The relationship between the sports and investment worlds has often been uneasy. In the mid-1980s, Tottenham Hotspur became the first English football club to be listed on the stock market, but by 1991, following worsening economic conditions, Tottenham’s shares were suspended.

Manchester United, at the start of the 1990s, floated on the London Stock Exchange. It gave the team an advantage just as the FA Premier League was being formed. But this also made Manchester United more vulnerable to a takeover, and it was taken off the market when the Glazer family bought the club. It has since been floated on the New York Stock Exchange.

Football and rugby: a good investment?For many people, investing in a sports club represents a ‘trophy investment’ and, invariably, the investors are already wealthy and aware that sports clubs are focused on playing success rather than delivering returns.

The revenues for the world’s top 20 football clubs increased by 12% over the past year to €7.4bn, according to the

Deloitte Football Money League 2017. But, equally, the rewards for players are such that clubs have rarely posted healthy profits. However, the revenue streams mean investors could sell their club for a profit; for example, France’s Paris St Germain, purchased by Middle Eastern investors some five years ago, is now among the top six in Europe, and would likely make a generous return on the owners’ investment. Furthermore, a successful disposal came with the acquisition of Chelsea by Roman Abramovich. The club’s owner, Ken Bates, purchased Chelsea for £1 in 1982 and, although it is often overlooked that he spent significantly over 21 years, he sold his asset for £140m.

Landmarks in club ownership

Landmarks in club ownership

Andrea Sartori, global head of sports at KPMG and head of the company’s Football Benchmark team, credits the UEFA Financial Fair Play (FFP) regulations, the initiative established to prevent professional football clubs from spending more than they earn, as the catalyst for stricter financial management discipline that has already started to become evident. However, he says: “Pure returns on investment considerations do not always exist in any decision-making. There is often a degree of emotion, philanthropy, occasionally ego-driven reasons and, in some countries, even politics. In fact, in football there are often a lot of irrational decisions made. Synergies with other assets owned by a prospective owner can also be a driver to the acquisition of a club.”

Gary Sweet, CEO of Luton Town, echoes and expands on this point. “Much of the value of any investment might not necessarily be measured by capital,” he says. “[But] being involved with a club like Luton can bring enormous goodwill benefits.”

Rugby, similarly, has always attracted high profile sponsorship and interest from sponsors and investors. The game has grasped professionalism and employed creative ways to market themselves. But the sport does not have the financial clout of football as evidenced by the total revenues of its top clubs. Leicester Tigers, arguably the best supported club in Britain, generated £19m in 2016, a fraction of the drawing power of top level football.

Jim Turley, a former banker and England rugby international at youth level, has maintained his interest in rugby union and, in particular, Roslyn Park. Jim has been involved at the club for some years, acting as chairman and also spearheading fundraising initiatives. “From a cash flow point of view, without the involvement of individuals, the sport cannot make the game pay,” Jim says. “So anyone investing below the very highest level has to be aware that this struggle exists.”

Generating incomeWhile investors in smaller clubs may have to settle for goodwill benefits instead of financial returns, one aspect of sport where they can make a return is real estate. Gary points to Luton Town’s proposed ground relocation as a project that offers possible benefits for investors in the future.

Most clubs that have moved to new purpose-built stadiums have realised a number of benefits. Arsenal, for example, after moving from its old home at Highbury to the Emirates Stadium, enjoyed a dramatic increase in revenue generation. In 2005, the club’s match day revenues totalled £37m, but by 2007 this had risen to £90m, and in 2016 revenues were close to £100m. Moreover, commercial revenues grew on the back of this, climbing from £30m in 2006 to £106m in 2016.

Regardless of the potential a new ground offers, real estate and ground development have to be handled sensitively, as sports fans are sceptical about the motives of developers. This underlines the importance of the ‘fit and proper person test’ for potential owners of British football clubs, which attempts to prevent corrupt individuals from buying a club.

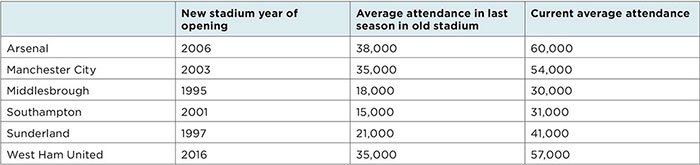

How audiences can grow – increased crowds for selected English football clubs that have relocated

How audiences can grow – increased crowds for selected English football clubs that have relocated

Although the elite band of clubs enjoy huge revenue streams from television, commercial activity and performance-related income, there are other ways for clubs to drive revenues, Andrea explains: “Player trading and talent management is an area of income that is invaluable and some clubs, such as Udinese in Italy, Porto in Portugal, Ajax in the Netherlands and Sevilla in Spain, have demonstrated their expertise, leveraging strong academies to make notable profits. Therefore, a club’s ability to successfully trade players and/or grow talent is something that strategic investors might look closely at.”

The clubs that are more successful at this demonstrate there is still a place for prudence and financial acumen – qualities that would appeal to would-be investors. Not surprisingly, the clubs excelling at player trading do not derive the greatest benefits from playing success or commercial activities and broadcasting fees.

The market driversRight now, the appetite for European football is coming from all corners of the globe. Very few top English clubs are locally owned and many have investors from China, the Middle East, Russia and the US. China, in particular, has been investing in European football clubs as well as paying inflated fees for players.

Sport in the US: a serious business

In many ways, North American sport is a better proposition for investors. For example, the National Football League (NFL) accounts for five of the top ten in Forbes’ list of the most valuable sports teams. The Dallas Cowboys are ranked number one with a value of $4bn, a figure that has more than doubled since 2011. The owner, Jerry Jones, bought the club for just $140m in 1989.

NFL clubs have, generally, proved to be good investments, but American football teams rarely sell shares to the public. Other US sports such as baseball and basketball also feature in the Forbes list. Major League Baseball team the New York Yankees was valued at $3.4bn in 2016, while basketball’s New York Knicks was valued at $3bn. The Yankees are effectively the property of the Steinbrenner family, while the Knicks are owned by the Madison Square Garden Company.

Elsewhere, there are a number of investors who have built portfolios of clubs across Europe and other parts of the world. Red Bull, the Austrian beverage company, has – rather controversially – invested in clubs in Salzburg, Leipzig, New York and Ghana. Sceptics suggest that the future of big-time football rests in the hands of the corporate world.

If that’s true, investment opportunities for the average retail investor may be limited to the lower leagues and should be accompanied by realistic expectations of returns, which may not necessarily be monetary. Even the possibility of a portfolio investment, through a fund dedicated to football, has its challenges. Generally, shares of football clubs are illiquid and performance can be stagnant. That said, there are professional funds dedicated to football clubs and players, but these are not widely available. Some, such as the Football Talent Fund, floundered due to regulatory issues.

At the highest level, however, the acquisition of a club can often be part of an overall basket of assets that provide exposure for the owner, and in the case of football, there are few more visible or compelling activities across the globe.