It's predicted that 21% of advisers will retire in the UK in the next five years, according to the Heath Report Three, published in January 2019. And a GlobalData report on the financial adviser market, published in February 2019, says that 8.4% of advisers are already considering exiting the profession, providing a steady pipeline for acquirers.

The Heath Report Three also forecasts that 40–50% of advisers are planning to exit the independent financial adviser profession in the next ten years – not necessarily through retirement. Alongside this, professionals are being driven out by regulatory burdens and pressures on fees, reports GlobalData.

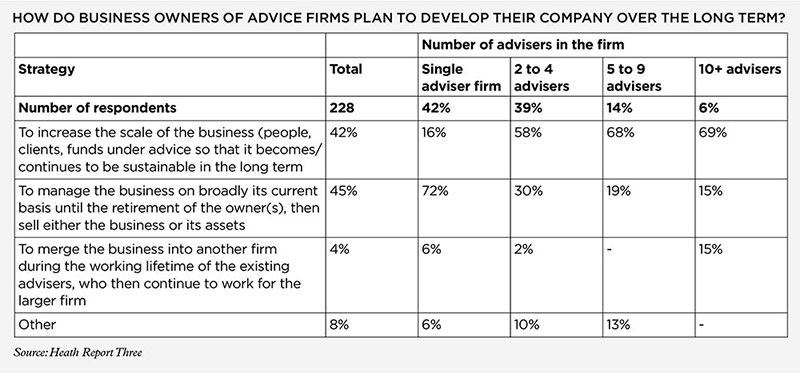

According to the Heath Report Three, nearly half (45%) of advisers plan to sell their business or assets, which is good news for consolidators who have been snapping up advisory businesses for the past few years. This article explores what business owners need to know before they make a deal.

This demand for advisory businesses is also encouraging for those who want to cash in their businesses without selling out their clients. GlobalData reports that 11.8% of advisers see consolidation as a good opportunity, meaning the majority would perhaps prefer to sell their business to a fellow adviser whose interests are aligned with their own.

This demand for advisory businesses is also encouraging for those who want to cash in their businesses without selling out their clients. GlobalData reports that 11.8% of advisers see consolidation as a good opportunity, meaning the majority would perhaps prefer to sell their business to a fellow adviser whose interests are aligned with their own.

Numerous factors are driving financial advisers out of the sector – the average age of a financial adviser is now close to 50 years. However, the regulatory burdens are growing and not just from domestic regulator the FCA; the second Markets in Financial Instruments Directive from the European Union brings its own set of complexities. Pensions freedom and choice has driven defined benefit members to the advice sector, as they consider transfers out bring with them increased liability for advisers.

At the same time, collapses of investment firms – such as those involved in the issuance of mini-bonds including Independent Portfolio Managers in November 2017 and London Capital & Finance in November 2019 – all increase compensation payouts by the Financial Ombudsman Service (FOS).

Top tips for business owners

1. Be clear in what you want from

the sale

2. Be honest about whether you can work for the buyer's company

3. Make sure the sale is in your clients' best interests

4. Provide good-quality management information and data for acquirers

5. Think about the implications for your staff

6. Conduct thorough due diligence on potential buyers

This is driving concern about the ability to meet personal indemnity insurance premiums since the FOS increased compensation levels from 1 April 2019. The limit increased from £150,000 to £350,000 for complaints about actions by firms on or after that date. For complaints about actions before 1 April that were referred to the FOS after that date, the limit has risen to £160,000.

The FCA has also confirmed that both award limits will be automatically adjusted every year to ensure they keep pace with inflation.

All of this combines to make financial planning and advice an increasingly expensive business.

The mergers and acquisitions market has been buoyant for a while and deal volumes in the financial services sector increased by 4.9% between 2017 and 2018, according to a report from Experian. However, ensuring a successful sale is a delicate business. This is all against the backdrop of Brexit uncertainties and recession fears, which are piling further pressure on business owners.

Know yourself

Steven Fine, managing director at Growth Focus, a business that helps financial planners sell their business, says the sales process must begin with a fact-finding mission – much like financial planners conduct with their own clients – to establish objectives and goals.

Steven says: “The first thing we ask owners thinking about an exit is to consider their ideal scenario. Do they want to retire or carry on working in the buyer’s organisation? Over what time frame do they want to exit? Once we know what they want, we can work backwards from there.”

Steven says potential business owners looking to sell need to complete a thorough assessment of their own expectations, before they can decide how, when and where to sell. The next step is to understand the options.

There are numerous ways in which business owners can take some or all of their ‘chips off the table’ – sell some or all of the business without negatively impacting clients. Steven says these typically include an immediate sale, in which the business is acquired outright in full by a new owner. New owners can be other independents, CISI Accredited Financial Planning Firms™ or large wealth management firms. More typically, acquisitions are made by larger businesses operating under a default centralised investment proposition or discretionary advice model.

Knowing oneself also means knowing one’s staff. It is important to inform employees about what might be happening and the timescales involved. Since employees are a major part of the business’ appeal to a buyer – and more than likely the seller wants to get the best for their staff – getting employee buy-in is essential, so they stay with the business and remain motivated. There needs to be strong lines of communication between owners and employees throughout the process. This should include finding out how different types of sale would impact the workforce, ways to keep them on board and to reassure them about their legal position and how their benefits are protected.

Depending on how a business is structured, business owners can also consider selling tranches of equity to a new owner with the guarantee that the new partner buys the full balance at an agreed time. During this period, the business owner might agree to work for the new owner, and within these deals, there may be any number of additional agreements, for example, the business owner must meet performance targets before they can retire. Similarly, the buyer might have to agree to certain conditions that ensure the exiting planner’s clients are serviced appropriately.

Know your client

Whichever option the business owner chooses, the interests of their incumbent clients must be paramount. Financial planning is a people business; the asset that business owners are selling is the book of clients. It is imperative, therefore, that the sale does not impinge on their customers’ current service levels.

Protecting clients is also of particular interest to the FCA. The regulator’s 2017 Supervision review report, which covers acquisitions of financial businesses, is far from complimentary about how clients are considered during mergers and acquisitions.

FCA criticism of financial planning acquisitions

1. Details of the services offered by the new business and the associated level of charges were not provided to clients at the start of the relationship

2. Differences between the service offered by the new business/adviser and that provided by the previous business/adviser were not explained (for example, differences in frequency of reviews or rebalancing exercises)

3. Clients were not told about any difference to the tax (VAT) status of the ongoing service charge

4. Clients were not told they could opt out of any ongoing service the acquiring business intended to provide

5. Where historic advice responsibility was not taken over by the new business, clients were not told about this

6. Clients were not told how they could complain about advice given by the original business

Source: FCA

The FCA states: “We were disappointed overall that none of the firms assessed were able to consistently show that clients’ needs were suitably considered. While firms focused on the commercial benefits, they did not focus enough on how clients were impacted by the acquisition.”

The next stage is to get the firm in order. Dominic Rose, strategy and acquisitions director at Quilter Private Client Advisers, which completed 14 acquisitions in 2018 and a further six of financial advice firms, which included Petrus in 2019, says, “If you are preparing your firm for sale, make sure you have good-quality management information, as failing to do so will cause you to lose credibility with the buyer.”

Know your buyer

A critical decision for any financial planner is what type of buyer they want to work with. Many of the publicised deals involve large consolidators that buyout smaller financial planners, such as those involving Quilter, or the four acquisitions made by Fairstone Group. Although the latter is not a financial planning business itself, its acquisitions included Lofthouse Gate, a pension planner and asset manager, in the six months to September 2019. These approaches see the acquirer take over the financial planning business in its entirety, rebranding the firm and centralising the operation within the acquiring firm. But this is not the only route.

Matthew Marais CFP®, founder of Vertus Capital, which loans money to independent financial planners to help them acquire other firms, says selling to similar, local financial planners can help align interests.

Matthew says: “A [traditional consolidator's] business model of choice delivers shareholder value, is scalable and helps manage risk. But is it good for the end client? Those models have a role to play in the market, but there is still a huge need for alternative solutions.”

Matthew says financial planners must have peace of mind that their clients will receive the same level of personalised service and that they are invested in the most suitable products and not obliged to join the buyer’s suite of offerings.

“These financial planners live in the same town as their clients, they go to the same pubs and know their families well. We need to offer business owners solutions that allow them to exit and leave their clients with a like-minded financial planner,” Matthew says.

However, Dominic believes that larger firms are just as capable as a small independent operation of providing a cultural fit, it just requires careful due diligence to ensure you fully understand the target company’s culture, and not just what you are being told about its culture.

“In a retiring adviser scenario, before a sale completes, we arrange for our advisers to meet the exiting adviser (where applicable) to ensure there will be a cultural fit and that the personalities of the client and the proposed new adviser match, as this aids the success of the relationship transfer,” he says.

Today’s financial planners looking to leave the market are fortunate in their timing. There are plenty of willing suitors, while vendor financing options are increasing. They can also consider selling shares of the company via employee ownership trusts that have seen an increase in popularity since 2014, when government made it easier to set up such arrangements. It may be tempting to rush to exit, but business owners are advised to take their time, make the right decision and ensure success for both themselves, their clients and their staff.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.