For a senior regulator to operate across such vastly different sectors as financial services, telecoms and healthcare is unusual, perhaps. But for Christine Farnish, Chair of the Peer-to-Peer Finance Association (P2PFA), it comes naturally. With a track record of working at the highest levels across a variety of specialisms, regulating one of the newest phenomena in the financial services sector – peer-to-peer lending – is unlikely to put her off her stride.

Farnish brings a wealth of experience to the table. She was CEO of the National Association of Pension Funds, as well as the statutory UK consumer body, Consumer Focus, and the Family and Parenting Institute, and she served on the Boards of the Office of Fair Trading and the Advertising Standards Authority. Her mantra throughout has been to speak up for the consumer. It is this focus that drives her forward and has enabled her to make a virtue of her sector diversity.

“I’ve had quite a varied career,” she acknowledges. Farnish started in the financial services sector 20 years ago, joining the Financial Services Authority (FSA) from Oftel, the telecoms sector regulator. “They wanted someone to lead their work on consumer policies and I thought this was a really important job that I’d like to do.”

As the only senior person at the FSA at the time without a financial services background, Farnish found herself on a steep learning curve. But, she notes, it was a fascinating time to join the Authority, because a number of former regulators were being merged together – all of them had different cultures and approaches to regulation, and did not necessarily share the same objectives.

Royal recognitionFarnish now pursues a portfolio career. In addition to chairing the P2PFA, she is an independent director of water and sewerage regulator Ofwat, gas and electricity regulator Ofgem, the Association of British Travel Agents and Brighton and Sussex University Hospitals. If that is not enough to keep her busy, she is also a member of AXA’s Stakeholder Advisory Panel. She recently served as Independent Reviewer of the Money Advice Service on behalf of Treasury Ministers. And in 2013, she was awarded a CBE for services to financial services and consumer affairs.

Farnish joined the P2PFA – set up as a self-regulatory body for the sector to promote high standards of conduct and consumer protection – in 2012. The organisation was only founded the previous year – a reminder of peer-to-peer lending’s relative youth. “It’s a new part of financial services and this is a new body that is really trying to educate people about what it is. It also seeks to talk to regulators and government to ensure that new entrant firms can compete fairly in a market dominated by platforms that have been around a very long time,” says Farnish.

Put simply, P2P finance is a means of enabling consumers and businesses to borrow and lend money, by helping people who have money to put it to work and achieve competitive returns through lending to other individuals or businesses online. It covers debt finance performed over a digital platform where there is no disintermediation.

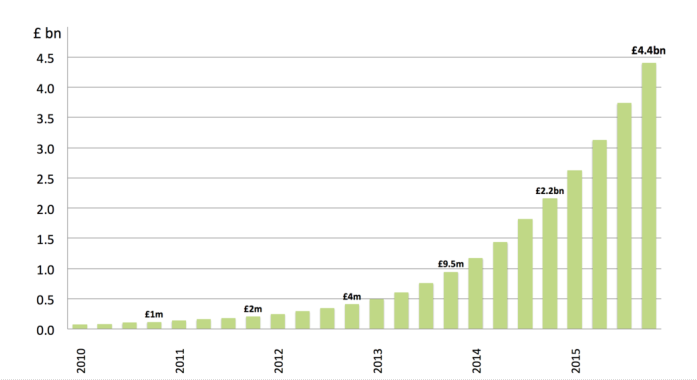

P2P’s remarkable riseP2P was pioneered in the UK in 2005 and, as of the fourth quarter of 2015, platforms had enabled lenders to provide over £4.4bn of funds to UK consumers and businesses, with expectations that the sector will continue to double in size every six months.

“The sector’s been growing pretty fast. It has more than doubled year-on-year each year, and the first quarter 2016 figures will show that we have done over £5bn worth of lending in the UK over the past five years,” says Farnish. “That is quite something, considering we started out with virtually nothing.”

Peer-to-peer lending growth over five years. Source: P2PFA

All this begs the question of what is driving such rapid growth. Is it more than the emergence of a convenient, disruptive technology platform? “It is a combination of factors,” says Farnish. “The first thing to say is that it wouldn’t be possible without digital technology; digital platforms sitting in the middle co-ordinating these players and managing the risks on behalf of the lending consumers. Obviously, penetration of access to the internet has played a big part in this.”

For Farnish, who was at Oftel 25 years ago when the information superhighway was the height of innovation, the current dynamism of the financial technology space seems strangely familiar. “Back then, we were just talking about things like that in theoretical terms, but now it’s real. And it is the same with P2P lending,” she says. “More people have digital access than ever before, but the other part of the story is the fact that there’s a very simple understandable proposition here that people can get their heads around, where you can see what is happening to your money; similarly on the borrowing side.”

Encouraging track recordNot everyone, though, is fully enamoured with P2P finance. Some criticism has focused on the lack of testing through a full credit cycle. Lord Adair Turner, a former FSA chief, has said it has not yet gone through a “‘kick the tyres’ type of credit analysis”.

Farnish points out that one of the largest P2P platforms, Zopa, has gone through a full credit cycle. None of the lenders lost any of their capital even though interest rates were falling. “That was a good experience and testimony to the professionalism that the risk managers have shown on these platforms. They take credit risk underwriting incredibly seriously because they cannot afford not to.”

As the independent chair of P2PFA, Farnish says she can walk away at any time if she feels that the organisation is not doing right by consumers. “That is the ultimate sanction I have. I am completely independent and they have also appointed another independent board director, Tony Boorman, who used to be the [Chief] Ombudsman [of the Financial Ombudsman Service] and who is also fiercely independent. Between us we take very seriously the responsibility to ensure that anyone who is part of P2PFA membership upholds good standards and is clear, honest and transparent about what they do and say to their customers.”

The CV

2012 to date: Chair of the Peer-to-Peer Finance Association

2010: Chair of the Family & Parenting Institute

2008: Sat on the Consumer Focus Board

2006: Group MD of Public Policy at Barclays

2002: CEO of the National Association of Pension Funds

1998: Consumer Affairs Director at the FSA

1994: Deputy Director General at Oftel Despite the rigours of overseeing a new and exciting part of the financial services universe, Farnish says she is at a nice time in her career when she does not need to be a wage slave.

“I don't have to work full time as I’m independent and that's wonderful. Chairing the P2PFA takes up some of my time and I'm also on the Ofgem and Ofwat boards. Both of these utility sectors are going through major changes that are really important to customers and it is fascinating being part of those journeys. I’m also on the board of my local hospital, which is my public service work, and that presents another interesting set of issues to grapple with,” she says.

Outside interestsFarnish still has a fair amount of time to herself, though, which allows her to indulge her passion – long-distance trekking in the mountains with her husband, who has written books on the subject.

“It’s all off the beaten track, and damned hard work – but amazing nonetheless,” she says.

Another passion is football: specifically, Tottenham Hotspur FC, who at the time of writing were pushing Leicester City hard for the top spot in the English Premier League. “As a long-suffering Spurs fan, this has been a wonderful season – just watching the energy and talent,” she says. “And even if we don’t win it, if we end up ahead of Arsenal, I’ll be happy!”