How regulators and institutions are rising to the challenge of climate change and the need for responsible finance

by Andrew Strange

At the launch of the COP26 Private Finance Agenda in February, Mark Carney spoke of the need for better climate risk management as a step on the path towards a sustainable financial system.

At the same event Christine Lagarde, president of the European Central Bank, said that overall economic losses caused by natural hazards had increased from US$60bn in 1980 to US$150bn in 2019.

In addition to the physical risk from changing weather patterns, the transition to a net zero economy could lead to many currently lucrative assets, such as oil and coal, being stranded, having suffered from unanticipated or premature write-downs, devaluation or conversion to liabilities.

A 2017 report, Perspectives for the energy transition, published by the International Energy Agency (IEA) and the International Renewable Energy Agency (IRENA), estimates that the total value of stranded assets across the global energy sector could reach US$20tn within the next 30 years, if the world were to delay the implementation of renewable energy policies and energy efficiency deployment until 2030.

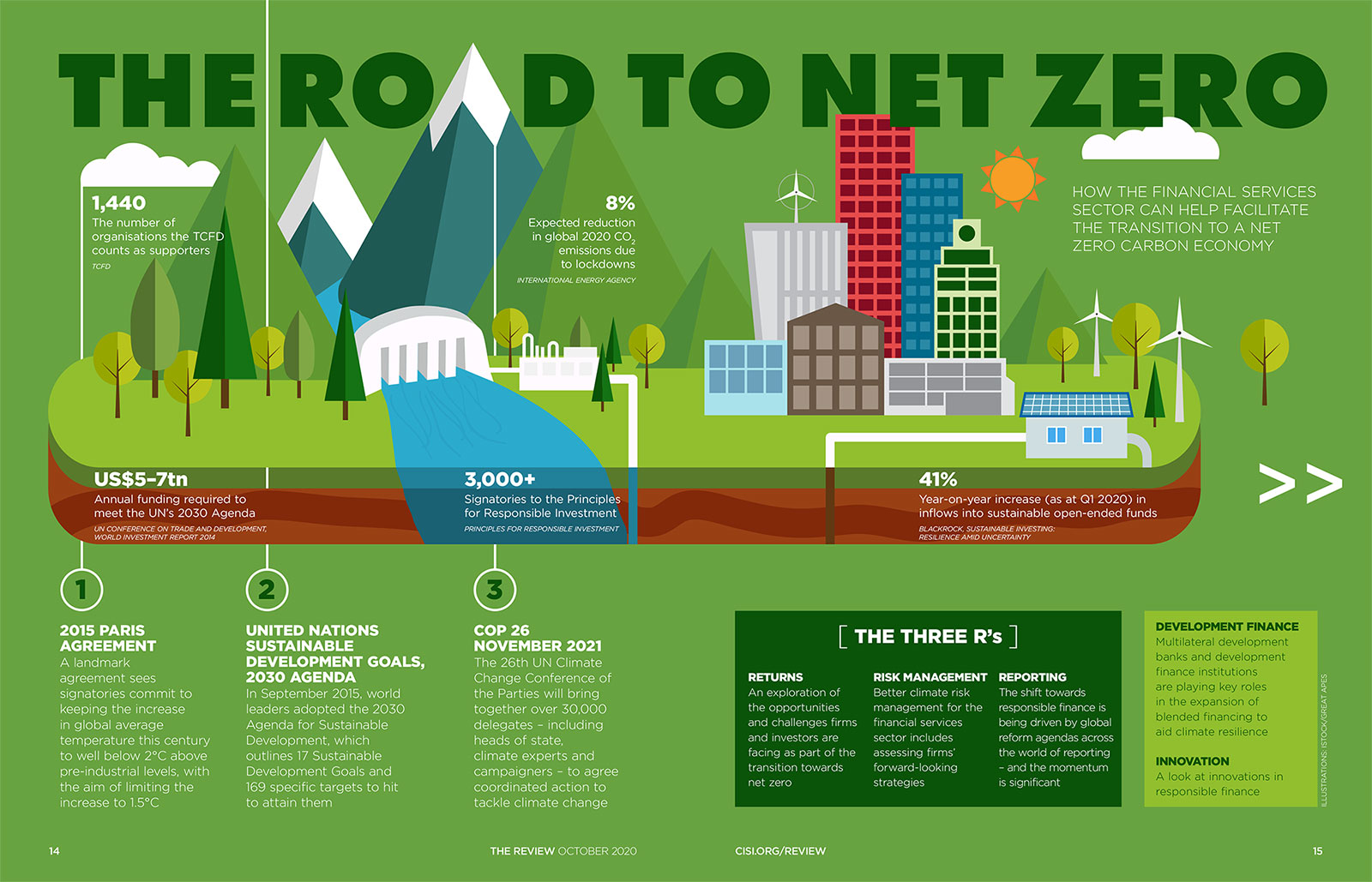

Over the past three decades, the international community has launched three key initiatives to try and limit the rise in temperatures: the UN Framework Convention on Climate Change in 1994, the Kyoto Protocol in 1997 and, most recently, the 2015 Paris Agreement. This seeks to keep the global temperature rise to below 2°C above pre-industrial levels and strives to limit the increase to 1.5°C. However, in October 2019, Carney told the UK House of Commons Treasury Select Committee that capital market investments were probably consistent with a rise above 4°C.

Taking action

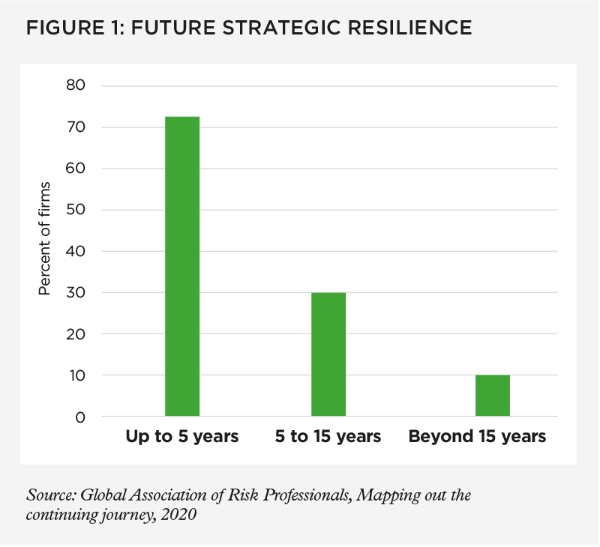

Perhaps unsurprisingly, the situation has left many financial institutions uncertain about their long-term resilience. The Global Association of Risk Professionals’ second annual global survey of climate risk management at financial firms, Mapping out the continuing journey, 2020, finds that many companies are concerned about regulatory uncertainty. And while more than 70% of the 71 surveyed firms believe their strategy is resilient to climate change over the next five years, only 10% are confident in their resilience beyond 15 years (see Figure 1).

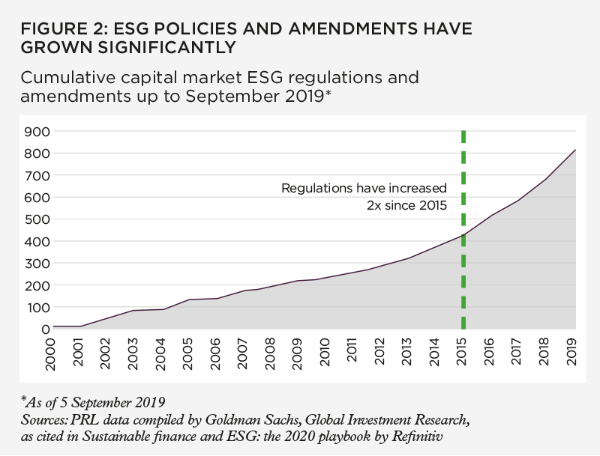

The EU’s action plan for financing sustainable growth, one of the most notable climate-related initiatives, was followed by the EU Taxonomy and the European Green Deal in 2019. The UK’s Green Finance Strategy was launched in July 2019 to align private sector financial flows with clean, environmentally sustainable and resilient growth. In China, the development of a national green finance system has been endorsed by President Xi Jinping and the State Council and is supported by 220 of the country’s largest financial institutions (see also The Review’s ‘Fifty shades of green’, published in November 2019).

Professor Alexander Van de Putte, chief strategy officer at the Astana International Financial Centre and professor of strategic foresight at the IE Business School in Madrid, says that further regulation could well be on the way in order to scale back subsidies to the fossil fuel sector and level the playing field. A working paper published by the International Monetary Fund in May 2019 reports that direct and indirect subsidies to the fossil fuel sector totalled US$5.2tn a year, or 6.5% of the global economy, in 2017.

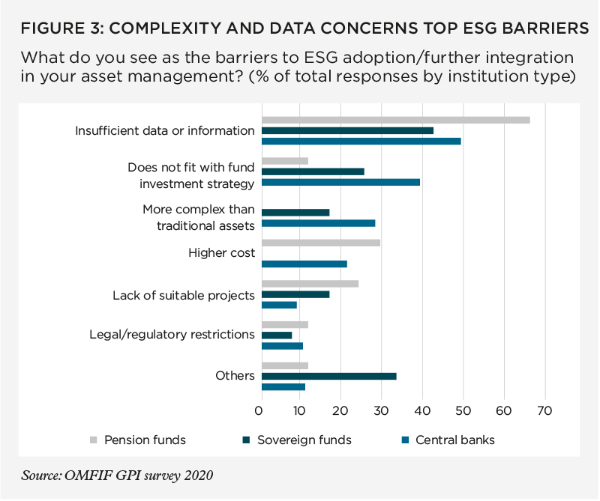

Climate-related disclosureIt is difficult for policymakers and institutions to make informed decisions without transparency around climate-related performance. To overcome this obstacle, Carney and former New York mayor Michael Bloomberg announced the creation of the Task Force on Climate-related Financial Disclosures (TCFD) during the 2015 Paris negotiations. It provides a framework for disclosure from both financial institutions and the companies they invest in, or lend to.

"Perhaps we’ve seen recently what an abrupt transition to a low-carbon world might look like"

Scenario analysis is also becoming an important tool for stress testing institutions’ resilience in the face of climate change. ShareAction is a London-based charity that aims to promote global responsible investment. Its April 2020 report, Banking on a low-carbon future II, outlines that 85% of the largest European banks have started to carry out scenario analysis, while in the case of 75 of the largest global asset managers, the figure stands at 35%, according to the charity’s Point of no returns part III – climate change report, published in June 2020.

Sonia Hierzig, head of financial sector research at the charity, says: "There is a clear trend, with an increasing number of financial institutions recognising the importance of such analysis. However, many currently only use the 2°C scenarios for this analysis, instead of the variety of scenarios recommended by the TCFD."

"We are not going to move from an oil-fuelled world to a renewable, energy-fuelled world overnight"

Central banks are increasingly stepping in to add more rigour to scenario analysis. The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) – a coalition of more than 50 central banks and regulators that launched back in December 2017 – made its first climate scenarios available in June 2020. And the Bank of England plans to become the first regulator to stress test banks and insurers against different climate scenarios.

Stranded assetsThe possible cost of stranded assets predicted by the IEA and IRENA is sobering, and there have already been glimpses of what a stranded-asset world might look like, with negative oil prices and corporate bankruptcies.

Simon Thompson, chief executive of the Chartered Banker Institute, says: "Perhaps we’ve seen recently what an abrupt transition to a low-carbon world might look like. We’ve seen negative oil futures prices. For many years there has been this debate about stranded assets and fossil fuels having to be left in the ground. It has always seemed a bit academic and theoretical and that it’s 10 or 20 years off – well, it happened this year. We had some of the Midwest forward crude prices going negative. That’s something that was an asset and suddenly became a liability. One of the drivers was people saying ‘we don’t need oil anymore'."

Simon acknowledges that "we are not going to move from an oil-fuelled world to a renewable, energy-fuelled world overnight," and that the transition period will be "much longer than environmental campaigners would want". However, he believes that "investors who are holding – either directly or through their portfolios – large numbers of carbon-intensive stocks" are living on borrowed time, predicting that they are "going to see some conversion to liability and asset stranding, and that may happen sooner rather than later".

Another example more clearly linked to the climate emergency is Northern California’s PG&E, which was forced to declare the largest US utility bankruptcy in history in the wake of the wildfires that devastated entire Californian communities in 2017 and 2018. This could be the first of many climate-related bankruptcies. PG&E’s grids, like many assets, were built for a different climate. A Californian landscape left drier by climate change, combined with the firm’s old spark-prone electrical infrastructure, proved the perfect recipe for disaster, according to a report by academics at the University of California, Berkeley.

"There are economic opportunities associated with meeting this new demand, such as solar, wind, or innovative green technologies"

PG&E has since reached an agreement with the governor of California’s office allowing it to emerge from bankruptcy in exchange for some concessions. These include stronger governance, forgoing shareholder dividends for three years and measures that could lead to a state takeover if it fails to meet safety and accountability milestones.

Long-term sustainabilitySome institutions are taking strong action to reduce their exposure to climate-related risks. In his 2020 annual letter to CEOs, BlackRock CEO Larry Fink warns that "we are on the edge of a fundamental reshaping of finance". He says that BlackRock is convinced that sustainability and climate-integrated portfolios can provide better risk-adjusted returns to investors.

Omar Shaikh, managing director of the Global Ethical Finance Initiative, says that while there are many risks associated with climate change, there are also "fascinating" opportunities for firms: "There are economic opportunities associated with meeting this new demand, such as solar, wind, or innovative green technologies. We also see opportunities in capital markets, where demand for green bonds has increased considerably."

On 8 June 2020, the NGFS released a statement calling for a green recovery out of the Covid-19 crisis. It points to the IEA’s prediction that lockdowns will lead to an 8% reduction in carbon dioxide emissions this year. And it warns that to meet the requirements of the Paris Agreement, emissions will have to fall by a similar order of magnitude every year for a decade. The statement says that the world can’t afford to repeat the Covid-19 experience, and calls for the recovery to lay the groundwork for an orderly transition to a more sustainable economy.

It’s becoming ever more urgent that the world moves away from its reliance on carbon and builds a more sustainable society – and the finance sector has a key role to play. The sector’s stewardship of trillions of pounds of investment capital that can be redirected to support the UN’s targets puts financial professionals at the forefront of the fight against climate change. The challenge, however, will be to simultaneously meet the goals of society, institutions and investors.

Click to enlarge

The full article was originally published in the October 2020 flipbook edition of The Review.

The full flipbook edition is now available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting 'Yes'.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.