How has regulatory rollout affected your firm? Let us know in the comments.There seems to be no end to the layers of regulation coming from the EU and the FCA. The high level of activity, coupled with the complexity and specific expertise needed to interpret and then apply the new rules, has made compliance officers a sought-after breed.

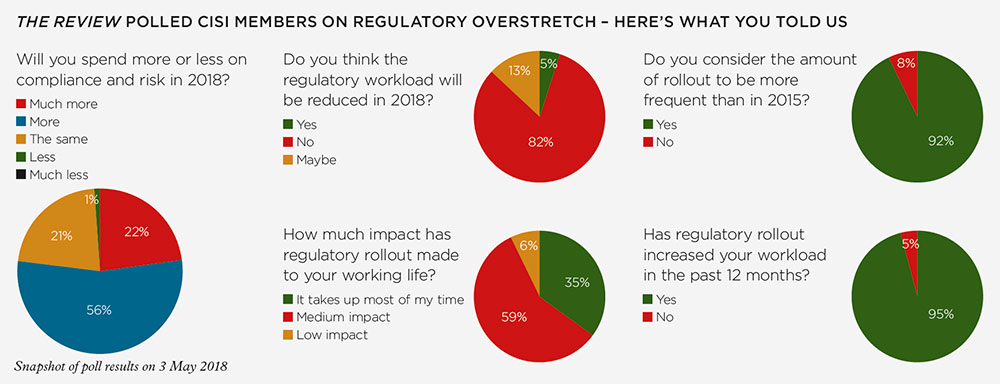

However, implementing multiple pieces of regulation at the same time isn’t just a challenge for compliance staff. A broad range of professionals have responded to an online poll on

The Review platform asking about the impact of regulatory rollout. Almost half (48%) work in risk and compliance, followed by 19% in wealth management, 10% in operations, with markets, financial planning, fintech, corporate finance and ‘other’ making up the rest.

An overwhelming majority – 96% – say regulatory rollout has increased their workload over the past year and over a third say regulatory issues take up most of their time. Staff are working hard, across the board.

New regulationsOne of the most far-reaching pieces of regulation has been MiFID II, an EU law implemented in January 2018 that provides harmonised rules for investment services across its member states. A senior person who works in operations at a wealth manager, and who agreed to speak to us on condition of anonymity, says: “MiFID II has put pressure on the whole firm. The first part of MiFID II, transaction reporting, has been the most difficult to roll out.”

Another EU initiative, GDPR, rolled out in May 2018, addresses the export of personal data outside the EU. Among other things, GDPR provides new rights for people to access the information companies hold about them, obligations for better data management for businesses and, in the event of non-compliance, a new regime of fines.

Then there’s the EU’s Packaged Retail Investment and Insurance-based Products (PRIIPs) regulation, which came into effect in January 2018, and aims to help retail investors better understand and compare key features, risks, rewards and costs of different products through short Key Information Documents (KIDs).

A priority going forward will be the extension of the Senior Managers and Certification Regime (SMCR), the FCA regulation for the UK that promotes greater accountability among individuals. This extension – the initial implementation was in 2016 – includes three main pillars: the Senior Managers Regime, which sets out the senior management functions that apply to firms; the Certification Regime, which requires firms to assess the fitness and propriety of certain employees, who in their role, may pose a risk of harm to the firm and its clients; and Conduct Rules, which relate to professional behaviour rather than the conduct of business. SMCR is to be implemented for insurers in late 2018 and for solo-regulated firms in mid-to-late 2019.

A sector under stress

A sector under stress

Our

poll results show that 92% think the current amount of rollout is more frequent than in 2015. And when asked whether they think the regulatory workload will be reduced in 2018, 82% say ‘no’.

Ian Shipway CFP

TM Chartered FCSI, managing director of HC Wealth Management, believes the end is far from near: “There’s obvious stress in the system, but we haven’t reached the peak; there’s much more to come.”

The workload resulting from GDPR implementation has been significant, ranging from information audits, documentation of the data being compiled and held and how it is shared and used, proof of compliance, and the appointment of data protection officers. But this is just one of many regulations firms are implementing.

Firms across the financial sector have little choice but to accommodate the cost implications of new regulation. Our

poll shows that 97% expect to spend either the same or more on rollout in 2018.

MiFID II, in particular, has tested the ability of the financial system to adapt to new rulings. “This was ambitious in its scale and designed to improve protection for investors,” says Graeme Pollok of G&M Compliance Services. “However, the fund management sector, which is impacted most by MiFID II, is less regulated than, for example, banks, which have their own supervisors at regulators. Therefore, it has been something of a major commitment for the sector.”

A new normalWith so much regulation bringing more restrictions, as well as costs, can businesses, particularly small and medium-sized enterprises (SMEs), continue to be efficient and effective?

In February 2018, the Federation of Small Businesses said that a third of small companies were not ready for GDPR. Non-compliant firms are looking at potential fines of up to €20m or 4% of annual turnover.

“The FCA understands that the new regulations, MiFID II for example, come with a lot of commitment and work. But they want to see companies making serious attempts to fulfil the requirements in accordance with the timeline,” says Dominic Crabb of London Capital,

With all this intense work going on behind the scenes, and our research revealing little expectation that the pressure will dissipate anytime soon, it is probably fair to say that our interviewee sums up the situation neatly by asking: “Who knows what is on the horizon for us next?”

The original version of this article appears in the Q2 2018 print edition of The Review. All members, excluding student members, are eligible to receive the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.