Barclays sums it up as "creating opportunities to rise". For Lloyds Banking Group it's about "helping Britain prosper". BlackRock wants "to help more and more people invest in their financial wellbeing". What each of these financial services firms is talking about is their 'purpose', a term that has gained traction in the corporate lexicon.

Purpose in contextThe UK's Financial Reporting Council (FRC) and the FCA have both introduced purpose into their supervision regimes in the past two years. In 2018, the FRC's UK Corporate Governance Code was revised to make establishing corporate purpose a board responsibility. In 2019, the FCA introduced culture and purpose as key components of its Firm Assessment Model, which is at the heart of its approach to supervising some 58,000 firms. In its final April 2019 report on its Approach to supervision, the FCA says: "We look at the purpose of a firm to understand what it is trying to achieve in practice, not just what is written in its mission statement. A strong understanding of firms' business models allows [us] to identify where there is poor alignment between firms' profit incentive and the interests of consumers and markets functioning well."

In its Business plan 2019/2020 (p.13), the FCA identifies purpose as one of four drivers of behaviour in a healthy business culture, alongside leadership, reward and managing people, and governance. In France, too, the PACTE (Action Plan for Business Growth and Transformation) law made a provision similar to the UK Corporate Governance Code during 2019. But the growing emphasis on purpose is also the consequence of a shift in outlook within the business community itself. In May 2019, Quartz Insights and WE published Leading with purpose in an age defined by it, a global study based on a survey of 254 management and C-suite leaders encompassing a range of sectors. Some 73% of respondents believe purpose leadership will become as important as financial performance.

In August 2019, the Business Roundtable – an organisation comprising CEOs of leading corporations in the US – redefined the purpose of a corporation from serving shareholders to serving all stakeholders, including customers, employers, communities and suppliers.

It would be easy to point the finger at the 2007–2008 financial crisis, or an even more recent so-called 'crisis in capitalism' – whereby large companies become ever more powerful at the expense of workers – as further triggers for the new focus on purpose. Mark Goyder, founder of Tomorrow's Company – a London-based think tank that set out to enable business to become a force for good – and co-author of a recently published book called

Entrusted: stewardship for responsible wealth creation, acknowledges that the financial crisis has prompted renewed attention with regard to purpose, but he suggests a deeper and more fundamental explanation for the current focus: "What's really driven this is the search for meaning and the sense that there's got to be more to life than just making money."

Mark took part in an FCA-instigated series of round table working groups between June and October 2019 to explore the business case for being purposeful, looking at how it can improve culture and success, as well as the barriers and how these could be overcome. The round tables covered seven financial services sub-sectors: retail banking, wholesale financial markets, general insurance, retail lending, pensions and retirement income, retail investment, and investment management.

"What's really driven this is the search for meaning and the sense that there's got to be more to life than just making money"

Results of these discussions fed into essays written by participants – and courtesy of contributions from academics and others – and published in an FCA discussion paper (DP20/1) in March 2020, titled Transforming culture in financial services: driving purposeful cultures. In the introduction, the FCA says that the "purpose of a firm sits at the heart of its business model, strategy and culture" – a point echoed in many of the essays. CISI CEO Simon Culhane, Chartered FCSI, who chaired the retail investment round table working group, co-wrote the retail investment sector essay in DP20/1 with Mark and Quilter CEO Paul Feeney. The essay, titled 'Restoring trust – the case for the financial services industry to rethink its purpose', proposes a common statement of purpose for the financial services sector that would commit every signatory to a number of shared values, including dealing with customers fairly and ethically, investing in employees, and supporting communities and the environment – as well as generating long-term value for shareholders.

Charis Williams, research manager at the CISI, which ran two streams as part of the FCA culture programme, says one of the key points that came out in the discussions with practitioners is the importance of purpose being understood at every level. "The clear message from practitioners is that, whether you are a senior member of the board or a junior member of frontline staff, purpose should be equally important to you," Charis says.

Quotes from the wholesale round table participants. Click image to read it at full size

Purpose and the Covid-19 crisis

The Covid-19 pandemic has had a severe impact on economic activity, with the International Monetary Fund predicting that the global economy will contract by 3% in 2020. A clearly defined sense of purpose could provide an invaluable framework for companies in the months and years ahead, as the sector seeks to absorb the shockwaves. Handelsbanken, another organisation that authored an essay in DP20/1, titled 'When what + how = why', is an example of a firm with a 'top-to-bottom' purposeful model. The model, which was implemented five decades ago, aims to embed shared purpose throughout the bank by aligning its business model with two fundamental values: trust in the individual and taking the long-term view.

With the world in the grip of a pandemic, actions in the financial services sector will speak louder than words. CISI chair Michael Cole-Fontayn MCSI, who chaired the wholesale financial markets round table working group says: "All stakeholders are judging every aspect of corporate behaviour in a heightened way during this pandemic and determining how companies are serving society." Purposeful firms such as BlackRock, which contributed an essay in DP20/1 titled 'Purpose: at the heart of profitability', are issuing strong responses. BlackRock has committed US$50m of funding to global relief efforts, with a particular focus on communities where it operates."All stakeholders are judging every aspect of corporate behaviour in a heightened way during this pandemic and determining how companies are serving society"

Notably, the FCA has announced its intention to double down on its focus on purpose in its Business Plan 2020/21, which was published on 7 April 2020. Despite an inevitable revision of immediate priorities, the report makes it clear that work to address corporate culture will continue in the areas that the regulator classifies as key cultural drivers in organisations.

Simon Culhane notes that many purposeful firms already have a model that will enable them to "weather disruptions such as those caused by the pandemic". He says: "Those firms that have previously focused entirely on profit will, by definition, have hitherto prioritised short-term gains. This is likely to have left them ill-equipped to deal with the longer-term challenges posed by the pandemic."

Purpose and corporate culture

The idea of corporate purpose stems from the recognition that companies that enjoy long-term success are driven by more than simply generating profits for shareholders. There's no single definition of what is meant by corporate purpose, and it's easy to confuse with all those other high-minded company statements, such as mission, vision and values. Alex Edmans, professor of finance at London Business School and author of a new book, Grow the pie: how great companies deliver both purpose and profit, says: "The way I would define it is: how is the world a better place by your company being here?" Purpose is about the company's core business – does it generate profit as a result of serving society?

Jonathan Davidson, director of supervision – retail and authorisations at the FCA, says, "We would define purpose as 'why you come to work', the ultimate motivator." In any case, purpose is taken as shorthand for 'purpose beyond profit', since nobody doubts that profits will always be a key driver, and any company needs to make a profit to survive (a point made in a previous CISI City View article on the topic). What the focus on purpose recognises is that making a profit is not, or should not be, the sole driving force in an organisation.

Purpose beyond profit

Jonathan explains why the FCA is choosing to place increased emphasis on purpose. "We did a lot of reflection and research on the main drivers of harm in firms," he says. "Typically it's either that they have a business model where there is a huge incentive to do something bad that gives poor outcomes – for example, making a lot of money by giving poor advice – or it is down to the culture and the behaviour of the individuals."

Culture within every financial firm broadly fits into one of three categories, he says: those where firms set out to make money at any cost; those that are compliant but still overwhelmingly profit-driven; and those that are purposeful in a more inclusive way towards other stakeholders. "We are saying it is good for you as a firm if you are purposeful," Jonathan continues. "It will be healthy, profits will be sustainable, you won't suddenly have some terrible regulatory intervention, you will have a queue of people wanting to work for you, and customers who say they trust you and feel you are on their side."

The finance sector, through its investment muscle, has a significant part to play in ensuring that purpose beyond profit is embraced across the corporate landscape

We've already seen that purpose beyond profit has powerful traction in the US, with its adoption by the Business Roundtable, but it is also making waves elsewhere. In Sweden, start-up Doconomy offers a digital banking service where a consumer's spending and savings are measured by their impact on the planet. Italian insurance giant Generali is also backing up its statement on purpose – the firm declares on its website that its "purpose is to actively protect and enhance people's lives" – with actions, having set up an Extraordinary International Fund on 13 March 2020 that will provide up to €100m of funding to help fight the Covid-19 pandemic. However, some international firms have expressed the view that it is a struggle to have a common purpose across all parts of their business in all countries in which they operate. Tech companies such as Google, for example, have found it difficult to reconcile a purpose that involves universal access to information with state censorship in China.

The finance sector, through its investment muscle, has a significant part to play in ensuring that purpose beyond profit is embraced across the corporate landscape. As a result of the FCA initiative, the CISI is now reviewing its own purpose as an organisation and is in the process of holding a series of events with various stakeholders, including CISI staff, clients and members. The calendar of events has been paused in light of Covid-19, but is set to resume in the near future. "Our aim is to come up with a clear statement of purpose that will inform our future activities," says Charis Williams.

The business case for purpose

Making a business case for purpose entails measuring aspects such as attracting staff, retention of employees and consumer trust – all of which can ultimately lead to greater profits. But, Alex says, the benefits may be hard to measure. Far more important is that it provides a clear framework on which to make decisions. He cites the example of French energy company ENGIE, which made a difficult decision to close a coal-fired power plant in Australia, as it didn't align with the firm's future vision for sustainable energy. "Because it had a clear purpose to move towards a low-carbon economy, that helped it take that tough decision," Alex says.

The Global leadership forecast 2018 – a three-way collaboration between Development Dimensions International, The Conference Board and EY that includes data from 25,812 leaders and 2,547 HR professionals across 2,488 organisations – offers tangible data regarding a business case for purpose. The report reveals that purposeful companies – companies that actively put purpose into practice – outperform the market by 42% when it comes to financial performance. This is in contrast to companies that have a purpose statement, but don't 'walk the walk'. These companies merely perform at the mean of organisations, while companies without a purpose statement underperform by 42%

Putting purpose into practice

At financial planning firm Paradigm Norton, the first step in making the firm's purpose and values come to life is at the recruitment stage, and employee engagement is key. "When we recruit graduates it's really all around purpose and values – there's nothing more than that," explains Paradigm's founder and CEO, Barry Horner CFP™ Chartered MCSI. "If they have a good university degree in economics or maths, we don't need to question their academic ability, but we do need to work out if they align with the purpose of the company and if our values resonate with them."

Tracey Davidson, Chartered MCSI, deputy CEO of Handelsbanken in the UK and a CISI Board member, says that employee engagement is vital to Handelsbanken's purpose as an organisation. The current crisis has, inevitably, highlighted the value of human capital. Tracey believes that employee buy-in allows Handelsbanken to be more agile and better able to adapt to the current climate: "An unshakeable belief in the individual gives us the confidence to devolve decision-making power and accountability to colleagues all over the bank. This in turn creates more engaged employees."

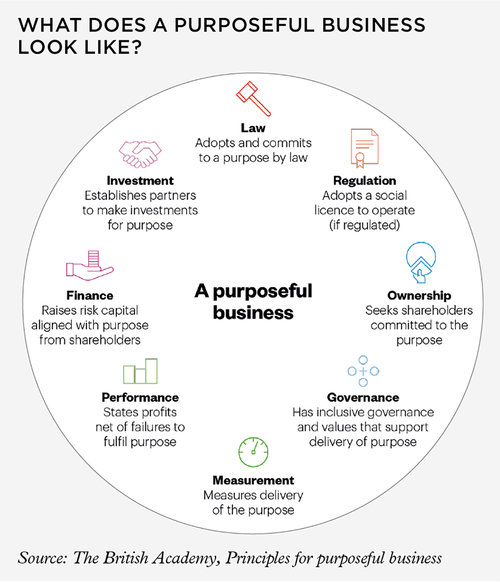

The round tables run by the CISI did provoke some scepticism from participants that purpose was too intangible, and that some firms would adopt a statement of purpose without actually putting it into action. This is clearly a crucial point. According to Mark, there is a systematic and comprehensive approach that firms can adopt. It involves identifying all your key relationships and looking at how you will bring the purpose and values to life in each one of these, identifying what outcomes should be measured and rewarded. Simon points to specific examples of firms adopting purposeful actions amid the pandemic, citing "tangible actions taken by many companies, which for many includes putting their employees' health and financial security as a priority, and adapting operations to produce items such as personal protective equipment".

The round tables run by the CISI did provoke some scepticism from participants that purpose was too intangible

Jonathan acknowledges that it can be a challenge to authentically assess how purpose-driven any individual firm is. "We are doing some work at the moment on how you might do that [assess the culture of firms] and there's some interesting behavioural science," he comments. "But we look at the evidence and make judgements based on our human experience. For example, we get access to the firm's board minutes and, if the strategy documents say go for growth, and it's all about profit and there's no mention of value to the customer, we can start to draw conclusions about the overriding ethos." Purpose beyond profit is not a fad, says Jonathan, and it is now part of the way the FCA assesses the firms it regulates.

Professional bodies also have a role to play when it comes to supporting 'purposeful individuals'. In a thematic essay titled 'Strengthening purpose in financial services: proud to be a professional' in DP20/1, the Chartered Body Alliance (CISI, Chartered Insurance Institute, Chartered Banker Institute) says that members of professional bodies demonstrate purpose, both individually and collectively, through adherence to a code of professional conduct, professional qualifications, and a commitment to continuing professional development. The essay argues that "professional bodies provide aspirational standards and qualifications that give those members who achieve them a sense of meaningful professional pride and purpose beyond that bestowed by their firm alone."

Fundamental to the purpose-driven approach is a growing belief that purpose and shareholder profit are not mutually exclusive; when you deliver value to all your stakeholders, that doesn't mean there is less for shareholders. Doing the right thing, in other words, is ultimately good business.

The full article was originally published in the June 2020 flipbook edition of The Review.

The full flipbook edition is now available online.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.