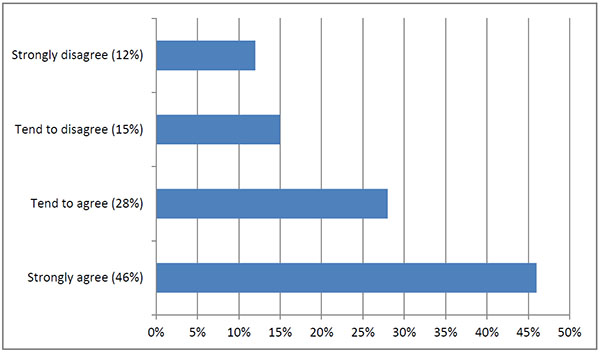

The precise question was: “At a time when the City is looking forward to new business opportunities from the Capital Markets Union (CMU), the UK Government plans a referendum on Brexit by the end of 2017. Brexit would substantially reduce the ability of the City to benefit from CMU.” About three-quarters of the 854 who completed the survey felt it would, with almost half “strongly” agreeing.

CISI survey results

“It would be a disaster for all financial specialists in London,” came one blunt comment on Brexit. “A British exit from the EU would seriously hurt the UK as a whole economically. It would cut off duty free trade, labour and capital flow to and from the UK,” was another in favour of staying in. Likewise: “Freedom and capital, used wisely, brings prosperity.”

One respondent pointed out that “even if it were able to negotiate terms, the City would be unlikely to obtain a relationship as favourable as Norway and Switzerland. And even if it could, it would have reduced the scope to shape and influence the formation of rules. It is well to remember that it would affect the whole of the UK, not merely the City. The beneficiaries are likely to be Frankfurt, Paris, Milan, Amsterdam, and also Luxembourg and Dublin, which might struggle to cope with the outflow and influx.” This commentator also mused on whether Edinburgh, “propelled into a newly independent Scotland, might take some of London’s bounty.”

Greater certainty was key in another comment: “The consequences are potentially unknown, but remaining in the CMU perhaps provides greater clarity, which Brexit wouldn’t, at least in the short term.”

There were of course some strident voices on the other side of the debate, such as: “The City should throw off the bureaucratic and political noose which the EU has tied round its neck. This will buttress its leadership of world finance.” Then: “The question is irrelevant. The City would benefit longer-term from a Brexit. This is a more important question.” And: “Much recent European regulation has actually been antagonistic to the City of London.”

One respondent remarked: “Britain, and especially London, will be much better off in case of a Brexit. Anyone having at least half an eye open to the complete failure of the EU dream of a unified and dynamic market and society in Europe, can easily see that there is a need for a fully independent and sovereign UK. I am not British, but I believe Europe and the world needs a stronger UK and Commonwealth.”

Some felt the decision depended on “terms and conditions”, and one respondent made the key point that “Brexit is not the only option – and probably the least likely result. A looser union is the optimum. But, even an exit would give the UK the status of, say, Switzerland, which benefits a lot from its capital market links with Europe. The world of capital markets has English as its common language – that alone would ensure US and Asian banks stay established in the UK for their European business.”

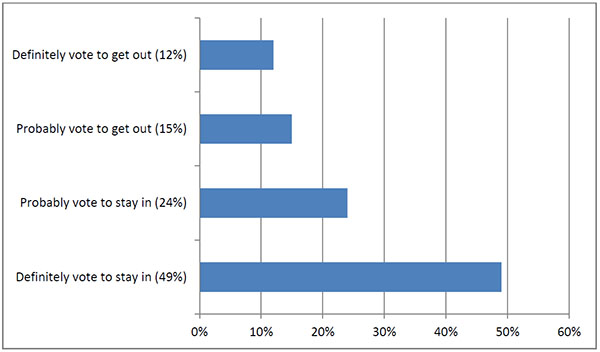

CSFI poll also points to clear trends

The CISI poll results were eerily similar to one completed by the Centre for the Study of Financial Innovation (CSFI) in February and March this year. The first question asked by the CSFI was on voting intentions in a referendum on EU membership if the UK Government “cannot reach a satisfactory agreement,” and that points to a similar desire to stay in.

CSFI survey results

The CSFI report makes it clear that the mood in the City with regard to membership of the EU has changed in recent years. “Three or four years ago when Brexit still seemed a very distant prospect, there appeared to be something exciting, even romantic, about it. Britain (it was argued) could be liberated from the ‘tyranny of contiguity’, could pick and choose its trading partners from areas of the world with better economic prospects than sclerotic Europe, and could become a sort of ‘super-Singapore’ – a high-growth, offshore financial centre not hemmed in by the dead hand of Brussels bureaucracy.”

More recently, however, as a referendum became more likely in the run-up to the general election, there has been a sense that the mood has changed – that the City is more worried about concrete short-term issues like jobs, and “less enthused about the potentially pie-in-the-sky long-term prospect of becoming a global and financial economic powerhouse.”

A subsidiary conclusion, which also bears out a feeling that has grown over the last couple of years at CSFI round-tables, and particularly at meetings of its Young Economists group, is that younger City folk are more pro-European than their elders. In the 18–30 age group, 80% of respondents said they would “definitely” or “probably” vote to stay in; in the 60-plus age group, the comparable figure was 66% – still high, but significantly lower. Two explanations offer themselves – that older respondents (many in or nearing retirement) are worried about their job prospects; and/or that older respondents, raised on tales of Empire when half the world was pink, tend to be more ‘global’ in their outlook, while younger respondents are more ‘European’.