Businesses, educators and government are responding to innovations of the Fourth Industrial Revolution – artificial intelligence, big data, quantum computing – but is it enough to tackle the digital skills crisis?

by Phil Thornton

In June 2019, Facebook unveiled its plans for a global digital currency, called Libra, that would allow its billions of users to make financial transactions, a move that had the potential to shake up the global banking system. Since then, however, PayPal has withdrawn its support and other payment providers are reported to be considering doing so. Regulators, notably in the US, France and Germany, have also expressed reservations.

Even if Libra never makes it to market, however, it is evidence of the digital disruption that has been sweeping through finance for some time. Electronic trading, for example, became mainstream in the 1990s, which, as explained in a previous Review article, required formalising of processes through compliance, codes and reporting requirements, which in turn created a “need for training and education about these new ways of working”.

But what are these ‘new’ digital skills, and how can employees ensure they future-proof their careers? Charlotte Crosswell, CEO of Innovate Finance, which represents the fintech sector, says it is growing at a rapid pace and the supply of talent to support it in the long run is fast being overtaken by demand.

Digital skills shortage While many workers have the basic digital skills required to do their job, the more complex skills remain sought after. A Review article published in June 2019 looks at the lack of digital skills in the financial services sector and the necessity for action. It says that, according to the Digital Marketing Institute, skills needed to help future-proof workers include expert data analysis, such as extracting, analysing and translating useful information in a dataset, and network and information security to ensure watertight cyber security.

The article highlights some key figures, including the UK government’s Education and Skills Funding Agency prediction that within the next 20 years, 90% of jobs will require some level of digital skills. And by 2022, more than 130 million new roles could emerge as a result of the new division of labour between humans, machines and algorithms, according to the World Economic Forum’s Future of jobs report 2018 .

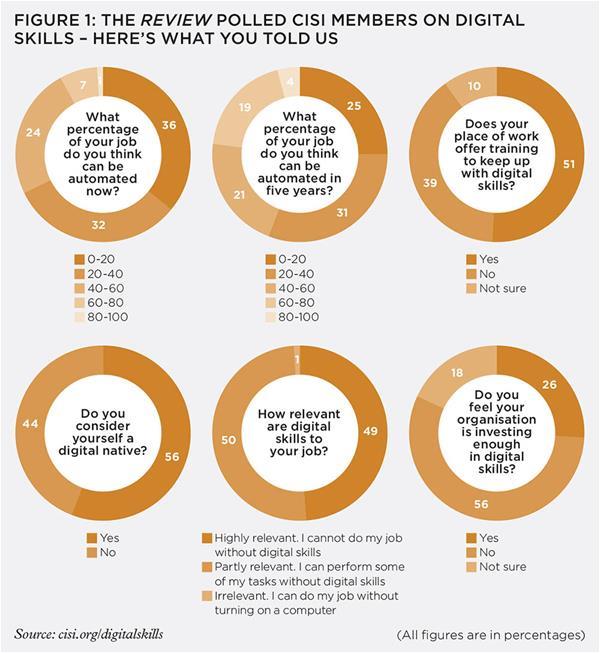

Only 56% of respondents to the poll questions included in the Review article, answered mostly by those who work in wealth management, operations, or compliance, risk and regulation, consider themselves to be a digital native, and just 51% feel their place of work offers the required training to keep up with digital skills, despite nearly 99% maintaining that digital skills are either highly or partly relevant to their job.

Separate research by the consulting firm McKinsey indicates that between 25% and 34% of financial jobs in areas such as procurement and payroll will be lost in the US and Germany by 2030, while the number of financial and business specialists will rise by between 5% and 24%. And a recent report by Parker Fitzgerald, the London consultancy, entitled Banking in 2019: a year of transition, finds that British banks are falling behind in their use of technology.

While the Fourth Industrial Revolution offers huge opportunities, the extent and speed of change risk creating a significant mismatch between the tech skills required by financial services firms and those acquired by people leaving academia at all levels, according to Marcus Scott, chief operating officer of TheCityUK, the sector-led body representing UK-based financial and related professional services. He describes the risk of a fintech skills shortage as “very serious”.

The crisis

The Lord Mayor of London, Alderman Peter Estlin, gave a speech on digital skills at Gresham College in London in January 2019. He referred to statistics from several reports that highlight the scale of the crisis, including that 12.6 million people lack basic digital skills, that 5.8 million adults in the UK (9% of the population) have never even used the internet, and that the estimated cost to the British economy per year in lost GDP is £63bn.

“On the face of it, then, we really are experiencing a digital skills crisis,” said Alderman Estlin, who pointedly asked his audience: “RUDQ?” – referring to the newly minted concept of digital quotient or DQ, an education framework and assessment that involves eight skills we all need to be familiar with as digital citizens or workers.

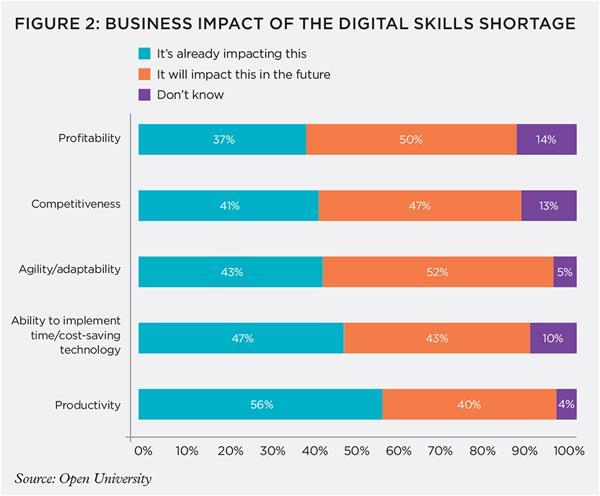

Around 40% of 500 UK chief technology officers, HR directors and HR managers surveyed by the Open University in its 2019 report, Bridging the digital divide, say their profitability, competitiveness and agility have been impacted by digital skills shortages, with 50% saying they expect to suffer in the future (see figure 2). And in a 2018 Accenture Research survey of more than 1,200 CEOs and top executives who use artificial intelligence (AI) as part of the business function of their companies – called Reworking the revolution – respondents describe only about a quarter (26%) of their workforce as ready for AI adoption.

Research by Accenture in 2016 into the digital readiness of the financial sector finds just 53% of firms training employees in digital skills. Our 2019 Review poll results reflect this, with 56% of respondents saying they do not feel their organisation is investing enough in digital skills training, and 39% saying their place of work does not offer training in this area.

The response

The UK government launched its digital strategy in 2017, setting out how the UK can build a “world-leading digital economy that works for everyone”. And in 2018, then-Chancellor of the Exchequer Philip Hammond unveiled the Financial Services Skills Taskforce (FSST), which he said would “harness emerging technologies” and “ensure a wealth of talent for the financial sector, securing its future post-Brexit”.

The taskforce, convened by TheCityUK, was asked to help the sector access a better long-term pipeline of specialist skills and support efforts to retrain or refresh employees’ skills over their working lives.

It produced an interim report in June 2019 and will produce full recommendations in November 2019. The June report sets out ways in which firms and employees can future-proof themselves amid the rapid pace of technological changes.

Its chair, Mark Hoban, a former MP and chair of reinsurance firm Flood Re, says skills required by financial services firms are changing significantly. Skills such as coding and software development, user experience, product design, data science and cyber are on the increase at all levels.

In recognition of the need for action, the Chartered Body Alliance – Chartered Banker Institute, Chartered Institute for Securities & Investment, and Chartered Insurance Institute – held fringe events at the two main UK political party conferences in September 2019.

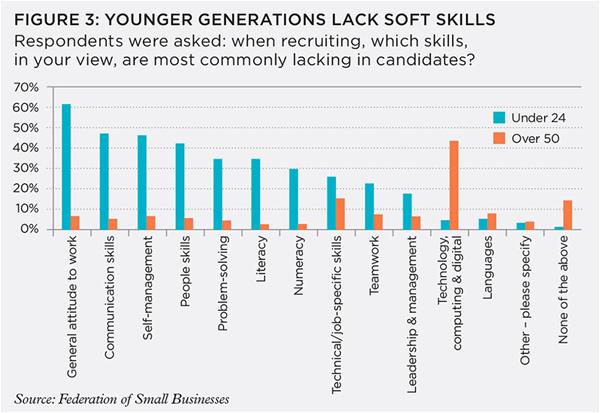

The events, titled ‘Upskill, Reskill, Future Skill: The next generation challenge for financial services’, included panellists from TheCityUK and MPs discussing potential solutions to the mismatch between supply and demand, and the need to remain competitive with other sectors in the economy. TheCityUK said: “As the digitalisation of the economy matures, many of the required [digital] skills are common across all sectors. We are competing with the rest of the economy for skills such as data science, machine learning, user experience and cyber. These skills are in short supply versus the increasing demand. It is often those skills seen as ‘soft skills’ which are the differentiators for successful challengers: adaptability, resilience, disruptive thinking, curiosity, customer rapport. We need to develop those behaviours quickly.”

There is evidence that companies, educators and other organisations are also responding. Employers are starting to realise that they need to invest in upskilling and reskilling – teaching additional and new skills to their current workforce. For example, Barclays has partnered up those of its employees it says are digitally empowered with less confident colleagues. It has some 16,000 ‘digital eagles’ who help colleagues to become more proficient with digital techniques.

In 2018, HSBC launched a recruitment drive for more than 1,000 digital roles, including user interface designers, digital product managers, software engineers, solution architects, exploratory testers and delivery managers.

However, it can also be argued that technologists in the sector need to bear some responsibility, in terms of better understanding the workings of finance, in order to aid the drive for digital skills in the fintech era. Michael Mainelli, Chartered FCSI(Hon), co-founder and director of City-based commercial think tank Z/Yen, believes that both sides must shoulder the burden of accountability in order to achieve a “proper understanding of the biggest revolution going”.

Soft skills crucial

Many will find they need soft skills to work alongside fintech and AI. These include adaptability, empathy, resilience, constructive thinking, curiosity, customer focus and rapport, and an ability to manage a diverse team, including specialists, generalists, contractors and homeworkers.

In its interim report, the Financial Services Skills Taskforce says that managers will need to cultivate virtual teams, and place greater emphasis on soft skills. In recognition of this need, the CISI’s Professional Refresher online training solution offers plenty of scope when it comes to boosting soft skills, with modules including Influencing Teams and Problem Solving focusing on things such as creative thinking and emotional intelligence.

Successfully merging digital and soft skills will often come down to identifying tasks that AI can do and humans cannot, and vice versa, Marcus says. He gives an anecdotal example of a global US-headquartered bank where, several years ago, about 4,000 people were investigating false positives – potential frauds identified by computers that turned out not to be fraud – at any one time.

Successfully merging digital and soft skills will often come down to identifying tasks that AI can do and humans cannot, and vice versa, Marcus says. He gives an anecdotal example of a global US-headquartered bank where, several years ago, about 4,000 people were investigating false positives – potential frauds identified by computers that turned out not to be fraud – at any one time.

Education, education, education

As Alderman Estlin said in his Mansion House speech in January 2019, “By assessing now what skills are needed for the future, we can put in place the right measures today to make sure our education system can deliver the skills we need tomorrow.”

Greg Wade, policy manager for skills at Universities UK, which represents the university sector, says: “There are good examples across many universities of taking strides to meet that demand, both by offering innovative courses and by ensuring that digital skills are increasingly embedded into courses.”

A leading example is Imperial College London, which has modularised significant amounts of undergraduate content, including on coding, data analytics and AI, to enable easier incorporation in other courses. Meanwhile, Manchester University is one of the few in the country that has a full AI degree.

However, our online report highlights research by Jisc, a national research and education network, which finds that only half of further and higher education students believe their courses have prepared them sufficiently for the digital workplace, while almost a third say they have not been informed which digital skills they need to improve. This is despite more than four out of five (82%) saying that digital skills are important in their chosen career.

Given the advent of innovations such as Libra from digitally native companies, financial services employers, educators and workers will need to ensure they can answer Alderman Estlin’s question “RUDQ?” in the affirmative. In order to future-proof themselves against constant technological change, firms and their current and prospective employees must ensure they have not only the latest digital skills but also the soft skills – communication, empathy and leadership – that will ensure they can both work alongside but also fully exploit the advantages that innovations such as AI and AR can bring. As Estlin concluded: “A fundamentally different skill set is needed for us to cope with, and thrive in, today’s digital landscape.”

The full version of this article is published in the October 2019 print edition of The Review. All members, excluding student members, are eligible to receive the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.