The Big Bang transformed UK financial markets, restoring London’s pre-20th century Did you experience the Big Bang in 1986? How has it impacted financial services? Share your thoughts with us by commenting belowrole as the capital of international finance. By ending price-fixing and admitting foreign players, it boosted competition. It also introduced electronic screen-based securities trading, and the financial services sector went on to experience fantastic growth. Yet some believe the changes paved the way for the 2007 financial crisis.

The story began in 1979 when the Office of Fair Trading (OFT) proposed an investigation into the “restrictive practices” of the London Stock Exchange (LSE). This was in line with the new Thatcher Government’s belief in free market principles and its determination to modernise and internationalise the City of London.

Chief among these practices was the system of fixed minimum commissions. Another was the single capacity rule, which drew an unbreachable distinction between stockbrokers and stockjobbers. Brokers were agents who acted for their clients in return for commission, while jobbers acted as principals, making markets, providing liquidity, and making their money from the spread between buying and selling. The separation allowed brokers to put their clients’ interests first at all times, ensuring no conflict of interest.

Both jobber and broker had to be independent and not part of any larger financial organisation. Their partners had to be elected members of the LSE in their personal capacity, with unlimited liability. Foreigners were excluded from LSE membership. If the firm traded as a corporate entity, all directors had to accept unlimited liability, which effectively barred big banks. “The problem was that these restrictions in practice ensured that the stock exchange was woefully under-capitalised,” recalls Nigel Lawson, Chancellor of the Exchequer from 1983 to 1989, writing in

Big Bang 20 years on for the Centre for Policy Studies.

"There was no way in which London could remain a world-class financial centre without a world-class securities business"

He notes that, while the City was a world leader across a whole range of financial markets, such as foreign exchange, in securities it was in danger of becoming a backwater. “There was no way in which London could remain a world-class financial centre without a world-class securities business,” he said. “So the sooner genuine reform came, the better.”

In the end, Trade and Industry Secretary Cecil Parkinson and LSE Chairman Nicholas Goodison agreed that the OFT would back off if the exchange reformed itself. Fixed commissions would be abolished and single capacity would be replaced by dual capacity, allowing jobbers (now market makers) and brokers to coexist under the same roof. These became known as dual capacity firms, and were able to sell shares and bonds to investors, while also trading them as principals. Others also included lending and merchant banking (now investment banking) to create financial supermarkets. “Everyone wanted broking skills,” remembers Senior Adviser to Deutsche Bank, Scott Dobbie FCSI(Hon), who was Chairman of the CISI from 2000 to 2009. “The big banks felt that they had to have jobbing as part of their one-stop shop or they would lose out.”

Going digital

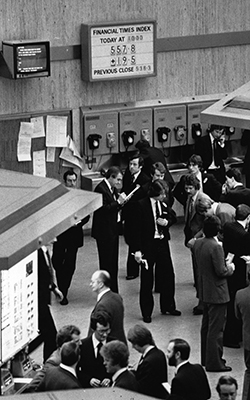

LSE membership was opened to corporates, and individual members were eventually split off into the Securities Institute, which then became the CISI in 1992. The other momentous change that took place, though much faster than the LSE had anticipated, was the wholesale migration of trading from the open outcry trading floor to electronic screens.

LSE membership was opened to corporates, and individual members were eventually split off into the Securities Institute, which then became the CISI in 1992. The other momentous change that took place, though much faster than the LSE had anticipated, was the wholesale migration of trading from the open outcry trading floor to electronic screens.

Rather than being phased in over time, the decision was made to implement all of these reforms on the same day – hence the ‘Big Bang’. The day was 27 October 1986.

This all added up to a giant welcome mat at the City’s front door, and for two years before the big day there was a scramble for firms and talent as heavyweight banks from the US, France, Germany and Japan waved their chequebooks and bought their way in.

When the big day dawned, brokers took an immediate income hit. In those days Dobbie was a partner with brokers Wood Mackenzie, which was bought by Hill Samuel, a UK merchant bank. He reports that the firm’s commission rate effectively halved on day one. “Turnover increased quite a lot, and share valuations went up,” he acknowledges, “so it was not as big a disaster as it might have been.”

The new regime took some getting used to, according to Ian MacDougall, a retired former Extel-rated analyst, who at the time was with brokers W Greenwell (acquired by Midland Bank, now part of HSBC). “There was a lot of confusion,” he remembers. “The vast majority of the broking side had very little understanding or experience of market making.”

Success in the new age required three things, MacDougall says. “You needed the right owner, who was prepared to wear some losses. You needed the right people, because with market making it was suddenly possible to make or lose a lot of money very quickly. And you needed the right technology, because if yours was slower, you got left with all the duff stock.”

"Before the Big Bang, the big thing was to have institutional business. Private clients were very much a sideline"Now that competition had been unleashed, institutional investors were able to drive dealing commissions down to the bone. That made them one of the Big Bang’s winners. Another group of winners was more of a surprise, as the first CISI Chairman Graham Ross Russell (from 1992 to 2000) explains. This was the private client broker (since restyled as wealth manager), whose commissions did not suffer in the same way. “Before the Big Bang, the big thing was to have institutional business,” says Ross Russell, who had been a partner at brokers Laurence Prust. “Private clients were very much a sideline.”

When Laurence Prust was bought by Crédit Commercial de France in 1985 (itself later bought by HSBC), they could have had the private client business for nothing, Ross Russell says. “But they didn’t want it. Eventually, the private side merged with Rathbones and today it’s worth more than the rest of the firm put together.”

Commissions may have gone down since the Big Bang, but floating a company has become considerably more expensive. The costs of an initial public offering as led by an investment bank are many times more than the old-style underwriting costs associated with flotation. “It’s the only time I have ever seen competition and prices go up at the same time," says Sir Alan Yarrow, Chartered FCSI(Hon), current CISI Chairman.

US invasion

Another unintended consequence was that UK banks did not, as Prime Minister Margaret Thatcher had hoped, come to dominate the new City. They enjoyed mixed fortunes at best, while it was the (“cut-throat”, according to one Big Bang veteran) US banks that ultimately had the lion’s share of success.

“They had years of experience, and they hired the best people,” Dobbie explains. The UK has had to settle for what ex-Bank of England Governor Eddie George called the Wimbledon effect – lacking the best players but hosting the best tournament.

It was the highly motivated – and motivating – Americans in particular who changed the character and culture of the City. Getting in at 9.30am, having long boozy lunches and then signing a few letters before heading home – a lifestyle some senior types still enjoyed – was replaced by breakfast meetings and Perrier water.

They bid up the pay of corporate financiers, traders and analysts, as they competed for skills. They also introduced a much more legalistic attitude to business. “Although regulation is of course much tighter now, almost everyone sailed in the middle of the safe harbour before the Big Bang,” Dobbie says. “Ever since, the investment banks have always tested the edge of the harbour.”

Hand in hand with this has come the rise of compliance, replacing the old ‘my word is my bond’ culture of putting the client first. Ross Russell notes that, as small firms disappeared, individual responsibility for good behaviour has been replaced by corporate responsibility, which does not work quite so well.

“Within the old Stock Exchange, the culture within the firm was the main factor ensuring that it didn’t take on doubtful business,” he says. “Now we are in the age of the compliance officer, whose role is to ensure compliance with more and more laws introduced by industry regulators – sometimes possibly at the expense of fulfilling the spirit behind the law.”

Sir Alan agrees that the Big Bang was very important in making London a global centre. "But we must accept that not all of its outcomes were good and that some must be changed," he insists.

The Big Bang caused a change in compensation whereby individuals were encouraged to put their personal interests before those of their clients, Sir Alan says. “They didn’t take the risk, but they took the return, and that’s a type of theft,” he believes. “We as the City must put that right and, indeed, we have been doing so for the last seven years.”

Big Bang: Timeline

1979

OFT proposes investigation into “restrictive practices” at the LSE

1983

Margaret Thatcher’s Government and LSE agree to settle wide ranging anti-trust case

1984

Gower Report into investor protection published, calling for new regulatory body

1985

Securities & Investments Board (SIB), precursor to the FSA, founded

1986

On 27 October, new rules come into play, heralded as the ‘Big Bang’ of deregulation

1989

Thatcher hails City as “a thriving centre of commerce and finance, bringing advantage to the whole of our country”

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.