It is no exaggeration to say the EU’s

Markets in Financial Instruments Directive (MiFID II) will radically change the way that its securities and derivatives markets are regulated. While the impact of the 148-page document will affect every nook and cranny of financial markets, one of the most significant impacts will be on investment managers.

Although the directive came into force in July 2014, member states were given until the start of this year to implement it – a date that has been put back to 3 January 2018, giving financial firms and their advisers a few more precious months to put their thought processes in place.

Why MiFID II is being implemented: a timeline

– 2004: European Commission proposes first MiFID to create a single market for investment services and activities and improve competitiveness in EU markets.

– November 2007: MiFID is applied in the UK, but the onset of the global financial crisis highlights weaknesses in its structure.

– April 2010: Committee of European Securities Regulators opens review of MiFID.

– October 2012: European Parliament adopts amendments to proposals.

– June 2013: EU Council agrees general approach.

– June 2014: After four years of drafting, final texts of the MiFID II and a new Markets in Financial Instruments Regulation (MiFIR) were published in the Official Journal.

– July 2014: MiFID II enters into force. Initial implementation date set at 3 January 2017.

– March 2015: UK’s HM Treasury publishes consultation paper on transposition of MiFID II.

– February 2016: European Commission delays implementation until 3 January 2018 to allow for building of complex technical IT infrastructure needed to enable enforcement.

– July 2017: UK meets revised deadline of transposing the directive into law by 3 July 2017.

MiFID II imposes many requirements on asset managers. It requires an investment firm to disclose information to a client on all costs and charges related to financial instruments and ancillary services, such as management fees and exit charges.

Suitability requirements mean firms that provide investment advice and portfolio management act in their clients’ best interests. On top of that are product governance requirements that regulate the lifecycle of products or services, ensuring firms that manufacture and distribute financial instruments act in the clients’ best interests. Finally, firms must take “all sufficient steps” – a tougher test than “all reasonable steps” under MiFID I – to obtain the best possible result for their clients when executing orders.

But one of the most important issues will be the need for sell-side companies to separate charges for execution from charges for access to research. The European Commission is determined to inject clarity, so investors can see clearly how much asset managers are paying external analysts for research.

Currently, fund managers receive research from investment banks for free, in exchange for placing trades with them. Free research that asset managers currently receive from brokers will be considered an “inducement to trade”.

To avoid the receipt of research being considered an unacceptable inducement, fund managers have a simple decision to take: absorb the cost of this themselves out of their profit and loss (P&L) accounts or pass it on to their clients. If they choose the latter option then, as Neil Scarth, principal at Frost Consulting, explains in

The Review in May 2017, they will need to set up a research payment account (RPA) to pay for third-party research, funded either separately from other charges, or together with a commission.

Absorbing costsA number of fund managers have revealed how they will deal with the issue. Some, such as Vanguard, Aberdeen Asset Management and JP Morgan Asset Management, have decided to absorb the cost of research within their P&L.

Vanguard, the US firm with $4.4tn under management, said it had “extensive internal research capabilities” but also used external research. “Those research costs will be paid out of the management fees and therefore absorbed in Vanguard’s P&L,” a spokesperson commented.

T. Rowe Price Group, with $927bn of assets, has said its UK-based investment manager, T. Rowe Price International, will pay for third-party research. “We have ensured our clients’ best interests are protected while preserving our globally collaborative investment process and our access to important third-party research,” says Rob Sharps, group chief investment officer.

Hawksmoor Investment Management will bear the cost of third-party research, although head of research Jim Wood-Smith has questioned the trend. “That is seen to be the ‘right’ thing to do,” he states in a note to investors. “But why? Do investors in a fund really believe that their managers should not have research? If the investors do not want to pay to give the managers the tools they need to do the job, then why have they invested in the first place? What about a desk? Or a biro? Or a telephone?”

Other major fund managers, such as Schroders and Invesco, initially decided to pass on some costs to clients but have since changed their minds. In September, Peter Harrison, Schroders’ group chief executive, said: “While we have met the main research principles of MiFID II for a number of years, we have concluded that we should absorb the cost of research for those clients affected by MiFID II.” There are now just a handful of managers planning to pass costs on.

The statistics

– 12% of fund managers were, or expected to be, ready by mid-2017.

– 35% said they would be cutting it fine in Q4.

– Two-thirds of fund managers rely on email to obtain written research.

Source: RSRCHXchange

– There has been a fall in the percentage of research budgets funds expect to spend with the top nine investment banks – from 40% in 2012 to 13% in 2014 and 7.8% in 2017.

– Asked about the number of research providers, 45.2% said they expect it to fall sharply, 32% to fall slightly, 17.4% to remain the same, 3.6% to increase slightly and 1.8% to increase sharply.

Source: RSRCHxchange MiFID II Survey, June 2017

Chris Turnbull, co-founder of Electronic Research Interchange (ERIC), a marketplace for research for regulated institutional investors, said managers are increasingly reassessing decisions. “Funds that initially decided to charge through an RPA have now decided to go down the P&L route. The more asset managers say they will put it on the P&L, the harder it is for asset managers to say they will charge clients. Word spreads and it can be used as a PR exercise.”

Whichever decision firms take, they will be under pressure to cut their research costs either to limit the hit to their P&L or reduce the charge to clients. Vanguard said it expects to spend less than $5m a year on research costs, while JP Morgan Asset Management, which is also absorbing the research costs, said it is committing substantial resources to internal research capabilities.

Indeed, one key issue is how much the investment banks will charge. Again there is a split, with some banks, such as BBVA, NatWest, Credit Suisse, ING and Daiwa preparing to provide some or all research for free, but others proposing up to £1m a year. A market in research will emerge as some managers choose to take research on one sector from one bank, but research on another from a rival. At the moment the overall trend is unclear, as some banks have not announced their pricing plans.

A survey of 562 global managers by RSRCHXchange, an aggregator and marketplace for institutional research, finds that 85% expect to comply with MiFID II rules in Q4 2017, or in January 2018. Vicky Sanders, its co-founder, said the largest firms are the most advanced. “Although our survey forecasts a last-minute sprint as firms race to be compliant in the fourth quarter, it’s been reassuring to see buy-side firms progress from a standing start to nearly finished in around four to six weeks,” she says. “At the same time, the onus of setting a price for research rests firmly with providers. As of now this process is not yet well advanced.”

Research budgets

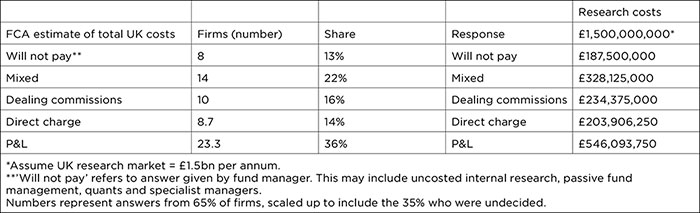

The survey says that more than 60% have already set, or begun to set, their research budgets, and are making decisions on which payment methods to use. Analysis of the survey by Alistair Haig of the University of Edinburgh Business School, who helped design the questionnaire, shows 36% will chose P&L, 14% direct charge, 16% dealing commission and 22% a mixture (see Table 1 and Graph 1).

Table 1: Expected methods of payment

Source: RSRCHxchange MiFID II Survey, June 2017; University of Edinburgh Business School

Source: RSRCHxchange MiFID II Survey, June 2017; University of Edinburgh Business School

Graph 1: Expected methods of payment

Source: RSRCHxchange MiFID II Survey, June 2017; University of Edinburgh Business School

Source: RSRCHxchange MiFID II Survey, June 2017; University of Edinburgh Business School

“We’ve seen press releases from managers who have decided how to pay for research, but even if the move is to P&L, their work isn't done,” Vicky says. “As those payment method decisions are made, agreeing prices and negotiating service level agreements with providers who ‘make the list’ will consume the majority of time between now and year end.”

Smaller fund managers with fewer resources are more likely to have looked at these issues later than large rivals. They also have to work within tighter research budgets. While some banks have cut or eliminated prices for written research, they have offset this by raising prices for bespoke services, which means managers have to be careful of what added extras they buy. The European Securities and Markets Authority has told managers to have procedures to report cases of unsolicited research being received when no payment plan is in place.

The real issue now is whether market players will be prepared on 3 January 2018. A survey by ERIC earlier in 2017 finds that 38% of managers are not confident. ERIC has launched a new survey, and Chris says he expects there will be “incomplete situations” in January 2018.

“There will be people who realise they have a problem when they no longer receive research from providers who have effectively had to cut them off,” he says. “That’s the point when they will want to address it.”