The UK has an ageing population. According to charity Age UK, by 2030 more than 20% of the population will be aged over 65 and represent a significant market segment for financial planners. Growing old can present the idea of downsizing, due to many reasons, such as the cost of running a property, appropriate access, and simply not needing as much space. Some living in large homes may not want or need to downsize, but for some it could mean that there is a large amount of illiquid capital in their portfolio if the property is included, which could cause cashflow problems later. How should clients be advised on this, and how can innovative products help achieve a client’s objectives?

The financial planning demands of this client base are varied and complex, and are not confined to pensions. Financial planners do not expect to simply recommend downsizing as a solution to freeing up cash. Some elderly occupants may require wheelchair access, or proximity to facilities, which makes it more challenging to find a suitable alternative to their current home. The ageing population has – according to research by the London-based Centre for the Study of Financial Innovation – exposed a shortage of suitable housing for older people.

It has been a long journey for equity release products

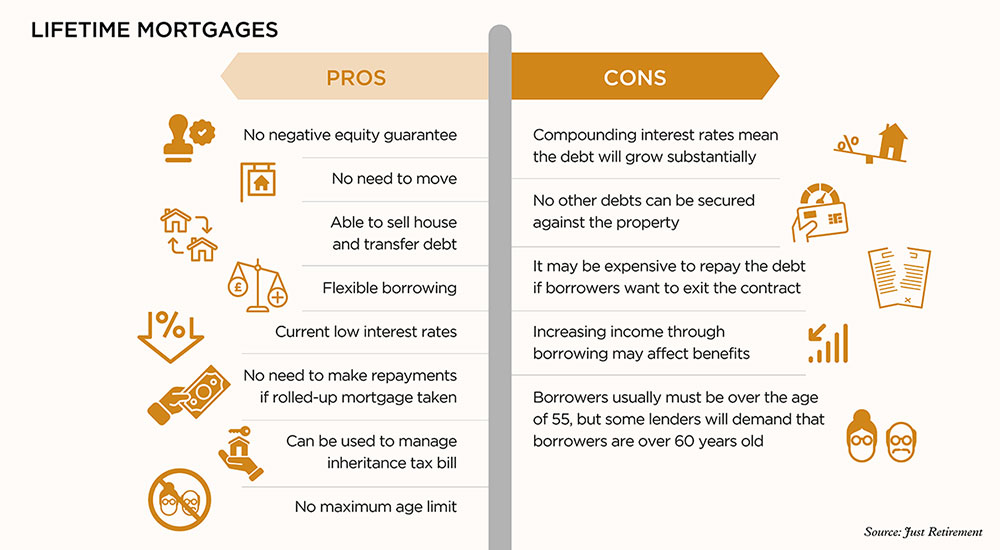

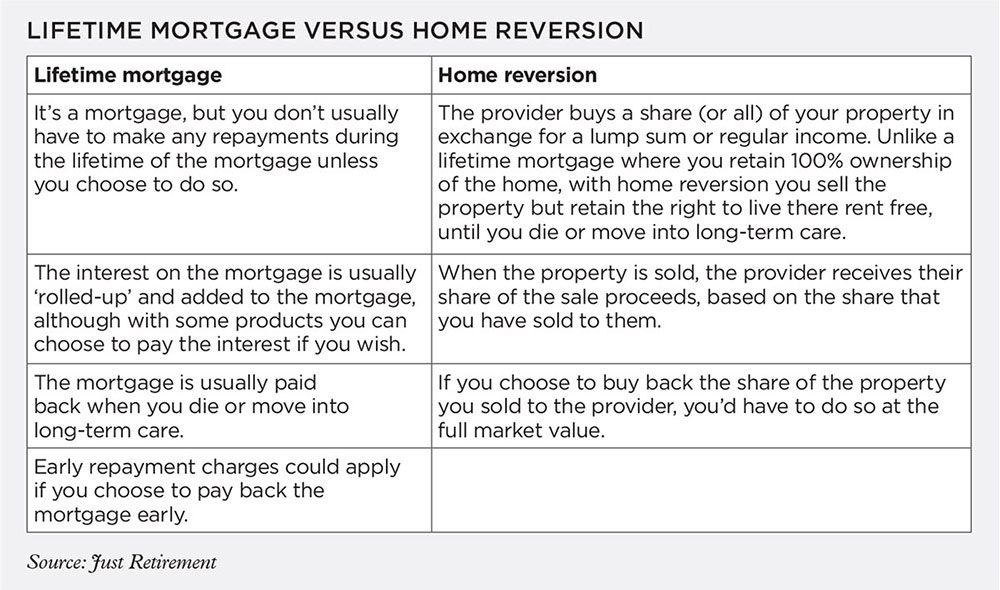

Financial planners are reviewing the newer equity release products as a source of possible solutions. Lifetime mortgages fall under this equity release umbrella. Aimed at the over-55s and regulated by the FCA, a lifetime mortgage is a debt secured against a percentage of the home that is repaid along with any interest on the death of the borrower (or last borrower if a joint mortgage). The house will usually need to be sold, but surviving family can repay the debt without a sale if they have the available funds. Borrowers can choose to ring-fence a portion of the property’s value to pass to loved ones.

Typically, lenders require that borrowers stay in the home and maintain the property. If they choose to move out, the home is sold and normally the debt is repaid at that point, but lenders may also allow the debt to transfer to a new property.

Such products are proving increasingly popular. Figures published in April 2019 by the Equity Release Council, which registers reputable providers, show that the sector enjoyed the biggest annual increase in customer numbers during 2018, compared to other equity release products. According to the Equity Release Council, there were 46,379 new lifetime mortgages taken out in 2018 compared to 37,014 the previous year – an increase of 25%.

Lifetime mortgage options There are different kinds of lifetime mortgages, but they usually fall into two distinct types. One is an interest roll-up mortgage, where a lump sum or regular amount is paid, against which interest is charged and added to the loan. The amount borrowed, including the rolled-up interest, is repaid only when the home is sold. The second type is an interest-paying mortgage, which provides a lump sum and borrowers make monthly or ad hoc payments. Some plans also allow borrowers to pay off capital as well as interest.

Simon Chalk, founder of equity release specialist Laterliving now! and member of the advisory board of the Society of Later Life Advisers (SOLLA), says: “There are lots of providers and products. Clients can pay some of the interest, all of the interest and some of the capital back. In a way, clients can create or design their own mortgage to shape their needs and budget.”

People usually only borrow against their homes as a last resort

Other equity release options that differ from lifetime mortgages include home reversion products, where the homeowner sells all or a share of their home – rather than borrows – in exchange for a lump sum of money or a lifetime of regular income, while retaining ownership of the remaining share. This differs from a lifetime mortgage in that the owner has relinquished ownership of all or a share of their home. However, no interest is charged under this option, and when the homeowner dies or requires long-term care due to ill health and goes into a residential or nursing home, the property is sold and the provider receives their share of the sale proceeds, based on the share that has been sold to them.

With a home reversion plan, the client knows precisely what they have parted with and, equally, what has been ring-fenced for later use, possibly to leave in a will to specific family members.

However, home reversion means selling either all or part of the value of the home to someone else, usually at a discounted price. It is not possible to benefit from appreciation in house prices for the part that has been sold, once the deal is done, and should the homeowner die early, their estate has effectively lost out on escalation in value of that proportion of that asset. Consequently, these types of options are largely seen as less favourable than a lifetime mortgage, which provides more flexibility.

While enjoying a renaissance, it has been a long journey for equity release products, which suffered a collapse in reputation towards the end of the 1980s. According to a 2001 report commissioned by the Council of Mortgage Lenders, the early equity release days of the 1980s and very early 1990s saw some borrowers use their loans to invest in stock market-related investment bonds, which were supposed to pay enough income to cover the mortgage and provide an additional payment for investors.

While enjoying a renaissance, it has been a long journey for equity release products, which suffered a collapse in reputation towards the end of the 1980s. According to a 2001 report commissioned by the Council of Mortgage Lenders, the early equity release days of the 1980s and very early 1990s saw some borrowers use their loans to invest in stock market-related investment bonds, which were supposed to pay enough income to cover the mortgage and provide an additional payment for investors.

However, subsequent work by MPs and the insurance ombudsman revealed that such loans were taken unadvised and borrowers were encouraged by salespeople to enter the deals. These bonds failed to deliver following the stock market crash of 1988, just at the point at which house prices fell and interest rates rose on mortgages, leaving people saddled with debt. This resulted in some homeowners being effectively trapped in their homes as it was financially unviable to sell up and move. This caused many homeowners a great deal of distress at a time when they would have reasonably been expecting to be enjoying their retirement.

That all changed in 1991 with the formation of trade body Safe Home Income Plans – now the Equity Release Council – which imposed standards to protect borrowers (see box out).

The Equity Release Council’s standards to protect borrowers

1. Interest rates should be fixed or, if they are variable, capped for the life of the loan

2. Borrowers have the right to remain in their property for life or until they need to move into long-term care, provided the property is the main residence and the contract is kept

3. Borrowers have the right to move to another property acceptable to the product provider as continuing security for their equity release loan

4. The product must have a ‘no negative equity’ guarantee. When property is sold, and agents’ and solicitors’ fees have been paid, even if the amount left is not enough to repay the outstanding loan to the provider, neither the borrower nor their estate will be liable to pay any more.

Roger Jackson CFPTM Chartered MCSI, director of financial planning at Financial Management Bureau, says that, as a result of these changes, lifetime mortgages are much more weighted in favour of the borrower than the equity release products pre-1991.

Suitable borrowersHowever, that does not mean lifetime mortgages are considered suitable for everyone. Roger says the products are typically limited to clients in need of extra income and the only asset against which they can raise cash is their home.

“The types of people opting for lifetime mortgages are those who are asset rich and cash poor. They have lots of equity in their home but not much in the bank. People usually only borrow against their homes as a last resort,” he adds.

Consequently, it is unusual for a financial planner to work with clients solely in need of a lifetime mortgage. These products are usually part of a specialist equity release adviser’s remit.

Craig Palfrey CFPTM Chartered MCSI, managing partner at Penguin Wealth, explains that there is “only so much financial planning one can do” in a situation where a client only has a house and a limited income.

Keeping it in the family In cases where people want to borrow together, joint lifetime mortgages work in the same way as they do for individuals. Certain criteria must be met, notably that both applicants are of eligible age. The amount available to borrow may be limited to the youngest person on the deeds, both applicants must be the homeowners, and they should be married, civil partners or living as partners.

Joint lifetime mortgages do not have to be repaid until the second person on the mortgage either dies or moves into long-term care. However, there are issues to be considered, specifically covering the costs of long-term care of both borrowers. Local authorities do means testing to check eligibility for help towards long-term care costs, and homes are an eligible asset.

However, if one of the homeowners still resides in the property, the local authority will not take the house into consideration as part of funding for long-term care. Cash is taken into consideration, however, which means any equity released from the home would be taken into account in local authority assessments and might need to be used by borrowers to pay the care costs.

Financial planners need to do thorough analysis to understand how the lifetime mortgage might impact long-term care funding, for example by ensuring clients only draw the cash they need and not large amounts of excess cash. They should also help clients separate cash assets according to who owns what, and make sure the local authority only takes into account each individual’s assets.

Lifetime mortgages can pay for long-term care, so long as the client stays in their home. The flexibility of taking an income as and when it is needed, or in lump sums, makes lifetime mortgages a practical way of meeting the costs of home care. However, it is important that clients are sure they can cover the cost of care using the lifetime mortgage and, crucially, that they know that the cost of care can increase unexpectedly.

If the borrowing requirements have changed significantly as a result of funding long-term care, the client may need support, since lifetime mortgages are not typically renegotiated. A drawdown mortgage adds flexibility and could be considered at the outset to allow borrowers to control the sums taken.

Roger says that in this kind of situation the client can only borrow a certain percentage of the equity content of the home depending on their age. Financial planners must remember that this percentage varies from provider to provider and product to product.

Roger says that in this kind of situation the client can only borrow a certain percentage of the equity content of the home depending on their age. Financial planners must remember that this percentage varies from provider to provider and product to product.

There are also issues with attempting to take a second lifetime mortgage. Roger says: “The mortgage provider would want a first charge on the property, rather than a second charge. Bringing another provider in may prove tricky. The client’s best option would be to return to their existing provider and see about increasing the cover level (if possible).”

IHT solutionFinancial planners could also ensure that clients are made aware of the potential impact that a lifetime mortgage might have on their children. There are pitfalls to avoid when managing inheritance tax (IHT) if the lifetime mortgage is given as a gift. First, if the donor dies within seven years of the gift, it will be liable for tax, and any income from the gift may be subject to capital gains tax. Second, since the homeowners remain in the property, passing on the wealth to family may be considered a gift with reversion of benefit and liable to IHT.

Lifetime mortgage case study

Cedar House Financial Services recently recommended a lifetime mortgage for a 73-year-old widowed client with a terminal illness. The client had an interest-only mortgage that had matured, along with £200,000 of additional secured and unsecured borrowing.

She was not in a position to downsize and could no longer afford to meet her monthly commitments. Her creditors began threatening legal action to retrieve their debts. We were able to arrange a lifetime mortgage for our client, using her current medical condition to obtain an enhanced facility on the new lifetime mortgage. The funds raised paid off all creditors, with an excess lump sum going towards care fees at home. Most importantly, the client’s mental wellbeing significantly improved, with the pressure from her creditors removed instantly.

Richard Kafton CFPTM Chartered MCSI is managing director of Cedar House Financial Services and an accredited member of SOLLA.

The product can also be useful when financial planning for IHT mitigation. If clients choose to borrow against their property and pass the cash to loved ones before they die, this has the benefit of reducing the size of the estate and could reduce IHT, which is payable on estates worth £325,000 and above for individuals and £650,000 for couples. There is an additional ‘top-up’ IHT break of £125,000, known as the residence nil rate band, available on homes passed to direct descendants on deaths after 6 April 2017.

However, any such gifts are only exempt from IHT if the donor survives for a period of seven years from the date of the gift. In addition, as the debt increases thanks to rising interest, the estate reduces still further.

Craig says he has arranged lifetime mortgages as part of IHT planning to help parents provide for their grown-up children, but says equity release is not a “go-to IHT planning solution”.

Last port of callSimon agrees that lifetime mortgages are a rare occurrence in conversations with clients and recommends calling on other sources of capital before borrowing against a home.

“People should delay equity release as long as possible. If they have a decent amount in the bank, say a five-figure sum, that should be used as a priority. Even with low interest rates, a debt against the home is going to build up over time,” he says.

Craig says that he prefers to talk to clients about downsizing rather than borrowing against equity release, arguing that because of compounding interest, the debt grows quickly.

However, Roger notes that there are occasions when individuals are so emotionally invested in their homes, or there are practical reasons why moving is undesirable, that lifetime mortgages are a viable option.

He says: “You can recommend downsizing, but clients may have spent 30 or 40 years creating their perfect home and it can be incredibly important to them to stay. Lifetime mortgages might be a solution here.”

Lifetime mortgages are another tool in the kit for financial planners helping those in later life, but they are limited. They may yet become more sophisticated and appeal to a wider section of clients as the population ages and more solutions come to market, but, at present, these planning options are a somewhat niche solution.

This article was originally published in the October 2019 print edition of The Review. All members, excluding student members, are eligible to receive the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting ‘Yes’.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.