Regulatory change is rarely welcomed but in reality is far from an unusual event for financial planning firms. In this article I have considered six issues that may be keeping the directors and compliance officers in many financial planning firms awake at night.

MiFID II

The revisions to the MiFID framework in the new Markets in Financial Instruments Directive and the related Markets in Financial Instrument Regulation are collectively referred to as MiFID II. In terms of scope this is a vast canvas of regulation covering everything from the operation of capital markets to the giving of investment advice to individual clients.

MiFID II (Directive 2014/65/EU) and MiFIR (Regulation (EU) No 600/2015 on Markets in Financial Instruments) replaces and updates the precursor MiFID regime. The new MiFID II regime comes into force on 3 January 2018.

There is insufficient space in this article to summarise the changes. However, the changes are largely updates to regulatory requirements or practices to reflect developments that have taken place within financial markets, in product design or development and in service development over the decade that has elapsed since MiFID first came into force in 2007.

The sheer scale of the directive and regulation can appear overwhelming. However, the important thing to establish is what, if anything, will change in terms of types of client the firm will deal with, the services it offers or plans to offer and the products or investments that a financial planning firm deals with. For many firms it may be that the impact of MiFID is relatively slight, especially if those firms do not deal in securities and /or derivatives, do not carry out discretionary investment portfolio management and do not handle or hold client money or assets.

Some firms may find that they need to apply to the FCA to vary their Part IV Permission or seek a waiver from certain requirements. It is possible too that as the scope of permission influences capital and liquidity requirements, some firms may find they need to consider whether their prudential category may change.

It is really important that financial planning firms carry out appropriate mapping of MiFID requirements onto their existing business and identify what (if any) gaps crystallise. The firm will then be able to determine whether any action is required.

However, while MiFID II is a very wide scope regulatory change, only a relatively small part of the directive and regulation applies to a typical financial planning firm. The majority of financial planning firms (but not all) may find the direct impact of MiFID II is relatively slight.

SMCR extension

The FCA published its consultation paper CP17/25, on the extension of the Senior Managers and Certification Regime (SMCR) in late July 2017. The consultation sets out how the FCA proposes to amend and extend the SMCR, previously introduced for banks and major asset managers. (As in the previous regime, there will be a parallel regime for insurance companies.) The consultation closes on 3 November 2017. There are several key developments that will have a major impact upon firms, including financial planning firms.

The first point to note is that the current Approved Persons Regime will be replaced by the SMCR with effect from a date likely to be in the second half of 2018. The FCA has indicated that there may well be a transition giving firms up to 12 months to become fully compliant with the new regime.

Under the SMCR, the FCA will withdraw the current requirement for all persons in senior management and customer facing roles to be registered with the FCA as an Approved Person. In future only senior managers will be required to be registered.

The FCA will make firms and their senior managers responsible for vetting and certifying the fit and proper status of all staff in roles that have the potential to cause significant harm to the firm or its customers. This is a wide-ranging scope that transfers responsibility to the firm for initial assessment and continuing assessment of Certification status.

The current proposals do not include appointed representatives. However, the FCA has indicated it will consult separately on appointedrepresentatives later in 2017.

The consultation is lengthy and complex. Not all requirements will apply to all firms. There will be three tiers of application. There will be a ‘core regime’ applicable to most firms. The ‘enhanced regime’ will impose a more onerous requirement on larger and more complex firms while the ‘limited scope regime’ will provide a proportionately lighter touch for certain types of firms deemed to pose a lower risk. The regimes and the firms that will fall into them are set out below.

|

Core regime

|

Enhanced regime

|

Limited scope regime

|

- All firms except enhanced regime firms and limited scope firms

|

- Significant Prudential sourcebook for Investment Firms (IFPRU) firms

- Client Assets sourcebook (CASS) large firms

- Firms with assets under management (AUM) of £50bn or more

- Firms with total intermediary regulated business revenue of £35m

- Firms with annual regulated revenue generated by consumer credit lending of £100 million or more

- Firms that are mortgage lenders with 10,000 or more regulated mortgages outstanding

|

- Limited permission consumer credit firms

- Sole traders

- Authorised professional firms whose only regulated activities are non‑mainstream regulated activities

- Oil market participants

- Service companies

- Energy market participants

- Subsidiaries of local authorities or registered social landlords

- Insurance intermediaries whose principal business is not insurance intermediation and who only have permission to carry on insurance mediation activity in relation to non-investment insurance contracts

- Internally managed alternative investment funds

|

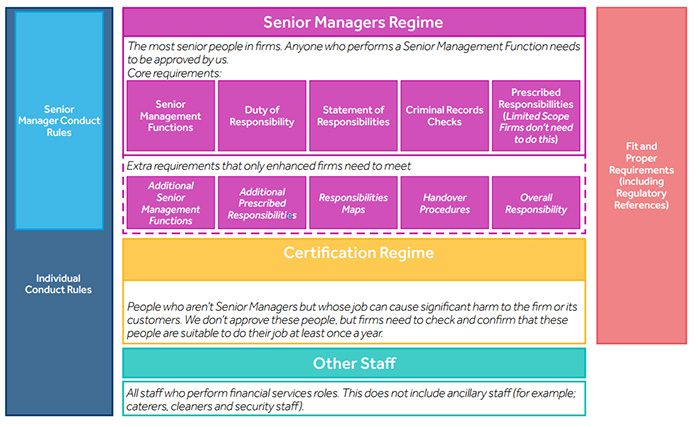

There is insufficient space in this article to provide details of the SMCR. However, the FCA has produced a helpful summary table in the consultation paper that gives a high-level overview of the proposed regime. I have reproduced the table below.

Source: FCA CP17/25

Note: Conduct Rules, the fit and proper requirements and regulatory references will apply to all non-executive directors, even if they are not a senior manager.

It will be vitally important that financial planning firms analyse how the SMCR will affect them. They must map the changes and assess how they will be able to deal with the assessment, referencing and record-keeping requirements for both senior managers and for those employees who will fall within the certification requirements.

Enterprise-wide risk assessment and risk management

The SMCR will means that firms will have to look afresh at the way their firm conducts its governance, risk management and compliance (GRC). However, while many smaller and medium-sized firms are relatively comfortable dealing with operational compliance and investment risk issues, they are often not comfortable or experienced in dealing with risk to their own business – the enterprise risks.

Stating the obvious, it is essential that risk assessment is carried out to identify the nature of the risks to be controlled and then to determine how best to mitigate, manage or control them. The important thing is not just to look at the obvious areas such as advice processes, suitability of advice, record-keeping, IT or financial controls but to look more widely across the firm and assess the major and minor issues that can seriously hamper or permanently damage a firm if they crystallise.

A major part of meeting the competence and fit and proper requirements under the SMCR will be for senior managers to be confident that all relevant risks have been identified and managed. Given the relatively low skills base within financial planning firms in the area of enterprise risk management (ERM), firms will be advised to consider how they can best add or gain access to relevant risk assessment and risk management expertise.

The General Data Protection Regulation

The General Data Protection Regulation (GDPR) is an EU regulation that will enhance data protection compared to the previous data protection regime.

Although the key principles of data privacy still hold true to the previous 1995 Data Protection directive, many changes have been introduced with the aim of enhancing the protection of citizen’s data.

The GDPR comes into force on 25 May 2018. Space prohibits a lengthy summary of its provisions but the main changes and enhancements are in relation to:

- Increased territorial scope (extra-territorial applicability)

- Penalties

- Consent

- Notification of breaches

- Right to access

- Right to be forgotten

- Data portability

- Privacy by design

- Data protection officers

There are many sources of information on the GDPR but there is now some urgency for financial planning firms to map the GDPR requirement onto their existing data protection processes and procedures and identify any gaps. This gap analysis will indicate whether any action is required by the firms or any of its critical suppliers.

FCA consultation on pension transfers and suitability

Level 6 Certificate in Pension Transfers & Planning Advice

Take advantage of our introductory offer of 40% off the exam fee and workbook

In June, the FCA issue a consultation (CP17/16) setting out proposals to further clarify what is acceptable practice in relation to the transfer of defined benefit (DB) pension benefits to defined contribution (DC) schemes. Defined pension benefits are also referred to as safeguarded benefits.

There are five key areas in the consultation.

1) Most people best advised not to transfer

The FCA appears to be slightly softening its previous stance that all advice on pension transfers should start from the assumption that a transfer is unsuitable. The proposed new rules are set to state “most consumers will be best advised” not to transfer their defined benefit pensions.

This is a reflection of the fact that transfer values are at a historically high level as trustees seek to take advantage of current investment conditions to offload the risk of paying pensions for longer periods due to increased life expectancy.

The introduction of the pension freedoms in April 2015 has coincidentally provided consumers with more options for access to their pension savings. Pension savings can now be accessed as income or cash rather than the previous annuity purchase. To take advantage of the higher lump sums under pension freedoms, DB pension benefits must be normally be transferred to a defined contribution (DC) scheme.

2) Advice required for conversion and transfer of safeguarded benefits

The FCA proposes to make it a compulsory requirement that a personalised recommendation must be included in any advice on conversion or transfer of safeguarded pension benefits. This is to ensure there is appropriate protection for consumers.

The regulator stated if advice does not include a personal recommendation “it won’t provide appropriate protection for consumers.”

3) Advisers must assess suitability better

The FCA proposes to amend the existing guidance that an adviser should start from the assumption that a transfer will be unsuitable. This will be replaced with a statement in the Handbook that, for most people, retaining safeguarded benefits will likely be in their best interests and there will be guidance that advisers should have regard to this. The FCA stance is a change of emphasis recognising that in certain very specific and very personal situations a transfer may be suitable advice.

The FCA made clear that in order to provide advice that is suitable, an adviser should consider:

- what the client's income needs are, how they may change and how these can be achieved, the role safeguarded benefits play in providing this income and the impact and risk if a conversion or transfer is made, eg, the loss of guarantees

- the suitability of the receiving scheme and the underlying investments in view of the client’s specific risk profile

- access to funds, either immediately or in the future

- review and follow-up arrangements to ensure the transfer remains suitable

- alternative ways of achieving the client’s objectives

- the relevant wider circumstances of the individual.

4) Pension transfer specialists redefined

Advice given relating to pension transfers, pension conversions and pension opt-outs must still be given or checked by a pension transfer specialist, who must be a fit and proper person with specific qualifications. However, the existing requirements do not specify what is intended when a pension transfer specialist checks advice prepared or given by someone else. It currently defines a pension transfer specialist as someone who checks the suitability of the transfer. Going forward he or she will also need to check the reasonableness of the outcome of the advice.

5) Appropriate pension transfer value analysis

It has been a requirement for many years that a transfer value analysis (TVA), between the benefits being given up and the benefits available under the receiving scheme, must be carried out prior to a transfer recommendation.

The TVA calculates the critical yield, ie, the rate of return required within the receiving scheme to match the benefits being given up in the DB scheme. The FCA proposes replacing TVA with an overarching requirement to undertake appropriate analysis of the client’s options – an ‘appropriate pension transfer analysis’ or APTA.

The FCA proposes to introduce a prescribed comparator providing a financial indication of the value of benefits being given up. This new analysis should include:

- an assessment of the client’s outgoings and therefore potential income needs throughout retirement

- the role of the ceding and receiving scheme in meeting those income needs and any other income or funds available to the client, meaning there must be an thorough understanding of the client’s potential cash flows

- fair basis (like for like) comparison of death benefits, eg, where the death benefit in the receiving scheme will take the form of a lump sum, then the death benefits in the ceding scheme should also be assessed on a capitalised basis also taking account of expected differences over time.

- when assessing suitability, advisers must consider each client’s risk appetite and ability to manage investments.

The elements above apply whether the intention is to withdraw funds and move them outside the pension environment, place them into another retail investment product or take them as cash. The taxation consequences should be an inherent part of the consideration of suitability.

Not all financial planning firms carry out pension transfer advice. Such firms have no action to take. However, those that do carry out pension transfer advice will need to carefully consider how they will adapt to and meet the more complex requirements of the proposed regime.

Brexit The UK has given notice to leave the EU and will do so in March 2019. This means the UK will no longer automatically benefit from the Single Market in Financial Services, which has facilitated the relatively easy and open market in financial services.

While by no means a majority, there are many financial planning firms who do business with clients who live or work in other countries within the EU or the European Economic Area (EEA). Similarly, there are some financial planning firms who conduct business that falls within the scope of MiFID II and some that conduct business in other EU or EEA countries utilising the MiFID Service or branch passport.

Brexit negotiations have to date remained largely deadlocked and have not yet begun to address the major functional issues for a future trade deal between the UK and the EU. It would appear from its published position papers that the trade in financial services is quite low down the UK Government’s agenda. This a very important issue but one where the desired clarity may not be provided for many months if not years. That of course makes planning very difficult.

While financial planning firms cannot ignore Brexit, given the lack of progress and clarity in negotiations, firms are best advised to assume a worst case scenario and that a hard Brexit will result. Firms should therefore plan for worst and hope for best.

And finally ...I have summarised above those topics that directors and compliance officers in financial planning firms tell me are keeping them awake at night. If readers of this article are not also being kept awake at night by these topics, perhaps they ought to be!

Views expressed in this article are those of the author alone and do not necessarily represent the views of the CISI.