Jim Totty and Richard Burrett of Earth Capital consider the theory and practice of measuring impacts and outcomes from private equity investing, based on a 'whole life' scorecard approach

As global capital markets embrace the urgent need for impact investing, private equity is at the forefront of this dramatic change. However, there is currently a wide range of bespoke approaches to impact measurement, and the lack of standard methodologies in private equity is hindering capital inflows. In this article, we set out a straightforward framework for impact measurement in the private markets.

At Earth Capital, we believe a ‘whole life’ scorecard is the approach that delivers consistent and robust impact measurement in private markets. It is easy and quick to implement in a ‘data-poor’ private equity environment, and allows comparison and aggregation across portfolios.

Dramatic market growth in impact investingThere has been a rapid increase in impact investing in recent years. At the end of 2018, Morgan Stanley Wealth Management commented that 84% of investors say they are interested in impact investing or putting their money behind companies that make a positive difference in the world. In April 2019, the Global Impact Investing Network (GIIN) assessed the size of the global impact investing market to be US$502bn. Yet this still remains a small subset of environmental, social and governance (ESG) integration and responsible investment. The Principles for Responsible Investment membership represents assets under management in excess of US$80tn. A key question is whether a simple framework for impact and its measurement is needed to promote positive impact investing, as opposed to investment that is merely doing ‘less harm’ through ESG integration.

Key differences between impact investing and ESG integration

Both the agreement of climate goals in the Paris Agreement in December 2015, and the broader delivery of the 17 UN Sustainable Development Goals (SDGs) from earlier that year, have done much to increase the flow of capital into the low carbon, sustainable and ‘just’ economy, particularly galvanising new investor focus in impact investing. However there needs to be a clear recognition of the distinction between traditional ESG integration and the new impact investing market.

Impact investing involves making investments with the conscious ‘forward looking’ intention to generate positive, measurable, social and environmental impact, alongside a financial return. This goes beyond ESG integration which is only a ‘backwards-looking’ reporting of ESG performance, and which may still permit investment in industries that can have negative environmental and social outcomes. In contrast impact investing looks to anticipate future societal and environmental needs and deliver positive returns for people, planet and profit.

ESG is often seen as changing finance, but only impact investing is consciously financing change

An ESG integration strategy identifies companies in a sector that perform better than peers in ESG metrics, and implements tilts, exclusions, or active engagement to weight and improve portfolios’ ESG performance. If this is not combined with some form of exclusion based screening, it may leave portfolios with significant residual exposure to a range of fossil fuel intensive industries, or sectors such as tobacco. An impact investing strategy, on the other hand, takes concrete action by investing in ‘pureplay’ investments focused on positive environmental and social outcomes. Both strategies seek to improve outcomes, but impact investing allows investors to make more focused and measurable contributions. ESG is often seen as changing finance, but only impact investing is consciously financing change.

Is private equity the key to impact investing?

Private equity, unlike other asset classes, offers a ‘pureplay’ exposure to impact investing by investing in new business models in technology and services. ESG integration in large cap listed equity and fixed income tends to focus on long-established businesses where, although data is becoming available, improvements in environmental and social performance may be slow, long-term projects. In contrast, private equity allows immediate exposure to pureplay impact-focused businesses, with new business models and more nimble market penetration.

Impact measurement in private equity – the story so far

A successful impact strategy must include robust measurement, and to date most private equity general partnerships (GPs) have evolved their own measurement methodologies, either entirely in-house or with the help of sustainability consultancies. Unfortunately, this wide range of bespoke methodologies is not helpful to capital markets, which seek standardisation. For both limited partnerships (LPs) and investee companies, significant time has to be invested in educating, explaining and implementing each GP’s approach. Further impact measurement shortcomings can include unclear objectives, poor data collection and analysis, inconsistent reporting and a lack of clear standards for what qualifies as an impact investment.

The urgency to exploit the investment opportunities in impact investing means that confusion over standards must not be allowed to impede inflows of capital. The current wide number of bespoke approaches now needs to coalesce rapidly around a small number of simple, consistent and understandable impact measurement standards. This pressure is analogous to the development of accounting standards from the 1930s onwards in response to events such as the 1929 stock market crash. Although there may be longer-term improvements of impact standards in parallel, there is no time to wait for this to make investments.

We cannot let the ‘perfect’ be the enemy of the ‘good’, time is pressing to make impact investments.

Cutting through the complexity in private equity impact measurement

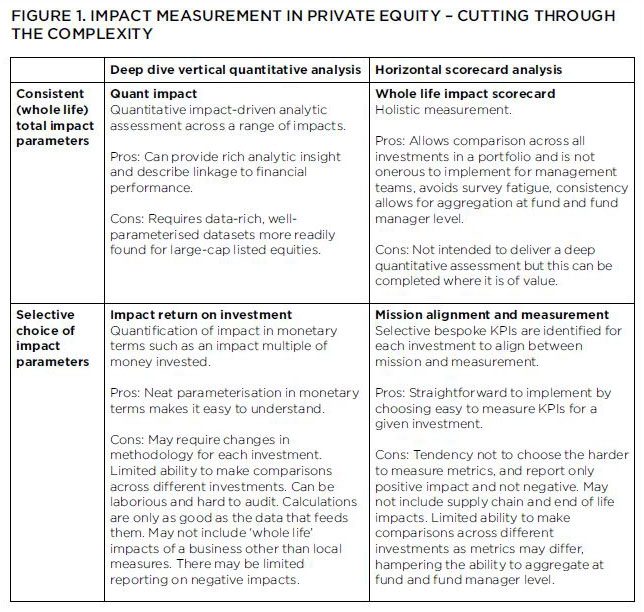

We have reviewed the approaches currently used by private equity funds and have identified key themes that characterise different approaches taken. These are set out in figure 1 below, ‘Impact measurement in private equity – cutting through the complexity’, which is defined by two key questions for an impact measurement approach in private equity:

- Do you attempt to measure all investments with the same set of consistent whole life measures and data sets, or do you select bespoke sets for each situation?

- Do you do ‘deep dive’ ‘vertical’ quantitative analysis, or do you apply a shallower ‘horizontal’ scorecard approach?

Although the ‘quant impact’ approach is normally only used for listed equity strategies, the other three methodologies are in current use in impact private equity.

Quantitative analysis such as the ‘return on investment’ can neatly parameterise in dollar terms, but it is only as good as the data it is fed, and can be complex to implement and hard to audit. If data is poorly parameterised or incomplete, its analysis risks becoming spurious. Whilst the advent of blockchain or 'big data' approaches may assist in these, this remains a future development for private equity.

Selective ‘self-certified’ choices of KPI’s bespoke to each investment are appealing from an ease of adoption perspective but have significant drawbacks. These ‘mission alignment and measurement’ scorecards may choose only metrics that are easily measurable and look good. This can go hand in hand with a tendency to report only positive impact and avoid negative impact. It is especially vital to include supply chain and end of life impacts in measurement. The 2017 GIIN survey The state of impact measurement and management practice reveals that two-thirds of the impact investment sector only report positive impact, and only 18% measure negative and/or net impact for all of their investments. Even if this is addressed, bespoke KPIs will limit the ability to make a comparison of impact across different investments or to consolidate at fund and fund manager level.

There are a number of further approaches used in impact investing:

- Social impact measurement often uses ‘Theory of Change’ models, however, in a ‘live’ investment environment, the goal setting and measurement this involves is effectively the same as the mission alignment and measurement selective scorecard above, ie, identify KPIs bespoke to each investment, and then measure against them.

- Control groups are an academic approach to compare investment outcomes against a randomised control group. This can be challenging to implement in many real-world investment situations, as a duplicate potential investment has to be identified and then kept ‘uninvested’ and measured for the lifetime of the actual investment.

- ‘Additionality’ is also studied in impact investing but its quantification in real investment situations has to be through either:

- ‘Full measurement’ approaches which require control groups with the inherent difficulties explained above, or

- a KPI scorecard ‘low, medium or high’ which is a subset of the KPIs in the ‘mission alignment and measurement’ discussed above.

- SDG based labelling of impact strategies can be used for high level sector mapping, but the SDGs do not lend themselves easily to quantitative holistic impact measurement. They can, nonetheless, help to define impact metrics for specific target areas.

At Earth Capital, we believe a ‘whole life’ scorecard is the approach that delivers consistent and robust impact measurement in private markets. Key performance indicators are selected across ESG tests. The scorecard is easy to implement and is not onerous to complete with portfolio companies. Start of life and end of life impacts are included, and negative impacts are considered and measured. The ‘whole life’ scorecard allows portfolio company improvement to be measured over time, comparisons can be made between investments, and it allows aggregation at both the fund and fund manager level.

Market developments

Impact Investing methodologies will continue to evolve for many years to come, with ongoing improvements in the choice and range of metrics in impact scorecards. The IFC’s Impact Management Framework and the Impact Management Project are invaluable initiatives in this evolution process.

What is clear however is that the global urgency of environmental and social needs means that impact investment must press ahead at speed. The simple measurement approaches set out in this article provide the measurement framework to enable this. Private market asset owners and asset managers will benefit from quick and straightforward impact approaches across both existing portfolios and new investments.

Conclusions

Impact investing is growing rapidly in response to rising demand for strategies that go beyond ESG integration to produce measurable societal benefits and support a transition to low carbon and sustainable and just economy. Private equity is at the forefront of this transition. The ability to effectively measure and manage desired impacts is critical to ensuring that impact investments fulfil their stated objectives. Reliable metrics are needed to avoid the potential risk of 'impact washing', and using the ‘impact’ label primarily for marketing and asset gathering purposes. Impact measurement and management should be embedded in all phases of the investment process, from initial due diligence and project selection to investee company performance management and reporting.

Quantitative analysis such as the return on investment can neatly parameterise in dollar terms. However, it is only as good as the data it is fed and can be complex to implement. Although this lends itself to large cap public market securities where high quality market data might support robust ‘quant’ analysis, it will remain challenging to implement this in the private equity space.

Selective ‘self-certified’ ‘mission alignment and measurement’ choices of KPIs bespoke to each investment are appealing from an ease of adoption perspective but currently have a tendency to only report positive, not negative impact, and to ignore whole life impacts. They limit the ability to make a comparison of impact across different investments or to consolidate at fund and fund manager level.

As a result, we believe a ‘whole life’ scorecard is the approach that delivers consistent and robust impact measurement in private markets. It is easy to implement, and allows comparison and aggregation across portfolios.

About Earth Capital

Earth Capital, a pioneer in impact investing since 2008, is a growth capital private equity investment manager totally focused towards sustainability – investing capital into sustainable technologies for resource efficiencies and renewable clean energy infrastructure opportunities. It invests globally in companies and infrastructure which address the challenges of sustainable development, such as climate change, energy, food and water security. It focuses on the commercialisation and deployment of proven, sustainable technologies, in various industries including agriculture, clean industry, energy generation, resource and energy efficiency, waste and water.

Earth Capital, a pioneer in impact investing since 2008, is a growth capital private equity investment manager totally focused towards sustainability – investing capital into sustainable technologies for resource efficiencies and renewable clean energy infrastructure opportunities. It invests globally in companies and infrastructure which address the challenges of sustainable development, such as climate change, energy, food and water security. It focuses on the commercialisation and deployment of proven, sustainable technologies, in various industries including agriculture, clean industry, energy generation, resource and energy efficiency, waste and water.

Its Earth Dividend™ impact measurement methodology is a ‘whole life’ scorecard developed for the private markets, based upon net ESG impacts and benefits. The Earth Dividend™ provides an annual measure of an investment’s sustainable development impact. It has been developed by Earth Capital’s in-house sustainable development specialists following review of international best practice approaches to the assessment, reporting and assurance of ESG issues and performance.

The Earth Dividend™ is established as part of the due diligence process and reported annually. The sustainability team works to identify improvements in each area where they add value and make commercial sense. The plan targets annual improvements in the investment's contribution to sustainable development to enhance the underlying commercial performance of the asset and help to maximise value on exit. The Earth Dividend™ enables a holistic understanding of the risk and impact of sustainable development; an understanding of where investments make a positive or negative impact; and identifies those areas where a business may be made more resilient and from where more value can be extracted.

The Earth Dividend™ is established as part of the due diligence process and reported annually. The sustainability team works to identify improvements in each area where they add value and make commercial sense. The plan targets annual improvements in the investment's contribution to sustainable development to enhance the underlying commercial performance of the asset and help to maximise value on exit. The Earth Dividend™ enables a holistic understanding of the risk and impact of sustainable development; an understanding of where investments make a positive or negative impact; and identifies those areas where a business may be made more resilient and from where more value can be extracted.

Read about The Earth Dividend™

Jim Totty, pictured top left, is managing partner at Earth Capital.

Richard Burrett, pictured bottom left, is chief sustainability officer at Earth Capital.

This article was originally published in the February 2020 print edition of Review of Financial Markets, the academic section of The Review.

The full print edition PDF of The Review is now available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.