna Bannor from The Brokerage says she feels there has been progress in recruitment practices. "I think nepotism used to be more [common]. In finance now, there's lots of testing in the recruitment stage, so you have to go through a lot to get hired, therefore merit is not ignored," she says.

Jakaria adds that for entry-level jobs, employers shouldn’t be setting unreasonable requirements such as 'X number of years' experience, or a book of contacts to enter a firm with, as that will limit the pool even further.

More opportunities for diverse groups

Targeting diverse groups at a younger age could help drive more people into the financial services sector. Billy Zi Rong Huang from The Brokerage suggests that more sector events could be catered towards school leavers, or people in school, or that sector bodies and firms could put on workshops during school holidays to show people what working in financial services is like.

When looking at the job sector in financial services, Billy noticed that his options as a school-leaver were very slim. "For people who don't want to go to university, there's not much opportunity," he says. Sumaya adds: "For some roles, you're required to go to university. There should be more pathways. Some people end up going to university as a transactional activity, not because it's what they want to do or it's the best thing for them to do." Apprenticeships are an alternative pathway for those wanting to enter the financial services sector without a degree. CISI qualifications are available as technical units in nine different financial services apprenticeships, with firms such as BNY Mellon, Rathbones and UBS.

What does it mean to be professional?

Edna and Sumaya believe there could be elements of the workplace, particularly in the financial services sector, that may be unappealing to those from a diverse background.

Edna mentions 'hair politics' – the racial discrimination that pertains to certain hair types that can be deemed to be unprofessional in the workplace. Research by Ashleigh Shelby Rosette, senior associate dean of executive MBA and non-degree programmes at Duke University's Fuqua School of Business in North Carolina; and Christy Zhou Koval, assistant professor of management at Michigan State University, published in the Social psychological and personality science journal, offers evidence of bias against natural black hairstyles (versus straightened) in the recruitment process in the US. The research, conducted via four studies, finds that black women with natural hairstyles "were perceived as less professional and less likely to be interviewed for a job". It says that this is a particularly salient issue in sectors with "strong dress norms".

"There should be an understanding of other people's cultures instead of expecting them to adhere to what's already in place"

Edna and Sumaya believe that the traditional idea of looking professional is outdated. Edna says that if "it's not affecting anyone else, it's not a problem".

Fostering an inclusive workforce

Once there's a diverse workforce in place, how can employers make them feel comfortable and included? Jakaria suggests that international companies could adopt some of the values of where they are located. "Understanding the local culture could strengthen synergies in the office among employees," he says. Sumaya says that respecting the individual cultures of diverse people is easily done. For example, she says, there should be a level of respect with regard to how people dress or the food they eat for lunch. "There should be an understanding of other people's cultures instead of expecting them to adhere to what's already in place," she says.

Both of the groups were in favour of employee surveys to find out how people actually feel about diversity and inclusion. "To avoid cherry-picking within the firm, it may be more beneficial to carry out a firm-wide survey. If there is criticism, action should be taken and followed up," Jakaria says.

Giulia Laghezza from the CISI class says that making people aware of different perspectives at work would help. Even small steps such as "encouraging companies to learn more about different cultures, like celebrating different holidays and festivals, such as Diwali. Not everyone celebrates Christmas," she says.

Speaking to the two groups, it's clear that diversity matters now more than ever, and there is more to promoting diversity than just the hiring process. Hiring diverse talent is not enough. The experience that employees have in a firm will shape their decision as to whether they remain and thrive. Although progress has been made, they say, there is still a long way to go.