Of course it couldn’t happen? It has. Taking control! Apparently we will. Soft, hard or diamond-hard Brexit? Who knows? There are numerous options forcing financial firms in the UK to consider the impact on their businesses of the UK choosing to leave the EU and having restricted or no access to the single market in the EU.

OK, rant over from a whinging remainer. Let’s deal with the reality. Banks, asset managers, insurance companies and global financial services groups need solutions and options post-Brexit, but that depends on the final outcome of negotiations, which may take two or more years to clarify. The importance of the EU to each business is crucial in this analysis. Should or can the UK go for the Norway model (ie, European Economic Area access, but which requires free movement of labour and an EU budget payment), or will the bilateral Swiss approach work (but again this has free movement of labour issues), or should we go for hard Brexit and not worry about access to the single market and go for the World Trade Organisation (WTO) option (which includes 10% tariffs for goods and services, but also includes EU red tape for non-EU countries importing and exporting)? Will the EU allow the UK to cherry pick from the EU menu (in areas such as financial services and car manufacturing)? Can businesses wait for the new trading agreements to be concluded?

After seven years of negotiation there is another option, the Comprehensive Economic and Trade Agreement (CETA), which is an international treaty between the EU and Canada (Canada being the tenth biggest by GDP, according to the October 2016 International Monetary Fund World Economic Outlook). The UK will be looking with interest at how CETA works out, given it is supposed to reduce tariffs by 98% and aid trade in goods and services. But how relevant is CETA as a model for financial services and access to the EU single market?

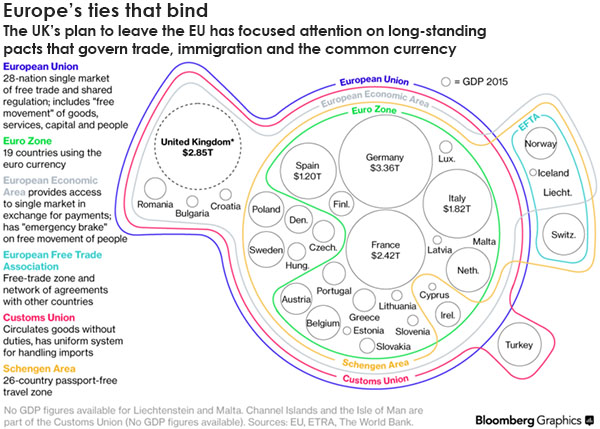

Bloomberg has provided a handy snapshot of current European agreements (including country GDP for the larger European economies like Germany, the UK, and France).

FCA's response to Brexit (EU Directives/regulations)

Let’s go back to the morning of the referendum result on 24 June 2016, when the FCA issued a statement confirming that "[EU] regulation will remain applicable until any changes are made, which will be a matter for Government and Parliament". The FCA also said: "Firms must continue to abide by their obligations under UK law, including those derived from EU law, and continue with implementation plans for legislation that is still to come into effect." So in other words, all EU law (such as the revised Markets in Financial Instruments Directive (MiFID II) and the revised Capital Requirements Directive), will continue to be applicable, and post-Brexit the UK will need to be very careful what EU financial services legislation it rejects, as at the very least it needs to retain ‘equivalence’ in regards to UK financial services to sell or receive services to and from the EU, as a non-EU third country.

EU Directives are EU legislation-setting goals that require EU Member States to implement (ie, through an Act of UK Parliament). However, the more recent trend over the last five years is for EU Regulations (binding EU legislative acts that must be applied entirely across the EU) to be implemented. In other words, by 2019, the UK will still need to have implemented MiFID II, European Market Infrastructure Regulation, Solvency II, and so on. The FCA’s approach is therefore not to diverge from the approach by the EU, but that may change over time. So, those thinking that the UK can take control of its financial services rules and ignore EU regulation are forgetting the UK remains subject to EU and global regulatory rules if it wants to do business abroad. Legal consultancy firm ClutchGroup has published ‘A tale of three speeches – understanding the FCA’s post-Brexit strategy’, which reiterates the global nature of financial services regulation.

In addition, the Great Repeal Bill is an Act of Parliament that is in fact not a repeal but an affirmation of current EU law, which converts it into UK law. However, going forwards the UK Parliament has the option to pick and choose what it wants. Sounds simple, but really after 40 years of being in the EU it will take years to establish a new order in financial services in the UK, and it’s arguable that there is very little wriggle room to avoid following all key international regulations.

The single market: what is passporting?

A key issue for Brexit is access to the single market, certainly for financial services and manufacturing. It’s based on the four pillars (freedom of movement of goods, persons, services and capital).

One of the perks of Europe's single market – which also currently includes the UK, Norway and EU countries such as the Netherlands – is ‘passporting’. This allows banks, investment firms and insurance companies to sell their services anywhere in the single market without having to establish a base in every country in Europe. Unfortunately for the UK, one of the key pillars of the single market is free movement of its citizens (the key bone of contention that hard core Brexiteers insist is a must in a post-Brexit world). Losing the passport (MiFID II; the Undertakings for Collective Investment in Transferable Securities Directive; the Alternative Investment Fund Managers Directive, and so on) will mean banks, insurance companies and financial firms with head offices in the UK will need to think seriously about restructuring and/or, relocating to an EU Member State.

CETA

The Comprehensive Economic and Trade Agreement (CETA) is an individually negotiated bilateral treaty with a third country in exchange for access to the single market (without all of the obligations that come with the Norway or Swiss models, such as paying in to the EU budget). It’s supposed to reduce tariffs on industrial goods and services by 98% (but will require proof that goods were made in Canada and meet EU standards). This sounds like a good possible option for the UK. While it encourages access to financial services, it doesn’t change current financial services rules in the EU or Canada, so does not include financial services passporting rights. In Canada there is no equivalence to a comprehensive EU single market, as each Canadian province has its own rules and licences. EU financial services companies have to abide by those different rules, which differ across Canada. That may change in the future, but for now financial services or passport options do not form part of the current CETA treaty. So CETA might have aspects which may be useful as part of the EU negotiation, but it’s not a template for financial services access to the EU single market.

Impact/recommendations for financial services firms

International law firm Simmons & Simmons produced a handy Brexit impact table for banks and investment firms with different group structures, and it includes guidance to liaise and have dialogue with relevant home state regulators to manage the medium to high risk scenarios.

|

Brexit: the impact on firm type

Bank/investment firm

|

|

Firm type

|

Impact

|

Details

|

Recommendation

|

|

UK branch of a third country firm

|

LOW

|

UK permission still intact and no freedom of services

|

|

|

UK branch of EU (non-UK) firm

|

MEDIUM TO HIGH

|

Premise of UK operations based on EU law and question whether home regulator and UK regulator will permit the continuation of the business without significant changes, whether in capital, oversight or others

|

Initial step is to start dialogue with home state regulator as to likely outcome. Also await UK stance on branch operations of EU firms post-Brexit

|

|

UK-headquartered EU firm (without branches or cross-border passport)

|

LOW

|

Based on current business model

|

Confirm status of current business and seek advice for future plans

|

|

HIGH

|

If any future plans include pan-European operations

|

|

UK-headquartered EU firm (with EU passport and/or branches)

|

HIGH

|

Freedom of services (cross-border and branch) will disappear

|

· Consider options including third country cross-border licences (very limited), and/or

· Consider alternative EU location for set-up

|

Source: Simmons & Simmons

How important is the EU to financial services firms’ business?

The impact of losing access to the single market (passport) impacts on financial services firms in different ways. International banks, asset managers and insurance companies with branches around Europe have options to use those branches instead of relying on the EU passport with the UK, while firms with few or no EU presence, but businesses which have significant EU business, will need to look at restructuring, setting up an EU branch, and looking at agency or intermediary options to sustain their business going forwards. Firms with little or no European business or strategy to do business in Europe will not be so adversely affected.

|

Types of EU exit

|

UK, International banks, assets managers (EU Head office, presence, branches across EU)

|

UK, International Banks, asset managers (UK head office, minimal or no EU presence, relying on passport ( with significant EU business)

|

UK banks, asset managers, no EU presence, minimal EU business, no strategy to expand in EU

|

UK banks, asset managers, no EU presence, minimal EU business, but have significant EU business/ strategy to expand in EU

|

|

World Trade Organisation

|

Low

|

High

|

Low

|

High

|

|

Hard Brexit

|

Low

|

High

|

Low

|

High

|

|

Soft Brexit (eg, EEA)

|

Low

|

Low/Medium

|

Low

|

Low

|

|

CETA type treaty

|

Low

|

High (no passport)

|

Low

|

High

|

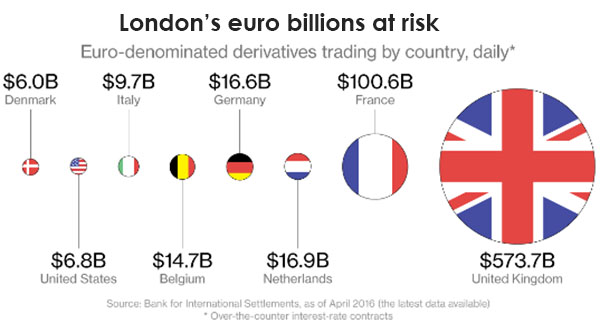

In addition, London’s financial clearing (traders in stocks, bonds, commodities and derivatives) is at risk (trading daily $573.7bn in the UK) if location of euros becomes a focal point. Firms with UK headquarters, with EU groups or UK firms with plans to do EU business requiring passports would be significantly impacted if the single market (passport) is lost.

Concluding comments

Some banks and financial services firms have already decided to leave the UK, and are not waiting for negotiations to be concluded. They have concluded either that they need EU business to survive or don’t want to risk losing continuous access to the EU single market. Other firms are waiting to see how negotiations go, hoping perhaps a carve-out for financial services can be agreed.

The reality is the UK financial services industry is joined at the hip to the EU, and will almost certainly require a significant transition stage to manage the new relationship with the EU post-2019. The UK may well have to swallow its pride and pay for access to the EU for financial services in the short term as financial firms see how final negotiations impact on them. This assumes the 27 EU countries agree to extend the transition period beyond two years. Failure to agree to an extension would mean the UK will default to the World Trade Organisation rules (no passport will exist for the UK; 10% tariffs and EU red tape to sell goods and services will be in place).

The key passporting issue was highlighted by the Bundesbank president, Jens Weidmann, who told The Guardian that UK companies would lose these rights if it did not remain part of at least the EEA (EU countries and Iceland, Liechtenstein and Norway). Andrew Tyrie MP, Chair of the Parliamentary Treasury Committee, said: “None of the current off-the-shelf arrangements can preserve existing passporting arrangements, while giving the UK the influence and control it needs over financial services regulation as it develops. Efforts to secure an appropriate arrangement for UK-based firms will be one of the most challenging aspects of the negotiations about the UK’s future relationship with the EU.”

The new May UK Government is sceptical about providing exact figures for immigration. I suspect taking control of immigration might not be a focus for them, which will not please financial services firms, manufacturing firms or hard or diamond-hard Brexiteers. However, all will be worth it in the end as the UK would have taken control, but I’m still puzzled over what. Meanwhile, UK financial firms will still have to follow new EU financial laws for the foreseeable future. Looks like the change is in the air for the UK and the USA, but whether it will result in a glorious future, only time will tell. The world had suddenly become less certain, less cohesive, and an angry electorate in the UK and USA has flexed its muscles for change, ripping up the old order. It will take time for the UK to adjust to the new world and for its global trade agreements to be negotiated. It may be optimistic, however, to believe that UK financial services will thrive in the same way as previously in a Europe where it will be obliged for the foreseeable future to follow EU law, but have no say in the design, analysis and final EU rules. It may however be prudent to hope for the best, but plan for the worst.

Views expressed in this article are those of the author alone and do not necessarily represent the views of the CISI.