A recent PRA report on SMCR provides feedback on the regime so far, but is its optimism premature?

by Lindsay Reid

All the interviewees featured in this piece wished to remain anonymous, given the sensitivities with regard to discussing SMCR compliance.

In December 2020, the PRA released its Evaluation of the Senior Managers and Certification Regime (SMCR) report. Its findings broadly indicate that the regime – see boxout at the end of the article for a brief overview of its implementation and aim – is having a positive impact and that there is much to be upbeat about. Around 95% of the 120 firms surveyed say that SMCR is having a "positive effect on individual behaviour".

But the survey sample represents less than 10% of the 1,500 financial institutions regulated by the PRA and the smallest fraction (0.2%) of the 60,000-odd businesses that have been subject to the SMCR regime since 9 December 2019 – any of which could cause harm and may lead to consumers losing confidence in the financial services sector.

And, while some firms’ CEOs may comment that there’s always room for improvement in many aspects of running a company, no leader is ever likely to say they are not fully committed to SMCR. As one retired compliance officer, who wishes to remain anonymous, tells The Review, "Most firms say they have changed their working practices but how do they evaluate the success of these changes? What interests me is the adage 'what doesn't get measured, doesn't get managed'."

A closer look at the figures

The report identifies nine key areas for improvements, which include refining the "data collection and analysis of diversity among the senior management population", collective accountability, and the PRA at some point adding an "inventory of guidance and expectations" to help senior managers handle new and emerging risks and accordingly adjust the dials for both their Prescribed Responsibilities and their individual accountability.

The paper states that "97% of firms reported integrating (to some degree) the SMCR in their business-as-usual practices in ways that went beyond the simple requirement to demonstrate regulatory compliance" and "some firms provided specific examples of how the SMCR had prompted improvements in internal processes".

And yet there was the Tullett Prebon fine in 2019 for its failure to conduct its business with due skill, care and diligence; failing to have adequate risk management systems; and failing to be open and cooperative with the FCA. Not only a stark reminder to the regulators of the financial services sector as to why changes were needed, but also, that some firms were not 'getting it'.

"SMCR’s new dawn seems to have gotten a bit lost amid other concerns and pressures"

The PRA report says that 83% of firms say "SMCR has changed their working practices for the better". But as one compliance officer for a private wealth firm tells The Review, "It’s much harder to gauge firm culture and behaviours with so many not in the office. Some have been productive, others not so. For some it’s a training issue, others it’s attitude." And with regards to working from home as a challenge to the culture aspect of SMCR, a senior compliance officer adds, "I think there may have been a degree of regulatory leniency which could be coming to an end shortly".

The report concludes that the sector and regulators "view the SMCR as performing an instrumental role in supporting better prudential and conduct outcomes, in line with International Monetary Fund expectations" and that "the evidence to date does not suggest the need for major changes to the approach taken".

Not all of the positive changes happening in firms and cited in the report can be attributable to SMCR, though. Major firms with the budget for committed community outreach programmes have increasingly and enthusiastically embraced their diversity and inclusion (D&I) programmes and activities as a means to bolster their credentials and reputation in the market, which echo the aims of SMCR. For example, Deutsche Bank UK has a university outreach programme called GROW – Graduate Outreach for Women – "developed to help women discover where a career in banking could take them".

Along with D&I, environmental, social and governance, the Task Force on Climate-related Financial Disclosures, Sustainable Finance Disclosure Regulation and the United Nations Principles for Responsible Investment (UNPRI) have played a key role in driving changes to behaviours and attitudes in corporate culture. For example, the UNPRI boasts 7,000 corporate signatories across 135 countries and is the world's largest voluntary corporate sustainability initiative.

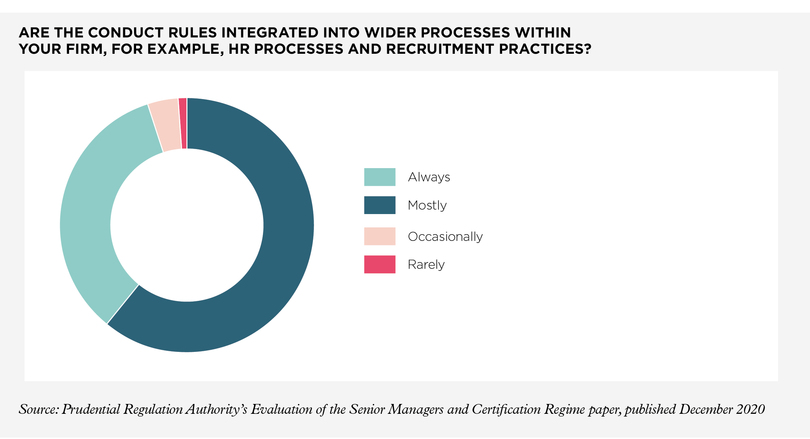

Job applicants now demand to see evidence of ethical practices, behaviour and conduct (principle of good stewardship) before aligning their allegiances. Increasingly, investors are interested in firms’ approaches to sustainability and ethical investing. The SMCR conduct rules have been integrated into HR and recruitment practices for 95% of surveyed firms, "at least most of the time", and 5% say that this is done occasionally or rarely.

But here’s the challenge to the good behaviours, habits and practices. As firms get to grips with the knottiness of economic recovery in the post-pandemic, Brexit world – how can regulators be confident that standards will not slip again? "SMCR’s new dawn seems to have gotten a bit lost amid other concerns and pressures," a senior compliance officer of a mid-size bank tells The Review.

Since 2016, firms have been overwhelmed by the cost and impact of implementing a tsunami of regulatory changes (such as Markets in Financial Instruments Directive II and the General Data Protection Regulation) while striving to remain sustainable and profitable. "Prevention of financial crime and the facilitation of tax evasion are much bigger concerns that are also perhaps indicative of a firm’s culture," according to the anti-money laundering officer for the UK branch of a foreign bank.

Can we expect to witness dynamic and doubtless, uncomfortable tensions across boardrooms, departments and functions as firms seek to optimise business-first ways out of the latest crisis at the expense of all the good governance and improvements in culture, behaviours, conduct and practice up to now?

It’s happened before (such as in foreign exchange and London interbank offered rate fixing) and this could mean that the optimism evident in the evaluation paper on SMCR report is a little premature.