Different cannabis regulations around the world mean that the grass is not always greener for investors

by Paul Bryant

This article is intended to illustrate the complexities that can arise for investors as a result of different global laws. The CISI does not condone any activity that would give rise to any criminal or regulatory offences.

Canada introduced some legal medicinal use of cannabis in 2001, and has evolved and relaxed legislation several times since then. Today, Health Canada, the government health agency, licenses and oversees a thriving commercial cannabis sector, and also registers individuals to produce limited amounts of cannabis for their own medicinal use. In a country with a population of 37 million, more than 350,000 patients are registered with licensed sellers of cannabis, according to the latest government data.

In October 2018, another giant leap of deregulation took place. With the introduction of the Cannabis Act, the recreational use of cannabis was legalised, albeit under very strict conditions, such as restricting youth access and the quantities allowed to be grown and possessed.

Other countries appear to be following suit. The medicinal use of cannabis is now legal in 33 US states, with recreational use legal in ten, plus the District of Columbia, according to the June 2019 fact sheet of the ETFMG Alternative Harvest ETF, which tracks the performance of cannabis equities. Research agency Prohibition Partners says in its 2019 European Cannabis Report: “Throughout Europe, countries are reconsidering the region-wide moratorium on medical cannabis. Key markets like France, the UK, and Spain are reviewing their current legislation while the sector leaders, Germany, Italy and the Netherlands, focus on expanding existing medical programmes.” In November 2018, the Home Office in the UK rescheduled cannabis-based medicinal products, saying, “For the first time in the UK, expert doctors have been given the option to legally issue prescriptions for cannabis-based medicines.”

Sector analysts at the Bank of Montreal (BMO) estimate that the size of the global cannabis market will reach almost US$200bn by 2025 – although this is dependent on legislation continuing to liberalise – which would make it around a quarter of the size of today’s tobacco industry.

Mark Noble, senior vice-president, ETF Strategy at Horizons ETFs Management (Canada) (which runs the Horizons Marijuana Life Sciences Index ETF, tracking the performance of 58 cannabis stocks), is bullish, but also warns investors of high risks: “We’ve seen marijuana stocks fly because of the excitement over the Canadian recreational opportunity and also the future medicinal and recreational opportunities presented by the opening up of the US and European markets [the net asset value of the ETF increased over 200% in the 24 months ending 3 June 2019]. But this is a sector in its infancy. There are more and more cannabis stocks coming to market and most are making losses and carry a high degree of risk. There’s a big question mark over how many will be around in a few years. Buying into the cannabis market today is a bit like buying into the NASDAQ in the early to mid-1990s. You will have some survivors and great investments, like Yahoo or Google, but also many failures, like pets.com.” Mark also points out that most of the investors in cannabis stocks are currently retail investors, with only a few institutions having the risk appetite to invest at this stage.

Cannabis product nuances

The medical and recreational ‘effects’ of cannabis result from two active chemical compounds, or cannabinoids – tetrahydrocannabinol (THC) and cannabidiol (CBD).

Prohibition Partners splits the cannabis market into four product types:

1. Pharmaceutical products, which are licensed medicines formulated from cannabinoids and have been through full clinical trials.

2. Medicinal products, which have not necessarily been through clinical trials but usually must be prescribed by a medical practitioner, depending on legal jurisdiction.

3. CBD products, which have zero or only trace quantities of the psychoactive THC cannabinoid and are derived from either cannabis or hemp plants. They are often sold in similar forms to medicinal cannabis (oils, creams, capsules for example) and to treat similar conditions.

4. Recreational cannabis, which is typically smoked or consumed in edibles for its intoxicating effects, made from parts of the cannabis plant containing THC.

Convergence on Canada

Canada’s exchanges list not only Canadian cannabis companies (the largest at the time of writing is Canopy Growth Corporation, with a market capitalisation of CAD$16bn), but also most of the publicly listed US cannabis companies (the largest at the time of writing is Acreage Holdings, with a market capitalisation of US$588m), and products such as the Horizons Marijuana Life Sciences Index ETF (with net assets of CAD$836m).

Canada’s dominance of cannabis capital markets has been assisted by the severe constraints placed on US cannabis companies. Mark of Horizons says that because these companies struggle to get access to capital markets in the US, or get banks to support them, many have chosen to list in Canada instead.

Jeremy Kuester, counsel in the Washington, DC office of law firm White & Case, explains that the underlying reason behind these constraints is that under federal law in the US – which is supreme over state law – it is still illegal to cultivate, distribute or sell cannabis. So businesses engaging in these activities are still falling foul of federal law, even if they are operating in ‘cannabis-legal’ states and these operations are legal under state law.

He expands on the consequences for cannabis companies and their investors: “When states legalise cannabis, they are not making it inherently legal. The implications of this legal divergence is that an investor in a US cannabis company could in theory be ‘aiding and abetting’ crime” (by funding activities that are illegal under federal law). Jeremy continues: “The odds of the US government taking enforcement action in a ‘state-permitted’ cannabis operation is pretty slim in my estimation, absent any other indicators of criminality (such as evidence of violent crime), but it’s still a technical violation of federal law, and as such financial institutions such as exchanges and banks steer well clear.”

This doesn’t mean that the US investment sector has totally shunned the cannabis sector, but it has certainly restricted its activities within the US. For example, the ETFMG Alternative Harvest ETF, listed on the NYSE Arca exchange is, according to its fact sheet, “designed to measure the performance of companies within the cannabis ecosystem”. But it will not “invest in any US or foreign company whose business activities are illegal under any applicable federal or state law”. As such, its cannabis investments include mostly non-US companies, with some investment in US companies that are ancillary to the industry – such as those providing hydroponic growing technology.

Similarly, New York based OTC Markets Group facilitates ‘over the counter’ trade (acting as a middleman for buyers and sellers to trade outside of exchanges) in around 60 publicly traded cannabis companies, mostly with their primary listings in Canada and Australia (but only those that don’t ‘touch the plant’ in the US – to avoid breaking federal law), according to Cromwell Coulson, CEO of OTC Markets Group.

Legal complexities in the UK

Cambridge-based GW Pharmaceuticals (GW), was listed on AIM until 2016 but now trades on the NASDAQ exchange in the US. GW is a bio-pharmaceutical company, developing licensed medicines derived from cannabis plants and taking them through all the necessary legal processes, such as clinical trials, before they can be prescribed. Some of the products developed to date are used to relieve the pain of muscle spasms in multiple sclerosis and to treat epileptic seizures. GW grows its own plants in the UK and the US, operating under the appropriate licences. Because it operates in this very specific (and clearly regulated) sub-segment of the cannabis sector, it is straightforward for UK investors to gain exposure to GW by purchasing shares on the NASDAQ exchange.

But if UK investors are looking for exposure to other areas of the cannabis sector (see boxout – Cannabis product nuances), things are not so simple. UK capital markets, investors and advisers are constrained when it comes to cannabis market participation. They run a significant risk of committing a money laundering offence under the UK Proceeds of Crime Act 2002 (POCA).

Katie Stephen, London-based partner at solicitors Norton Rose Fulbright, explains: “POCA prohibits receiving, dealing with, or being concerned in a transaction which facilitates the retention or movement of the ‘proceeds of crime’. The relevant laws are drafted in such a way that a crime essentially means an activity that is a serious crime in the UK, even if it is a legal activity in the country where the act happened.”

Therefore, a UK investor such as a fund manager, investing in or receiving dividends from a publicly listed Canadian company, which sells recreational cannabis in Canada (legally), would be transacting in the proceeds of crime, because selling recreational cannabis is illegal in the UK.

UK investors could also find themselves inadvertently exposed to cannabis investments as funds or other companies they are already invested in decide to move into the cannabis space. Holding shares or investing in companies whose business activities involve the cultivation of cannabis or sale of cannabis-related products may put investors at risk of committing a criminal offence if they receive any proceeds from such investments (such as dividends or proceeds of sale) or if they otherwise deal with the investment. And sometimes, the cannabis connection is not obvious.

UK investors could find themselves inadvertently exposed to cannabis investments

For example, major US beer, wine and spirits company, Constellation Brands, has taken a 37% stake in Canadian-based Canopy Growth Corporation, which is active in the medicinal and recreational cannabis market. Would an investment in Constellation Brands be a legal risk for a UK investor?

Katie says: “You have to look at the facts of each specific case and try and work out whether you could be committing a substantive money laundering offence or falling into the ambit of a reporting requirement. It’s not as simple as avoiding companies that have a recreational cannabis operation, as the legal position relating to ‘medicinal cannabis’ may also differ between the UK and Canada. A company appearing to only operate in the medicinal cannabis space could still be conducting activities that would be criminal in the UK.” She continues: “Any investor who discovers that they are holding a cannabis related investment should consider seeking advice before taking any steps in relation to the investment, as simply divesting themselves of the investment may give rise to a money laundering issue.”

If UK companies do want to make investments in the sector, potential solutions are to seek ‘consent’ for individual transactions from the National Crime Agency (NCA), or only transact with companies whose actions wouldn’t constitute a crime in the UK. But these are not always practical solutions. The NCA is allowed seven working days to respond to requests for consent, and for a fund manager needing to react quickly when buying or selling shares, this delay may be commercially impractical.

With respect to advisers, Katie says POCA also imposes disclosure and reporting requirements. Arranging an investment for a client in a cannabis company might be an offence, as failing to report such an investment might, if the adviser has knowledge of it or suspects it has been made – even if they weren’t directly involved.

According to Katie, investors shouldn’t hold their breath for clarity: “As far as we’re aware, there is no planned change to the law relating to recreational cannabis and we haven’t seen any signs of guidance being provided by the regulators. It’s difficult for them – the FCA can’t be seen to be condoning something that would give rise to a criminal offence in the UK.”

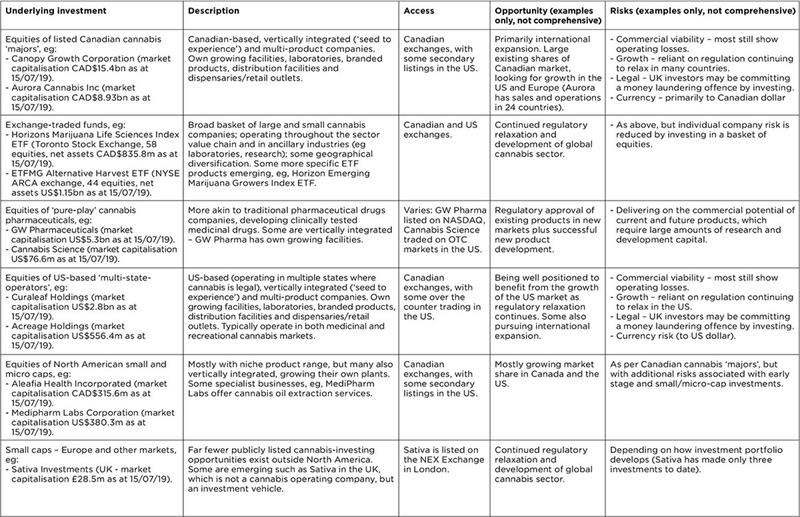

Routes to investing in the cannabis sectorThe table below outlines some of the paths to investing in the cannabis sector. It is not comprehensive and is intended to highlight some of the more common cannabis investing opportunities. The below examples are listed for illustrative purposes and should not be regarded as constituting investment advice.

Click the table to view the full-sized version.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.